Embarking on a journey through the intricate pathways of decentralized finance, one cannot help but encounter the innovative solutions brought forth by Binance Liquid Swap. This mechanism, seamlessly blending the realms of Decentralized Finance (DeFi) and Centralized Finance (CeFi), has piqued the curiosity of both novice and adept traders alike.

The concept of liquid swap, especially within the Binance ecosystem, has not only simplified token swaps but also unlocked new avenues for earning rewards through liquidity provision. But what exactly sets Binance Liquid Swap apart in the bustling crypto marketplace?

| Content | Details |

|---|---|

| 🔄 Binance Liquid Swap Overview | A decentralized exchange (DEX) that operates on the Binance infrastructure, offering a hybrid DeFi/CeFi platform. It enables users to swap tokens and earn rewards by contributing liquidity to the pools. |

| 💸 Impermanent Loss | Liquidity providers may encounter impermanent loss, especially during significant price fluctuations in the assets provided for liquidity. |

| 📉 Volatility | Engaging in trades between different crypto tokens on Binance Liquid Swap involves risks similar to standard cryptocurrency trading, such as the high volatility that could notably alter the value of your holdings. |

| 🔢 Limited Cryptocurrency Support | The platform supports a fewer number of cryptocurrencies compared to Binance’s spot markets. |

| ✅ Safe and User-friendly | Binance Liquid Swap is touted as safe and user-friendly. |

| ⚠️ Risk Warning Display | Users are presented with a risk warning message before engaging in exchanges. |

| 🛡️ Reputable Exchange | Binance, the underlying platform, is recognized as a reputable exchange with a robust history in security. |

| 🔍 Do Your Own Research (DYOR) | While the platform is generally safe, it is crucial to conduct thorough research and comprehend the risks before making an investment, as all investments inherently carry some level of risk. |

What you'll learn 👉

What is Binance Liquid Swap?

Binance Liquid Swap is the name of Binance’s DEx (Decentralized Exchange). It’s a regular-looking DeFi token swapping facility with liquidity pool staking. It’s supposed to be DeFi, but it runs on top of the Binance infrastructure, so in the end, it’s a hybrid DeFi/CeFi platform. Is this the best of both worlds? Possibly.

How does Liquid Swap work?

Binance uses am AMM (Automatic Market Maker) to facilitate token swapping. An AMM relies on a liquidity pool to execute these swaps (trades), from which the stakers in the pool derive a fee. When you commit your crypto to a staking pool, you generate a yield. The amount depends on which tokens you stake and the current market situation, but typically the rates are far better than you earn at retail banks.

Staking

First, you need to log on to a Binance account, from where you navigate to the ‘Finance’ dropdown bar and select Liquid Swap. This will take you to the Pool Overview page from where all the action happens. The first thing you need to do is choose the best liquidity pool for you.

Choosing a Liquidity Pool

This depends on which tokens you want to stake and the risks you are prepared to take. Staking stable coins all but guarantees that your investment will not devalue and cause issues such as impermanent loss (more of which later).

The highest yields come from the tokens that people want to borrow most. Borrowing stablecoins is popular as they’re almost universally accepted and there’s effectively no volatility. Staking a token that increases in value is great – it’s a double win. But, if you don’t want to take the risk of a token losing value, stablecoin staking is the way to go.

In the example below, I was able to earn 38% per year by only staking one side of the pool – USDT. That would be a great ROI in a year when the market was moving sideways.

Staking volatile tokens can be doubly profitable, but there’s a downside, too. If they fall too far in value or become out of balance with the other tokens in the pool, the AMM adjustments could cost you your yield. Be careful about which tokens you choose to stake.

Adding & Redeeming Liquidity

Head to the Pool Overview page to see a list of the token pairs. From the right-hand columns, select ‘Liquidity.’ The first time you try you’ll be faced with staking and swapping competency quiz. Binance requires 100% correct answers but conveniently, the correct answers are highlighted in green. Lol.

Once completed, you arrive at a Liquid Swap pop-up window, Here you can choose ‘Add’ or ‘Remove’ to stake tokens in a pool, or redeem assets that you previously staked. To add tokens to a pool, use the dropdown to select the pair if it isn’t already what you intended.

Then you have 3 choices. You can add to either token in the pair, or you can add to both sides of the pair. You enter the amount, making sure you have enough of the selected tokens in your Binance exchange account. Click the ‘I understand the terms of use etc…’ button, and hit Add Liquidity. Job done.

The pop-up window calculates the current pool size and proportions, and the fees of 0.2%. That’s 2 dollars per 1000, so it’s pretty good value. You can also see how much of the pool you own, the slippage, and the total yearly yield.

As a working example, I chose the DYDX/USDT pair. Staking 100 USDT, I would own 0.0033% of the pool containing 91,992.22 DYDX and about $1.5 million USDT. The yield is quoted at a whopping 38.24%, annually. It feels like a great way to invest those boring old stable coins.

Please read some of the articles we wrote related to Binance:

- Binance Staking Review

- 3 Steps to Calculate Binance Taxes

- Binance Options vs Futures

- How To Create & Trade NFTs on Binance

- Binance Margin vs Futures: What is The Difference?

- Binance Cross vs Isolated Margin

- Binance Wallet Review

- What is Binance Dual Investment?

- How to Short on Binance Futures?

- Binance Marketplace Review

Tokens Swaps

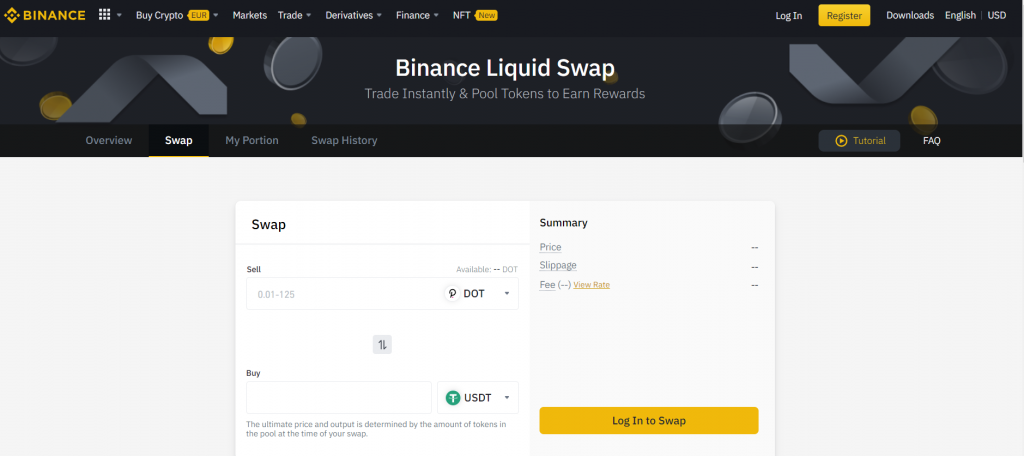

The Binance token swap pop-up window is totally standard, and you also access it from the Pool Overview page. Choose your token pair and click swap in the right-hand column to open the Token Swap window.

You toggle the coins between ‘buy’ and ‘sell,’ ensuring you have enough of the ‘sell’ coin in your Binance exchange wallet. It then calculates the number of tokens you will receive, the slippage, and the fess of 0.2%. Once you are happy, hit swap.

The Pros and Cons of Liquid Swap

Pros ✅

There are lots of good things to say about Liquid Swap but the best thing is its ease of use. It’s so simple that there’s really nothing to go wrong with the process. The fees are small enough to be ignored by regular crypto holders, and you can use your exchange account balances to start staking and swapping.

Another big win is staking only one side of a pool, so you don’t need to hold lots of volatile tokens to access the most profitable yields. Finally, the Binance brand reassures us that there’s no chance of a rug pull.

Cons ❌

There are a few downsides. The risks of impermanent loss and slippage are irksome, but they’re risks common to almost all liquidity pools. The ‘slippage’ refers to the change in the exchange rate brought about by your transaction. For smaller amounts, the slippage remains low, but if you try to buy too much you may end up distorting the pool and end up paying more for your tokens. Again, this issue is not peculiar to Binance, with almost all AMMs and DExs suffering from slippage.

There’s also the issue of handing over KYC data and allowing the authorities to peer into your account. Apart from that, it’s all good.

FAQs

Conclusions & Thoughts

Binance Liquid Swap is safe and easy to use. It’s not pure DeFi, but it’s a great way for noobs to learn how swapping and staking work in a low-risk environment. Once comfortable with the process, they could safely venture out into the wild world of DeFi.

There are still things that could go wrong when staking in a liquidity pool on Liquid Swap. Impermanent loss and token price collapse are the most common issues for all DExs, but on Binance you are protected from a rug pull. Amazingly, it’s still a thing. Even crypto billionaires and all-around Whale-Chads like Mark Cuban can get taken for a fool.

Thoughts

DeFi services running on top of infrastructure managed by centralized companies are a popular choice for regular cryptophiles. Binance, Exodus, and Coinbase all have DeFi options whilst still submitting to SEC regulation. Here’s why.

The burden of security is shared. For example, Exodus gives you a second chance to recover your DeFi wallet even if your device is destroyed, and you lose your 12-word seed phrase. It’s contrary to the ethos of DeFi, but it works. Binance is a solid platform and Liquid Swap is a great introduction to the world of staking and swapping.