Blockchain technology is taking the world by storm with the intention to revolutionize many industries, including finance, supply chains, IoT and maybe even space travel. However, it appears that banking and in particular, consumer lending, are top on the list.

Over the past year, a few platforms focused purely on borrowing and lending have appeared and developed new advanced ways to incorporate lending and borrowing into crypto space. However, this is not an easy thing to do because blockchain is still relatively young and doesn’t have many user-friendly tools required for complex operations. Also, one of the biggest problems with cryptocurrencies is the lack of regulations and excessive privacy and anonymity that the customers get. Most prominent investors are discouraged by the crypto market volatility and lack of control, but that doesn’t stop determined entrepreneurs from achieving sound results.

In this article, we’re going to go over two of the currently running lending operators – SALT and ETHLend – which strive to change the way people lend and receive all sorts of financial instruments. The rest of this article compares these companies, their features, quirks, and dark sides, in an attempt to discern which can best position itself as a market leader in the crypto loan space.

What you'll learn 👉

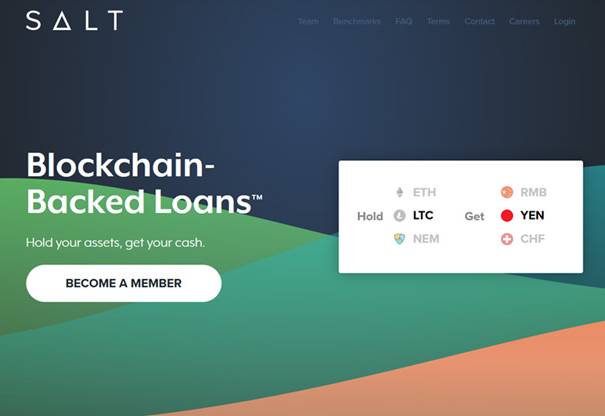

SALT Lending

Based in the USA, SALT (Secured Automated Lending Technology) is the world’s first Cryptocurrency Lending Platform which will allow you to use your Bitcoin/Cryptocurrency as collateral. The official website explains that the name is also a reference to “the time in history when table salt gained use as a store of value, becoming one of humanity’s first monies”. The company was launched on December 27th 2017 and it came out with a broad social media ad campaign and got many thousands of enthusiasts interested in the platform. SALT is a fairly straightforward platform and their slogan is “Hold Your Assets, Get Your Cash”. The platform has served more than 50,000 people , and they have issued more than $7 million in BTC-backed loans. Also, the company is backed by a strong team including Shawn Owen (CEO), a serial entrepreneur with experience in management and ownership of enterprise operations, and advisor Erik Voorhees, a prominent member of the bitcoin community and the founder and CEO of ShapeShift.

Their sales pitch went as follows. A lot of times, people need cash in order to pay the bills, buy groceries, pay for (doctor) medical expenses, write a check for apartment rent, etc. Those who hold a lot of their assets as crypto can access the value within them only if they sell them. The issue with selling cryptos, generally speaking, is that popular cryptocurrency has been rising in value exponentially through the last several years, reaching new highs on a monthly basis. The cryptocurrency has been rising in value throughout 2017, growing more than 1,500%, and some people say that the cryptocurrency’s value could triple in 2018. Selling crypto would probably end up costing you more, because, by the time you’re ready to repurchase the cryptocurrency, prices will have gone up.

If you want to find out how this platform works, check their original video that appeared on YouTube. The company gave the example of selling Bitcoin in January 2017 and then purchasing it back after the price jump seen last year.

Borrowing money or assets using cryptocurrency is getting more popular because it can actually prevent (at least temporarily) the need to pay capital gains tax.

Here’s how SALT Lending works.

You sign up through SALTLending.com. You need to provide minimal personal information (your first name, last name, and a valid email address) to create an account and become a member. Currently, only customers with US bank accounts are supported, but US nationality does not appear to be required. The next step is to buy some SALT tokens, which are ERC20 tokens on the Ethereum blockchain. This is required in order to gain access to the platform. The platform offers three membership tiers:

- Base(1 SALT/year)

- Premier(10 SALT/year)

- Enterprise(100 SALT/year)

Only a single token is required for access to the basic membership package, which entitles you to up to one loan at a time, and for borrowing up to $10,000. Higher membership tiers give you more flexible loan terms and enable you to borrow more money across additional currencies, but they require a higher SALT cost. Higher tiers also enjoy a range of other perks such as early access to new products, credit/debit cards, and portfolio management.

The next step is to deposit your crypto collateral. The platform is currently only able to offer Bitcoin and Ether collateralized loans but aims to accept other cryptocurrencies by Q3 2018 (at one point, their website included listing Ripple and NEM as potential collateral choices).

Once your loan is approved, the lender’s funds will be deposited into your bank account within a couple of days and a loan contract will have begun. You then pay monthly installments based on the loan terms. When your loan is paid-off, SALT releases your collateral from the smart contract and returns it back to you. It’s important to note that SALT streamlines every step of the loan.

Originally, loan payments could only be made in USD, but a couple of months ago the company announced that borrowers could use SALT tokens to pay down loans or buy better interest rates. At launch, the SALT tokens were given an official valuation by the company of $25 each (far above the exchange (market) price), which means that each token would entitle you to up to $25 worth of “services” from the company. This amount was later changed and now the SALT tokens are worth $27.50 on the platform. Therefore, it is currently possible to get a loan in USD, and completely repay it using only SALT tokens.

One more thing worth noting is that, although SALT Lending doesn’t conduct credit checks, the company does require Know Your Customer (KYC) and Anti-Money Laundering (AML) verification, so be prepared to upload an ID.

In order to make the SALT token more interesting, the company also announced a new upcoming scheme called “proof of access” (PoA), a mechanism to incentivize and reward members for contributing to SALT’s success.

The idea is that a borrower may choose to deposit additional SALT tokens and lock them in their accounts or in synchronized wallets in exchange for a number of benefits, including improved loan terms and product costs, exclusive features and products, and enhanced service and benefits.

The Downside to SALT

The problem with Salt Lending is that while the company promises that when you’ve paid the loan off completely, your Bitcoin will be automatically returned to you, there is a strong risk that you could lose collateral. This unfortunate event would happen in the event of a margin call.

A margin call is when your collateral depreciates in value to such a degree that the company algorithms will demand that you pay them in order to rebalance the loan to collateral ratio. In simple terms, imagine that you borrowed $10,000 and you secured it with $12,500 of Bitcoin (125% of the loan amount) when Bitcoin was $10,000 each exactly. This means that your loan is 125% over-collateralized, which means that there is a little wiggle room in the event that the price of Bitcoin drops as much as 25%. If, however, the price of Bitcoin drops to let’s say $5000 each, your loan-to-value ratio is now unfavorable to the company, which means that it is likely that a margin call would occur.

Once the margin call occurs, the borrower has a set amount of time in order to respond. Their choice of responses can be either to deposit more crypto to the SALT collateral wallet to bring the ratio back to 80% or to suffer the liquidation of collateral and even potentially face a fee for doing so.

However, the problem is that the time a borrower would have in order to respond to the call is not known. Imagine, for example that you borrowed some USD, and then got stuck on an international flight with no internet access, and when you landed, you discovered that your crypto had been liquidated against your will.

The other downside for SALT is that the average person can only borrow money. SALT isn’t a P2P lending platform. To become a SALT lender you have to be an Accredited Investor or a financial organization, and you have to pass SALT’s screening process. This is in contrast to other fiat based P2P lending platforms like Lending Club, which allows its members to borrow and lend money from each other.

ETHLend

ETHLend is a lending service that offers secured loans on the Ethereum blockchain. It’s a secured lending system that’s particularly popular for people in China, South Korea, and Japan, which are some of the biggest markets for Ether (and cryptocurrency in general). ETHLend was developed by Stanislav Kulechov, a law student at the University of Helsinki who specializes in Smart Contracts and blockchain technology.

ETHLend’s key goal is to provide financial access to people who have less access to banks or have no access to banks at all. It is worth mentioning that this platform is not allowed in the USA. This takes away a huge chunk of the crypto population. ETHLend has announced a strategic partnership with Brickblock, a trading platform that aims to connect real-world assets and cryptos to create a new generation asset trading platform, to explore further blockchain lending opportunities.

Opposed to SALT which charges a membership fee, requires identity verification, and restriction to US Bank account holders, the working of ETHLend is very simple and user-friendly. In ETHLend, the borrowing and lending activity occurs via smart contract and money is ever held by ETHLend itself. Hence, anyone can transact with anyone directly, without any institution or third party. While the service is not quite up and running properly yet, some loans are working. Also, a lot of progress has been done in the last couple of months towards reaching a proper public release.

The platform runs on Ethereum network and uses ERC20 tokens, such as Golem or OmiseGO tokens, among many other possible choices, as a deposit on the loan.

The lending process is pretty straightforward. If someone wants to be a lender, they simply engage in a smart contract through the ETHLend platform where the rates and collateral are stipulated. It’s important to note that apparently, anyone can be a lender without restriction. ETHLend requires borrowers to post ERC-20 compatible tokens or Ethereum Name Service (ENS) domains as collateral and lenders to deposit their Ether. To place a loan request, a borrower must set data such as the loan amount, the interest rate, and the time to borrow. Once all this data is set, ETHLend contracts make the exchange and the loan agreement will be created. The borrower then needs to make regular payments in Ether to the lender, but if they fail to do so, then the Smart Contract transfers the digital tokens (the ones used as collateral) to the lender’s Ethereum address. On the other hand, if the loan is paid off normally and on time, the lender will then receive his or her original principal plus interest.

One more thing worth mentioning is that it does not appear that ETHLend would or even could ever liquidate assets in the event of a drop in valuation. The reason for that is that funds are only held between borrowers and lenders and never ETHLend itself. This seems to be so because the loan is denominated in Ether itself and not on a USD evaluation. Therefore, if the value of one Ether drops, the value of the loan does not change.

According to the official website, ETHLend is perfect for a number of purposes. For example, it is perfect for crypto miners who are looking to get capital in which to get more mining equipment or get started mining. This platform is also great for those people who are in any financial need. They could potentially use the platform to borrow Ether and then sell it for fiat currency, which is quite similar to how Salt Lending works.

However, with ETHLend, the advantage is that since the service is completely anonymous and automated, it allows a borrower and a lender to decide essential loan details without the need of a middleman, which means that a lender and buyer anywhere in the world can create a loan contract on their own terms.

The Downside to ETHLend

ETHLend runs as a decentralized lending application (DAPP) on the Ethereum Network and all loans are denominated in Ether. This means that it can be difficult for a regular person to get what is essentially a cash loan if they need to buy something that is not easily bought with crypto.

If they do need traditional fiat cash, they would likely need to pay fees to a crypto exchange in order to get cash, which is appeared to be a taxable event and could be subject to capital gains taxes.

Also, ETHLend focuses on lending money to those who otherwise would not be able to get loans, which poses a huge issue, because the lender will need to feel safe and assured that the person they are lending to will be able to repay the loan. Because there is little collateral as well, it becomes very difficult to recover your funds should they fail to pay, and you could end up with a bunch of ERC-20 tokens that you would have to sell in order to recoup your lost Ether.

Conclusion

SALT and ETHLend are great options for those who want/need to make some real-world expenses and don’t want to lose the potential gains from their crypto holdings. The reason that these companies are so valuable and the reason that they have such massive potential; even if they are not quite up and running properly yet is because in theory, they can replace banks. However, both these companies are admittedly in early development stages and they both still have a long way to go.

SALT and ETHLend are the current leaders in blockchain-based loans. However, there are a few other competitors popping up in the space. One example is Everex, a platform that plans to offer microloans to those without access to traditional forms of credit. Another platform called Celsius plans to allow anyone who’s in need of cash to easily borrow from the Celsius platform without having to sell their crypto holdings. In the future, they also plan to offer cash loans. However, the problem with those loans is that they have the risk of getting a margin call.

As I already said, the P2P lending market is still in its infancy, but according to Morgan Stanley, this market will be $490 billion by the year 2020.