Bybit Trading Bot Review & Tutorial – Are ByBit Trading Bots Legit & Profitable?

What you'll learn 👉

What Is Bybit Trading Bot?

In the rapidly evolving world of cryptocurrency trading, the quest for the perfect trading tool never ceases. Today, we turn our focus to a platform that has been making waves in the crypto community: Bybit. In this comprehensive Bybit trading bot review, we’ll delve into the intricacies of this automated tool, exploring its features, functionality, and overall performance.

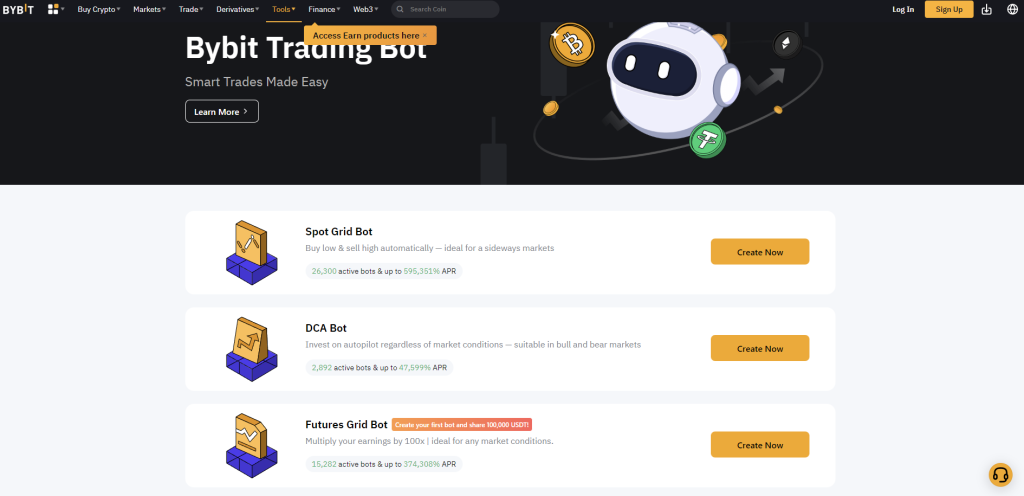

Bybit’s trading bot has been lauded for its ability to maximize profits and streamline trading processes. But does it truly live up to the hype? Can it be the key to unlocking your trading potential? We’ll dissect the bot’s three main types: the Spot grid bot, the Futures grid bot, and the DCA bot, each offering unique strategies to optimize your trading experience.

Whether you’re a seasoned trader or a newcomer to the crypto scene, this Bybit bot review aims to provide you with an in-depth understanding of the platform’s capabilities. So, buckle up as we embark on this journey to uncover the realities of trading with Bybit’s bot.

| Topic | Summary |

|---|---|

| 🤖 What Is Bybit Trading Bot? | Bybit’s Grid Bots are automated computer programs designed to help you buy low and sell high within predetermined intervals. They allow users to analyze and decide the best time to make profitable trades by defining entry and exit points through technical analysis. |

| 📊 Three types of ByBit bots | There are three types of ByBit bots: Spot grid bot, futures grid bot, and DCA bot. The Spot grid bot is the most popular. The futures grid bot is similar but amplifies your investment, profit, and risk by using up to 100x leverage. The DCA bot buys price dips of a coin you choose with the amount you predetermined. |

| 🎯 How Do Bybit Grid Bots Work? | Bybit trading bot works by setting up a series of buy and sell orders in either direction, creating a ‘trading grid’ with multiple orders waiting to be triggered by market conditions. A buy order will be placed when the price reaches your target, followed by a sell order higher up on the grid. If the price climbs to the next grid, that sell order will be executed, letting you profit from price fluctuations. |

Three types of ByBit bots

- Spot grid bot

- futures grid bot

- DCA bot

We will put focus on spot grid bot as that one is by far the most popular. The futures grid bot is essentially the same except it amplifies your investment, profit, and risk by using up to 100x leverage.

DCA is just buying price dips of a coin you choose with the amount you predetermined.

How Do Bybit Grid Bots Work?

So, how does the Bybit trading bot work? It’s simple – when you launch the bot, you can set up a series of buy and sell orders in either direction. This creates what’s known as a ‘trading grid’ with multiple orders waiting to be triggered by market conditions.

A buy order will be placed when the price reaches your target, followed by a sell order higher up on the grid. If the price climbs to the next grid, that sell order will be executed, letting you profit from price fluctuations.

Whether it’s with Spot or Futures markets, Bybit has got you covered with their highly efficient Grid Bots that automate order placements, so you don’t have to worry about missing out any golden opportunities or succumbing to any emotions when trading.

Create Your Grid Bot

Creating your own grid bot on Bybit is easy and fun! All you have to do is head over to the Bots section in the Bybit homepage, click ‘Create’ and follow the steps.

First, select a spot pair for your bot and set the lower and upper price bounds as well as the number of grids required. Then determine how much you want to invest in total.

Bybit also offers an Auto Fill feature to automatically enter intelligent parameter suggestions based on the historical data of a coin in order to make the process even easier. Don’t forget that you can always check your parameters after setting them up!

When you’re finished, hit Create to start trading with your new grid bot. With just a few simple steps, your grid bot will be ready for market action!

View Your Active/History Grid Bots

Bybit’s trading bot offers a convenient way to manage your grid bots. To access the active and historical bots, simply press the ‘Create’ button and you will be taken to the My Grid Bots page. By selecting the ‘Details’ option in the upper right corner, you can check out more details about your trading results, such as Total Profit (USDT), Grid Profit (USDT), Total APR and more.

If you would like to explore more details of yours trading history, click on ‘History’ tab to view every activity you have done with the platform. All these useful features make it convenient for users to track their trading activities and maximize their profits with this amazing trading bot!

Grid Profit and Total P&L Calculation

Grid Profit and Total Profit & Loss Calculation are two key concepts to understand when creating a grid trading bot. Knowing how both of these variables interact is essential for an effective grid trading strategy.

When calculating grid profit, the size of the price movement has to be taken into account. A larger movement in the price results in a higher profit, while a smaller movement will produce lower profits. Additionally, because the interval between grids gets shorter as more grids are added, it can cause multiple trading fees that reduce your overall profits.

Finally, when setting up your grid bot, one must always double-check all details before hitting create. Once everything is confirmed and good to go, you’re ready to start trading!

Setting Up Your Copy Trade of Grid Trading

Setting up a copy trade of grid trading is quick and easy when you use bybit’s trading bot. As they explain on learn.bybit.com, the Grid Bot leaderboard shows the best-performing traders on a daily and 7-day basis, ranked by total annual percentage rate (total APR). This total APR is calculated as the sum of the profit or loss of their base token plus any grid profits they’ve earned over that time period.

To set up your copy trade, simply select one of the top traders from either list and click “Copy”. Once this has been done, you can customize your settings to match those of your selected trader. By doing so, you’ll be able to start participating in profitable trades without having to manually monitor them!

Terminating Your Grid Bots

Terminating your Grid Bot on bybit is easy. Start by heading to the My Grid Bots page and clicking on Details of the grid bot you want to close, then tap on Terminate. From there, you’ll need to choose one of several processing methods: Received quote token, Currently holding tokens, and Base Token.

Using the BTC/USDT Spot Grid Bot as an example here’s how it would look: you’ll receive a quote token (USDT), currently holding tokens (BTC+USDT), and a base token (BTC). To avoid confusion and ensure that exchanging between tokens will be based on the market price with the associated Spot fee charged, Bybit offers clear notes explaining each process step in detail.

Once you are done choosing your chosen settlement processing method and click Confirm, your funds will automatically be transferred back to your Spot Account. You can view all details about this terminated Grid Bot in the History section, including Grid Profit, Filled Time, and Avg. Filled Price, Filled Qty., and Trading Fees. The number of coins you receive will depend on the settlement processing method you choose. So ensure that before terminating a grid bot you understand exactly how this works!

Are Grid Bots Profitable?

Are grid bots profitable? It’s a question many people have when it comes to auto trading with Bybit. The answer is that, yes, grid bots can be profitable! They’re designed to buy and sell at pre-defined prices to take advantage of market changes. However, if the token value dips too low below the profits gained by the grid bot, then it could result in a negative total return.

It’s important to remember that you will accrue trading fees while using these bots. The fee structure is the same as those found on Bybit’s Spot and Futures platforms; these fees will be charged once an order is filled successfully. So keep in mind that these fees need to be accounted for before you can truly assess whether using these automated trading strategies is indeed worthwhile for you or not.

The Bottom Line

The bottom line is that Bybit’s trading bots offer an excellent solution for automated investing and trading. As it provides grid strategies suitable for volatile and sideways markets, you can set parameters to ensure a positive profit result, while the Copy Trade feature allows you to mirror other successful traders’ bot placements. Plus, experienced traders can always share their own strategies with others.

All of these features make this platform easy to use and conveniently efficient to get the best returns on investments. So if you’re looking for automation in your trading, then Bybit’s trading bots are just what you need!

Read also: