Ethereum is not just a currency, it’s an environment and that is the primary difference between Ethereum and any other cryptocurrency. Here anyone can take advantage of the blockchain technology to build their own projects and DAPPS (decentralized applications) through smart contracts, which is a very important distinction because this very thing shows you the true scope of what is possible in Ethereum.

Think of Ethereum like the internet and all the DAPPS as websites that run in it and you will see that there is something really interesting about these DAPPS. They are all decentralized and not owned by an individual, they are owned by people. The way that happens is usually by a crowd-sale called the “ICO”, which means that you purchase certain tokens of that DAPP in exchange of your ether.

Ether tokens are usually of 2 varieties:

Work Tokens – Work tokens identify you as a sort of shareholder in the DAPP and because of that, you have a say in the direction that that DAPP takes. DAO tokens are a perfect example of this because you would have the right to vote on whether a particular DAPP could get funding from the DAO or not if you were a DAO token holder.

Usage Tokens – Usage tokens act like native currency in their respective DAPPS and Golem is a pretty good example of this. You will need to pay with Golem Network Token (GNT) if you want to use the services in Golem. These tokens won’t give you any particular rights or privilege within the network itself although they have monetary value.

What you'll learn 👉

Is Ethereum Token Just Like Bitcoin?

Bitcoin’s been around for almost eight years and that’s why many people are familiar to it. On the other hand, Ethereum was only developed two years ago and that’s why not so many people have heard of it.

Ethereum was created by Vitalik Buterin, a young programmer who began working on Ethereum after he dropped out of college. He was told about bitcoin by his father and decided to create a platform for smart contracts; which bitcoin is not designed to do.

Ethereum is a fork of Ethereum Classic – read more here on the differences between the two ethereum blockchains.

There are many reasons why Ether tokens and bitcoins are called cryptocurrencies:

- They are used to pay for things (including pre-school tuition).

- They can be only be purchased and sold digitally

- They fall outside of the control of central banks and other government entities that might control a national currency

They’re built on a technology called blockchain, which is a kind of ledger that records and verifies transactions made on it. All transactions made on these decentralized networks are public and the best thing is that they are not controlled by one governing entity. Lately, the idea that both sides of a party can get an accurate and verifiable record of the transaction instantly, has gripped Wall Street and other institutions. They saw it as something that can be used in lots of ways.

These tokens can be acquired in multiple ways. They can be purchased on an exchange just like you would any investment. Also, you can use computer software to solve complex math problems to „mine“ for them. In order to control the supply, these math problems get more complex as more coins are mined.

There is a key difference between bitcoin and ethereum. Bitcoin was designed to be a currency from the start and Buterin conceived of Ethereum as a platform on which two parties could enter into a contract without a third party.

These smart contracts create trust between two parties. According to The Huffington Post, the Ethereum platform is powered by ether tokens. They can be used as both a currency and can “represent virtual shares, assets, proof of membership, and more and its numerous applications are partially responsible for its popularity and recent rise.

Why Do We Need Ethereum Tokens?

If all these DAPPS are made in the Ethereum Network, then why don’t we simply use Ether to pay for every transaction within those DAPPS and why do we need a native currency for them? The answer to that question is pretty simple. Even in real life there are many places where we use a form of token over cash.

For example, when you go to the water park they take your money, tie a band around your wrist and you gain access to all the rides in the park and you can buy food as well with the band. The water park is the DAPP, your money is ether and the band is the token in this case.

Or, do you remember that time you purchased those movie tickets for Spiderman and included an extra coke and popcorn in your ticket? How did you get in the hall when you entered the theatre? By showing them the ticket. How did you purchase your coke and popcorn? Again, you showed them the ticket. The cinema theatre is the DAPP, your money is Ether and the ticket is the token in this example.

You make the process much more simple and seamless by using tokens to execute certain functions in the smart contract of the DAPPS. Also, tokens are great for the overall value of ether.

First, I will explain how exactly one can create a token and how can a DAPP issue tokens in exchange of ether before we go any deeper.

How to Create an Ethereum Token

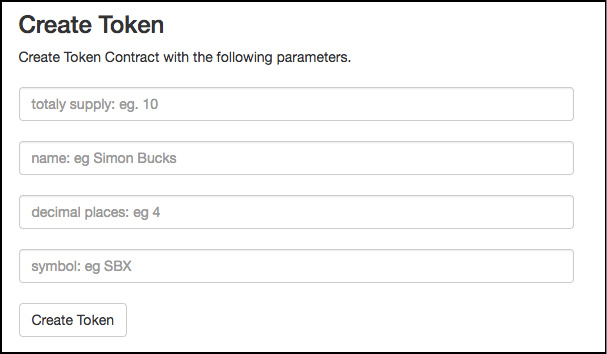

The easiest way for you to create a token is simply going to Token Factory and check out their system because they have a superbly user-friendly system. This system can be used right away:

Solidity is the language used to code in Ethereum and if you want to code your tokens from scratch you should definitely be well versed in this language.

(You can also use Bancor to create smart contents. I will cover that a bit later in the guide.)

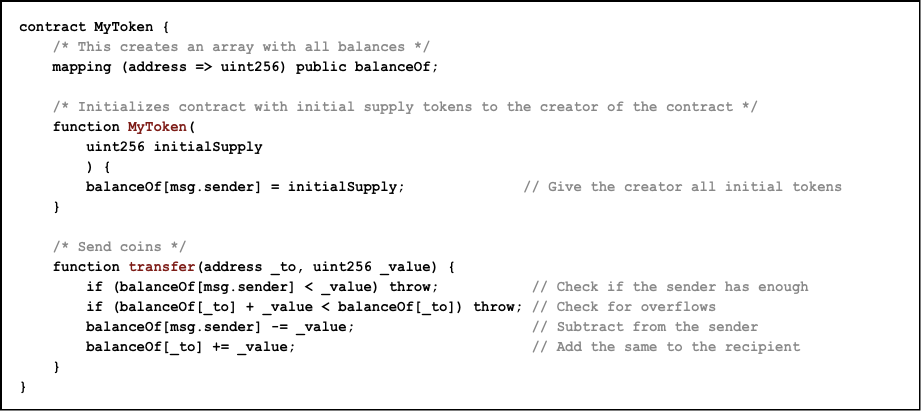

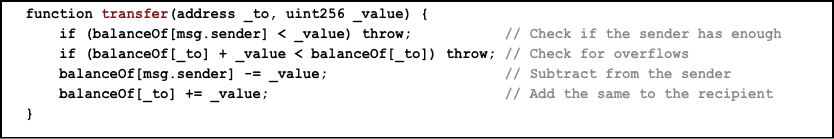

Token contracts can be very complicated. However, this is what a basic token contract looks like:

Now we will break the code down into its bare necessities. There are three specific parts of this function:

- The mapping

- All tokens are given to the creator.

- The token is transferred to a sender for ether.

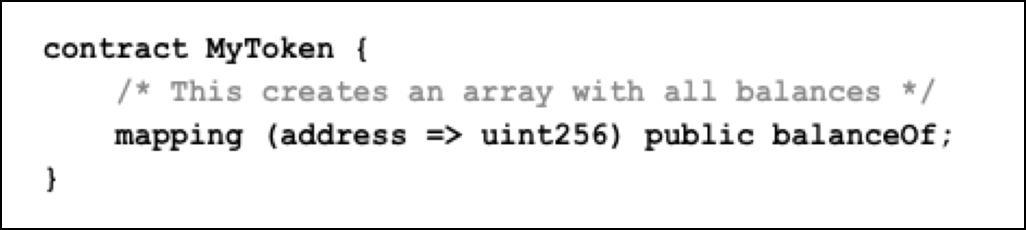

The mapping part:

This creates a database and everyone can see the balance of their tokens in the database. Tokens like ETH itself is logged into an open ledger and anyone can see all the balances and transactions of that particular token.

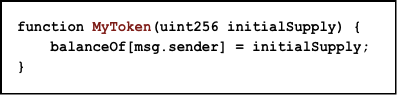

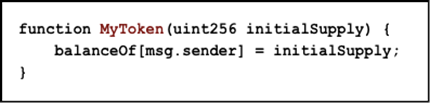

All tokens are given to the creator: Whoever has created the smart contract and tokens in this part of the function will get all the tokens:

The token is transferred to a sender for ether: This is the last part of the code. Here a sender can get an equivalent amount of token for the ether that they invest into the DAPP.

The function is very self-explanatory and straightforward. Firstly, it will check if the sender has the requested amount of tokens in their balance, then the code will deduct the said amount of token from the sender balance and then add that value to the recipient’s balance.

The creators of various DAPPS have to create their own tokens, which was an absolute nightmare for wallets, exchanges and other smart contracts that were going to interact with various DAPPS and tokens. The problem with this is that they would have to completely re-invent the wheel every single time for every single DAPP who had their own unique token to make their system compliant with the DAPP.

Imagine reinventing and updating your code over and over again every time you need to interact with a new token! A huge problem and something had to be done to circumnavigate this problem. The Initial Standards Token which would solve all these problems was introduced by Vitalik Buterin, in DevCon 1 2015. After that, Fabian Vogelstellar, one of the founders of the Mist Wallet, took these standards and polished them up. He also added some of his own to come up with the Ethereum Request for Comments 20 aka ERC20 standard for tokens.

ERC20 Ethereum Standard for Tokens

The ERC20 Ethereum standard is basically a specific set of functions. Developers must use this set in their tokens to make them ERC20 compliant. This is not an enforced rule. However, most DAPP developers are encouraged to follow the standards to ensure that their tokens can undergo interactions with various wallets, exchanges and smart contracts without any problems. This was great news for everyone. At least now you have an idea of how future tokens are expected to behave. ERC20 tokens have gotten widespread approval. Today most of the DAPPS sold on ICO’s have tokens based on the ERC20 standard.

What does a token need to have to be ERC20 compliant? Well, it needs a set of 6 functions that can be recognized and identified by other smart contracts. This in turn leads to seamless interactions and when executed, the following 4 basic activities are what all the ERC20 tokens required to do:

- Get the entire token supply.

- Get the account balance.

- The token is transferred from one party to another.

- The use of token as a monetary asset needs to be approved.

Ok, so now I have explained what tokens are and what exactly they do. I have also explained how to create them and what rules they follow. But, the big question is, how exactly you get your hands on tokens when a new and exciting DAPP comes along. You can get them through the ICOs.

What Are ICOs?

ICOs or Initial Coin Offerings have been truly revolutionary. They are basically crowd sales, the cryptocurrency version of crowdfunding and they have managed to accomplish these great tasks:

- Anyone can become invested in a project they are interested in by buying the tokens of that particular DAPP. By doing this they become a part of the project themselves. (I am talking about Work Tokens here).

- ICOs have provided the easiest way by which DAPP developers can get the required funding for their project.

How Do ICOs Work?

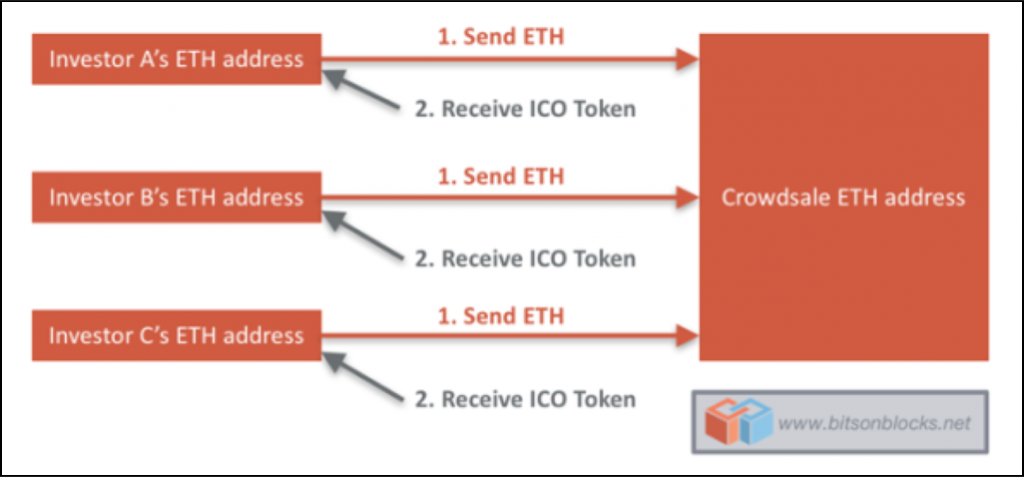

Firstly, the developer issues a limited amount of tokens, which is very important because in this way they are ensuring that the tokens itself have a value and the ICO has a goal to aim for. The tokens can either increase or decrease depending on how the crowd sale is going or they may have a static pre-determined price.

Here is a list of upcoming ICOs.

The transaction is a pretty simple one. You send a particular amount of ether to the crowd sale address if you want to purchase tokens and you will receive your corresponding amount of tokens when the contract acknowledges that this transaction is done. As I already said, everything on Ethereum is decentralized. This means that an ICO is considered a success if it is properly well-distributed and a majority of its chunk is not owned by one entity.

The DAO ($150 million) was the biggest ICO of all time. However, it was recently overtaken by Bancor ($152 million).

An amazing over $ billion dollars have been raised in ICOs in the past 12 months alone.

Note: Because of the sheer amount of money that developers have been raising even before the creation of an Alpha version of their product ICOs have become an extremely controversial topic nowadays and some people are accusing it of being a Ponzi scheme. I don’t exactly label it that. However, before proceeding with future ICOs there are certain aspects that need to be checked.

How Does An Ethereum Token Get Its Value?

Now we’ll find out what gives Ethereum tokens their value in the first place. There are mainly two factors that help tokens get their value:

- Trust

- Supply and Demand

Trust: Tokens will only have value if people have trust in it and this is the case with any currency. Trust comes from a lot of sources like the kind of service provided by the DAPP, the credibility of the developers etc.

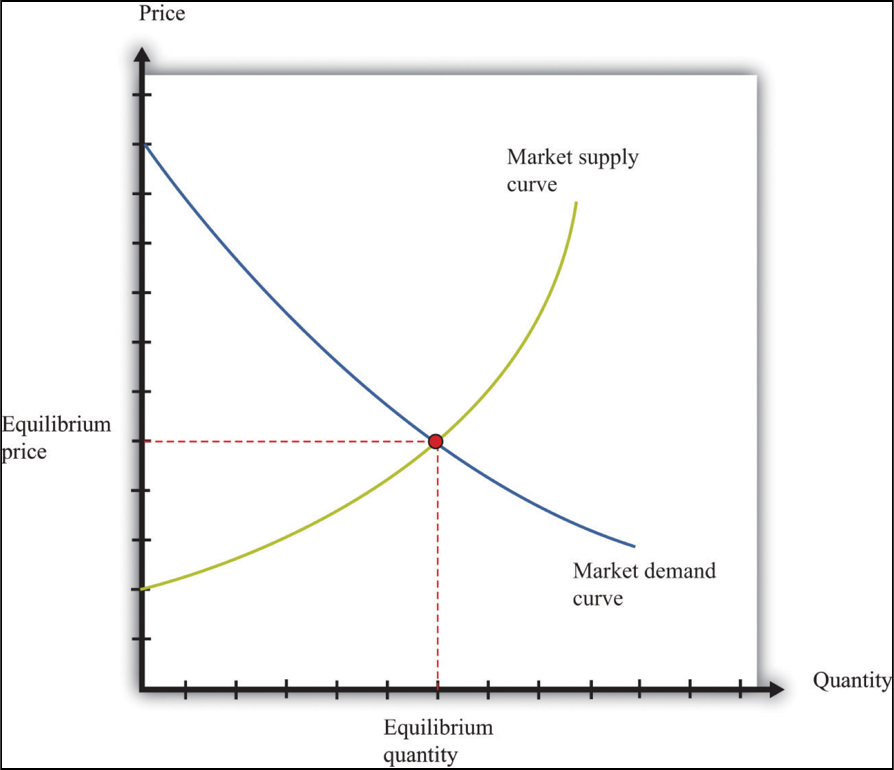

Supply and Demand: This is basic economics 101 because more the demand and lesser the supply more will be the price of the product. This is how supply-demand graph looks like:

As you can see, the equilibrium is the sweet spot where both the curves intersect. So, how do Tokens take care of supply and demand? Do you remember the token creation code and specifically, the second part of the code? Now we’ll take another look:

As you can see, there is a fixed amount of tokens that can be issued. Like ether, token transactions are also recorded in the open ledger, which means that each and every token is accounted for. The developers will have to create a new application if they want to change the number of tokens issued. Any code that is issued in the blockchain is irreversible. This means that the old application cannot be changed in any way.

This takes care of the “supply” part. But what about the demand? The demand depends on many factors:

- Has the DAPP been marketed in the right way?

- What is the quality of the DAPP?

- Is that DAPP going to solve issues?

- Are people interested in the DAPP?

The value of the token is going to be pretty high if the demand of the DAPP is sufficiently high, and with the supply remaining constant.

We have gained at least an introductory knowledge about tokens. Now, let’s do some research on the 3 hottest Ethereum Tokens in the market right now:

Augur

Founders: Jack Peterson and Joey Krug

Money Raised in ICO: $5.2 million

Token Cap: 11 million REP

You have all probably watched that old game show “Who Wants To Be A Millionaire?” where every contestant had 3 lifelines, one of which was audience poll. Basically, they could ask the audience that question if they were stuck on a question. The audience was then supposed to vote on the option that they knew or felt was to be correct and they got it right more often than not. This phenomenon is called the “Wisdom Of The Crowd”. This proves that groups of people are correct more often than individuals. Augur used that same idea in prediction markets.

What Are Prediction Markets?

Prediction markets are speculative markets. They allow users to buy and sell shares in the outcome of an event. For example, if you have specialized knowledge in a particular field, eg. a football match, you wager on the favorable outcome by taking different factors into consideration.

Prediction markets have been around for a while, but Augur is the first decentralized one. This means that users do not have to trust a central authority to report on the outcome of events, because this could create a single point of failure and leaves the market open to mistakes or outright manipulation. With Augur, thousands of REP token holders will verify this outcome. This will make manipulation or error virtually impossible.

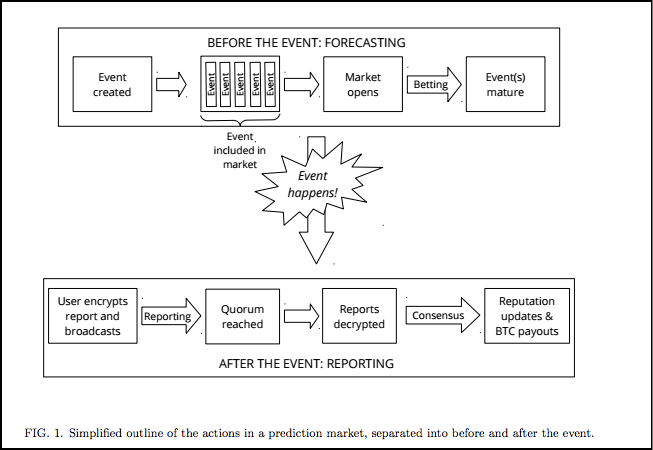

How does Augur work?

Augur is an Ethereum-based decentralized prediction and it allows users to create their markets for specific questions they may have and to profit from the trading purchases while allowing users to purchase positive or negative shares regarding the outcome of a future event.

Augur is used by three kinds of people:

- The Reporters (also known as the REP token holders).

- The Market Creators.

- The Wagerers.

The Reporters the people who own the REP tokens. This means that they are obligated to report on the outcomes of their fields of choice. They also report on the outcome when an event is near maturation. They risk losing 20% of their REP coins if they report wrongly or they do not report at all. The value of augur is directly proportional to the quality of the reporters because no one will want to use augur if a lot of the reporters are dishonest. This may greatly decrease the demand, which forces all the reporters to remain honest.

The Market Creators will be creating the markets for the reporters to report on and, as a result, they will earn market fees.

The Wagerers are the people who will be betting on the outcome of the future of the markets based on the reports by the reporters.

The Reporting Period

The reporting is done in two phases. The reporters submit their report to the network within the first month of the completion of the event. This is tightly secured and kept away from the public. The second phase happens a month later. The reports are shown in an open ledger which is free for all to see and we reach a final consensus when that is done.

Aftermath of the Consensus

The wagerers get their reward for putting their bets.

The wagerers give fees to the reporters who reported honestly.

The reporters who didn’t report correctly get 20% of their REP deducted. This goes to the reporters who reported honestly and correctly.

This is augur’s curve:

Current market cap is sitting at about $242 million.

Current market cap is sitting at about $242 million.

Pros

- It is based on the concept of “wisdom of the crowd”. This helps keep the whole system honest.

- It forces the reporters to report honestly because there is risk of losing their REP tokens.

- It helps to make correct future predictions for markets.

- It is not dependent on a central entity for market predictions. This keeps it free of human greed.

Cons

- It tends to reward the people who purchased in early and accumulated REP coins as compared to those who are newer buyers.

Future

Augur is growing from strength to strength. However, it is facing stiff competition from Gnosis (a similar token), and how it comes out of this battle will greatly affect its future.

Golem

Founder: Julian Zawistowski

Money Raised in ICO: $8.6 million

Token Cap: 1 Billion GNT

Imagine this situation. You are in your home with a super powerful PC and CPU and you are hardly using it at night. On the other hand, at the same time an animator in Philippines is desperately looking to render a high-def video. Wouldn’t it be amazing if he could somehow access your computer’s power and get his job done in one night? That’s no longer a pipedream with Golem.

Golem describes itself as an “Airbnb for computers” and it is usually called “worldwide supercomputer” because anyone can contribute to it and anyone can purchase computation from it. It is essentially a peer-to-peer network which sources computing infrastructure in a decentralized manner to create a global market for computation. You can essentially “rent out” some of the CPU power in the network by tapping into the Golem network and use it for your own projects.

There are three user groups in the Golem network:

- Requestors

- Providers

- Software Developers

Requestors are people who want to access the power in the golem network and they do so by paying with GNT (Golem Network Token).

Providers are people in the Golem network who are renting out their computer power and they get paid in GNT for their services.

Software Developers create applications which enable utilization of network resources. In case the requestors want to use their software, they will have to pay GNT to the software developers to gain access to their software. They will also have to pay the providers the required amount to rent out their computer power.

The Sandbox

The Golem system can be exploited in one way. Imagine this situation. A requestor rents out a provider’s hardware to use it to run a virus code and this steals all the data in that hardware or the entire system. What happens then is that all the transactions in Golem will be run in a sandbox environment to counteract this problem. What does this mean? It means that you will be under a lot of rules when you rent out a provider’s hardware. These rules will restrict your movement and if you were a hacker you won’t really have the freedom to move about and do what you want.

Pros

- It is a very interesting concept. It can effectively create the world’s first decentralized super computer.

- Over the last few years the value of GNT has been steadily rising.

- It makes good use of underutilized computer equipment.

- It can give access to people living in poorer countries to world class computer machines.

- Software developers are given a platform to release and showcase their software.

- The team behind Golem is extremely good and proven.

- The sandbox environment contains no potential hacks.

Cons

- There is a way to contain any hacks. However, no sandbox is perfect because a bug can be exploited which can render the whole system useless.

- There are some potential latency problems because of over usage.

- Golem will take 8 years to run at an optimal state, according to the roadmap given in their white paper. This is too long a time.

Future

Golem has a very good team backing it, headed by a very capable leader, and it looks like it has a pretty bright future with a very interesting concept. The team has been together since DevCon 1. It looks like they have what it takes to make the concept really work and there is no reason to doubt their potential seeing the growth in GNT’s value over the past couple of months.

Bancor

Founders: Bprotocol Foundation

Money Raised in ICO: $153 million

Token Cap: Unknown

Thanks to its ICO Bancor has shaken the crypto world down to its very foundations and people have invested an amazing $153 million into the company! But what is the fuss all about? What is so amazing and interesting about Bancor? The sheer amount of tokens is definitely one of the problems that MAY affect the Ethereum community in the future. Most of the popular tokens can be easily exchanged. However, the problem arises when you have rare tokens.

Tokens like GNT can be easily exchanged and bought. But what happens when you have tokens that nobody wants to exchange with and how do you liquidate your tokens then? This is where Bancor offers an extremely elegant solution – it has come up with the idea of issuing smart tokens.

Read also:

What Is A Smart Token?

The idea of the smart token is to make tokens which completely do away with currency exchanges and smart tokens hold one or more other tokens in reserve and enable any party to instantly buy or liquidate the smart token in exchange for any of its reserve tokens. Normally, you will have to go to an exchange if you were to purchase a token. Here someone will try to match you with someone else and after the transaction takes places. It can get hard to have someone match up with you if you have a rare token that no one really uses.

This means that Bancor builds tokens with smart contracts built inside it. This formula allows you to have exchanges directly with the smart contract itself and it basically becomes its own market maker!

The Maths behind Smart Tokens

The following formula runs the smart contract inside these smart tokens:

Price = (Balance)/ (Supply * CRR)

Now we’ll examine the equation.

Price = This is the price of the smart token.

Balance = This is the money with which you were purchasing the token (We are only talking about Ethereum tokens so ETH in this case).

Supply = This is the total supply of the tokens available in the market.

CRR (Constant Reserve Ratio) = The ratio between the original balance and the market cap. Its value is always <1, which is a constant and will never change.

We have defined all the values and variables in the equation. Let’s see now how altering every single one of them will affect the price of our token

Case 1: Purchasing new tokens

You will purchase new tokens by adding ETH to the smart contract of your token and obviously “Balance” will increase when you do that. Because you are purchasing new tokens, it also means that you are creating new tokens out of nothing. This in turn increases the “Supply” itself. „CRR“ won’t change because it is a constant.

So let’s re-examine the equation keeping this in mind:

Price = (Balance)/ (Supply * CRR)

Now, keep in mind, CRR remains unchanged. This means that while the value of supply has changed (Supply * CRR) will still be a smaller value than (Balance).

Numerator (Balance) > Denominator (Supply * CRR). The overall value of the price of a token will INCREASE.

Case 2: Selling your tokens

What will happen if I want to sell my tokens? Your “Balance” will go down because you are taking Eth out of the smart contract. At the same time your “Supply” will go down because you are literally commanding the smart contract to destroy the required amount of tokens. Since ”CRR” is a constant, it remains the same as before.

Put these values in the equation now:

Price = (Balance)/ (Supply * CRR)

The numerator will still be greater than the denominator. However, the overall price will drop since the new numerator will be less than the original numerator (on account of balance reducing).

All that you have to do is to simply put numbers in the equation and check out the changes itself. What exactly happens when you are purchasing and selling new smart tokens?

Now, suppose you sell a lot of coins at once and you don’t have enough balance to counter it out. What happens then? The great thing about this equation is that it has been made in a way that it adjusts itself dynamically to any and all circumstances. You can check out the Bancor white page where they have a couple more complicated formulas if you are interested. You will see that the equations will always hold true.

To Summarize

When you want to PURCHASE smart tokens you are giving ETH to the smart contract. There is also instructing the equation to literally come up with new tokens.

On the other hand, you are instructing the smart contract to destroy the required amount of tokens and deduct the value of ETH from your Balance and transfer it to your wallet when you want to SELL smart tokens.

Pros

- The idea of smart tokens has gigantic potential.

- It has completely taken the middle man out of cryptocurrency exchanges.

- Since the middle man no longer exists you won’t have to pay any extra taxes or charges.

- It gives an interface for you to make newer tokens.

- It makes sure that the tokens can always be liquidated.

Cons

- The idea of smart tokens is extremely nascent and untested.

- For people who are new to cryptocurrency the idea of the smart tokens can be a little tough to grasp.

- The ICO was highly controversial because they didn’t keep a market cap initially for close to an hour, which greatly affects the price of the tokens.

Conclusion

A number of tokens that have come out in the past one year is amazing and shows no sign of stopping. You will be getting a new and steady supply of tokens as long as people are looking to innovate on the Ethereum blockchain.

Tokens are going to evolve into becoming more and more versatile because they can be anything from currency, to real world assets, to IOUs and it thus appears reasonable to state that soon, all money, whether centrally issued or otherwise, whether dollar or euro, will be turned into pure code. Fabian Vogelstellar, the man who gave us the ERC20 token Standard says about tokenization:

[x_blockquote type=”left”]„I believe we are just at the beginning of tokenizing everything and maybe in the future, you will be able to buy a share of the chair you are sitting on, the paint inside your house or a fraction of equity in a huge building complex.“[/x_blockquote]

[x_share title=”Share this Post” facebook=”true” twitter=”true” google_plus=”true” linkedin=”true” pinterest=”true” reddit=”true” email=”true”]