As crypto adoption continues to explode, there’s an increased number of crypto exchanges hitting the market. That said, there’s rising demand for derivatives crypto exchanges as traders seek a variety of trading options.

When assessing the right crypto exchange to use, one needs to look at factors such as security, liquidity, fees, user interface among other things. Two trading platforms that have taken center stage amongst crypto lovers are Binance and FTX.

The two exchanges have continued to record astronomical growths as the number of new registrations continues to explode. While the two are commendable when it comes to trading, there lies lots of differences in the features they offer.

Let’s explore the differences between the two and assess which one is right for you in the following comprehensive review.

Visit Binance Now Visit FTX Now

What you'll learn 👉

User Interface, Layout, and Availability

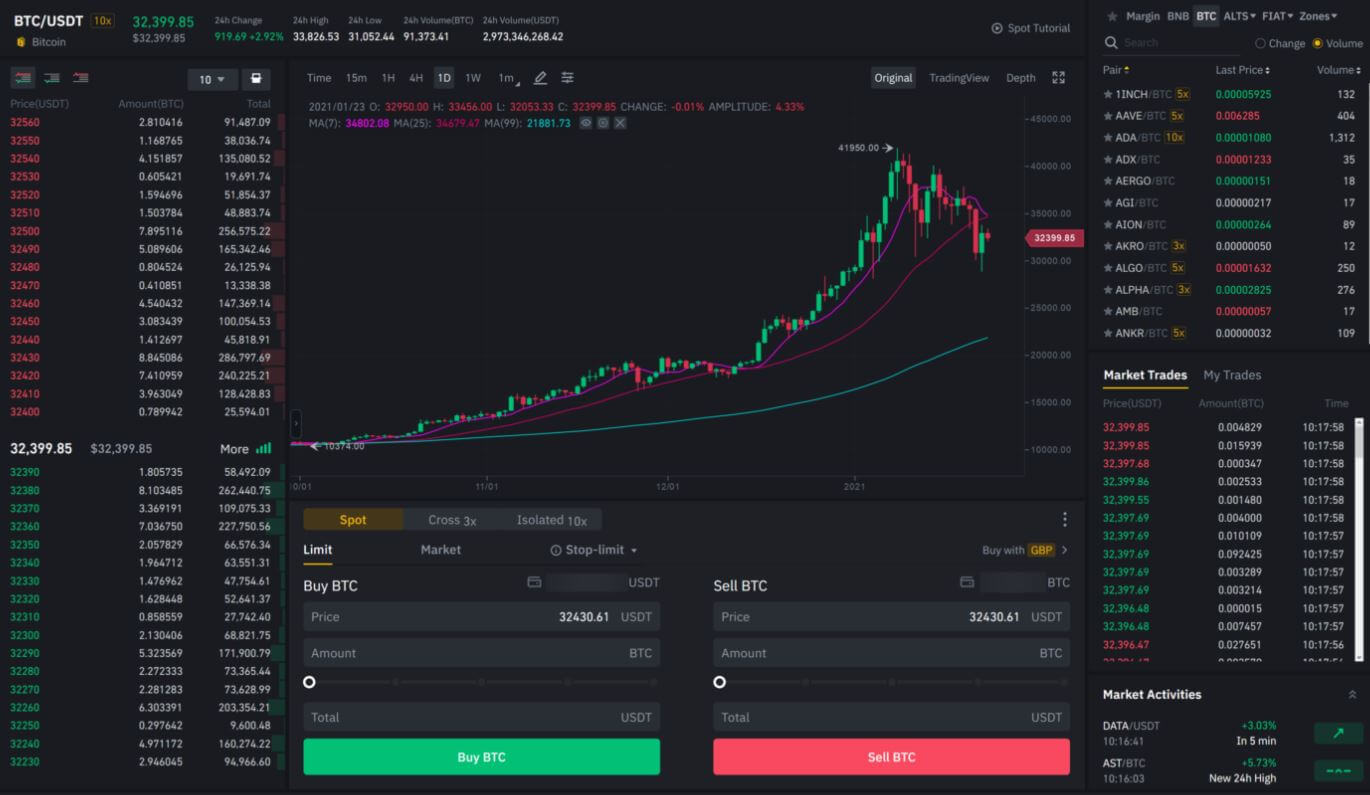

Binance boasts of an advanced user interface that lets an investor or trader navigate the site. However, many beginners have complained of difficulty in navigating the site including understanding the layout. Finding the order book, placing a trade, and even checking one’s balances can be a headache for novices.

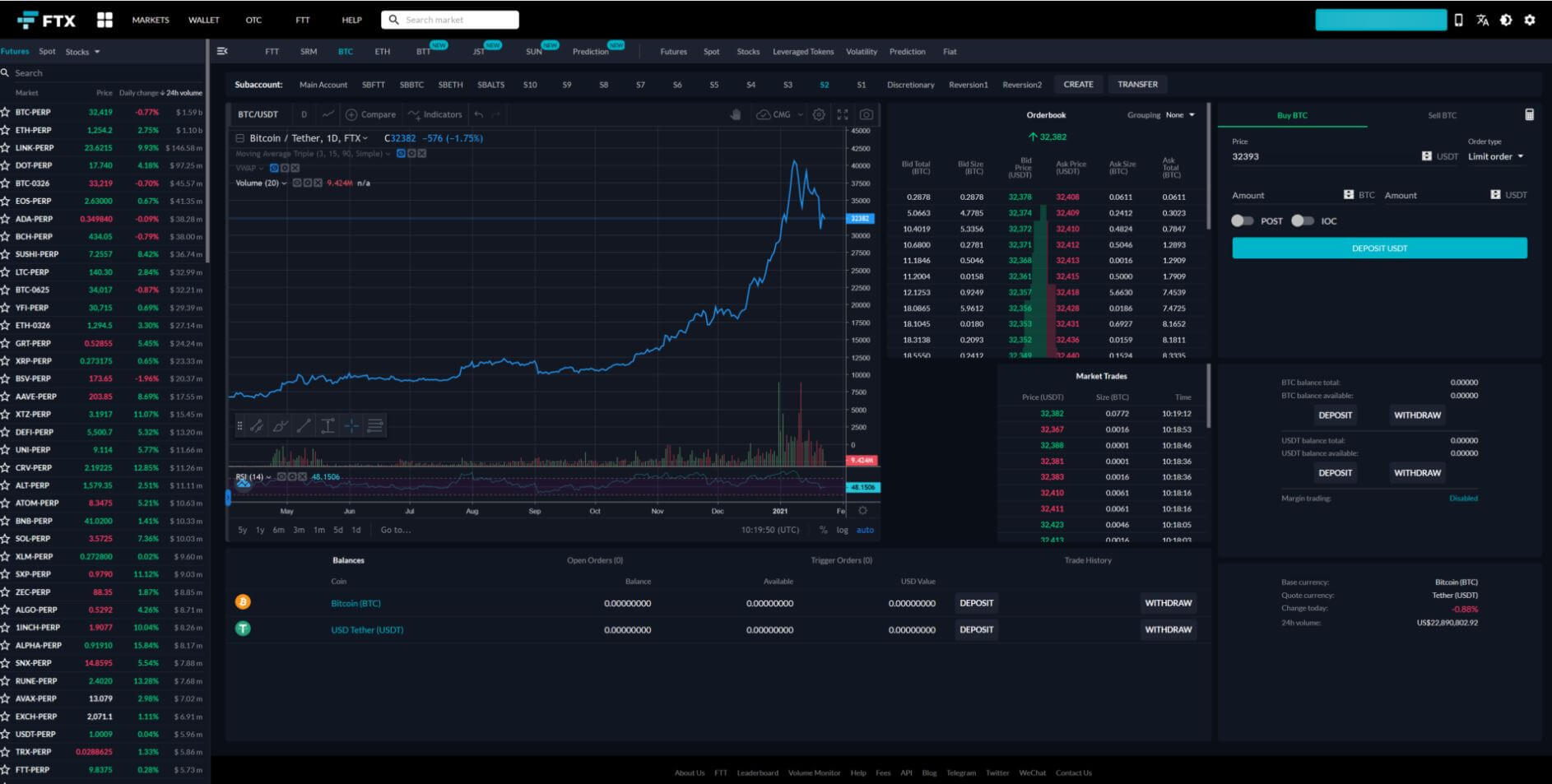

As for FTX, its UI is easy to understand and beginner-friendly, The customizable UI allows users to build their own layout by dragging boxes around. Better yet, one can track the markets directly or even follow their favorite markets.

In terms of availability, both exchanges rarely have downtime. However, Binance often has isolated cases where it shuts withdrawals of some coins especially when there’s a surge in demand.

⚡️ Verdict: FTX has a more user-friendly user interface that allows one to customize it by building their own layout.

Leverage and Trading Pairs Available Comparison

When it comes to trading pairs and products, Binance has one of the largest range of products in the crypto space As both a spot and derivatives exchange, Binance has over 202 cryptocurrencies available on the platform compared to FTX’s 35 trading pairs.

In terms of leverage, FTX provides leverage trading to only 45 ERC-20 tokens with a maximum leverage of up to 3X. On the other hand, Binance has a wide range of leveraged tokens dubbed the BLVT which are tradeable on the spot market. It also has a variety of futures contracts such as USDT-M Futures, Coin-M Futures, and Binance Vanilla options.

Binance provides over 125X leverage on Bitcoin and above 50X leverage on other coins. Perpetual pairs on FTX enjoy leverage of 101X.

⚡️ Verdict: Binance wins since it offers higher leverage on positions and provides a wide range of trading pairs and products.

FTX vs Binance – Trading Experience

The trading experience on Binance is on another level. The platform has several top-notch features that allow users to enjoy and get the best out of their trading experience. These cool features include Binance futures battle, Binance futures leaderboard, and an asset conversion function. You can even enjoy the cross-collateral feature that lets you use a crypto asset to borrow another crypto.

When it comes to FTX, the platform is designed by traders for traders. About that, the platform is a derivative market that specializes in futures. The collateral used on the platform is USD. It also allows the use of subaccounts to isolate trading positions from each other. One can also customize their graphs and edit the graph settings.

⚡️ Verdict: Binance wins on this one due to its superior trading experience that combines various features that make the process interesting and engaging.

Access to Orderbooks and Charts

An order book is a crucial area in any crypto exchange. For Binance, their order book is ‘busy’ and moves very fast – due to the high number of users on the platform. The platform boasts high liquidity especially for top cryptocurrencies such as Bitcoin and Ethereum. The order book is easily accessible but a beginner may find it hard to understand especially when placing a trade.

The charts on Binance are pretty easy to understand. The platform gives you the option of basic and advanced charts complete with candlesticks and volume bars.

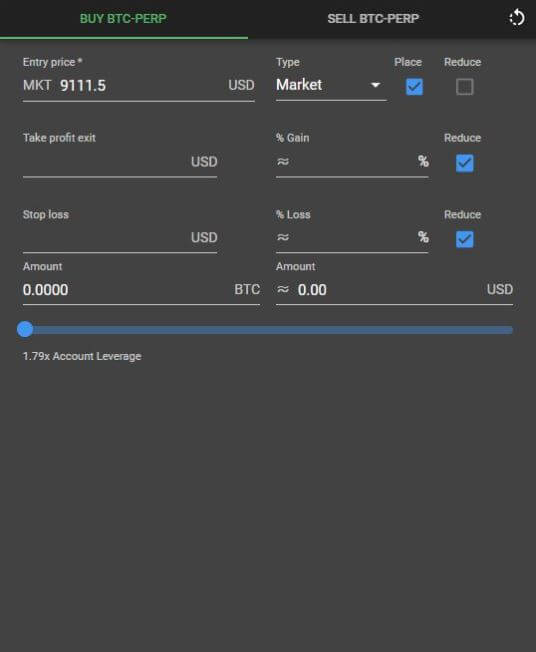

As a derivatives exchange, FTX has an advanced order book with a user-friendly interface. AS mentioned, you can customize the layout. Placing an order is easy and allows one to set the leverage position as well as adjust the collateral. The charts on the platform are candlesticks which provide hourly, daily, weekly and yearly outlooks of the market.

⚡️ Verdict: Both platforms have a robust order book but Binance provides better charts for comprehensive technical analysis.

Types of Orders

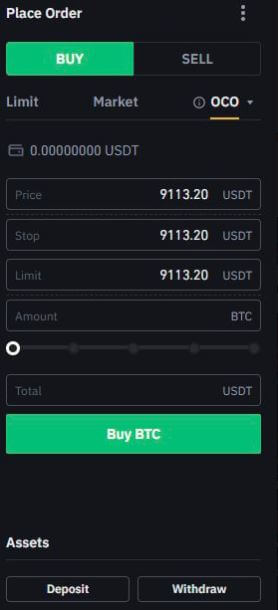

Both trading platforms have a variety of order types to accommodate diverse trading needs. For Binance Futures, the available orders are:

- Limit order

- Stop limit order

- Market order

- Stop market order

- Trailing market order

For FTX, the advanced types of orders are:

- Stop-loss limit

- Stop-loss market

- Trailing stop

- Take profit

- Take profit limit orders

The stop loss feature on both platforms helps cushion traders and investors against volatility.

⚡️ Verdict: Seems like a tie on this feature since both exchanges cater to the trader by providing five types of orders for each.

Robust Calculator

As a trader, you need a platform that crunches out the numbers to provide you with a clear picture of the trade. Binance’s calculator is robust and helps you easily calculate the initial margin, PnL, and the liquidation price before one places an order. It also shows one the target price for long and short positions.

The calculator on FTX isn’t as advanced as its counterparts. It’s mainly for calculating the Profit and Loss (PNL) on the account as well as the fees.

⚡️ Verdict: Binance has a more robust calculator compared to FTX which gives a clearer picture of different aspects of the trade.

Visit Binance Now Visit FTX Now

Isolated Margin and Cross Margin

When it comes to trading margins, Binance offers two types for its futures account; isolated and cross margins. When placing a trade, the user can pick the isolated margin which is independent for each trading pair. For the cross-margin mode, the user can only have one account which is shared by all the positions.

To use isolated margin trading on FTX, one will need to create a sub-account. Each position is independent with separate collateral which gives the user total control over the sub-account. The default setup of FTX allows the user to have collateral in a centralized place.

⚡️ Verdict: Isolated and cross margin trading on FTX is more friendly and convenient for traders compared to the same feature on Binance.

Trading Fees

FTX takes pride in being a crypto exchange with very low transaction fees. While they have a tiered fee structure, the platform has zero fees for its market makers. Market takers attract a fee of 0.07% on FTX. Leveraged tokens on FTX attract a fee of 0.1% with a management fee of 0.03% daily.

Between FTX fees vs Binance, there are no deposit fees on Binance with a tiered fee structure with nine levels. The taker and maker fee on Binance is 0.1%. However, both platforms provide their native token holders (FTT holders for FTX and BNB holders for Binance) with large discounts on fees.

⚡️ Verdict: FTX boasts of extremely low transaction fees compared with Binance.

Identity Verification

Both Binance and FTX take identity verification seriously as part of their Know Your Customer (KYC) process. Both require you to sign up using an email. To verify your identity as an individual. You will be required to upload documents such as your government-issued ID card or passport. The verification process takes a few hours to 3 business days.

⚡️ Verdict: FTX has a quick onboarding process and even faster identity verification following successful submission of the required documents.

Withdrawal Options

Binance supports the withdrawal of fiat from the currency and provides users with numerous withdrawal options. The withdrawal method depends on one’s country and the currency. Binance allows withdrawal using credit cards, debit cards, cash, or wire transfer.

Withdrawals on FTX are free and processed within minutes. The available withdrawal options on FTX are ACH, wire transfer, Silvergate Exchange Network (SEN), and in crypto.

⚡️ Verdict: Binance wins due to its customized withdrawal options based on one’s region and currency.

Bottom Line

Comparing these two platforms isn’t easy since both have superior features and competitive rates. Looking at the parameters above, there lie some outstanding differences. For a trader, whether novice or advanced, FTX is designed for an exemplary trading experience. FTX also boasts of lower trading and transaction fees.

That said, there’s a reason why Binance is the leading crypto exchange in the world. Not only does it have deep liquidity but it offers a hundred trading pairs which give traders options. The platform also has other features such as futures trading, a robust P2P platform, an easy onboarding process, margin trading among others.

FTX is quickly making its mark on the crypto scene and its immense capability can’t be underestimated. A seasoned crypto enthusiast will find the platform rich and useful. For a beginner in crypto, Binance is great since it also has a Binance Academy to enlighten you about the platform and various other aspects of crypto.

Visit Binance Now Visit FTX Now

In case you want to compare with other exchanges, check this out: