One of the benefits of bitcoin and other cryptocurrencies is their decentralized system. And this is the case not only in 2025, but many years before.

Cryptos have no central authority, and you can earn passively through a process called Mining. Mining, which is also called ‘proof of work,’ is a consensus mechanism that requires users to guess a random number. The winner gets to update the ledger.

While this is very reliable and secure, it is very resource-intensive (it uses a lot of electricity). The solution to this is another consensus mechanism called Proof of Stake. The Proof of Stake (PoS) uses validators instead of miners and instead of using up much electricity; they lock up funds into a network (or a node).

The nodes compete to forge the next blocks using factors such as how much money is being staked and for how long it is being staked. This prevents a single entity from monopolizing the system. A few examples of projects that use the PoS mechanism include Tezos, Cardano, and Tron. Ethereum is also in the process of moving from Proof of Work to Proof of Stake.

What you'll learn 👉

How To Stake Tezos (XTZ)

Tezos, which uses a Proof of Stake mechanism, is very easy to stake. Staking Tezos is not rocket science. It doesn’t require much additional knowledge or technical know-how. All you need to have to trade tezos is a wallet that enables tezos and a minimum of 1XTZ in the wallet.

Best Places To Stake Tezos (XTZ)

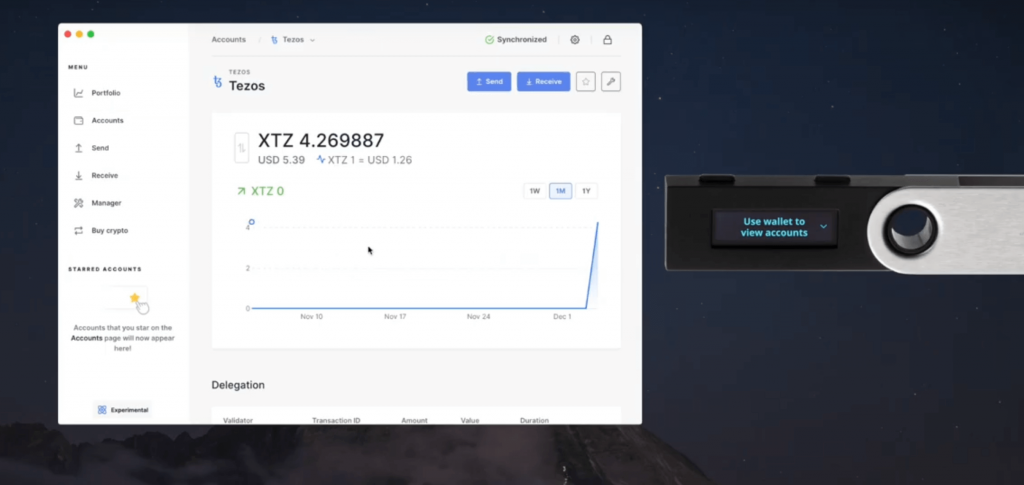

1. Ledger Wallet

To Stake on the Ledger Wallet, you will need to have downloaded the ledger live app. It’s important to note that you should download from verifiable sources so your wallet would not be compromised. Install Tezos wallet on your Live app and connect them together. To do this, click on “accounts,” and on the top right corner, select “Add Accounts.” Search or TEZOS and click continue. Add Tezos token to your wallet as you cannot stake without first owning some. To Stake, you’ll see “earn rewards” on the account page. Click on it, and a pop-up will appear asking you to confirm your choice of account. When you click on continue, you’ll automatically be linked to a verifier.

Staking Tezos on Ledger Wallet will earn you an annual reward of 6% after the verifier’s fees have been removed.

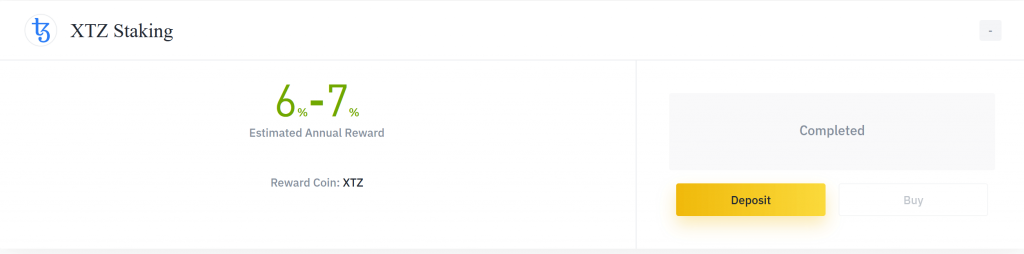

2. Binance

In December 2019, Binance announced plans to start staking Tezos. It was a great step forward and one that was highly welcomed. Staking Tezos on Binance is as easy as cutting butter. To start staking Tezos on Binance, you would have to open a Binance wallet (if you didn’t have one before). After opening one, you’ll deposit Tezos on your account and automatically, you qualify to start receiving staking rewards. It’s worth noting that Binance concludes rewards payment on the 20th of the month, So you should not be too worried if your rewards do not come on time. Staking Tezos on Binance will earn you 6-7% annual returns. Coupled with the fact that Binance doesn’t charge for Staking, you may be in one of the most profitable staking wallets.

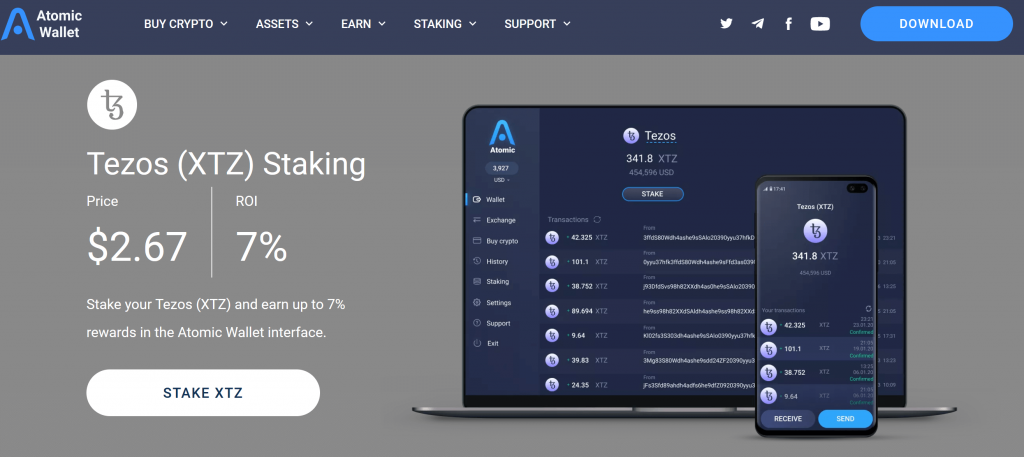

3. Atomic Wallet

Staking in Atomic wallet is unique. You’ll need to download the application and open an account. After you open your account, you can proceed to buy Tezos. This can be done from trading pairs. When you own the coin, click on it and tap on ‘stake.’ On Atomic Wallet, you can only stake with one Baker (or validator). After you agree, click Stake to continue. Confirm the transaction by imputing your password. Your rewards will proceed in roughly 60 days (22cycles with one cycle created In 68 hours). Subsequently, payment is made at 19-20 days intervals (7 cycles). You earn a 7% yearly yield on atomic wallet, and because it is decentralized, you pay zero fees apart from the validator’s cut.

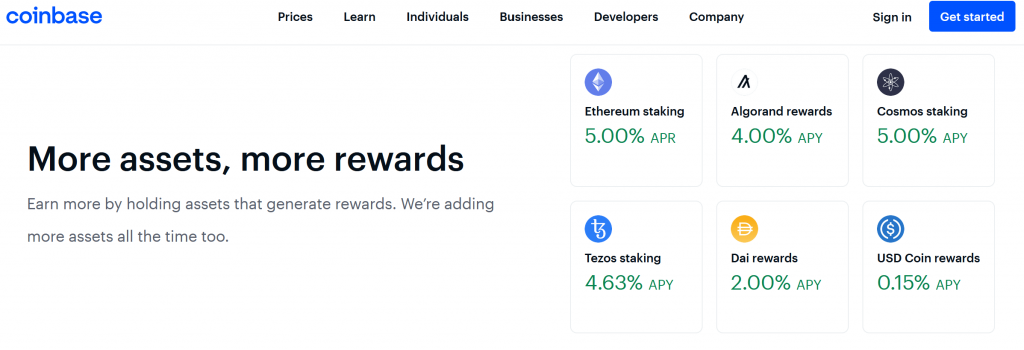

4. Coinbase

Staking on Coinbase is only available to the UK, France, Belgium, Slovakia, Spain and The US (bar New York and Hawaii). Coinbase offers roughly 5% annual rewards on Staking, which is quite low compared to its counterparts, and you’ll need to have kept your tokens for 30-40 days for funds verification before you start earning rewards. To stake on Coinbase, you will need to have enabled Staking. To do this,

- Go to account

- Scroll down to settings

- Click on financial service

You’ll see two tabs; rewards and Staking. Toggle both tabs to enable them. After you deposit the Tezos token, you’ll be eligible for staking rewards.

5. Temple Wallet

To stake Tezos (XTZ) using Temple Wallet, follow these steps:

Step 1: Open the Temple Wallet

- Launch the Temple Wallet app or extension and ensure your XTZ balance is visible.

Step 2: Navigate to the Delegate & Stake Section

- Access the Delegate & Stake section from the main menu.

Step 3: Choose a Baker for Delegation

- Select a baker from the list. For example, you can choose Everstake as your baker. Confirm the delegation by reviewing the details and approving the transaction12.

Step 4: Start Staking Your XTZ

- After delegation, click the Stake button. Enter the amount of XTZ you wish to stake and confirm the transaction12.

Step 5: Confirm the Staking Transaction

- Review the transaction details and confirm to complete the staking process. Once successful, your XTZ will begin earning rewards

Are There Risks With Staking Tezos?

Market Risk

One of the biggest risks an investor faces in Staking is the market risk. Volatility is a common thing in cryptocurrencies, and if it doesn’t favour you, it can be very distasteful. A 40% drop in your token’s price would mean your staking rewards will drop also. Investors need to be careful and do a very detailed analysis to avoid irrecoverable losses.

Liquidity Risk

Liquidity is one major value in cryptocurrency. In the likely event the micro-cap altcoin you staked on has little or no liquidity on exchange, it may be challenging to swap your coins for BTC or other coins. A way to mitigate liquidity risks is to trade assets with high trading volume.

Rewards Duration

Rewards do not come immediately after you have staked. There’s a period between when you first staked to when rewards start flowing in. subsequently, you receive the rewards in a regular timed manner, some after three days and some after seven days. It’s not so good because it will reduce the time you can reinvest your rewards to earn more.

Validator Risk

Though not every time, validators can invite the wrath of the blockchain network if they misbehave. A continuous absence from validating blocks can incur penalties that will change and affect your overall staking rewards. The penalty is called slashing, and a large chunk of the staked tokens could be lost.

Validator Costs

Why can’t I be the validator for my tokens? Well, operating on your validator node is expensive, hardware-wise and in electricity costs. Why spend so much when you can pay someone a small percentage of the staking rewards and stake the excesses?

Loss or Theft

If you’re trading on decentralized wallets, it’s important to guard against theft by keeping your private keys safe. Pay good afternoon to security irrespective of if you’re a trader or a “HODL-er.”

What happens to staking rewards when changing validator?

It is possible you have to change your validator. Perhaps due to late payment or slightly higher fees. Since tezos doesn’t have a lockup period for funds (meaning you can withdraw or transfer funds even after staking), there is a likelihood you can see a better validator and want to change the validator. While this process différs from wallet to wallet, one thing remains the same; the timing of the rewards is affected. If you change the validator, you cannot earn from your new validator until the new reward cycle is completed.

What actually happens when I Stake my Tezos?

By staking Tezos, you are delegating your address and the rights that come with it to a baker. A baker is someone who validates transactions on a Proof of Stake Blockchain. The more tokens a baker has in his care, the more likely her is to validate transactions and earn rewards. These rewards are shared accordingly to the owners who delegated their tokens.

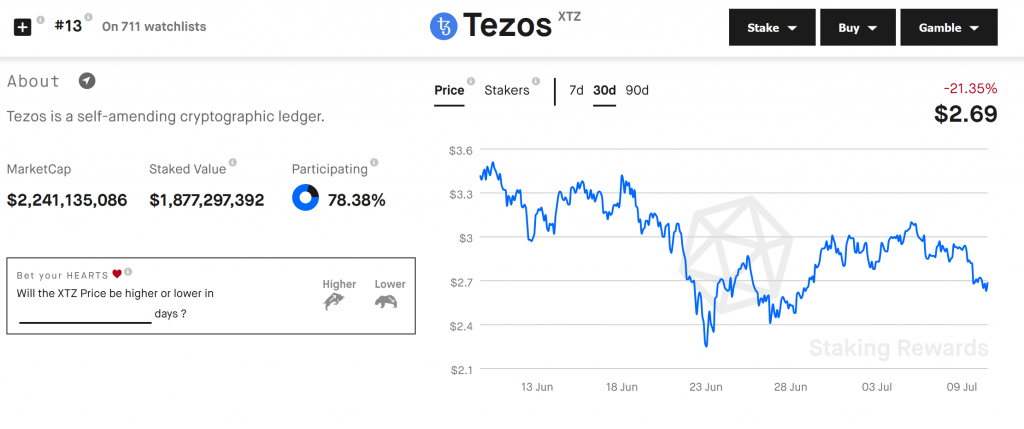

How much can I earn from Staking my Tezos?

Staking rewards on tezos differs from one wallet to another. The average percentage range of earnings on wallets is between 5% and 7% annual yield ( after the validator’s fees have been removed).

When will I start earning rewards?

To start earning rewards, it takes 12 cycles (36 days). While rewards are earned after seven cycles, frequently, most delegation services will pay bakers once the rewards are unfrozen five cycles after that. Some bakers can choose to pay upfront (I.e. after the 7cycles), but most of them pay after.

How Do I Earn Tezos Staking Rewards With Coinbase?

On Coinbase, Tezos is staked on behalf of customers and rewards are distributed directly to their accounts. Their reward holding period is between 35-40 days after which you now earn rewards at every 3-days interval. As with other wallets, your coins do not leave your account. You only delegate the voting rights for staking. You can transfer or receive funds into the account. Coinbase offers a 5% annual reward on every coin staked.

What Is The Best Way To Stake Tezos Coins

Like in the stock market where you are advised to reinvest your dividends, you will earn more by staking your rewards. The difference might not be visible now, but a pump in the token price would mean your interests would also increase. For instance, earning 6% on a $10 token would only give you $0.6. if the same token increases to $100, you would earn $6 on each coin you own. Staking your gains means you will have more quantity, and it’s an act of positioning yourself well when the token price increases.

There’s also a myriad of wallets you can trade Tezos with, and they slightly differ In their offers. In the end, it all boils down to users’ preferences.

Can I choose the amount I want to Stake and is my balance spendable while it’s Staked?

Unlike some other tokens with lockup periods for deposit and withdrawal, you can transfer your coins even when you’re staking and yet to get rewards. You have full authority and jurisdiction over your coins, and you can decide to do them however you please. Staking Tezos means you have given up your delegation rights to another. Not your coins, not access to your wallet. Just your delegation rights.

What happens if you add or withdraw funds?

If you add funds to your wallet during a staking cycle, you will not earn on the new deposit until the 36-days reward holding period is completed. You’ll still earn on the former stakes coins. For withdrawal, if you remove funds before rewards start, you will still earn your rewards for the token for 36 days also before the system adjusts to your reduced balance.

For example, if you had 1000 XTZ and then added 2000XTZ, you would receive the rewards for the 1000XTZ for the next 36 days before the system automatically adjusts your Stake to 3000XTZ. The same happens if you had 1000XTZ and you withdrew 500XTZ. You would still earn rewards for 1000XTZ till the 36 days are over before the system adjusts to 500XTZ.

What is over-delegation?

Over-delegation is a term that refers to an occurrence your Tezos baking account does not (or in coming days would not) have the required amount of tezos in it to act as a security deposit for baking or to endorse a block. This is primarily for bakers, not for delegators. To bake, the Network requires eight times the amount used for endorsing a block. If, for instance, we’re in cycle 23, it would require 23 XTZ to endorse a block and 23×8 XTZ (284XTZ) to bake.

Is over delegation that important?

Yes. Amongst others, there are two major demerits from overdelegation.

1. Missed blocks: When a baker cannot post the required security deposit, although he has the delegated rights to do so, the whole Network has to wait for another period before another baker has the rights to bake. This causes instability in the block and the Network at large.

2. If a baker is not endorsing blocks, the system cannot pay the Baker for a job not done. This reduces payouts to the delegators under the Baker. A drag in the block endorsements can also cause a delay in payout for delegators under other bakers.

What is the minimum amount I need to start staking?

Most tokens require users to own a minimum amount before you can delegate tokens. To stake Tezos, you must have at least 1XTZ in your wallet. Having less than that would not earn you any delegation rewards.

Also, check out our other staking guides:

Thank you for the work you put in to write this article. Is there a current update for your findings? As of today, these numbers are grossly inaccurate.

Thanks again.