Dogecoin has carved out its own niche, and with it, opportunities for investors to grow their portfolios. This guide delves into the world of Dogecoin staking, offering a comprehensive overview of how to stake Dogecoin and the potential rewards that come with it.

Elon Musk’s involvement in Donald Trump’s administration has led to the creation of the “Department of Government Efficiency” (DOGE), a political initiative aimed at reforming the federal government. The name “DOGE” has drawn attention due to its humorous connection to the cryptocurrency Dogecoin, but the program itself is serious in its objectives. In any case, this has only contributed to the popularity of the biggest meme coin.

Staking Dogecoin can be a profitable venture. By staking your Doge, you’re not only contributing to the stability of the network but also earning rewards in the process. This guide will walk you through the best platforms for Doge staking, providing insights into their features, benefits, and potential returns.

| Platform 🏦 | Summary 📝 |

|---|---|

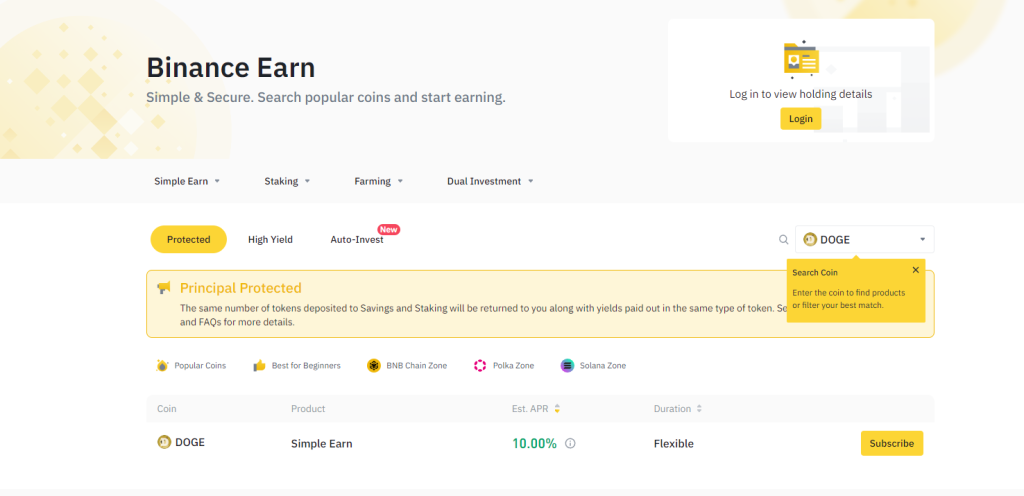

| Binance ⚖️ | Binance offers three main categories of investment products for Dogecoin staking: Protected (10% Estimated APR), High Yield (1%-44%) with liquidity mining pools, and Portfolio Auto-Invest (0.50% – 1.00%). |

| KuCoin 🪙 | KuCoin offers several earning features for Dogecoin owners, including lending it in the Doge Funding Market for a daily interest average rate of 0.02% at the time of writing. |

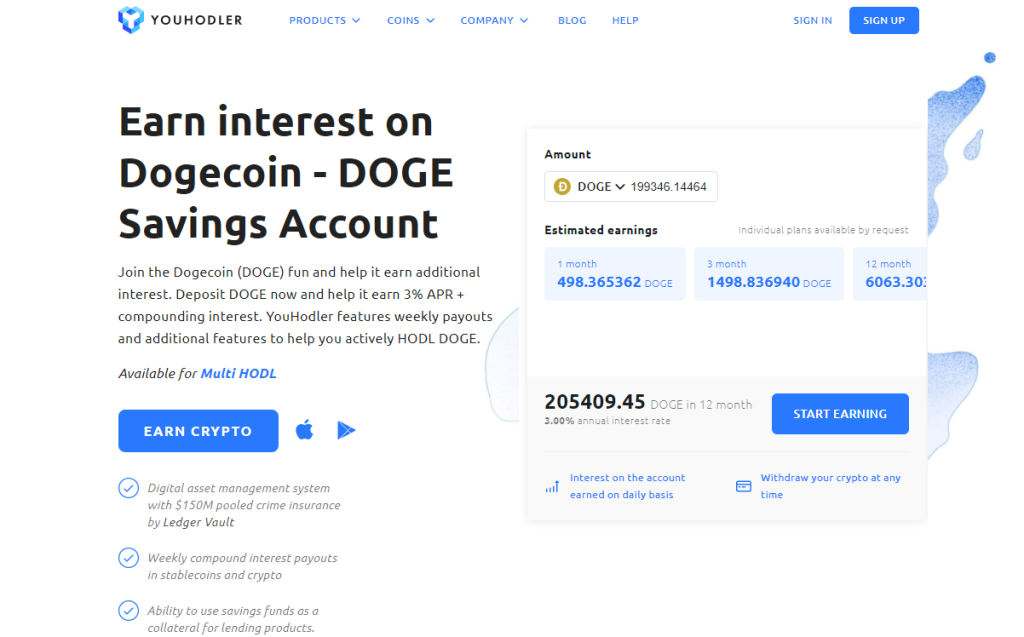

| YouHodler 🏦 | YouHodler is a cryptocurrency exchange platform with a “Doge Saving Account” program, offering a 3%+ APR and compounding interest earnings. |

| PancakeSwap 🥞 | PancakeSwap, a DeFi platform on BNB Chain, allows users to earn up to 9.17% APR on Doge-BNB. |

| Uniswap 🔄 | Uniswap supports pool mining using the Wrapped DogeCoin (WDOGE) token on the Ethereum blockchain. |

| Thorswap ⚡ | Thorswap is a multi-chain dex powered by Thorchain. It allows users to perform multi-chain swaps of native tokens such as Doge, Bitcoin, or LTC to hundreds of other ERC-20 tokens and cryptocurrencies. |

What you'll learn 👉

Doge is not proof of stake technology, so how can you stake Dogecoin?

Dogecoin is a cryptocurrency similar to Bitcoin that uses the PoW (proof of work) consensus mechanism to validate transactions on the blockchain. You can’t stake Dogecoin in a traditional decentralized way, as it does not use the proof of stake consensus mechanism like other popular cryptocurrencies, such as Ethereum or BNB.

However, you can soft stake your Dogecoin tokens and generate yield rewards by depositing them to a centralized exchange that offers that option.

Other methods for staking Dogecoins include bridging your tokens to the Ethereum or BNB blockchain (you get the so called wrapped tokens), using Defi liquidity mining protocols, lending pools, and more.

One of the most popular methods for staking Dogecoin is through a process called soft staking, which means staking the tokens on a centralized exchange, such as Binance or Kucoin, without having them locked (you can stake and trade them simultaneously).

As opposed to mining, where miners use computer power to validate transactions and generate rewards, staking involves users pledging capital to help secure the network. The Dogecoin Foundation announced that they intend to move Dogecoin to Proof of stake technology in the near future, which will boost the speed and possibly the cryptocurrency’s adoption.

Best places to stake Dogecoin – centralized platforms

Binance

You can stake Dogecoins and earn rewards on Binance using three main categories of investment products as follows:

Protected (10% Estimated APR).

High Yield (1%-44%) – Liquidity mining pools with DOGE/BTC, DOGE/USDT, and Dual Investment with up to 84%.

Portfolio Auto-Invest (0.50% – 1.00%)- Users can earn passive income from Dogecoins and claim daily earning rewards.

Kucoin

The Kucoin platform offers several earning features for Dogecoin owners, including lending it in the Doge Funding Market for a daily interest average rate of 0.02% at the time of writing.

YouHodler

YouHodler is a cryptocurrency exchange platform with a “Doge Saving Account” program, with a 3%+ APR and compounding interest earnings that encourage users to hold Doge for the long term.

Decentralized Exchanges

DeFi platforms are another way to earn passing income from your Dogecoin tokens is by participating in liquidity mining pools, also known as pooling. You will have to bridge your native Dogecoin tokens to the network specific to each DAPP that allows this feature.

Users who participate in these liquidity mining pools expose their tokens to impermanent loss, and they can potentially lose more than they earn through yield farm rewards. Here are some of the most popular Dogecoin-friendly automated Defi protocols available on the market:

Pancakeswap (on BNB Chain)

Users can earn up to 9.17% APR on Doge-BNB.

Uniswap – (on ETH)

Uniswap supports pool mining using the Wrapped DogeCoin (WDOGE) token on the Ethereum blockchain.

Thorswap (on the Thorchain Decentralized Liquidity Network, Avalanche, ETH, and m)

Thorswap is a multi-chain dex powered by Thorchain. It comes with an interesting feature that allows users to multi-chain swaps of native tokens such as Doge, Bitcoin, or LTC to hundreds of other ERC-20 tokens and cryptocurrencies. DOGE-RUNE and other top liquidity pools can be found on the liquidity statistics website thoryield.com.

How Is Dogecoin Mined?

Dogecoin is a proof-of-work cryptocurrency mined like other PoW-based coins, such as bitcoin or Litecoin. The mining process involves using computational power to compete at solving mathematical problems for rewards in Dogecoin. Mining difficulty increases with time, which requires miners to upgrade their hash rate in order to keep up.

Although Dogecoin can be mined using a basic CPU or a GPU card, due to the high difficulty reached and the rise in electricity costs, it is only possible to make a profit by mining Dogecoin with a powerful computing machine known as an ASIC miner.

An ASIC machine is an integrated circuit chip customized for a specific use rather than for general purposes like CPU or GPU.

Read also:

- How & Where To Stake (Wrapped) Bitcoin

- How To Pay Taxes On Staking Crypto?

- Best Staking Platforms

- Where to stake Shiba Inu

- Best ETH staking platforms

How much money can I earn staking Dogecoin?

High-Yield decentralized liquidity pools offer better earnings, while centralized exchanges such as Binance.com involve fewer risks and have a lower APR. You can earn from 1% to 85% APR on Dogecoin, depending on which type of cryptocurrency platform you use for staking your Dogecoin coins.

FAQs

Some of the best platforms for staking Doge available on the market are Binance, Kucoin, YouHodler, and decentralized platforms such as UniSwap, PancakeSwap or the Thorswap multi-chain swap.

Yes. Binance.com offer several plans and options for staking Dogecoins. However, their staking process is not On-Chain, since Dogecoin is not a proof-of-stake token (yet).

Yes. Staking cryptocurrency coins also involves market risks. If those risks are low or high is debatable, with some crypto community users saying that staking is a low-risk and profitable strategy, while Forbes.com describes it as high-risk for losses.

Yes. Aside from the market and other risks associated with this form of investing, some platforms also require a lockup period from 1 day to 2 years or more, which can stop the investors from accessing tokens if they need them sooner.

It depends on your goals and the platform used for staking. Ethereum allows users to claim their staking rewards after 6.5 minutes, while Cardano requires five days. On average, staking investor claim rewards once a week.

You can stake Doge on centralized cryptocurrency exchanges (such as Binance or Kucoin), decentralized apps (Defi apps such as UniSwap or PancakeSwap), non-custodial wallets (Exodus), and many more.

The Robinhood platform does not accept staking Dogecoin or other cryptocurrencies.

Yes, the Dogecoin Foundation has announced plans to adopt proof of stake technology in the future.

Trust Wallet users can’t use the built-in feature to stack native Dogecoin directly on the wallet. However, you can use the wallet browser function to interact with Defi protocols like UniSwap, after bridging your Doge to Ethereum or other blockchains.