Cryptotax.io Review – Pricing, Supported Exchanges & Wallets, Countries

What you'll learn 👉

What is CryptoTax?

We live in a world where the crypto market is rapidly growing. Just look at the growth in this year (2021) alone. More and more people are entering the market every day. In the US alone, more than 60 million people own some kind of cryptocurrency which is pretty exciting information.

However, regardless of the market’s potential, crypto investors, holders, and traders need to understand that they must pay the taxes. They are subject to them just like anybody else. In fact, as the market grew, the interest of governments for the crypto industry around the world did as well. Now (October 2021) crypto taxes are regulated by the laws in most countries.

Therefore, this article will take a close look at one of the platforms that help the crypto world pay taxes more efficiently.

CryptoTax is a crypto tax tool that helps its users to calculate taxes and figure out the amount of taxes they need to pay. The main goal of the platform is to help individuals and companies in meeting their legal obligations arising from dealing with blockchain-based assets.

The platform was launched in Germany back in 2017. The original idea for the Crypto Tax team was to operate only in Germany for the time being. However, as the platform grew, the team became ambitious, and pretty quickly they launched CryptoTax US, CryptoTax Switzerland, and CryptoTax International in 2019.

Another big change happened on the platform in September 2020. The team announced that they have merged with Blockpit, another crypto tax software based in Germany that helps with the calculation of crypto taxes as well as the tax on realized profits.

In other words, the name of the platform now is Blockpit CryptoTax. Thus, sometimes I mention the platform in the article, I will use that name, just to be precise. The two companies were actually competitors, operating on the same fields and on the same market.

However, since the beginning of 2020, the two teams were in constant contact trying to find a way to work together and merge eventually. They took a close look at the companies’ structures and recognized a very big synergy potential, especially in technological merging and country coverage. The goal for both CryptoTax and Blockpit was to become “the largest provider of crypto tax solutions”.

The Blockpit CryptoTax continued to grow ever since the migration. I would like to show you how the tool works and the best features of the platform. So, let’s dive into the details and main vocal points of the article.

CryptoTax Features

The Blockpit CryptoTax has many exciting features that can make your life easier in terms of calculating taxes and meeting your legal tax obligations.

First of all, I have to say that the CryptoTax.io website is kind of poorly designed. Black and white colors are basically the only colors you can see, so the team did not pay a lot of attention to designing it in a modern way. I personally do not like to comment on the designs of any website (since if I do not like it, it does not mean that somebody else won’t), but this one really raised a red flag as one of the worst ones I have seen.

However, it is easy to use since you can find what you are looking for pretty quickly.

Let me list some of the features that are visible on the homepage of the Blockpit CryptoTax platform:

- Data import – You can import data from exchanges and wallets to get all your transactions. The platform offers you to automatically keep your portfolio up to date with the API imports

- Various transaction types – one of the best features of the Blockpit Cryptotax platform is you ask me. They support all kinds of different transaction types such as staking, airdrops, or any kind of crypto activity with full compliance with the US tax law

- Various tax documents – the platform does its best to support all forms required for your tax filing. The Blockpit CryptoTax tool works closely with the Big 4 organization and this collaboration ensures that all calculations are in accordance with the current state of the law

- Free and easy to contact support – You can easily create your own report using the platform’s features. However, if you still have questions or dilemmas about it, feel free to contact Blockpit CryptoTax’s support team. As per some experiences of users who reached out to them, they are very responsive

- Portfolio management – the platform offers monitoring transactions across wallets and exchanges

Furthermore, on the homepage, you can find some platform’s reviews that users wrote. Let me show you one of them:

“Taxing crypto-currencies correctly has felt like driving a car without a driver’s license for me so far. With Blockpit Cryptotax, I have now found a reliable partner with fair prices and can concentrate 100% on the track – thanks!”

To be honest, I have not found many bad reviews about the platform. It has a nice 4.1 average review on the Trustpilot website. In most of the reviews, users praised how quickly and responsively CryptoTax’s support responded. The sample is not big though (only 7 reviews).

Make sure to check out our guides on other tax calculators:

- Binance Tax Calculators

- Best Coinbase Tax Calculator

- CryptoTrader.Tax app review

- Cointracking.info Review

- Bitcoin.Tax vs CoinTracking vs CryptoTrader.Tax

- ZenLedger Review – Automatic Cryptocurrency Tax Calculator (+ Coupon Code)

- Tax Loss Harvesting – How to Reduce Your US Crypto Taxes

- How to Avoid Paying Taxes on Crypto [BUT DON’T DO IT, JUST PAY THEM]

- Koinly Review – Manage Your Crypto Taxes With Ease

- Crypto.com Tax Tool Review – Free Tax Calculator by Crypto.com

- Free Crypto Tax Calculators – Calculate Your Bitcoin Taxes For FREE

- Bitcoin Tax Free Countries – In These Countries You Pay 0% Tax On Your Bitcoin And Crypto

Supported countries

The CryptoTax tool offers country-specific tax reports for four countries – Germany, Austria, the United States of America, and Switzerland. So, they are pretty limited when it comes to country-specific tax help.

However, they do offer international tax reports for 189 countries, so you can still create an account and try to import all transactions and create tax reports even if you are not a citizen of the four countries mentioned above.

The difference between country-specific and international tax reports is not clear on the platform. However, it is safe to assume that international tax reports are generic reports with only information about your transactions and not much else.

So, if you are not a citizen of Germany, Austria, the US, or Switzerland, have your accountant review the report thoroughly, just to avoid any potential issues with it that are specific to the country where you live.

Supported exchanges

To be honest, the Crypto Tax tool does not support all of the major exchanges at the time of writing (October 2021) but they did show a list of exchanges they plan to support “soon”. So, let me show you some of the currently supported exchanges, and some that are coming soon.

Currently supported:Airswap, Binance, Bitcoin.de, BitMEX, Bitpanda, Bitstamp, Bittrex, Coinbase, Coinbase pro, Kraken, and Poloniex.

“Coming soon”: BitBay, Cex.io, Gate.io,Gemini, HitBTC, Huobi Global, KuCoin, Okex, Tidex, UpBit, and many others.

Supported wallets

The number of supported wallets on the CryptoTax platform is limited as well. Besides the Binance and Coinbase wallets, there are also Ledger, Tezos, and Ethereum wallets.

Some extremely popular cryptocurrency wallets such as Metamask or Math are not supported with no plan to support them soon whatsoever. Keep in mind that Metamask and Math wallets together have more than four million users, so if I were in CryptoTax’s shoes, I would definitely consider adding at least one of them to the supported list.

Other supported services (mining, staking, DeFi, Liquidity providing, NFTs, etc.)

CryptoTax supports tax reports for various types of services such as mining, staking, or airdrops. Unfortunately, crypto investors often forget that these types of services are taxable as well.

On the platform’s blog, you can read about how to create a tax report for staking here.

How does CryptoTax work?

Bitcoin, or any other cryptocurrency for that matter, is treated as a property for tax purposes. Nowadays, there are various tools and platforms that can help you save time and energy on generating and creating crypto tax reports.

Yes, you guessed it right, the Blcokpit CryptoTax tool is one of those platforms. The main advantage of the platform is that you do not have to be a tax professional to use it. Most of the work will be done by the CryptoTax actually.

Once you register (it is free by the way, but more about that later), all you need to do is to import relevant data from the exchanges, or wallets that you use. CryptoTax supports various transactions such as staking, airdrops, or any kind of crypto activity with full compliance with the US tax law.

The CryptoTax works by connecting to a user’s exchange data by using an Application Programming Interface (API) or Comma Separated Values (CSV) files. Trust me, and the process is more straightforward than it sounds.

The tool will then generate needed tax reports. Make sure to review them, or even better have your accountant review them thoroughly before you file them to the relevant tax institutions in your country.

If you run into any issues while you do the process above, just contact CryptoTax customer support. As per multiple users’ experiences, they are very responsive and helpful. And, this is how the CryptoTax tool works in a nutshell.

CryptoTax Pricing

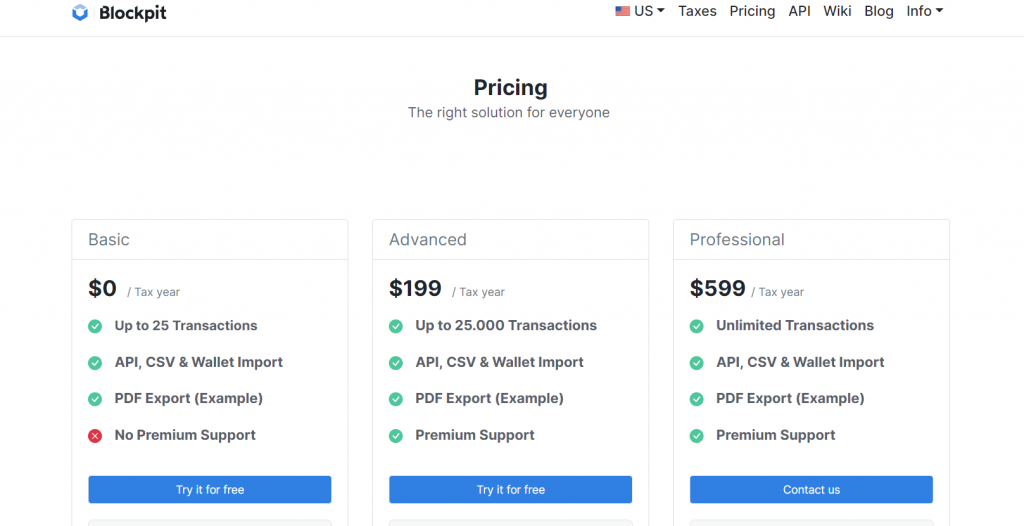

The CryptoTax tool offers three types of plans to its users. Basic (free), Advanced ($199 a year), and Professional ($599 a year). Having a free plan is cool, but keep in mind it has a lot of limitations.

The main difference between the cost-free plan and the paid one is the number of transactions. With the free plan, you are limited to only 25 transactions in a year, which is suitable mostly for beginners.

Another big difference is the availability of premium support which is not available on the free plan. This probably means that if you are on a Basic plan, you are not able to reach out to some of the tax experts who work with the platform.

However, other than these two differences (they are big, do not get me wrong), other parts of the plans are the same between these three – API, CSV & Wallet Import, and PDF Export (Example) are features available on each of the plans.

My most sincere suggestion here is to choose a Basic (cost-free) plan if you are a beginner, or if you just do not have more than 25 crypto transactions in a year. With that being said, if you are a more experienced, and more active crypto trader or investor, a Basic plan will not be enough for you.

At this point, it is good to note that all opinions and suggestions written in this article are not considered financial advice.

CryptoTax Mobile App

(Blockpit) CryptoTax has a standalone mobile app, available on both iOS and Android operating systems.

One negative side I immediately noticed when I downloaded the app is that you are not able to create an account in the app alone. You are rather redirected to their web mobile app that is extremely buggy (besides the already mentioned bad design).

The design on the app itself I did not like either. It just looks like the team around CryptoTax did not pay much attention to this. On the positive side of things, the app offers all features that the desktop version does.

Is CryptoTaxIO legit

Yes, CryptoTax is a completely legit crypto tax tool. If there were any doubts regarding the safety, the migration with Blockpit just shows how serious the team is about the project.

The main advantage I see with the CryptoTax (when I compare it with its competitors) is the number of countries they support for generating tax reports. You can literally use the platform from almost anywhere in the world and see if it suits your needs.

Conclusion

The Blockpit CryptoTax is a tool that can make your life easier when it comes to crypto tax reports. The most important question you should ask yourself is, “Do I really need to use a tool like this?”. I think you might rather quickly find out an answer to that question once you read this article.

In general, the platform has both positive and negative sides. The biggest positive is the number of countries where the tool is available, and probably the biggest negative side is a limited number of exchanges and wallets supported.

Please note that if you decide to sell your cryptocurrencies for fiat money, you need to pay taxes in your respected country. However, you should do your own research and find out whether you have a need to use platforms like this, or not really.

FAQ’s

Let’s have a look at some frequently asked questions about CryptoTax and crypto taxes in general.

What Are Crypto Taxing Events?

Crypto taxing events are all transactions where you had capital gains for exchanging crypto with fiat money or using cryptocurrency to purchase goods and services.

What is the cost basis for cryptocurrency trades?

Your cost basis is the amount you spend in order to obtain your crypto, including fees and other acquisition costs.

I lost money trading cryptocurrency. Do I still pay tax?

Yes. Cryptocurrencies are treated as property by most tax services, and they are subject to capital gains and losses rules.

How do cryptocurrency taxes work?

This is a country-by-country scenario. h In most countries, you do not have to pay taxes by simply just holding them in your cryptocurrency wallet. However, when you exchange them for fiat money, this is when you have a capital gain (or loss), and then you have to pay for taxes at that point.

What if my exchange is not on the list of supported exchanges?

In that case, please reach out to CryptoTax customer support and if see if they can help you. They are very helpful and responsive.

Can I avoid paying taxes on my crypto trades?

In theory, you can, but is highly recommended not to do it. Please read more about it in our article here.

Is It Safe to Connect Tax Calculators to Exchanges?

This shouldn’t be an issue. API connections are considered safe and secure. I have not found a single review online that CryptoTax had issues with safety and connected exchanges.

Are airdrops, forks, staking, and mining taxed?

Yes. As per the IRS, the income from airdrops, forks, staking, and mining is to be taxed as ordinary income.

Does CryptoTax have a free plan?

Yes, the platform has a cost-free plan (a Basic plan). Keep in mind though that it has some limitations when compared to the paid plans.