Launched in November of 2013, itBit is a bitcoin exchange and OTC desk you can access from one single account. The company’s headquarters is in New York, and they have an international office in Singapore and offer free deposits and withdrawals in Singapore dollars. itBit is the world’s first regulated digital asset platform, designed specifically for the institutional investor.

The exchange emerged at the moment when everyone started to think that Coinbase and Circle were definitively pulling away from the rest of the US pack. But Chad Cascarilla, the co-founder, and CEO of itBit came out of nowhere with an impressive $25 million Series A funding round and announced that they will be regulated as a bank in New York.

At least as far as itBit’s sizable compliance department is concerned, this means itBit can offer exchange services to all 50 states in the United States, surpassing its main US competitor, Coinbase, which offers its services in 33 US states.

itBit is a cryptocurrency exchange that allows the institutional investor to trade or store 11 different crypto assets.

Excellent liquidity levels, competitive fees, and available in all 50 states of the USA – itBit has set itself up as a serious option for US-based bitcoin traders.

What you'll learn 👉

Payment Methods Accepted

| Payment Method | Currencies | Funds Available | Fees |

| Wire Transfer | USD | 24 hours | None |

Traders can fund their accounts with a wire transfer. itBit charges no deposit fees, while fees charged by your bank may apply.

Limits and Liquidity

itBit provides two services: an OTC trading desk and global Bitcoin cryptocurrency exchanges. It’s important to note that neither service limits the number of Bitcoins that can be traded if proper verification process has been submitted.

itBit’s OTC trading desk trades between 15,000 – 25,000 XBT per month, and the average OTC trade size is about ~350 Bitcoins and made at or below spot price.

Check here to find more information on itBit’s OTC trading.

itBit Fees

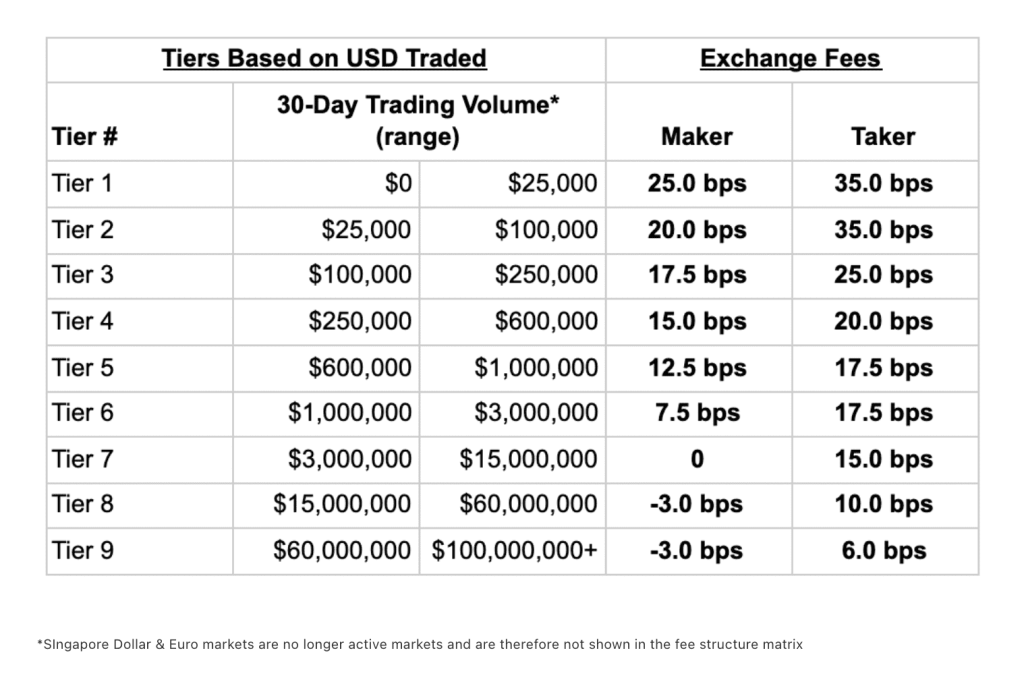

itBit exchange has a surprisingly simple fee structure for a large, institution-oriented exchange.

In November of 2015, itBit introduced a new, simple trading fee structure. In case the 30-day trading volume doesn’t surpass 8000 BTC, the maker fee is 0%, and itBit charges just a 0.2% taker fee on its global crypto exchange. On the other hand, special lower fees apply if the trader has a 30-day volume higher than 8000 BTC. Special fees are not available to the public, and users will have to contact the exchange at ICG@itbit.com in order to get them.

Meanwhile, a flat 0.1% fee is charged on the OTC trading desk. However, trades are often executed at or below the spot price.

Withdrawal Fees

US dollar withdrawal via ACH is free up to $3000 for US citizens. For over $3000 the fee of $20 is applied. The International Wire Transfer fee is $40, and SWIFT transfers are also charged $40 plus intermediary charges paid to the third party.

EUR withdrawals with SEPA transfers under 50,000 EUR are charged 8.14 EUR. SEPA transfer exceeding 50,000 EUR is charged 70.32 EUR.

The withdrawal limit is set by default to $2,500 daily and $15,000 monthly. The withdrawal limit is automatically raised to $15,000 daily and $300,000 monthly after the two-factor authentication is added to the account.

Bitcoin and Singapore Dollar withdrawals are free of charge.

Deposit Fees

When it comes to deposits, the SWIFT deposit fee is $40 + agent fees. USD Wire Transfer has a fee of $10 from the US and $40 from other countries.

The following fees apply for EUR deposits with SEPA Transfer:

- 3.70 EUR for transfers below 50,000 EUR

- 35.15 EUR for transfers above 50,000 EUR

Non-SEPA transfers in EUR – 1% of the amount transferred with a maximum of 35.15 EUR and a minimum of 3.71 EUR.

Bitcoin and Singapore Dollar deposits are free of charge.

Reputation

itBit is a well-secured exchange with 2FA on login, and each login triggers an automatic email address with login time and IP address to prevent any hacks. It uses third-party security with multiple–layer DDoS protection. This feature makes itBit a tough cookie to crack for hackers.

itBit exchange was the first Bitcoin crypto exchange to receive a charter from the New York State Department of Financial Services, which gives it the ability to operate legally in all 50 U.S. states.

The exchange doesn’t use PGP encryption in emails and it hasn’t been hacked until now.

As a licensed exchange, itBit is audited regularly, follows all consumer protection laws, and offers FDIC insurance on all fiat currencies balances owned by US clients which go up to $250,000.

Speed

International accounts may take 1-3 days to become verified, while US users may be able to verify faster using itBit’s knowledge-based authentication system.

Depending on your bank, deposits made via wire transfer can take anywhere from 1-3 days to arrive.

Once an account has been verified and successfully funded, purchases can be made instantly.

Privacy

U.S. residents can complete identity verification using itBit’s Knowledge-Based Authentication. This does not require ID scans.

On the other hand, users outside the United States must provide proof of residence documents and ID scans.

Supported Countries

itBit offers its services around the globe in most countries. The only U.S. state that is not supported in Texas.

Customer Support

itBit offers global 24/7 phone support, and its US office can be reached at (855)-997-2994.

itBit also has one of the best FAQ databases and offers an extensive education library.

Support is also available via Whatsapp at (+65) 8428 3877 or through email at help@itbit.com.

Conclusion – itBit Review

itBit has earned the right to be considered a top US exchange and for a good reason. It is the only Bitcoin exchange in the world that has been federally regulated and offers exchange services in all 50 states of the USA. Their fees are competitive and the trading platform’s liquidity is good in all currency pairs.

Ultimately, itBit is a highly–regulated and insured bitcoin exchange catering to active traders and institutions, and its services are particularly appealing to those who routinely make trades over 100 BTC in value or anyone who trades more than 2500 BTC per month.