Multitrader.io Review – Price, Supported Exchanges, Features, Profitability

What you'll learn 👉

Multitrader.io Overview

Crypto arbitrage trading platform is not big news in the crypto world since traders want to make as much profit as possible on the market. In short, it is buying cryptocurrencies at a lower price in one exchange and selling them at a higher price in another one, where significant profits can be made.

However, when trading in this way is done manually, it can take a lot of time. That is why there are bot platforms for arbitrage trading in cryptocurrencies, among which is Multitrader.io, to which we will dedicate this article.

They offer grid automated trading bot in addition to arbitrage bots, and they boast about being one of the most secure arbitrage trading bot services in the industry.

What is MultiTrader

MultiTrader is an automated trading platform for arbitrage trading in digital assets that uses cryptotrading bots to facilitate trading itself. The bots chosen by the users use custom strategies and execute the set actions based on the set parameters.

In addition to basic services, the platform provides users with other important information when trading related to market conditions and can also perform analyses of potential arbitrage with access to digital assets prices in order books.

⚡️ Before we move on to the MultiTrader’s features, check out our articles on the best crypto trading bots, our guide about the best market-making (scalping) bitcoin bots, and an article about the best bot trading strategies you can utilize when trading crypto, and finally, crypto grid bots.

MULTITRADER SOLUTION FEATURES

👉 Cross-exchange order book matching

One of the characteristics of MultiTrader is the search for a pair of currencies that can be bought and then sold at certain prices that respect the law of arbitration and, of course, make a profit. This is possible by recording the prices of cryptos from all crypto exchanges with which this platform is connected, as well as ticker prices. In this case, arbitrage trade is often realized between smaller and larger exchanges. Cross-exchange order book matching is exactly the way that allows Multitrader to search for a possible arbitrage trade.

👉 Real-time automated trading

This means that an unlimited number of botscan be determined with different arbitrage strategies that will monitor the market situation and react in small time moments, literally in milliseconds, if the given parameter appears.

👉 Optmiser and backtesting

The role of the optimizer is to test a bunch of different combinations of parameters to come up with the most optimal setting for bots. This service is very useful because it uses historical data for the simulation and runs several times during the day for all possible crypto exchanges for a given tradingpair of currencies. By detailed analysis of this simulation, you can adjust the parameters that will suit the trade.

👉 Backtesting

The back-tester uses historical data to test bot parameters. Arbitrage parameters from the file history, which are so-called theoretical parameters, can be used, and the platform will perform a trading simulation based on them.

👉 Trade management

This platform gives the possibility to use tools that monitor the work of trading bots, as well as the outcome of their trading. You can also have an insight into all the details of each trade, analyze them and search the trading history with different arbitration strategies.

ARBITRAGE STRATEGIES

With the help of bots, Multitrader uses 3 types of arbitration strategies to make as much profit as possible.

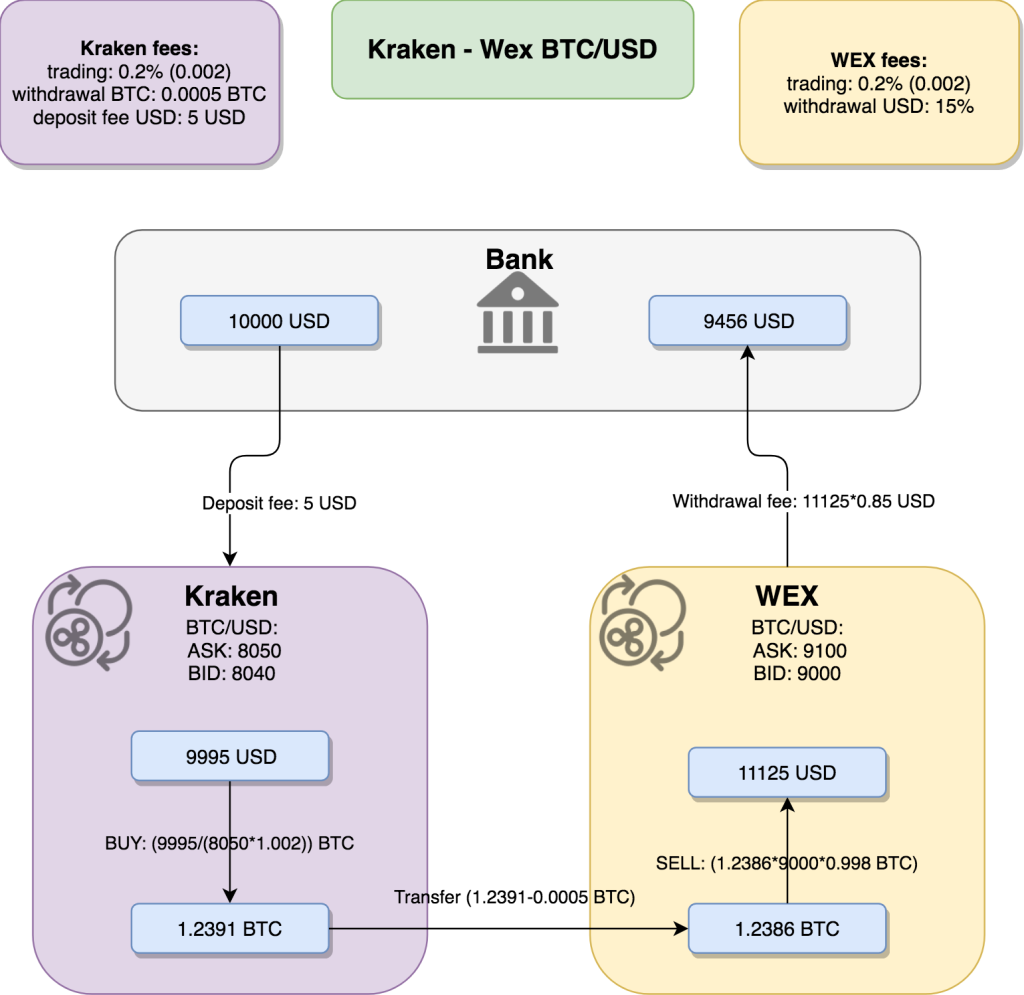

👉 Basic with withdrawal

Arbitrage trading is not just about buying cryptos in one exchange at a lower price and selling them in another exchange at a higher price and making a profit. If so, everything would be too simple. There are also some intermediate steps that include withdrawal fee and deposit fees that must be paid, so it often happens that the trader is at a loss. That is why there is a MultiTrader – it analyzes each trade, including the time of the purchase, and the taxes that need to be paid, and all of this is presented on a clearly visible chart.

So, the two most important items here are time (the crypto market is very volatile, and it changes from minute to minute) and trade commissions (they must be paid on both exchanges, whether it is a withdrawal or swapping of one currency to another).

MultiTrader monitors changes in the price of the desired pair of cryptocurrencies on both selected crypto exchanges over time and neatly records them on a chart so we can see how prices change during the day and whether we are in potential loss of profit. It should be taken into account that the withdrawal of one currency between exchanges takes some time, so it is notinstant, and the price can change during that period of withdrawal.

To make everything clearer, there are nicely explained examples on MultiTrader’s website.

👉 Auto rebalancing

Here we are talking about how to avoid costly withdrawals, as the case in the previous section.

So, trading is performed when the price of a currency is lower on one exchange than on another, and then we wait for the price to rise on that second exchange (to become higher than it was) and to trade in the reverse direction. This type of strategy is very desirable and useful in bullish trading when currency prices vary many times during the day between exchanges.

So, we will look at them, for example, LTC / BTC pair in exchanges A and B. MultiTrader analyzes the pairing of cross-exchange order books for both exchanges for a specific trading pair of currencies. On the Y-axis of the chart, it represents the percentage of profits from arbitrage trading – there are two lines that represent gains or losses from trading – one line in direction A →B as the main direction represents the percentage of profit, and the other line for B ←A represents the negative percentage of profit, actually, that is loss.

The important thing here is that an analysis was done for the amount of 0.75 LTC. If a larger amount was taken for trade, then the opportunities for arbitration would be less. To avoid this, the MultiTrader uses an auto-rebalancing strategy. In short, instead of taking everything, MultiTrader takes what is available and with what profit. So, we can have more purchases in a row than a single sale if it’s available instead of one big purchase and sale.

The example shows that the amounts of BTC and LTCincrease at each step. However, over time, prices vary, so they may fall at some point. Although this happens, it is not worrying because the prices fluctuate in both directions, so after a few transactions, the balance will return.

👉 Spread trading

This arbitration strategy consists of two phases – the earning phase and the losing phase. In the first phase, there is earning at arbitration if the prices on the two exchanges are distant. In the second phase, when prices get closer, there are losses, but they are lower than we earned in phase one. A spread trading strategy is useful for markets that are constantly above others.

An example nicely explained on MultiTrader’s official website shows how potential profits can easily turn into losses due to high withdrawal fee. So, while it is inevitable that there will be a loss, we need to earn more than we will lose.

Supported exchanges

At present, Multitrader.io is cooperating with 21 exchanges, and some of them are:

- Bittrex,

- BitFinex,

- Coinbase PRO,

- Binance,

- Poloniex,

- Kraken,

- Gemini,

- Exmo,

- Luno,

- Bitbay,

- Upbit,

- Coinone,

- Bitstamp,

- Cex.io,

- YoBit and

- Kucoin.

Pricing

The surprise for everyone is that using this platform is free! On MultiTRader’s website, you can find guides that explain in detail and clearly everything about arbitrage trading using the tools that MultiTrader provides completely, as well as the use of bots that will trade for you according to a predetermined strategy.

Conclusion

After a complete analysis of the services provided by this platform, it can be easily concluded that MultiTrader.io is appropriate and useful. Since it uses 3 types of arbitration strategies, by detailed study, users can achieve very high profits. It has excellent characteristics in the form of optimization and back-testing, which can help a lot in finding the right strategy and parameters.

On the other hand, articles that describe the work of strategies and features of this platform in a simple way are very useful, and that’s how they can help even beginners in this sphere of trading.

It is also a great advantage that it is free, and there is also a contact form on their website that you can use to contact support.

As in any trade, in the arbitration trade, there are risks, so you should be aware of how you manage your money.

Read also: