What you'll learn 👉

FTX vs FTX.us: Key differences

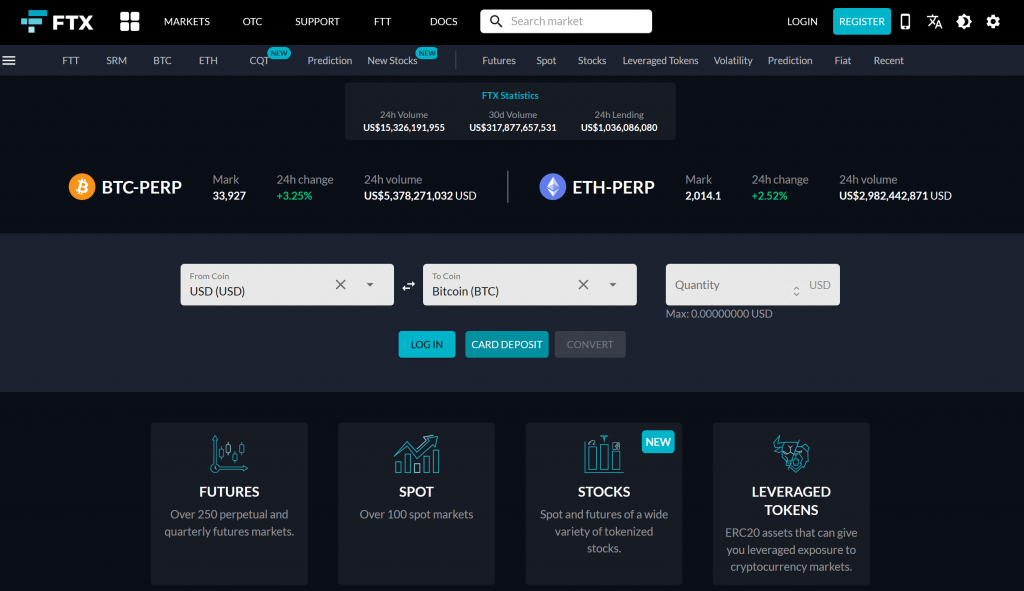

The FTX exchange is a cryptocurrency derivatives exchange that offers various unique financial products. Founded in 2019, the exchange has increased in popularity and the number of registered users.

FTX has two exchanges, the first one is ftx.com for users from all over the world except US citizens. For the US-based traders, FTX has made a US-regulated exchange on the FTX.us domain. US residents aren’t allowed to trade the exchange’s native cryptocurrency, called FTT. They can’t take part in multiple contracts on the platform as well.

Photo source: https://www.ftx.com

Best Suited For

US citizens are restricted from using the FTX.com exchange due to the regulations imposed by the US government on its citizens regarding the trading of cryptocurrencies, but they are free to use the FTX.us exchange that is US-regulated.

Users from other countries than the US should use the FTX.com domain because it offers all the features of the FTX.us exchange as well as the features that aren’t allowed in the US.

Despite all the work the exchange puts in order to provide newbies with a good user experience, it is still more suited for experienced traders because trading derivatives carries a high risk and can be too hard to understand, especially for beginners. Most products offered by the exchange require a profound knowledge of both the market and the digital asset that you would like to trade, as well as some experience in technical analysis.

Background

FTX strives to provide the best trading experience for its customers. Its motto is “For traders, by traders”. Since its inception in 2019, the exchange’s goal has been to provide traders with new yet innovative financial products that can be used by both novices and professional traders. For instance, FTX offers Leveraged tokens, futures, and options trading.

Trading experience

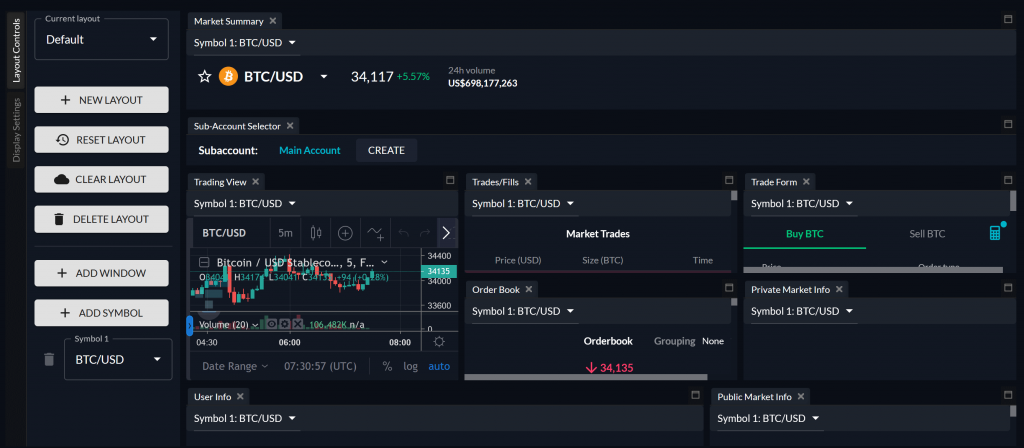

The FTX team designed FTX.com’s user interface and made sure that it is user-friendly and easy to use. They put in the middle FTX’s trading chart which offers many trading features, drawing tools, and a chart pattern overlay. FTX.com has also integrated TradingView charts that you can use for technical analysis. Next to it, there are more details such as the price performance, order details, and the trading history.

What makes FTX a great choice for novices is the convenience of tracking and controlling their positions. For instance, the trading platform gives its users more available order types than most exchanges. Here is the list of the orders available:

- Market order

- Limit order

- Stop limit

- Stop market

- Trailing stop

- Take profit

- Take profit limit

Another great feature of this exchange is the ability to use API keys in order to automate trading using crypto trading bots.

FTX.us has pretty much the same trading experience as FTX.com, but it is easier to use since the exchange has fewer features than FTX.com.

Available coins and contracts

FTX.com is a derivatives exchange where you can’t trade any real digital assets. In fact, the exchange allows you to trade a product that illustrates the value of the coin you are willing to trade.

FTX.com supports future contracts for more than 80 cryptocurrencies. Unlike its competitors, it allowed the future trading of coins with low market caps. It also supports multiple fiat currencies such as: USD, EUR, AUD, GBP, SGD, TRY, HKD, TRY, CAD, BRL, and CHF.

One of FTX’s unique features is the MOVE contract, which allows traders to trade market volatility. This contract represents the absolute value of the amount a digital asset moves over a time period, like the weekly for example. In fact, it doesn’t matter whether the price goes up or down, what matters is the amount in USD the price moved during a period of time.

You can also trade perpetual futures on the platform. These futures do not expire. Instead, they get updated each hour.

Another unique feature offered by the exchange is Leveraged Tokens. These tokens are innovative ERC-20 tokens that can give you leveraged exposure to crypto markets. Let’s say you want to trade ETHBULL, whenever ETH goes up by 1%, this token will go up by 3%(3x).

FTX.us, meanwhile, has fewer cryptocurrencies and contracts available for its users. For instance, it only supports 24 cryptocurrencies. Moreover, the exchange has fewer financial products compared to FTX.com: margin lending and borrowing, margin trading, and spot trading.

Leverage & margin trading

The FTX.com exchange currently supports up to 101x leverage. However, users have a default maximum leverage of 10x. In order to trade with higher leverage, traders should go to the settings section and increase their maximum leverage by changing the “Account Leverage” section.

FTX.us on the other hand supports up to 10x leverage for US crypto traders.

Trading fees

FTX.com has set up six tiers of trading fees based on a taker maker model. Like many other exchanges, FTX gradually decreases the fees for traders based on their daily trading volume to encourage users to trade in higher volumes. Tier 1 traders need to pay a taker fee of 0.07% and a maker fee of 0.02% while tier 6 traders only pay 0.04% in taker fees and a maker fee of 0%.

As for FTX.us, the exchange charges higher fees in general for its users. It operates using the same taker maker model but has 9 tiers instead of 6. Tier 1 traders pay 0.1% in maker fees and 0.4% in taker fees, while tier 9 traders pay only 0% in maker fees and 0.05% in taker fees.

Here is the list of fees for the FTX.us users:

Deposits & withdrawals

FTX.com allows deposits in multiple cryptocurrencies: Bitcoin, Ethereum, Bitcoin Cash, Litecoin and various stablecoins (TUSD, Tether, PAX, and USDC).

The exchange handles all deposits and withdrawals promptly and doesn’t charge fees on deposits and withdrawals except for ETH, ERC-20 tokens, and small BTC withdrawals (<0.01 BTC).

Aside from crypto deposits and withdrawals, FTX allows you to deposit and withdraw your local fiat currency using an ab bank wire transfer. It only takes one weekday to process USD wire transfers and a bit longer to process other currencies’ wire transfers. The exchange doesn’t charge fees on deposits and charges a $75 US fee on USD withdrawals under $10,000.

FTX.us is also fast at processing crypto deposits and withdrawals, but depositing and withdrawing USD can take up to two business days. FTX.us also charges a fee for USD wire transfer deposits and withdrawals. The minimum fee users need to pay is $5 and the maximum is set to $35.

Read also:

- Binance vs FTX: Fees, Features, Limits, Payment Methods

- Bybit vs FTX: Fees, Leverage, Security & Features Compared

- FTX vs BitMEX: Fees, Limits, Supported Coins, Deposit & Withdrawals

- FTX vs Coinbase : Fees, Features & Security Compared

Security and Trustworthiness

FTX.com uses multiple security features to make sure that the user’s funds are kept safe and his personal information never gets leaked. These security features include:

Password strength: anyone who wants to register an account on the exchange will have to provide a powerful password that includes special characters, lowercase and uppercase letters, and at least one number. This feature facilitates the blocking of brute-force attacks.

2FA: FTX.com supports 2FA, which gives the users an extra layer of security against unauthorized access to their accounts.

Withdrawal lock after 2FA removal or password change: a 24-hour withdrawal lock is triggered whenever a user removes 2FA or changes his password.

Tracking and notifying users of suspicious activity: the FTX.com exchange notifies its users about any login to the user’s account from a new IP address, even if the user didn’t activate 2FA on the account.

FTX.us offers better security to its customers by requiring a mandatory 2FA set up in order to make any transaction on the account. It also shares all the security features of FTX.com.

Insurance funds

In order to make sure its traders don’t suffer major losses while leverage trading, FTX.com has set up an insurance fund. Whenever users trade in high leverages (between 50x and 100x), they need to pay higher trading fees, which will be allocated to this insurance fund.

When the market is exceptionally volatile, the exchange might not be able to liquidate its users in time, forcing them to close their positions, which leads to customer losses. These losses will be covered by the insurance fund.

FTX.us users can benefit from this insurance fund like FTX.com’s traders do. However, in compliance with the US legal guidelines, users’ losses on the platform won’t be topic to insurance coverage by the SIPC or FDIC agencies.

KYC conditions

There aren’t any conditions for going through a KYC verification while using the FTX.com exchange. However, users who don’t verify their KYC will have a limited daily trading volume. For instance, there are three tiers of account verification:

Tier 1: All you need to do is to provide an e-mail address, and you will be able to trade up to $1,000 every day.

Tier 2: By providing your country of residence, your daily trading limits increase to $2,000.

Tier 3: You need to provide a photo ID, your source of income, and a proof of address in order to trade with no limits on your trading volume.

FTX.us has the same tiers of verification, but it should be noted that you can’t use fiat currencies on the exchange without going through KYC verification.

Special features (VIP program, OTC trading)

In order to satisfy the need of professional traders, FTX has a VIP program that offers multiple benefits, such as:

1)Lower fees

2)account managers

3)Flexible API limits

4) Access to VIP meetups

5) Assistance from a senior developer for any API-related questions.

6)The option to provide inputs on new FTX products

For institutional traders, FTX offers an “Over The Counter” exchange that can be accessed at the otc.ftx.com subdomain. All the user needs to get started is an FTX account. Then, they will be able to fund their OTC account using the FTX wallet. Traders who use the OTC portal will get instant, 24/7 OTC quotes on most major digital assets.

Native token availability and benefits

In order to keep up with its competitors, FTX.com has released its own token called “FTT”. FTT.com has made it to the top 50 cryptocurrencies by market cap. It is currently ranked #26 according to coinmarketcap.com.

The token is listed on multiple popular exchanges such as Binance, BitMex, and Bitfinex.

Holding FTT on the FTX.com exchange offers many benefits to users. These perks include:

- Their trading fees get reduced.

- The possibility of using FTT tokens as collateral on the exchange

- FTT holders will get socialized gains from the insurance fund.

- The ability to stake FTT and make passive income.

Here is the list of the discounts for trading fees offered for the FTT token holders on the FTX.com trading platform:

While FTX.com supports the trading of the FTT token, the token isn’t available for trading on the FTX.us exchange and isn’t accessible for users due to legal reasons.

Visit FTX Now Visit FTX.us Now

Customer support and education

FTX offers a comprehensive set of user guides and a FAQs section that covers almost any common problem. Also, the exchange has a support team that can be reached via e-mail in case you didn’t find a solution to your problem in the well-documented FTX help center.

The same thing goes for the FTX.us exchange. You can access the exchange’s FAQs using this link, and you will find an answer to almost any question you might have about how the exchange works and its services.

Add to that, the FTX team has set up multiple WeChat and Telegram groups where traders can communicate with each other. You can also ask for help on Telegram and the support team will reply to your inquiry within a few hours.

Finally, FTX.com and FTX.us have a very active Twitter accounts where the exchange shares updates to their products and connects with their users. Feel free to follow FTX.com’s account to get more insight into the exchange.

FTX.us also has an account where they post news regarding their policies and features so feel free to follow them in case you are interested in what the exchange has to offer.

Ressources: https://help.ftx.com