What you'll learn 👉

Table Of Contents

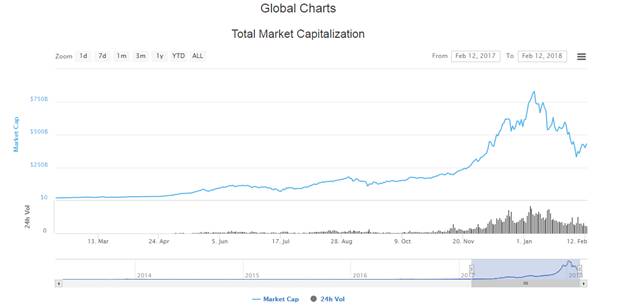

According to web site coinmarketcap.com, the total market capitalization of cryptocurrencies currently stands at $506 billion. One year ago, the total market capitalization was at just under $19 billion. This means, that in the period of just one year it rose by more than 2,000 percent.

On 8th of January 2018, the total market cap reached its peak at $828 billion, which is a rise of more than 4,000 percent compared to its value in February 2017.

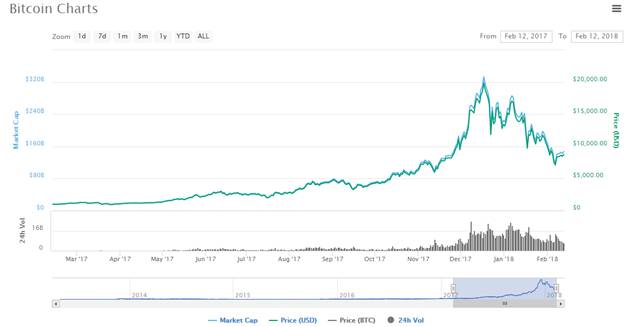

At the same time, as the biggest and most popular cryptocurrency, Bitcoin’s market cap was rising in value at a similar pace as well as in the price.

In February 2017, the price of 1 BTC was $1,003 and in December 2017 it reached its peak price at $19,873. It means that if you have invested $100 in Bitcoin in February 2017 and sold it in December 2017, you return would be more than 1,900 percent earning you profit of around $2,000.

With these unexpected massive increases in the market cap and prices, some economic experts, including Wolf of Wallstreet Jordan Belfort, have come out and called Bitcoin a “fraud.” Others, such as Ray Dalio, call it a “bubble.”

Bitcoin experienced a bubble before. In December 2013, the price climbed above $1,000 before declining to the $200 neighborhood by early 2015.

“Bubbles are periods of contagious excitement about some investable asset that is enhanced by public observations of increases in price, and envy of people who made lot money so easily” said Professor Christian Catalini of MIT.

In 2017, Bitcoin became popular as a speculative instrument, losing the idea and purpose of Bitcoin as a payment system. The increased transaction cost, delayed network confirmation, extreme volatility in prices and constant forks coming in, Bitcoin could not establish itself as a payment mechanism. Real use of the currency and the blockchain infrastructure by the enterprises will be a deciding factor of the sustenance of the crypto currency. Additionally, the rise of several other cryptocurrencies, such as Ethereum, Ripple and its own rival Bitcoin Cash, has contributed to the skepticism that in near future value of Bitcoin might retrace to lower levels.

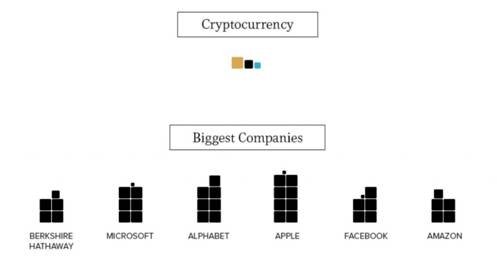

Cryptocurrency market cap vs. global markets

As it was previously stated, the market cap of digital currencies, the world’s fastest growing asset class, stands at $426 billion. Bitcoin’s market cap alone stands at $144 billion which is larger than of the payment processing company Paypal and the fast food company McDonald’s which currently stands at $89 billion and $128 billion respectively.

In comparison to other global markets, the cryptocurrency market cap is not as big as you may think.

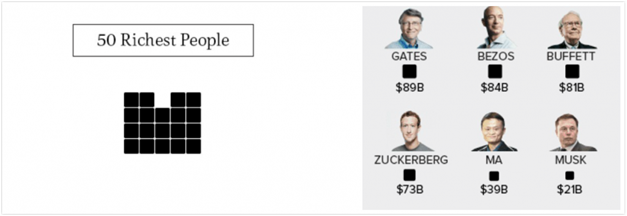

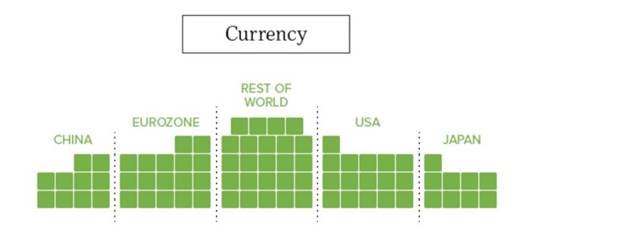

Recently, a web site called The Money Project has assembled a string of amusing pictures depicting the market cap of the world’s money and markets. Let’s take a look.

Note: Please bear in mind that each block square is worth $100 billion.

For instance, Apple Inc, an American tech company based in Silicon Valley in Cupertino, California has a market cap of $826 billion. According to Ronnie Moas, the Founder and Director of Research at Standpoint Research, Inc, „Bitcoin needs to be taken seriously as within five years it could reach $800 billion“.

In total, the world’s richest people, are valuated at lumping 1.9$ trillion. Satoshi Nakamoto, the founder of Bitcoin and initial creator of the Original Bitcoin client, is also one of the members of the billionaire club with his coins remaining unmoved from day one.

Chris Larsen, the Executive Chairman and co-founder of Ripple, recently joined the billionaire club after the surge in the price of Ripple coin from $0.007 to $1.10. Chris is the owner of 5.19 billion of XRP coins which means that it is worth around $5.7 billion.

The world’s coins and banknotes are currently valued at around $7.6 trillion.

The gold market is large and complex. Gold is mined on every continent except Antarctica, shipped around the world to be refined, and sold to a diverse set of end users: central banks, institutional and retail investors, technology companies, and jewelers. According to the World Gold Council, total gold above ground stocks: 187,200 tonnes. Current price of the gold is $1,328,

On the contrary, total supply of Bitcoin is limited to 21 million coins.

It is interesting that both Bitcoin and gold are generated through the process of mining, only for the different purpose. Gold mine exploration is challenging and complex. It requires significant time, financial resources and expertise in many disciplines – e.g. geography, geology, chemistry and engineering. The likelihood of a discovery leading to a mine being developed is very low – less than 0.1% of prospected sites will lead to a productive mine. And only 10% of global gold deposits contain sufficient gold to justify further development.

On the other hand, the process for verification of transactions or payments from one user to another on a decentralized network and a channel for introduction of new coins are called Bitcoin mining.

So, is it late to invest?

Well no one can say is it late or not. As Robert Shiller, author of the book Irrational Exuberance and a 2013 winner of the Nobel Memorial Prize in Economic Science, said: “It’s hard to know when the bubble will end,” he says. „It’s impossible to know if the price will keep going up, and it’s hard to even guess. We also have no idea if going “short” right now, or betting that the price will decline, will be better than going “long,” or betting that the price will continue to go up over time.“

So before you decide to invest or not to invest let’s take a look at some factors impacting the decision.

Bitcoin as an asset

Unlike other investments, such as bonds, deposits and stocks that offer this or that kind of rate of return, investing in Bitcoin is profitable only if its price increases. With other traditional investment assets such as real estate and gold underperforming in the recent years, investing in a revolutionary technology, Bitcoin produced a staggering return on investment for the investors. Positive approach from the regulators by allowing Bitcoin the status of an asset class can result in fresh capital and can push the Bitcoin price to unseen waters.

Recent monetary policies and low interest rates, implemented by governments and banks, are pushing investors to cryptocurrencies that are not affected by changes in the traditional market.

Limited amount of Bitcoins

Total supply of Bitcoin is limited to 21 million coins. At the moment, there 16.8 million coins mined and taking into consideration that mining process drops by half every couple of years means that around 80 percent of Bitcoins are already here. Currently, every 10 minutes, 25 Bitcoins are created. By 2140, all 21 million bitcoins will be mined.

The Bitcoin inflation rate steadily trends downwards. At the time of writing, more than 3 out of every 4 Bitcoins that will ever exist has already been mined, and the annual inflation rate is just 4%. The block reward given to miners is made up of newly-created Bitcoins plus transaction fees. As inflation goes to zero miners will obtain an income only from transaction fees which will provide an incentive to keep mining to make transactions irreversible.

Affordability

With the current price of one Bitcoin at $8,757, you will probably think that you are late to get into game of investing in cryptocurrencies if you do not have that kind of extra cash. Besides the expensive Bitcoin price, you can invest in other cryptocurrencies on the market. There are many options like IOTA, Stellar, Ripple and NEM which are very affordable with prices at $1.81, $0.39, $1.07 and $0.55 respectively.

Unregulated

Contrary to the traditional fiat currencies, where the value of USD, EUR or GBP is determined by the decisions from governments, central banks, politicians and financial institutions, digital currencies remain unaffected by them due to the fact that they are based on decentralized network.

Additionally, there are many countries around the world where profits made from cryptocurrency trading are tax exempted. Such a tax treatment can be found in Italy, Germany, Austria, Denmark, Slovenia, Belarus, etc.

Diversity

Not many people understand that you can use digital currency as a mean of payment, an investment and a technology. With your coins you are able to purchase an apartment, go to exchange and speculate with it and you are also investing in the technology behind the blockchain.

Digital currencies are very diverse and very comprehensive. If you decide to purchase any digital coins today, you’re backing a lot more than a type of money.

Final thoughts

The old Chinese proverb says: „The best time to plant a tree was 20 years ago. The second best time is now.”

If indeed you decide to invest in Bitcoin and cryptocurrencies, be sure to diversify. The goal of diversifying is to reduce the risk while avoiding the small returns of low-risk assets like bonds. You get the both of best worlds with diversification — lower net risk and the potential for high returns.

Because it is neither a real estate nor it is a stock market, Bitcoin is a great tool for portfolio diversification.

If you are hardcore crypto-fanatic, you probably hold some of these coins as well. Here are the wallet solutions for them:

- Top top bitcoin wallets are mentioned in this article.

- Read here about ether wallets.

- Want to find out what is the best offline wallet for DASH coin? This article is for you.

- Looking for litecoin android wallet? Read this.

- Want to find out what is the best offline wallet for NEO? This article is for you.

- Looking for Bitcoin Cash android wallet? Read this.

- Read here about best PIVX wallets.

- Searching for best best wallet for ripple? Check this out.