TokenTax Review – Is Token Tax a Good Crypto Tax Calculator?

Today, cryptocurrencies are taxed in almost every country in the world. However, calculating your crypto taxes is one of the more stressful parts of being a crypto trader because it is very time consuming – not to mention difficult! The time it takes to report on your crypto taxes depend on many things, such as the number of coins you have, the number of trades you’ve done, and the number of exchanges you use.

Furthermore, every crypto exchange has a different output for tracking your trades, with some providing no output at all. Each of your trades need to be individually added up and recorded, which means that you will need to put up a lot of time and effort to do the job properly.

With all of this confusion, there is one thing we know for sure — whether you exchange Ether for BTC, sell BTC for fiat or stake some Tezos, it’s more important than ever to report your crypto gains/losses to the IRS (or your country’s tax authority). One of the best ways to do this job is through crypto tax software.

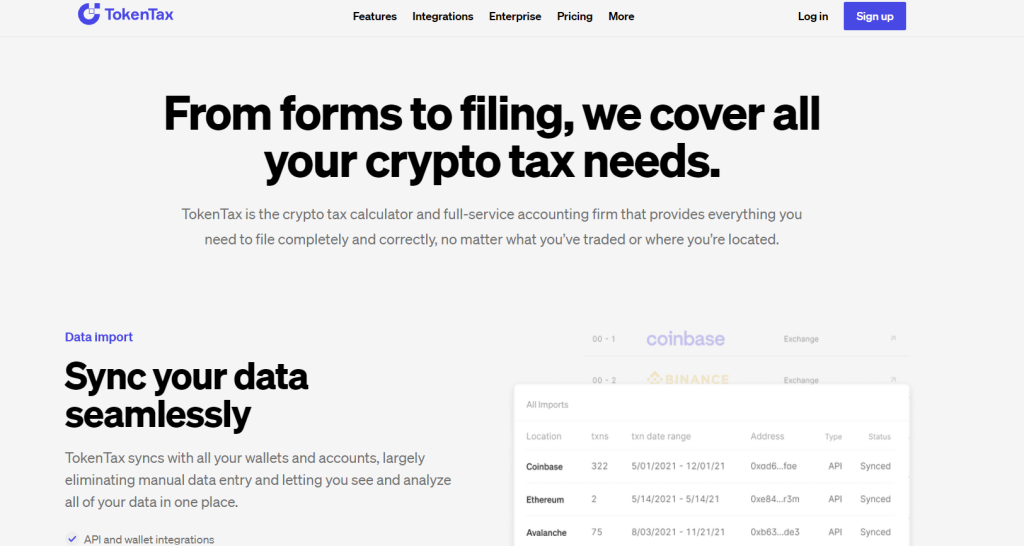

Launched right before the 2017 tax season, TokenTax is one of the easiest ways to report your cryptocurrency capital gains and income taxes to your government. Rated by Forbes as the best platform for filing cryptocurrency taxes, TokenTax is a crypto tax software platform and cryptocurrency tax accounting firm that automatically calculates the applicable crypto taxes and generate the necessary crypto tax forms.

It is the only crypto tax platform currently available that supports every major exchange and has direct connections with all the platforms to automatically import your trading data. For the crypto exchanges with no imports, the only thing that you need to do is to simply upload a file with your trading data and TokenTax will automatically ingest your information. Once all of your information is uploaded, TokenTax will generate all the forms you need to file your crypto taxes, including forms 8949, TurboTax, FBAR, FATCA, or any other file you might need.

TokenTax’s platform is extremely beginner friendly and their dashboard is very clean and easy to understand what’s going on. There aren’t too many buttons and blobs of text which may be distracting for newbies. Another great thing about TokenTax is their clean and standardized instructions for connecting to various exchanges and wallets. Once you successfully connect a crypto exchange or wallet, you should be able to integrate your other ones very easily.

It’s also important to note that TokenTax is a New York based crypto tax company but serves every country of the world, so whether you are from South Africa, France, Spain, Portugal, Australia, the UK, or any other country, the platform will sort you.

What you'll learn 👉

TokenTax Features

TokenTax has earned the title of being the best crypto tax software service out there because the platform automatically calculates the applicable crypto taxes and generate the necessary crypto tax forms.

According to TokenTax, 96% of their users have seen their tax bill reduced by more than they paid them for their crypto tax service. The company bases its claims on their algorithm that takes into account numerous variables — such as users’ filing state, filing status, estimated income to make their tax minimization calculations as precise as possible.

Many crypto portfolio trackers available on the market today provide several ways to calculate your capital gains and losses and they offer straightforward specific-share accounting methods that are simple to calculate. FIFO (first-in-first-out) and LIFO (ast-in-first-out) are the most popular methods because they are the two simplest types of “specific shares” accounting to keep track of from a record keeping perspective.

Under the LIFO method, the cost of inputs most recently purchased for use in production or for resale is matched with the revenues generated by items sold in a particular period. Contrary to LIFO, FIFO matches the cost of the oldest inputs with the revenue of goods sold in a given period.

A business that uses LIFO method for book purposes and FIFO method for tax purposes will have tax income higher than book income in inflationary periods, and the opposite during deflationary times. That’s the reason why FIFO, LIFO and similar methods are great for typical stock or bond purchases, but when it comes to trading volatile assets like cryptos, these methods might not be the perfect choice.

TokenTax’s tax minimization algorithm is a type of specific-shares accounting and for every sale of crypto, their algorithm will look at all available purchases and select the one that minimizes taxes. The platform provides the attention to all users and gets all the data uploaded—regardless of how messy. Additionally, Token Tax generates every tax that you need to properly file your crypto taxes, including: 8949, TurboTax, FBAR, FATCA.

On the other hand, TokenTax’s claim to work with every crypto exchange on the market today is based on your ability to download CSV files that store all your transactions. Simply head to the transaction page on the exchange, click on export CSV and upload it to TokenTax. However, it’s important to note that that upload ability is only available at the Premium level or higher. VIP customers get some additional help because they can conveniently connect their preferred crypto exchange to TokenTax and through the APIs, they will get all their transactions inside the software.

How Does TokenTax Work?

The entire process is quite simple actually because the platform does not require detailed information or put you through a KYC registration process. To sign up for TokenTax, follow the steps below:

1. Visit The TokenTax Website and Register Your Account.

TokenTax will ask for your filing status and state of residency, which is not obligatory, but without it, you may pay more than you need to.

2. Choose a plan.

TokenTax’s sole purpose is to calculate taxes, so many people think that the company does not offer a free trial. However, there actually is one and all you would need to do is to use the “skip” button on the top right of the corner. It’s important to note that, before you get the forms, you do need to sign up for a plan but you can first test it out for free.

3. Add Your Transactions.

This can be done in two ways:

– by uploading a CSV file that stores all your transaction

– by connecting your preferred exchange to TokenTax platform and through the APIs, you will get all your crypto transactions inside the software.

4. Choose Your Preferred Accounting Method.

After you complete step 3, TokenTax will use your personal information and preferred base currency to automatically calculate your tax liability. Your potential tax savings from the company’s estimate can be compared with calculations based on LIFO and FIFO accounting methods.

5. Download Your Tax Forms.

The last step would be to download your tax forms and file it with your tax return.

What once was an unimaginable pain to calculate how much tax you owe on each transaction you made in the crypto space, can now be done in just 5 simple steps.

TokenTax Subscription Prices

There are 4 different levels of membership for using TokenTax:

Basic ($19 Per Tax Year or $35 for Two Tax Years)

- Up to 500 transactions-per-year-limit

- Only supports Coinbase, Coinbase Pro, and Binance. TokenTax Basic will not pull data from any other crypto exchange, neither will it let you upload your transaction data.

- IRS Form 8949 or international support

- The ability to file an FBAR, which only applies to Americans who trade on a foreign crypto exchange and they must pay an extra $50 for the service.

- Live chat support

Premium ($199 Per Tax Year or $359 for Two Tax Years)

- Everything included in Basic plan

- Up to 6,000 transactions-per-year limit

- Support for every crypto exchange, but American TokenTax Premium subscribers who trade on foreign exchanges must pay $50 to generate a FBAR.

- Support for margin trading (on BitMEX, Deribit, and Bybit)

- Live chat sessions with TokenTax’s tax advisors

- The ability to upload transaction data in CSV format as well as tax calculations for ICOs and crypto mining

- Tax-loss harvesting dashboard

Pro ($799 Per Tax Year or $1,439 for Two Tax Years)

- Everything included in Premium plan

- Up to 12,000 transactions-per-year limit

- Tax-loss harvesting advisory session

- All margin exchanges supported

- Includes free FBAR-generation and priority support

- The cheapest plan that supports tax calculations for margin trading

VIP ($1,499 Per Tax Year or $2,699 for Two Tax Years)

- Everything included in Pro plan

- Advanced crypto reconciliation assisted by a CPA

- Two 30 minute sessions with a tax expert

- IRS audit assistance

- Help with issues such as lost or stolen coins

- No limit on transactions

If you only make a few dozen, or even a few hundred, trades per year, then you can probably make do with the Basic plan. Also, this plan only connects to either Coinbaseor Binanceso even if you are a basic, everyday-Joe user that just buys and holds but you are not using those two crypto exchanges, you may also need to opt for the premium plan. The VIP plan suits advanced net worth investors.

On the other hand, if your crypto trading is more intensive, then you would either need the premium or perhaps even the pro plan.

The TokenTax Team

Token Tax consists of a group of designers, software engineers, and finance experts who ensure everything moves on smoothly at all times. Members of the team were tired of the system currently used to calculate and file crypto capital gains tax, so they decided to create a platform that combines the love of design and user-experience focused engineering with unmatched tax expertise and knowledge. TokenTax has about a dozen employees and contractors led by its two founders.

Zac McClure (Co-Founder) – He had an eclectic career before starting TokenTax. After a 2-year stint in Investment Banking he joined Teach For America, where he taught math infused with personal finance and entrepreneurship. After a stint with Teach for America, McClure received his MBA from Wharton, and also holds degrees in International Finance and Accounting from USC. Zac also worked for social enterprises in Zimbabwe, Zambia, Madagascar, and India. McClure also worked for Social Impact investment firm Imprint Capital, Bain, and Elsevier

Alex Miles (Co-Founder): Alex is a former product engineer at Dropbox, where he met McClure and joined TokenTax. Miles is the lead developer and heads the technical side of TokenTax.

Alex Hays (Engineer): He is a senior software engineer and is currently based in Brooklyn.

You can post any questions below or reach out to them directly on Twitter, Facebook, Telegram, or at TokenTax.us!

TokenTax Affiliate Program

TokenTax allows you to make recurring income in one of those rare vertical markets that 99% of other affiliates don’t even know exists, which makes this opportunity so exciting.

All you need to do is focus on bringing in referrals, and you’ll set yourself up to earn nice recurring commissions of up to $199 every year for each client who purchases a full year of the Gold full filing package. TokenTax pays commissions every 30 days and you can chose between PayPal and Bitcoin.

Conclusion

Today, in most jurisdictions, digital asset investments returns are taxed in the same way as any other investment income, which means you need to make sure that you are filing your taxes correctly to remain compliant with the taxman. So whether you’re a hodler, crypto-accepting business, or institutional investor, TokenTax is the perfect platform for you.

The fact that it works with major crypto exchanges and has a great team makes it a preferable choice for most users. The main benefit of using this crypto tax software program is that it saves you time, stress, and money. Also, it can help you avoid facing steep crypto tax penalties in the future.

TokenTax Alternatives

TokenTax has a whole range of competitors, most of which we already covered in our reviews: