Bridging the gap between different blockchain networks has become a pivotal aspect in crypto. As two prominent players in this space, among others, there are Polygon and Arbitrum.

But how does one bridge Polygon to Arbitrum effectively? This article delves deep into the intricacies of the Polygon to Arbitrum bridge, offering insights and guiding users on how to seamlessly bridge POL to Arbitrum.

| 📌 Step | Description |

|---|---|

| 🌉 Choose a Bridging Platform | First, you need to choose a trusted cross-chain bridge to transfer your assets. Some of the platforms include Synapse, OpenOcean, Multichain, and Connext. |

| 🔗 Select Polygon as Your Origin Chain | After you’ve chosen your bridging platform, you need to select Polygon (POL) as your origin chain. |

| 🎯 Select Arbitrum as Your Destination Chain | Next, you need to select Arbitrum as your destination chain. |

| 🪙 Choose the Token and the Amount | Once you’ve selected Polygon and Arbitrum as your chains, you need to choose the token you want to bridge and the amount you want to transfer. |

| ✅ Confirm the Transfer | After choosing the token and the amount, you need to confirm the transfer. The transfer duration can vary based on the platform and network congestion. |

| ⏳ Wait for the Transfer to Complete | Finally, you need to wait for the transfer to complete. Once done, your tokens will be available on the Arbitrum chain. |

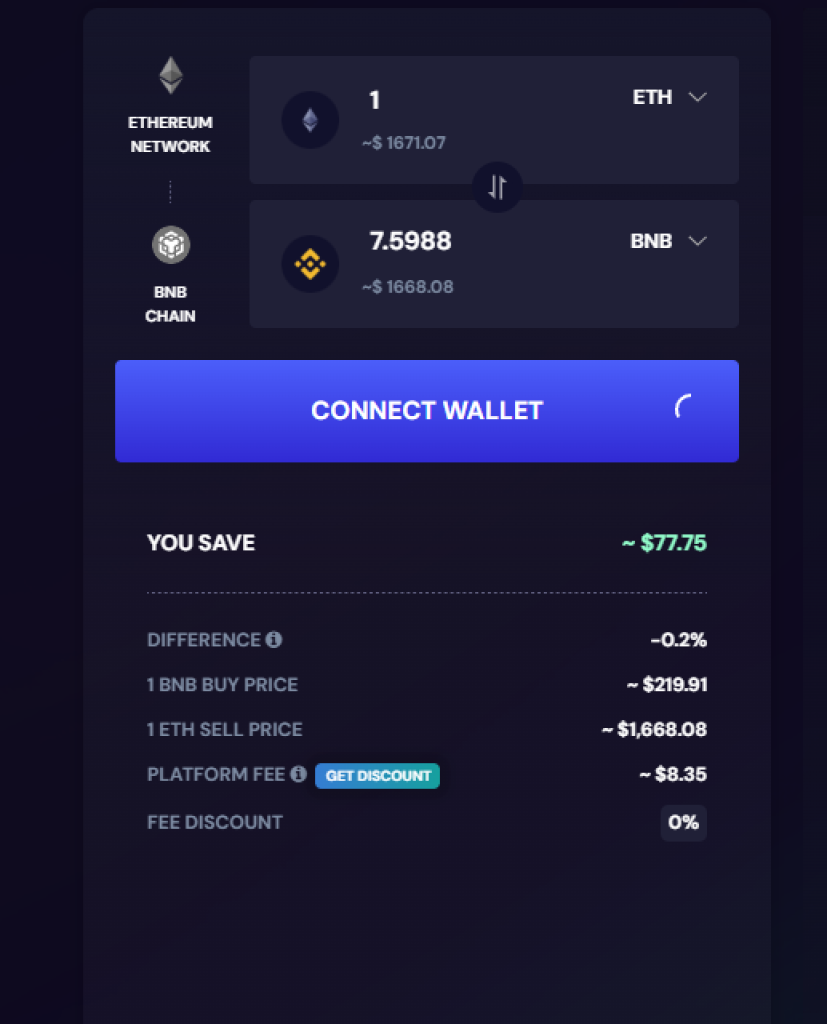

RocketX Exchange provides a seamless user experience for those interested in swapping assets across a wide range of blockchains, capturing the simplicity of a coin exchange on a single-network DEX. With a proven record of over 64,000 cross-chain swaps, the platform has amassed a total trading volume exceeding $72 million across an impressive 110 networks. A highlight among these is the Polygon to Arbitrum bridge, which facilitates effortless asset transfers between these two networks, in addition to other notable swaps like BTC to ETH, ETH to BNB, and ETH to AVAX, as well as integrations with Solana.

What you'll learn 👉

What is Polygon?

Polygon is a coin that is a new layer protocol on ETH. It is branded as a “better version of ETH blockchain” and aims to have much better fees involved. It is currently popular and in demand because of the widespread usage it has. It has a big community and is supported in almost all major exchanges as well with a high volume.

It has reached the top 10 in the ranking this year as well, which shows the power of Polygon in the community. With the high-tech innovations it has, it managed to drop the fee and increase the speed of transactions. With smart contract capabilities, the goal is to get more projects involved. With more projects, it will become a bigger ecosystem that people can use.

What is Arbitrum?

Arbitrum’s main goal is to create a system where people could make transactions outside of the ETH mainnet but then be applied to the mainnet eventually. This way if you are going to move things around multiple times, and there are others who want to do the same thing, you could do it on Arbitrum, and be in profit.

If you want to move your ETH on ERC20 to wrapped BTC, then Uni, then to another coin, and then back to ETH that will cost you a lot of gas fee, but if you move it to Arbitrum, then do as many moves as you want and get out again that’s just 2 fees involved for so many moves.

This is why it is seen as the best off-chain solution ETH had in recent years. It is based on Ethereum itself and provides a security layer on top of it to make things faster and cheaper by taking it off the mainnet. Uniswap is by far the most known project in Arbitrum right now, but more and more projects are coming every single day.

Arbitrum can’t list any tokens themselves, which means that other tokens need to list themselves there. This causes a slow improvement compared to Polygon which can add any token they want without needing the project to apply.

Bridging from Polygon to Arbitrum

RocketX Exchange – The best Polygon/Arbitrum Bridge

RocketX Exchange streamlines the intricate task of asset trading across a variety of blockchains, delivering a user experience comparable to a coin swap on a single-network DEX. The platform has a robust history of over 64,000 successful cross-chain transactions, accumulating more than $72 million in total trade volume across a diverse range of 110 networks. A key highlight is the Polygon to Arbitrum bridge, which enables smooth asset transfers between these two specific networks.

While RocketX has also incorporated high-speed blockchains like Solana, the Polygon to Arbitrum bridge is a central feature, facilitating easy asset movement between these networks and other EVM-compatible chains such as Ethereum.

As a non-custodial and fully decentralized platform, RocketX emphasizes security, user experience, and rewards programs, solidifying its status as a top-tier platform for effortless cross-chain transactions, particularly with its Polygon to Arbitrum bridge integration.

How to use RocketX as a DeFi Bridge?

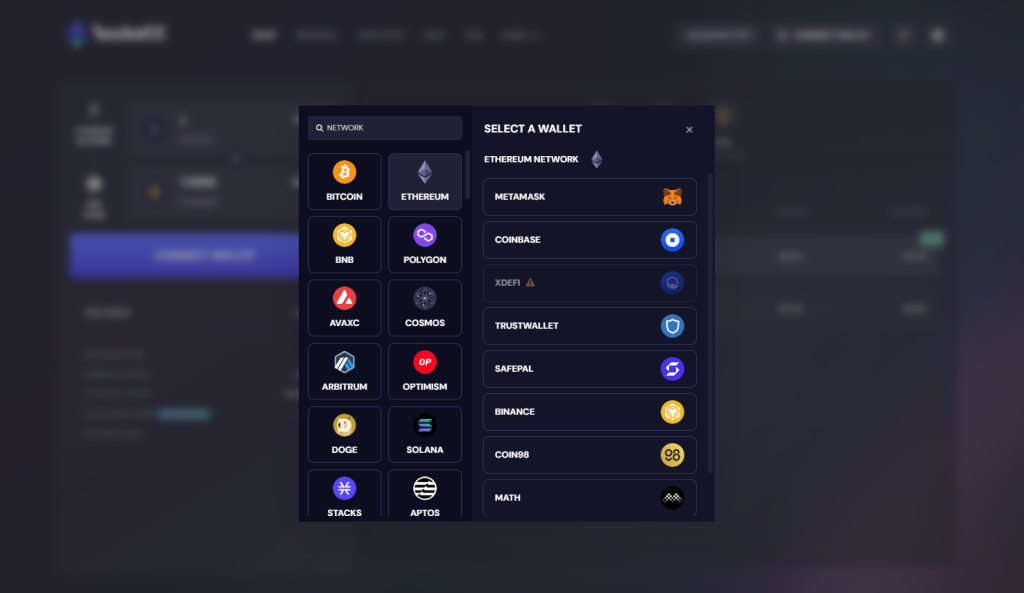

Here’s how to move coins between chains using RocketX exchange in 4 simple steps:

- Connect wallet

- Choose your chains

- Choose coins

- Click swap

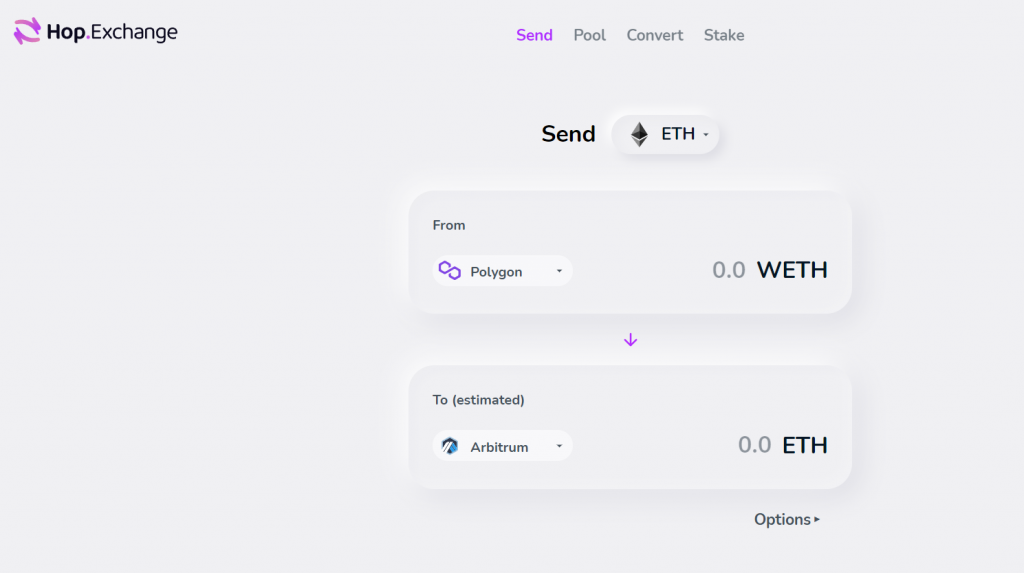

Hop.exchange bridge

Hop is a place where people could swap multiple tokens in between multiple chains. So far they are supporting mainly stablecoins such as USDC, DAI, and USDT but they also have ETH and POL as well. This means that you could swap your tokens in Polygon to Arbitrum with ease using these tokens.

The cost is not as significant as many other places that charge high amounts either so it is definitely a good option. Just go to hop.exchange, pick the token you want to swap, pick the chain it is on right now and pick the one you want to send and click approve button, then send it. It is a very simple tool that allows you to switch chains. It also has other networks but the main volume comes from ETH and Polygon chain bridge.

With a great team behind that has worked in the crypto industry for so long, hop has provided great potential for the future. Even though it is not the biggest bridge project in the world right now, it is one of the most promising ones.

Focusing mainly on swap between ETH and other stuff, this causes hop to be less liquidity available for arbitral but on small volumes, it is certainly still a valid option that people could use. There are constant improvements on the system, so by the time you read this article, there could be even more developments made to the website as well.

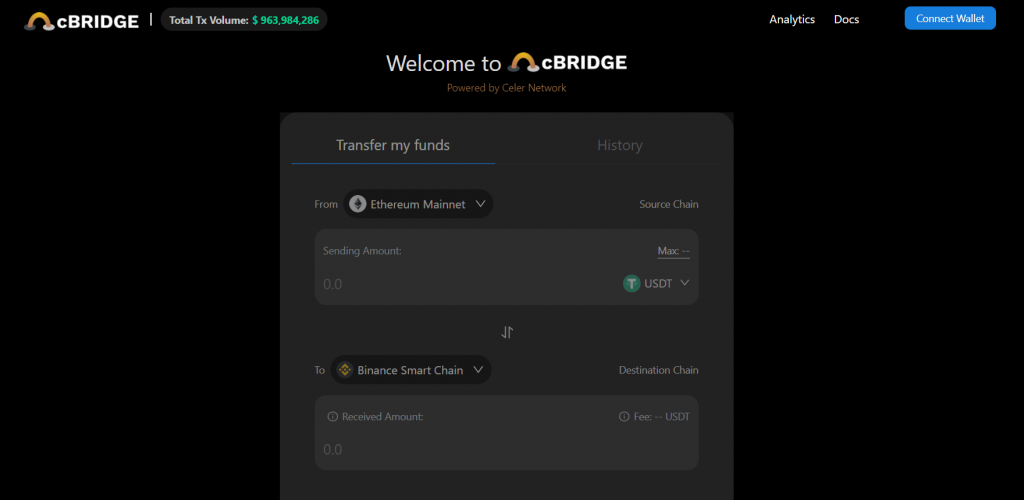

Cbridge by celer network

As a layer 2 protocol, the Celer network helps people move things around between chains in the ETH world to many other chains. With their new and improved version, they also make it quite quick and cheap as well. It is the main option for such swaps and has a huge volume as well.

One of the most known and used bridge networks in the existence, it reached a greater audience by providing better technology to bridge networks together. Liquidity providers for these swaps provide the funds needed for such swaps, just like any other yield farm we have people on both sides of the isle liquidity farming and earning a fee from their funds.

Thanks to these funds, people could move money from one side to another without needing to give anything to anyone directly. A non-custodial system for bridging your money between networks is achieved via this method.

Just like hop, you need to go to cbridge first, connect your wallet, pick the coin you want to swap and the network it is on right now, then pick the one you want to move to and approve/send. This method is the same in most places and cbridge is not a different one.

The only addition to what hop has as token options is WETH and WBTC that hop doesn’t have, which makes cbridge a bit more inclusive but only by a small margin. Since a bridge with a non-custodial system requires liquidity farmers and big funds, it is not easy to offer a widespread token selection.

Read also:

- Ethereum to AVAX Bridge

- How To Convert From Ethereum to Solana

- How To Move ETH From Ethereum to Polygon

- Ethereum To HECO Chain Bridge

- Best DeFi Bridges: Move Assets from ETH to BSC, Polygon & Vice Versa

- BSC to Solana Bridges