TaxBit Review: Cryptocurrency Tax Software You Can Depend On

Given the increasing popularity of digital currencies, governments worldwide are looking for ways to regulate the crypto revolution and tax digital currency use effectively. Many governments throughout the world have now issued crypto taxes that are due for cryptocurrencies, so soon every single transaction whether you bought or sold digital currency will need to be tracked and accounted for on your crypto taxes.

For example, in 2014 the IRS (the Internal Revenue Service) clarified that cryptocurrency is taxed as property, which means that every cryptocurrency trade or sale is a taxable event. Also, the IRS sent out tens of thousands of audit notices to US crypto traders, followed by releasing new crypto tax guidance in the fall. The IRS also included a new question on its 2019 tax return form. It requires all US taxpayers to attest whether they acquired, sold, or exchanged cryptocurrency at any point during the taxable year.

Trying to keep up with which coins you bought and sold is one of the more stressful parts of being a cryptocurrency trader.

Some exciting tools can help you calculate your crypto tax. However, the process needs to be made easier and more straightforward. Luckily there is a beneficial tool that is new on the market and that will help you sort out your digital currency transactions so that you will be prepared for tax season, introducing TaxBit.

What you'll learn 👉

TaxBit Overview

TaxBit, a Utah-based firm, is cryptocurrency tax software developed by industry-leading blockchain CPAs, software developers, and cryptocurrency tax attorneys. This feature has given the platform an edge over most tax software products currently on the market, as it runs data through carefully analyzed tax codes to ensure the compliance of tax reports to existing rules.

The platform offers cryptocurrency tax automation software targeted at crypto users, exchanges, and merchants. TaxBit launched its consumer product in January 2019 and has since helped thousands of crypto users automate their taxes. TaxBit has a mission to enable widespread cryptocurrency adoption by automating the regulatory hurdle of tax compliance. Users can easily use TaxBit’s do-it-yourself platform to produce all of their required crypto tax forms in minutes. That’s why the company’s consumer product is often referred to as the “TurboTax of crypto”.

In January 2020, the company announced a seed round of $5 million, with some of the industry’s biggest names participating, including Fintech venture firm, TTV Capital, Dragonfly Capital Partners, Collaborative Fund, Global Founders Capital, Table Management, Winklevoss Capital, Valar Ventures, Album VC, who previously led TaxBit’s pre-seed round, and more.

How Does TaxBit Work?

TaxBit’s crypto tax software is designed to handle millions of cryptocurrency transactions and currently supports over 4,200 digital assets, equities, commodities, and all fiat currencies. After you connect your exchanges, your data will automatically pull in and run through TaxBit’s tax engine. Rather than only producing a tax form at the end of the year, TaxBit offers its users real-time portfolio metrics as they trade.

The software avails an automated way of calculating and reporting taxes, oversees the synchronization of transaction data, calculates gains and losses, and claims capital losses while it is at it. To do this, the software avails an API integration system, which automatically pulls the user’s transaction history and cycles them through their tax engine. Note that the TaxBit software solely caters to crypto practitioners in the U.S. and would use IRS tax codes as guidelines for its tax reporting operations. The company is looking to extend its services to other countries like the UK, Canada, and Australia.

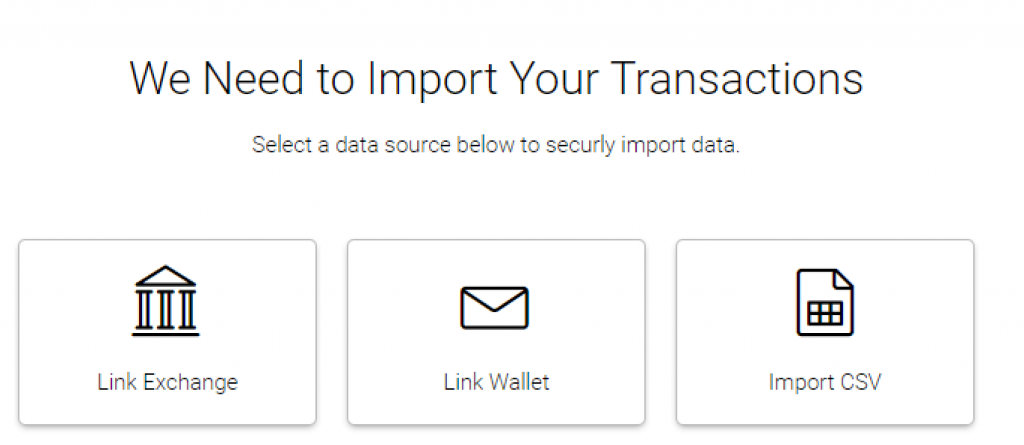

TaxBit currently supports 4,200 digital assets/commodities/equities, a broad array of crypto exchanges/wallets, and all fiat currencies, so users can automatically link their crypto exchange/wallets to the TaxBit platform via APIs and process all of the cryptocurrency transactions they had authorized. The platform also has a real-time portfolio tracking tool for users who want to see how each transaction they execute impacts their tax liabilities. If TaxBit does not support an exchange, users can capitalize on its automatic CSV conversion tool. However, API integration is a perfect choice, so it’s essential to verify that TaxBit supports your exchange before subscribing to any of its plans.

TaxBit Plans and Pricing – How Much Does TaxBit Cost?

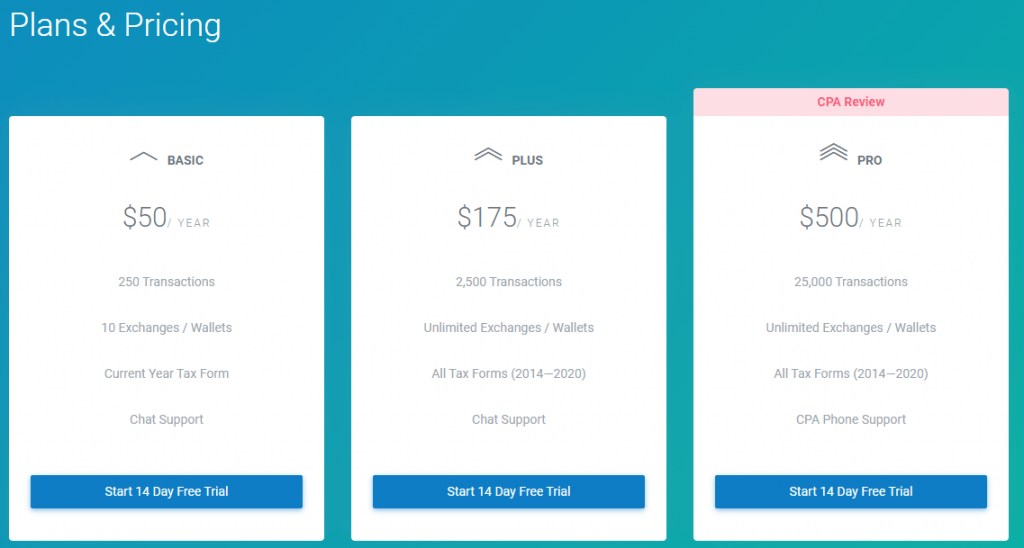

TaxBit price includes three subscription plans: Basic, Plus, and Pro.

Basic Plan – This plan comes in at $50 for the year and provides subscribers with a tax reporting service for 250 transactions and ten exchanges/wallets. The basic plan allows its users to download only one tax form.

Plus Plan – This plan has a price tag of $175 per year and allows 2,500 transactions and unlimited exchanges or wallets. Subscribers of the Plus plan can download all tax forms from 2014 to 2019.

Pro Plan – The third plan is for the “Pro” account which runs $500 a year. This plan lets users process 25,000 transactions from unlimited data sources. It’s also important to note that subscribers have access to tax forms from 2014 to date and are eligible for a CPA audit.

A lifetime membership runs $999 and allows a user unlimited transactions and wallets/exchanges. The site mentions that there are only 500 spots available for the lifetime membership. TaxBit also offers its users free trials. There is also an incentive program to reward users who refer new clients.

How to Use TaxBit?

Setting an account up on TaxBit is simple. The platform only asks for your email address, which becomes your account username, and credit card information. The venue may also ask for additional personal data such as your name, zip code, and tax demographic information in order to provide its users with a more customized and complete experience.

To calculate a user’s tax rates, TaxBit asks some basic demographic questions, such as your country of residence, filing status, estimated income, and tax year. Using this information, the platform will calculate your tax rates, both federal and each state, and apply your tax rates to each of your gains or losses. This will allow you to see an estimate of your total tax liability or refund.

Once your tax rates are calculated, TaxBit will guide you to link your crypto exchanges. Once a user connects their exchanges, TaxBit’s system starts pulling the user’s exchanges, which can take a couple of minutes. Once the syncing process is completed, you can dive into the interface and see all your crypto transactions’ tax impact. You can also download your cryptocurrency tax forms from within your account.

Your complete cryptocurrency tax forms can be downloaded in two ways. You can download it in PDF format, ready to then be sent to your CPA, or you can choose to download it in formats supported by popular tax filing software such as TurboTax, TaxAct, H&R Block, or TaxSlayer.

User Interface

TaxBit implemented a simple, slick, and mobile-friendly website design that improves user experience. Navigating the site as well as accessing features and service portals is very easy while researching the website.

TaxBit’s user interface is a sophisticated cryptocurrency tax engine that allows its customers to see a high-level overview of their account, as well as the ability to drill down on individual transactions. The interface was designed by leading Blockchain CPA’s and cryptocurrency tax attorneys and allows its customers to see their total portfolio value, gains or losses for the year, their coins, and their estimated tax liability. Cleverly and intuitively designed, this interface

TaxBit provides the users a way to track their taxable gains, which is very important because of the recent laws in the United States which say that digital currencies are now considered real property, every single buy, sell, and trade needs to be submitted for tax purposes. The platform also helps users by separating both short and long-term gains and losses of each crypto transaction so that come tax season, everything is in order, and the sum that needs to go to the IRS has already been set aside for you.

Customer Support

TaxBit customer support is top-notch. The platform segments its customer support channels to users according to the plan they choose. However, there is no reason to believe that this support model limits the chances of users to access help as at when due.

The crypto tax regulation in the U.S. is still in its formative stage, but it’s only a matter of time before cryptocurrency tax regulation hits crypto investors hard. That’s why the TaxBit team has made it its responsibility to continually update its users, via the website’s blog, on happenings in the crypto tax scene and how they affect their tax obligations.

TaxBit Security – Is TaxBit Safe?

TaxBit is an extremely safe platform because it only collects read-only API keys, which means that it can only view a user’s transactions and has zero access to the real digital assets. If there were a hack on the platform, the hacker would only have access to see a user’s transactions, with no access to the support. It’s also important to note that the platform does not store its customers’ personal information such as social security numbers or tax identification numbers on their servers. TaxBit also uses database servers hosted by AWS RDS, and all data is encrypted using AES 256 in transit and at rest.

One more thing worth noting is that the TaxBit hired the former Coinbase Compliance Director and former Facebook Policy and Compliance manager on Calibra to manage data security and customer privacy.

TaxBit Team

TaxBit is headquartered in Draper, Utah, founded by two brothers – Austin and Justin Woodward. The company has 15 employees.

Austin Woodward (CEO and Co-Founder) – He is a certified public accountant (“CPA”) with a master’s degree in accounting from BYU, a top-ranked accounting program in the world. Before he started TaxBit, Austin was the controller and financed professional at Qualtrics, a CXM platform that focuses on collecting, organizing, and understanding essential data relative to customers and employees.

Justin Woodward (Co-Founder – Tax Attorney at TaxBit) – He is a licensed tax attorney with a law degree from the University of Chicago, one of the most distinguished US law schools. Before TaxBit, Justin experienced working with the United States District Court as a judicial law clerk and American Law Institute as a legal researcher.

Other members of the team are:

- Brandon Woodward – Co-Founder/Product

- Josh Peterson – Customer Support Specialist

- Larry Christensen – Senior Software Engineer

- Matthew Smith – Principal Software Engineer

Conclusion

While the world of cryptocurrency continues to flourish, more laws will be issued, because the government will want its cut and will get it by enforcing new taxes on digital currencies. Filing taxes is an intimidating process, as is, but TaxBit strives to lessen the stress and simplify the process for merchants, individuals, and exchanges, alike. TaxBit has made its way to the thick of the crypto taxation conversation by offering top-notch services to crypto practitioners looking to find a fast and efficient way to report taxes. TaxBit provides a crypto tax software platform used by thousands of everyday crypto users, crypto exchanges, and merchants to manage their 1099 and enterprise reporting requirements.

The platform allows its users to easily connect over one hundred crypto exchanges to their TaxBit accounts. Users can also run their transactions through the U.S. tax code, manage their portfolio with the most advanced crypto portfolio tracking analytics, produce a full audit trail showing precisely how gains/losses are calculated, claim the capital loss deduction, and create their IRS 8949 crypto tax forms.

With a strong and qualified internal team, TaxBit will withhold the funds for taxes and keep everything organized for you.

TaxBit Alternatives

TaxBit has a whole range of competitors, most of which we already covered in our reviews:

- CryptoTrader.Tax review

- Cointracking.info review

- ZenLedger.io review

- Koinly review

- Cointracker review

- Best Binance Tax Calculators