The Polygon ecosystem is a vibrant hub of innovation, teeming with projects that are pushing the boundaries of what’s possible in the world of decentralized finance. From DeFi platforms to NFT marketplaces, the Polygon projects are diverse and cater to a wide range of needs in the crypto community.

In this article, we delve into the top Polygon projects, shedding light on the unique offerings of each and how they contribute to the overall growth and development of the Polygon ecosystem. We explore the Matic projects that are leveraging the scalability and efficiency of the Polygon network to deliver exceptional services to their users.

Whether you’re interested in yield farming, decentralized exchanges, or file storage services, the projects on Polygon have something to offer. We take a closer look at these projects, providing insights into their features, benefits, and the value they bring to the Polygon ecosystem.

Join us as we navigate the world of Polygon projects, helping you discover the gems in this rapidly growing ecosystem. Stay tuned as we explore the best of what Polygon has to offer, from its top projects to the promising ones that are just starting to make their mark.

| 🔷 Polygon Project | 🔑 Key Features | 💪 Pros | 👎 Cons |

|---|---|---|---|

| 🔄 IDEX | Hybrid Liquidity | Established reputation, Expected to bring benefits to the Polygon exchange world | Still in development, Some unanswered questions |

| 💰 Aave | Flash loans, Collateralized lending, Interest rate swaps | Wide range of supported assets, High liquidity, Integration with other DeFi protocols | Limited number of supported assets compared to other lending platforms |

| 🍣 SushiSwap | Yield farming, Staking, Decentralized governance | Community-driven project, High liquidity, Integration with other DeFi protocols | Vulnerable to smart contract risks, Potential for impermanent loss in liquidity provision |

| 🔄 Curve Finance | Low slippage, Low fees, Efficient stablecoin swaps | Designed for stablecoin trading, High liquidity, Low fees | Limited asset support, Vulnerable to smart contract risks |

| ⚡ QuickSwap | Fast and low-cost transactions, Liquidity mining, Yield farming | Fast transaction speeds, Low fees, High liquidity | Limited asset support compared to other DEXs |

| 🔮 Polymarket | Trading on the outcome of real-world events, Decentralized oracle system | Large variety of markets, Decentralized oracle system for reliable data | Limited liquidity for some markets, Potential regulatory risks |

| 🌐 Decentraland | User-generated content, Virtual reality experiences, In-world economy | Unique virtual world concept, Potential for user-driven economy | Limited mainstream adoption, Reliance on user-generated content |

| 🔗 Chainlink | Secure and reliable data feeds, Decentralized oracle infrastructure | Widely adopted oracle solution, Integration with various blockchain platforms | Relatively high gas fees for transactions, Potential competition from other oracle providers |

| 📊 The Graph | Indexing of blockchain data, Subgraph development, Querying | Efficient data access for DApps, Developer-friendly tools and documentation | Relatively new project, Potential competition from other indexing solutions |

| 🏗️ Polygon Studios | Layer 2 scaling solution for Ethereum, Fast and low-cost transactions | Ecosystem development, Partnerships with major players in the crypto space | Dependency on Ethereum, Potential scalability challenges in the long run |

What you'll learn 👉

Polygon Ecosystem Projects

Opacity

Opacity (OPCT) is a standout file storage service that strives to provide its users with privacy, decentralization, and secure access. Powered by Ethereum, it allows users to self-custody their data by using an encrypted “handle” that functions like a private key. This provides top-notch security as even Opacity cannot access your data. But with one click, you also have the ability to share any file with someone else without losing control.

Thanks to Polygon’s Layer 2, projects such as Opacity can benefit from faster transactions and more scalability options. Ethereum is a great platform for decentralized projects but, when the network gets congested, it limits a project’s potential unless they choose Polygon’s Layer 2 solution. So if you want privacy and reliability along with speed and scalability then Opacity might be the perfect option for you!

TokenPocket (TPT)

Tokenpocket is a non-custodial wallet that allows people to use them on multiple blockchains. It is working with ETH, EOS, DOT, TRON, BSC, and most importantly for us Polygon as well. This means you could use tokenpocket to stake, swap, and use it like any other wallet. It has been around for a while and it has proven to be trustworthy.

Based in China, it had certain questions about it, but they managed to prove their worth soon. With an open-source code and a non-custodial “you keep your keys’ ‘ method, they provided security as well. It had only a few hundred dollars for its token volume at the start but now has moved to millions of dollars as well. Proving once again that they are getting more popular over time.

NFT20

For the past year, the NFT world has been increasing at a rapid pace. This caused the investors to take a look at them in a different light. This is why NFT20 is one of the best places for polygon NFT investors. It allows people to buy, sell, trade, and store NFTs in the polygon blockchain. You get to check whichever NFT you want, see the price for it if you want to, or even swap one NFT with another one.

It is definitely an up-and-coming project that hasn’t seen the interest it should just yet. However, Polygon hasn’t been a vastly popular blockchain for too long either. With the newfound interest in Polygon, NFT20 is expected to be the main source for NFT investors in the polygon world.

Beefy.finance

Everyone probably heard about beefy by this time. It is a “vault” or more officially known as a “yield optimizer”. You put your tokens into farming there, and it automatically reinvests all the earnings to grow your profits larger. This way you do not have to work for it, no unstaking and restaking and all that work, just invest once and it exponentially increases in the long run.

Beefy.finance has recently added polygon as well, this means in any yield farm beefy has for polygon, you get to use their vault system for investing. They have pages of options from higher risky new tokens to tokens that are known for less risk low reward ratio. This allows investors to use beefy in polygon just like they have been for a long time with billions of dollars but in polygon this time instead of ETH or BSC.

Balancer

We all heard of Uniswap, Pancakeswap, and many other AMM defi protocols that made the news a lot in the past year. Balancer is also another AMM that manages to get the Polygon network involved. It doesn’t only have two token/coin pairs either, it has multiple coins involved in what they call “compositions”.

The highest volume one has %20 USDC, %20 Link, %20 WETH, %20 BAL (their own token) and %20 AAVE for example. This means anything in between of these tokens will be a profit for the liquidity provider. If you would like to invest in any Polygon AMM, Balancer is a rare multi-token LP option. It is still early to decide if that is a good thing or not, but it is a new thing to take a look at.

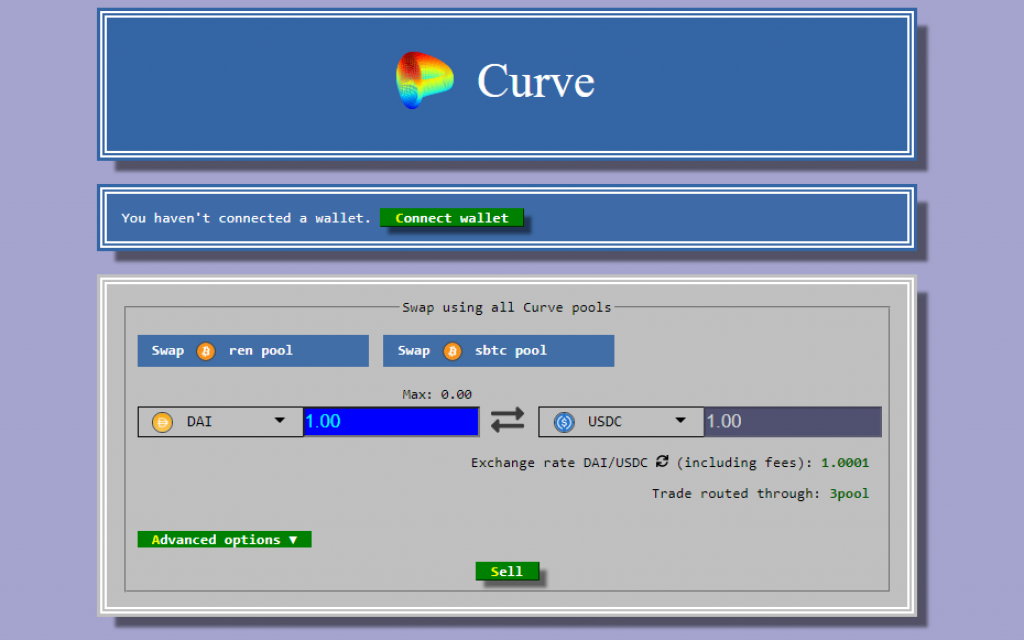

Curve

With a staggering close to half a billion dollars (and many times over) daily volume, Curve is a very well-known AMM. The polygon network part of the curve finance only has 20 million dollars or so volume. However, this could be mainly because the polygon network is growing only recently. They are also known for their amazing stablecoin returns as well. With a collection of stablecoins, you could invest and get a very high APR not seen in other places.

This is the main attraction of Curve and with the addition of Polygon, the same still applies to Matic network as well. There could be some doubt over how high they achieve it, but when you research it, it is mainly because of how well they position the rewarding process. Definitely worth checking it out considering they have been great in other networks. Plus their design is very cute and unique.

Polycat Finance

Polycat.finance is a yield farming website in the polygon ecosystem. They have their own token called Fish. They also have a Paw token as well. In the farming part of it just like anything on BSC or ETH, you get to do yield farming. This way you can provide liquidity for tokens in the Matic network. This allows swapping to happen a lot better as well. The token and the project are different points of view.

Project is a good one that provides a purpose in the polygon ecosystem. Whereas the token serves a purpose for profiting to investors. You could always use the yield farming part with tokens you trust without participating in the token part itself. Or you could buy the token for staking/farming and become an investor in polycat world too.

DexGuru

Dex means decentralized exchange and that is exactly what DexGuru is. You have yourself a website that is like a swap but it covers all swaps. You could have pancake router swaps, Uniswap router swaps, polygon swaps. Basically, it is one-stop for all the trading done in the defi world. It also supports a good chart as well, that way you get to see highs and lows. It means that if you want to do chart reading for the defi world, dexguru could definitely help with that.

A very improved version of all the swaps we have seen so far. Instead of just two boxes with tokens and numbers, we have a very good amount of data when we can trade. It also has one of the highest volumes in polygon network swaps as well. If you are interested in both defi world and technical analysis, this is the website to check.

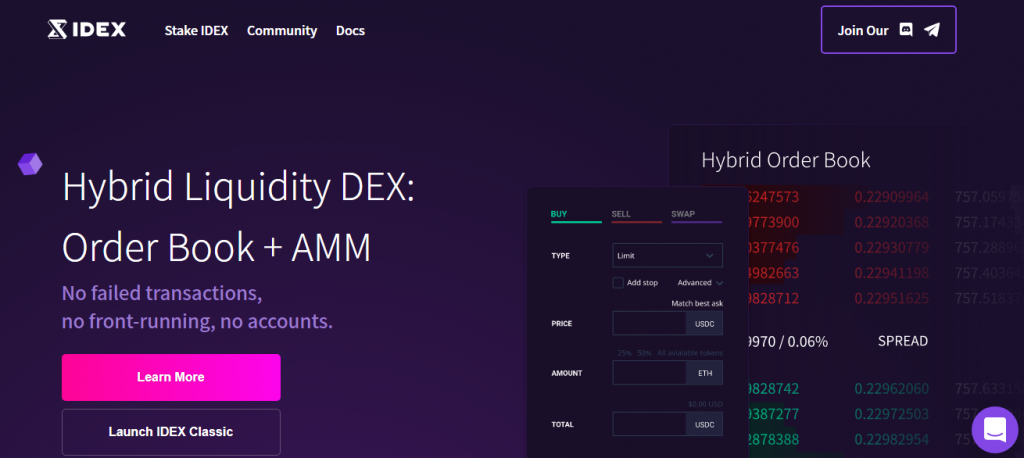

IDEX

This is another liquidity DEX in our list. IDEX has been around for a while and they are loved very much. They have recently introduced IDEX 3.0 which will be Hybrid Liquidity. This will allow them to prevent failed trades, slippage, front running problems. Polygon was announced a few months back but it is still in development. Eventually, any big name getting into Polygon definitely deserves a second look from polygon investors.

They have proved their merit on other chains so far, and polygon should not be expected to be any different. Hopefully when they launch their 3.0 with polygon network, that should be a new fresh breath of air for the polygon exchange world as well. There are still some questions to be answered by them, but it looks like a good addition for polygon no matter how it goes.

JellySwap

JellySwap is an atomic swap for cross-chain swaps. It is fairly old and also new. Old because they started a few years back, but new because they kept improving it. Not a big love for them in the community right now. Not because of anything bad, possibly lack of marketing could be the main reason. Even after so many years they have under 3k followers on twitter for example.

They also do not work properly on some browsers (like Opera) but fine on Chrome. Definitely one that has the best of intentions and yet falls short of delivering just enough to grow big as well. They are hopeful with a new rise thanks to adding polygon to their system and getting some more love from that specific community.

They have been working to add polygon network atomic swaps to their system for a while. With some more improvements they do promise a good potential, only time will show if this time they can reach a point enough to grow big.

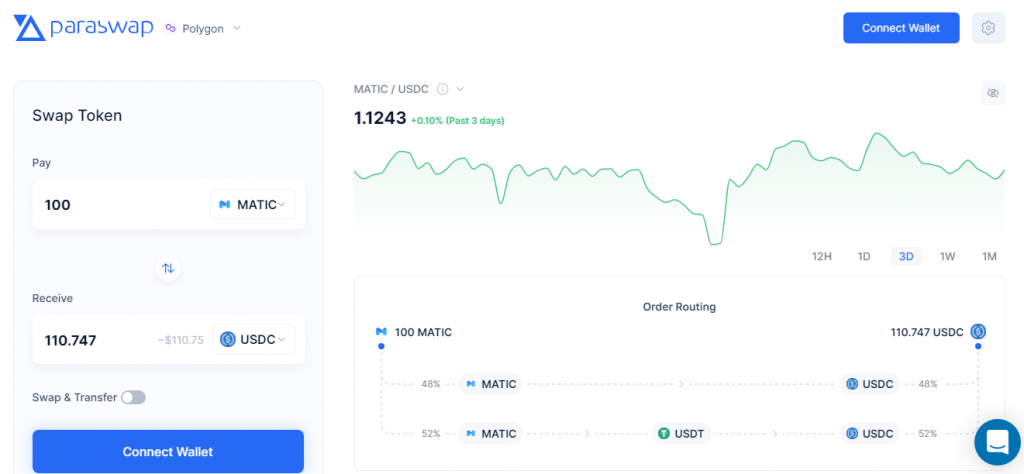

Paraswap

When you are a new chain ecosystem like Polygon that is getting a fresh start, you get endless amounts of exchanges and swaps. Paraswap is one of them, they are a swap that uses Link to find the easiest and cheapest and fastest ways to swap. Certainly not helpful when the fee they are charging is higher than average. However that could be covered with ledger nano integration if you have any.

Until we get more from Polygon itself, swaps will be what we have and Paraswap is not a bad one either. They are fairly new, started only this year and they have gained more attention than some of the old ones in our list. This means people are excited about Paraswap, but it still is not old enough to be at the top either. Hopefully with time and if they keep their clean name meanwhile, they should be one of the top polygon swaps in the future.

Fulcrum

Fulcrum is a lending and margin trading platform on defi world. On one side we have people who put collateral in order to margin trade in defi tokens. On the other side we have lenders who put out the amount required for margin traders to use. This way if the margin trader wins, they close their position and lenders earn, if they lose then whatever left goes to lenders.

Certainly a great way to make a profit on stablecoins that you may have. Usually a lot better than putting it on any bank. Here, instead of banks covering the world with their high rate loans, we have people bankrolling others’ margin trading for quick loans. Certainly allowing the crypto world to turn the banking world more p2p.

One small warning though, small amounts yield small returns and withdrawing or unlending requires a bit of fee, so it is advised to make sure your earnings will be higher than the fee that will be required.

Zapper (no token)

Zapper is a portfolio management website. It allows people to connect their wallets to their website and control it from one place. You can swap on any place, on the best options, you can stake it, you can send/receive. Basically it allows you to connect everything you have in crypto, in just one place.

From swaps to bridges to staking to even saving, it provides so much for the users. You can check your NFT’s, which coins you have, and all around control your crypto portfolio as a whole no matter what it is in one place. It also connects to polygon blockchain as well. This way whatever you are invested in the polygon network could be seen there as well.

Zerion (no token)

This is another portfolio management project. It has all the other products that Zapper provides and its ETH staking with low entry as well. Unfortunately it is not a widely popular product, with a very low active user count and followers. However that does not impact the usage of the wallet itself. It also shows all the hidden amounts that you may have forgotten in other places and all the claims that you may have.

This made it popular during and aftermath of uni airdrop for a while. If you want to have a change of scenery from all the other portfolio management websites, it is worth taking a look at it. However do not expect anything that would be different, it is good but also just the same thing.

Read also:

- How To Move ETH From Ethereum to Polygon – ETH To Polygon Bridges

- How To Make Emergency Withdrawal On Polygon (MATIC)

- Top 5 DEX on Polygon (MATIC) Network

- How To Revoke and Approve Token Allowance on BSC, Polygon Chains

- Best DeFi Bridges: Move Assets from ETH to BSC, Polygon & Vice Versa

- Best Dex on Solana – Swap Solana Tokens on Decentralized Exchanges

- Ethereum To HECO Chain Bridge – How To Send Coins From ETH To HECO

Conclusion

Polygon is still rather a new ecosystem. It has been here for a while if we check the first release of Matic network (now POL), however that has changed so much in the recent year. This means there will be a lot more projects on Polygon in the near future, but we have this list for now. They are certainly not better than their counterparts in Ethereum or BSC in most cases or just the same places that added polygon to their list.

Nevertheless, given some more time, there will be better and bigger projects on polygon for sure, meanwhile, we could check out the ones we have and certainly find some value in some of them as well. All we are required is a little bit more patience and a bit deeper research into what could become big in the long run with that potential fully used.