The world has been transitioning from analogue to digital for the last 40 years – it started with telephone exchanges in the ‘80s, cameras, video and music in the ‘90s, to banking and finance services in the noughties. Everything we do is now digitized, from shopping to communications, navigation and most commerce – and now it’s the turn of money.

Traditional fiat wallets and bank accounts are being superseded by digital wallets, which brings both complications and opportunities. Read on for the facts about how to store your cryptocurrency safely and efficiently.

What you'll learn 👉

Types of Crypto Wallets Explained

Anything of value needs to be stored carefully, but value means different things to different people. The risk and consequences of losing something will dictate how you protect it. More valuable assets demand better security, so you have to judge what is justified in the effort to keep your valuables safe.

Introduction to Wallets

12 years into the crypto revolution, and there are a variety of options for storing your cryptocurrency. Let’s start by taking a look at the possibilities.

But first, never forget that crypto, like hard-cash, it’s a bearer asset. That means whoever holds it in their hands owns it. Once it’s not in your possession, you don’t own it any more. This makes a big difference when choosing a wallet.

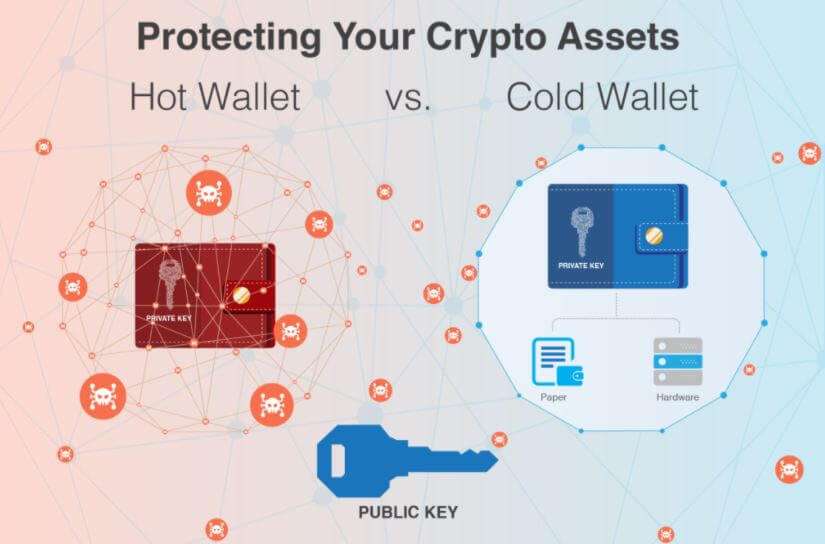

2 Types & 5 Sub-types of Crypto Wallets

Hot (Desktop, Mobile, Web Wallets) and Cold Wallets (Hardware & Paper Wallets)

The difference between hot and cold wallets is simple. A hot wallet is connected to the internet and a cold wallet is not. Paper and hardware wallets are considered cold storage, but desktop, mobile, and web wallets are not. It’s more complicated if you compromise a cold wallet by storing related information on an internet connected device, but for now, cold means offline and hot means online.

Cold vs. Hot wallets

So, which are better, cold or hot wallets? It depends on how much you need to store, your access requirements, the perceived threat, and your risk tolerance.

Cold Wallets

Crypto is far less likely to be stolen from a brand new, properly configured hardware or paper wallet. They are physical objects that can be hidden or protected in a safe or deposit box. Without getting their hands on your wallet, villains cannot heist your loot.

The dangers are losing or destroying your physical wallet or your seed phrase. If you are willing to accept total responsibility for protecting your own assets then a cold wallet is for you.

Hardware wallets

Is it time to invest in a more robust security solution? Do you need a hardware wallet? What are the costs, risks, and benefits of cold storage?

Paying $100 for a hardware wallet to protect $50 of Bitcoin makes no sense, but if you need to secure thousands of dollars of cryptocurrency, it’s a good investment. Only you can decide your risk tolerance, but personally, anything over $1000 is going into a hardware wallet.

Setup is straightforward but before you attempt it there are things to consider. Where did you buy your hardware wallet, who from, and who had access to it before you? Do not use a second hand device as this is already compromised. Make sure you buy from the company direct or a recommended supplier – don’t buy one on Ebay as it may have been hacked.

The setup process will generate a 24 word ‘seed-phrase’ (12 and 18 are also a thing) which you should write down on a traditional piece of paper with an analogue pen.

❌❌❌ Warning ❌❌❌

DO NOT save your seed-phrase on your computer, or email it to yourself as a backup.

DO NOT take a photo on your phone and share it with yourself.

That defeats the whole object of a cold wallet. Once information is online or stored on a device connected to the internet, it’s no longer truly ‘cold.’

Also, when storing a seed phrase:

TRY NOT TO make a ‘clever’ adjustment to the phrase that you might later forget.

DO NOT store half the phrase in one place and half elsewhere – this doubles the risk of loss or damage.

Popular Hardware Wallets

The most commonly used hardware wallets are made by Ledger and Trezor. Ledger makes the Nano S and the Nano x, and Trezor has their Trezor One and Trezor T. They range in price from $59 for the Nano S, up to $159 for the Trezor T, but perform the same basic functions

For beginners, the Ledger Nano S and the Trezor One are lower cost solutions, priced at $99 and $59 respectively. They are both lightweight thumb drive styles devices that run on Mac, Windows, and Linux. The Trezor One does not store XRP (Ripple), ADA (Cardano), or XMR (Monero), which will be a problem for some alt-coin holders.

For an upgrade, we have the ledger Nano X and the Trezor T at $119 and $159. The Nano X has several improvements such as a bigger screen so you can see both the transaction details and the wallet address on the same page. This is a huge improvement as sending crypto is always a fraught experience, and having all the information on the same screen can set your mind at rest.

With the Ledgers, a separate app is required for each different currency you store. The Nano S can hold up to 20 compared to 100 on the Nano X, depending on the size of the apps. The Trezor T has a touch screen and a removable SD card, compared to the Trezor One with its physical buttons and USB cable.

I will be compiling a more indepth comparison of the latest hardware wallets in a future article, so watch this space. Until then, check out our guides on other popular hardware wallets like Ellipal Titan, Safepal S1, Opolo Wallet, CoolWallet Pro, D’Cent, NGrave Zero, Secux V20, Archos Mini, CoolWallet S & Ellipal.

Paper Wallets

Although considered rather old-school, paper wallets still have their uses. There are some very important things to be aware of – and there’s one issue in particular that has caught out even experienced users.

Generating a paper wallet gives you a public and private key, printed on physical paper. Store that paper and recover the funds later, and as long as nobody has access to the paper wallet, your crypto will be safe. Always generate your paper wallet when you are not connected to the internet, and delete the files afterwards.

The hidden danger here is that to extract your crypto from a paper wallet, you might import the keys into a software wallet from where you can spend and transact.

Why does this matter? Well, this is fine if you empty the paper wallet all at once, but if you only spend a part of the value, the balance might appear on your desktop application at a different address. People who were not aware of this have often put their paper wallet back in their desk drawer, and deleted their temporary desktop wallet for security reasons. Later, they try to spend the balance of the paper wallet only to find it empty.

If the desktop wallet has been deleted, there may be no way to recover the funds. So, if you insist on using paper wallets, be aware of this and make sure the ‘change address’ on your software wallet is the same as the unique address on your paper wallet. Better still, use a paper wallet only once and make sure you empty it completely when you decide to spend your crypto.

You can generate paper wallets at bitaddress.org. The process is simple, but again, make sure you are offline when you do this, and delete all the associated files before you reconnect.

Hot Wallets

A nosey roommate, a determined hacker, a SIM Swap Attack, a lousy password, using a company laptop, whatever… If your wallet is online, then there are ways, as yet unthought of, to purloin your crypto.

The question we should ask ourselves is, “Does my reputable online crypto storage company have better security than me with my domestic security and good intentions?” If the answer is yes, then a hot wallet is for you.

Desktop Wallets

These are desktop applications and carry the associated risks. Whoever has access to the computer also has access to your crypto. I have used Electrum for years with no problems, but there are lots of options out there. Friends have had great experiences with Exodus, Armory, and Atomic Wallet.

They all have their unique selling points, too numerous to list here, but their common feature is that they have all been around for years, are trusted, and there have been no major jacks or leaks reported, so far.

Mobile Wallets

Your phone – the most vulnerable device on your personal network – is no place to store large amounts of crypto. Think about it like carrying thousands of dollars on your billfold. What if you lose your phone, drop it in the ocean, someone steals it? Mobile wallets are more convenient for day-to-day spending, but only trust them with small amounts of crypto that would not be devastating to lose.

A serious issue is the SIM Swap Attack, where a villain persuades your cell phone carrier to migrate your number to their device. This will give them access to your email account where many people have passwords and usernames backed up.

Worse still, when you request a new password, most exchanges will send you a verification code to establish that you are the owner of the account. The person who now controls your mobile number will receive the code and access your account. At that point it’s probably game over.

Mycelium is a preferred option as a mobile Bitcoin wallet, and for alt-coins, Coinomi is well regarded.

Web Wallets

Again, ask yourself this – “Who has better digital security standards, you or a digital security company?” You are at the mercy of any wallet provider but they have a vested interest in protecting your crypto. If your coins are on an exchange, then you’re already using a Web Wallet, so always use trusted companies that have been around for a while.

Long gone are the wild days of Mt. Gox when people lost millions in an exchange hack. Companies like Binance, Coinbase, Bitfinex and Kraken are multi-billion dollar concerns and have appropriate security strategies. I am happy to keep up to a couple of thousand dollars in these exchange wallets.

The Importance of Backups

Losing a few photos is aggravating, but losing your wealth is devastating. Always make backups, but don’t expose yourself to unnecessary risk. Do it right. For example, seed phrases should never be backed up online. A copy should be written on paper. Even your wifi-connected printer is vulnerable, so don’t use it to photocopy your seed-phrase or passwords. Keep your cold wallets cold by not backing up online.

Other than that, backup as you would normally. My choice is to have passwords stored on paper, in a secret hiding place. I never email passwords to myself.

FAQs

Which is the safest crypto wallet?

That depends what you are trying to protect against – being hacked, being burgled, losing your keys, or a local threat to your wealth. In general cold wallets are more secure from digital threats, but are vulnerable to physical burglary or destruction.

How many crypto wallets are there?

There are dozens of crypto wallets. Some are part of a platform or exchange, and some are dedicated crypto-housing services.

What is the best type of wallet for Cryptocurrency security?

It depends. You trade off security against access. Cold wallets, used properly, are the safest.

Is Coinbase a good wallet?

Choosing a well known, trusted, well run company is never a bad idea. Coinbase is as good as any out there.

Which crypto wallet has lowest fees?

All the software wallets I have used are completely free to download and install. Exchanges will charge a fee to export your crypto, so choose wisely.