What you'll learn 👉

How Are Cryptocurrency Gifts and Donations Taxed?

Gifts are one of the most common ways people show appreciation to others. However, there are some important things to consider before giving gifts in the form of cryptos.

In the US, generally, “gifting” cryptocurrency is considered a nontaxable event to the recipient because it does not involve cash or goods. This means that the recipient does not have to report this in income tax returns.

Taxes on the cryptocurrency gift are solely due by the recipient if and when he or she sells it in the future. Also, if the crypto gift/donation is worth less than $15,000, the donor (the individual making the gift) is exempt from paying taxes.

A gift tax return must be filed by the donor if the cryptocurrency’s value exceeds $15,000.00. (Form 709).

The Gift Tax Return (Form 709) requires information about the following:

- Amount of the gift

- Date of the gift

How to give crypto as a gift?

Cryptos are now much easier to purchase, give and receive as a gift, thanks to their soaring popularity. Here are some of the most common ways that people gift crypto.

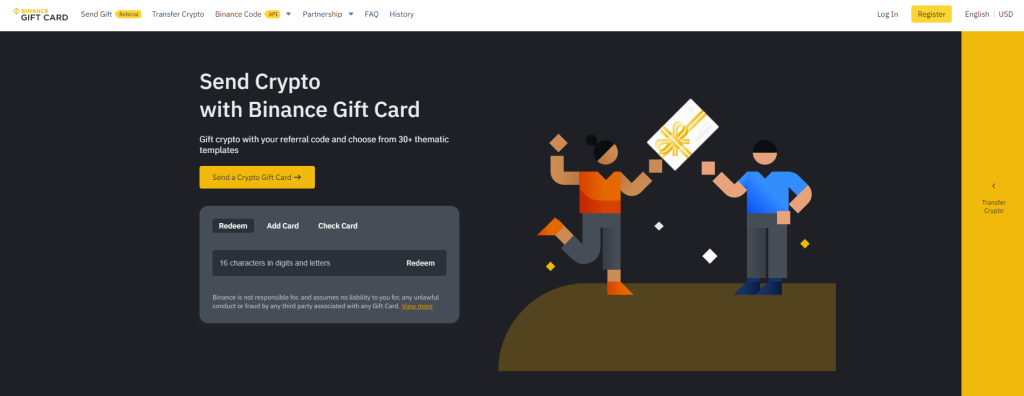

You can buy crypto gift cards from several websites. Choose one that looks trustworthy, has good reviews, and has what you’re looking for. We would recommend Binance – the largest crypto exchange that has Binance Gift Card that can be easily purchased and gifted to someone. Then choose the amount that you’d like to give and purchase it.

After making the deposit, you’ll receive an email containing a gift card worth the amount that was deposited. As with traditional retail gift cards, the recipient can use the gift card at any online store that accepts them.

Another way to do it is to simply fund a hardware or software wallet with some crypto and gift the device to someone. You would need to give them a seed phrase and potentially explain how to access the funds (if they are new to crypto).

And here are a couple of ways how you can gift NFT to someone.

How are crypto gifts taxed?

Fair market value more than or equal to the donor’s adjusted basis at the time of gifting crypto

Let’s now determine the fair market value of a crypto gift. If you are interested in giving away some of your coins, I highly recommend reading this part.

In simple terms, it says that the fair market value of the crypto asset being donated must be greater than or equal to the adjusted basis of the donor at the time of donation.

If the coins you received as a gift is now worth more when you want to sell them => you recorded a capital gain and your cost basis will be the value of the coin when it was originally purchased (by the person that gifted it to you).

Example: gifting person bought 1 BTC for $30,000 (first timestamp) => gifted the coins to you when they were worth $20,000 (second timepstamp). You want to sell them when they’re worth $40,000. Your cost basis is original cost when the coins were bought, meaning $30,000. So you pay capital gains on $40,000 – $30,000 = $10,000.

If the coins you received as a gift are now worth less when you want to sell them => you recorded a capital loss, and you need to calculate an adjusted cost basis for tax purposes. The adjusted cost basis will the value of the coins in the moment when they were gifted to you.

Example: gifting person bought 1 BTC for $30,000 (first timestamp) => gifted the coins to you when they were worth $20,000. You want to sell them when they’re worth $10,000. Your cost basis is adjusted cost when the coins were gifted to you, meaning $20,000. So you recorded capital loss on $10,000 – $20,000 = $10,000.

The fair market value of the donation is less than the donor’s adjusted basis at the time of gifting crypto

If the fair market value of a crypto asset is less than the adjusted basis, then the donor is entitled to receive the difference in cash. For example, let us say that the fair market value is $5,000 while the adjusted basis is $8,000. Then, the donor gets paid $3,000 because the fair market value is less than the adjusted base.

The opposite scenario happens if the fair market value of an asset is greater than the adjusted basis. In this case, the donor receives no money because the fair market value exceeds the adjusted basis. For example, let’s say that the fair market valuation is $15,000 while the adjusted base is $12,000. The donor receives nothing because the fair market value exceeded the adjusted base.

Cryptocurrency Donations

The Internal Revenue Service just recently released an update about crypto tax laws. The recommendations make it clear how taxpayers should disclose donations of virtual currencies like Bitcoin and Ethereum to nonprofits, among other things.

In general, donations of digital currency are treated like gifts of cash. This means that donors do not incur a taxable event when making contributions to nonprofit groups. As long as the donor holds onto the donated crypto for over a year, he or she can deduct the full amount of the donation from his or her income.

If the donor does not hold onto the cryptocurrency for longer than a year, however, the donation will be subject to capital gains treatment. Under current law, the donor must recognize a taxable gain each time the price of the digital currency rises above the amount paid for the contribution.

However, under the new rules, there will no longer be a taxable gain if the donor gives away the digital currency within a year of purchase. Instead, the donor will receive a charitable deduction equal to the fair market value of the cryptocurrency at the time of the gift.

Is gifting bitcoin to avoid tax a viable idea?

Unless you are giving away many millions of dollars worth of bitcoin, the majority of cryptocurrency gifts won’t be taxable. Since the lifetime gift and estate tax exemptions, as well as the yearly gift tax exemption, sometimes change, you might wish to double-check their current values before giving cryptos each year.

That being said, gifting bitcoin to avoid tax is not a smart idea. Here are a couple of ways how to report losses on crypto legally. And here are some tips that are more risky but could help you avoid paying taxes on crypto. And finally, a guide on how to borrow against crypto to reduce your tax bill.

Here are a couple of tips how to reduce your crypto tax bill:

- Hold Until Your Short-Term Gains Turn Into Long-Term Gains

- Offset Capital Gains with Capital Losses

- Sell In a Low-Income Year

- Reduce Your Taxable Income

- Invest in Crypto in a Self-Directed Individual Retirement Account

- Gift the Assets to a Family Member

- Donate Your Appreciated Cryptocurrency to Charity

- Move to a State with No Income Tax

Read also:

- How to do your Kraken taxes

- How to do your Kucoin taxes

- How to do your Pancakeswap taxes

- How to pay taxes on NFTs

- How to pay taxes on crypto staking