1inch Exchange Review: How Safe Is This DEX Aggregator?

1inch is a decentralized exchange or DEX aggregator meaning as opposed to operating as an exchange itself, it spreads orders among other DEXs and private liquidity providers with the aim of getting the best exchange rate. The platform is backed by 1INCH, a decentralized token launched in December 2020. Users earn 1INCH tokens by offering liquidity to the liquidity platform.

What you'll learn 👉

Overview

The past few years have seen an explosion of DEXs and liquidity pools, again in response to the booming decentralized finance industry. Decentralized finance has especially been hailed for connecting lenders and borrowers of crypto assets, allowing the former to earn interest on their crypto deposits while the latter access the much-needed loans from the liquidity pool.

Decentralized exchanges possess key advantageous features above their centralized counterparts among them increased security, self-custody, a variety of coins listed, and listing autonomy.

However, with the emergency of several DEXs and liquidity pools, monitoring and keeping track of movements on the various exchanges can be a nightmare. The industry also risks the explosion of thin order books with low liquidity that may lead to costly transaction cancellations. The full visibility of all listed trades creates some biased trading where front runners are able to pay higher prices to incentivize the network to prioritize mining their transactions.

This is where 1inch Exchange comes into play. The non-custodial DEX aggregator seeks to deal with the challenge of thin order books and front-runner miners. By splitting orders among other DEXs and private market makers, 1inch Exchange is able to get the best rates and minimize slippage. Currently, there are more than two dozen liquidity sources listed on the platform.

The user is able to view the available liquidity and prices of listed assets, all from the same dashboard which minimizes time by allowing easy access to multiple exchanges and order books.

How Does 1inch exchange work?

1inch Exchange is the brainchild of Sergej Kunz and Anton Bukov, two Russian computer engineers who had an interest in auditing smart contracts. The exchange officially went online in May 2019.

Currently, the 1inch exchange lists more than 20 liquidity pools including SushiSwap, Balancer, Uniswap, Curve, and Kyber Network. To sign up, users need to first connect to the Ethereum wallet, where they deposit their liquidity pool contributions, lend their crypto assets to borrowers, and earn interest rates.

After connecting to the wallet, users can then choose the assets they intend to exchange and also sample the best available rates. The DEX aggregator also allows users to test out various exchanges to test their preferences and maximize their returns.

To exchange the selected assets, the user proceeds to click “SWAP NOW”, where they will be prompted to a separate page to confirm the transaction. The user needs to ensure all details provided are correct before clicking “VERIFY”.

1inch exchange allows for splitting a single transaction into multiple DEXs in search of the best rates.

From the exchanges listed, 1inch exchange uses an algorithm to select the cheapest trade combinations from various exchanges and liquidity protocols listed. In this case, the cheapest trades are the ones with the lowest transaction/trade/commission fee.

The system also proposes to the user the cheapest way place the trade by swapping through various protocols and currencies before coming up with the Wrapped Bitcoin. This process ensures that the buyer exchanges the asset at the best available market rates.

1inch exchange launched a revamped V2 platform in 2020 that has improved features and capabilities. The latest version has more complex trades to keep prices low and alternative trade strategies to allow users to explore trade routes that guarantee low trade transaction costs.

How to swap tokens?

To swap their tokens, users need to simply choose the coin to be swapped and the amount. After this, the user can then select the token to swap with. For instance, one trade can involve swapping aTokens are cTokens or ETH for Wrapped Bitcoin.

To process the transaction, the Ethereum network charges a fee, which is has been code-named “gas fee”. More on “gas fee” in a separate section. Below is a summary of steps to follow to swap tokens on 1inch exchange;

- Step1: Choose the different DEXs you want to place your swap offer on

- Step2: Connect your Ethereum wallet by clicking on the “Connect Wallet” button in the user interface

- Step 3: Select the assets to be exchanged and the best available rates

- Step4: Enter the amount to be swapped and click “SWAP NOW” to complete the trade

- Step5: Click “VERIFY” to confirm the trade including the coin to be exchanged, the target token, and the amount to be exchanged

- Step6: Approve the transaction in your wallet after which the trade will be listed on the blockchain

How to place a limit order

If you don’t want to exchange your tokens at the market rates, you can place a limit order on inch exchange through the “LIMIT ORDER” icon which is available in V2. You can place a limit order by selecting the pairs and the amount to be exchanged followed by the duration within which the order is to be executed.

Staking tokens on 1inch

1INCH token holders can stake their coins on the 1inch protocol and become part of the 1inch instant governance and also earn governance rewards. Staking is the process where token holders pledge their tokens to be used in the verification of transactions on the blockchain in return for a token reward. Below is a simple process to follow when staking tokens on 1inch;

- Step1: visit the “DAO” section on the 1inch exchange

- Step2: click on “Connect Wallet” to link to the online wallet where funds are held. Enter the number of tokens to be staked.

- Step3: click on the “Lock” icon in the “amount” field to confirm the transaction in the wallet

- Step4: after mining the transaction in the wallet, click on “Stake token” to complete the transaction.

1inch Exchange fees

There are no 1inch exchange fees charged on this platform. No deposit fee, no withdrawal fee, and no exchange fee. Users only pay a small fee to individual decentralized exchanges used to route the tokens. The amount paid to the exchanges depends on the gas costs at the time of the trade. 1inch’s Chi GasToken enables users to save big on gas fees.

In addition to being a utility token, 1INCH exchange is also used to offer governance on the 1inch platform. The rewards and fees charged are dependent on the DAO voting and proposal.

1INCH token: What is it?

1INCH exchange is an ERC-20 token used to govern 1inch’s liquidity pool and DEX aggregator. The coin was launched on 26th December 2020 by the independent Board of the 1inch Foundation in an event that saw the platform distribute free tokens to its loyal members to celebrate the launch.

The tokens are used to complete various functions on the protocol like paying swap fees, paying price impact fees, and payment of government rewards for staking. 1INCH is both a utility and governance token. Governance tokens are used to complete transactions and govern network protocols on the blockchain. They earn governance rewards which are paid out directly to the holder’s wallet.

To help improve liquidity protocol, 1inch has started a new liquidity mining program for 1INCH on six different liquidity pools. The move is aimed at establishing the 1INCH as the leading token among leading liquidity protocols. The new liquidity pools are 1INCH-YFI, 1INCH-USDT, 1INCH-USDC, 1INCH-WBTC, 1INCH-DAI, and 1INCH-ETH.

1INCH tokenomics

The total number of 1INCH tokens to be supplied has been set at 1.5 million tokens, out of which 30% is allocated to the 1inch community. The 1inch community intends to distribute the apportioned share via airdrops over a span of four years.

Around 14.5% of the tokens will be used for development while the rest will be distributed between the team and investors.

Is 1inch Exchange safe?

As opposed to a centralized exchange where members’ cryptocurrencies are held in the exchange’s wallet, 1inch Exchange is a non-custodial DEX aggregator, which means it does not hold members’ funds at any time. This gives users more control of their deposits, helps improve transparency, and instills a sense of security among users.

Chi GasToken

1inch launched Chi Gastoken or “Chi” in June 2020 after being unveiled at DeFi’s “Hack Money” event earlier in May 2020. It is an ERC-20 token used to pay transaction commissions on the 1inch Exchange.

The token was primarily introduced to help exchange users save on Ethereum gas fees. The CHI gas token is said to be up to 42% cheaper. Gas is similar to bank charges on cash transfers. However, gas fees go up like traffic on the network increases. This means the higher the traffic, the higher the gas fees.

What is the Chi GasToken? Does it really help save transaction fees?

CHI has its price pegged to Ethereum’s gas price. This means a rise in gas price leads to an equal rise in the cost of CHI. It is hard to clearly state or predicts the exact size of gas fees due to market volatility.

The token is very similar to the GasToken token although it has several improvements. Mining CHI saves 1% in commission compared to mining GasToken (GST2. In addition, burning or selling CHI saves 10% compared to selling GST2.

Mooniswap: What is it?

Automated market makers are smart contracts that contribute to a liquidity pool and an algorithm is used to trade the contributed ERC20 tokens as opposed to an order book. Although it generally improves trading efficiency and speed, its high visibility opens a loophole for front-running traders can steal from token providers by trading on price swings.

Mooniswap is a novel automated market maker (AMM), released by the 1inch team in August 2020. The new AMM maintains virtual balances for different swap movements and therefore keeps most slippage in the pool.

When a swap is executed, the invariant algorithm in the market maker is not immediately activated and the new prices for upcoming trades are momentarily withheld. The AMM takes a period of around 5 minutes to slowly improve exchange rates for arbitrage traders.

With Mooniswap, arbitragers only collect a portion of the slippage and the rest is shared among liquidity providers in the pool. A delay in updating the price creates a competitive environment that forces arbitrageurs to trade at less profitable prices. This in turn adds value to liquidity providers.

Several trials and simulations have been done to test Mooniswap performance using real-world data. The collected data were compared with Uniswap V2. Pieces of data collected and analyzed include the prediction of Mooniswap liquidity providers’ income, the income of Uniswap V2 liquidity providers, cumulative price slippage, and trading volume.

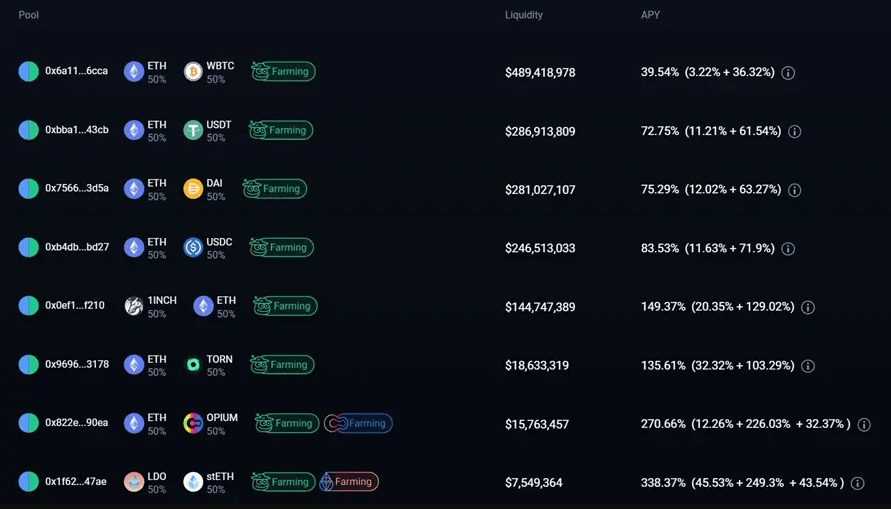

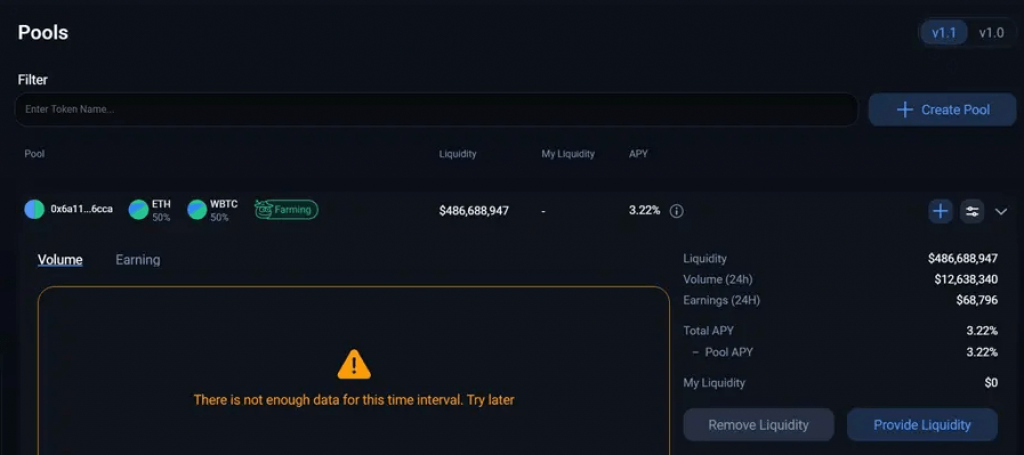

1inch Liquidity Pools

Mooniswap, 1inch’s liquidity protocol developed to create virtual balances to boost liquidity providers’ profit was rebranded to 1inch Liquidity Protocol. The rebranded protocol is found under the “pools” section under the DAO tab on the exchange’s interface. Users with liquidity on Mooniswap can simply transfer the 1inch liquidity protocol or remove it altogether. The 1inch liquidity protocol has various pools where providers can add liquidity and earn interest fees.

Adding Liquidity to Pools

Below are steps to follow toad liquidity to 1inch liquidity pools;

- Step1: Connect your wallet and click on “pool” under the DAO tab

- Step2: From the listed pools in the “pools” section, select the one you want to add liquidity and then proceed by clicking the “provide liquidity” button

- Step3: Deposit an equal value of the tokens to be mined in each 1inch liquidity pool

- Step4: To allow the smart contracts to deduct the tokens to be spent from your wallet, click the ”unlock” or ”infinite unlock” button

1inch Exchange Security

Security of crypto assets is one of the thorny issues and an ongoing conversation among players in the cryptocurrency industry.

To further improve the security of users’ assets, 1inch is non-custodial meaning the DEX aggregator does not interact with the user’s funds as the case with centralized exchanges. In centralized platforms, members’ deposits are held in central wallets or accounts.

Finally, 1inch has a clean sheet in terms of observing security and taming online fraud. The platform has never suffered any form of online threats or hacking which gives testimony to the reliability of its security strategy and features.

Why Use 1inch Exchange?

Several unique features put 1inch above its peers in the industry. It has a slick and simple user interface that is not only simple to use but also offers an improved trading experience. The exchange splits token swaps across 21 liquidity protocols, helping members save money by selecting swaps with the lowest fees.

The exchange has an agile and dexterous order filling mechanism that reduces the chances of failed transactions that may be costly to users. Users save big through the reduction in slippage, which makes up for the relatively higher gas fees incurred by DEX aggregators.

The exchange has attracted big names in the cryptocurrency industry with leading investors including Binance Labs, Kyber Network founder, Loi Luu, and Galaxy Digital.