What you'll learn 👉

Here’s Why Bitcoin Prices Are Different On Each Exchange

The price of Bitcoin fluctuates wildly throughout the day. This is true even though many people use the currency as a store of value rather than as a medium of exchange. In fact, some economists believe that the volatility of the price makes Bitcoins useful only as a speculative investment. However, the way that prices are calculated is often overlooked.

Variation in price is due to differences in supply and demand. When someone searches for “Bitcoin,” they are looking for information about the current state of the market. Therefore, the number of coins being traded is important if fewer people are trading, the price increases conversely, if more people are buying and selling, the price decreases.

Binance, the largest exchange, says that it accounts for approximately 53% of global volume. As such, it affects the overall price of Bitcoin. Other exchanges include Coinbase, Bitstamp, Kraken, Gemini, and others. These smaller exchanges account for the remaining 47%. They each operate independently, meaning they do not know what the other exchanges are doing. As a result, the price of Bitcoin can vary greatly from one exchange to the next.

No Standard Pricing

The primary explanation for discrepancies in Bitcoin prices across different exchanges is the simple fact that, as a decentralized digital currency, there is simply no standard or global price at any given period. This makes sense considering that it isn’t pegged to the USD or to any other fiat currencies, nor is it linked with a specific country or to any exchange.

As with commodities of all types – gold, silver, oil, etc. – supply and demand vary depending upon the time and market, and the price fluctuates accordingly. For example, during times of economic stability, people tend to buy into cryptos because they see them as a safe haven. During times of economic uncertainty, however, people are less likely to invest in something perceived as risky.

Liquidity

Liquidity is an important factor in crypto trading. In fact, it is the most crucial aspect of trading because it determines whether you make money or lose money. When you trade, there is always a difference between the bid price and the asking price. This is called the spread.

The wider the spread, the less liquid the market is. If the spread gets too wide, it could mean that there aren’t enough buyers and sellers present to move the price up or down.

In such cases, the prices are stuck. However, the opposite is true as well — if the spread narrows, it means that there are many buyers and sellers, and thus, the prices tend to rise and fall quickly. This makes it easier to profit from trades.

Exchange Volume

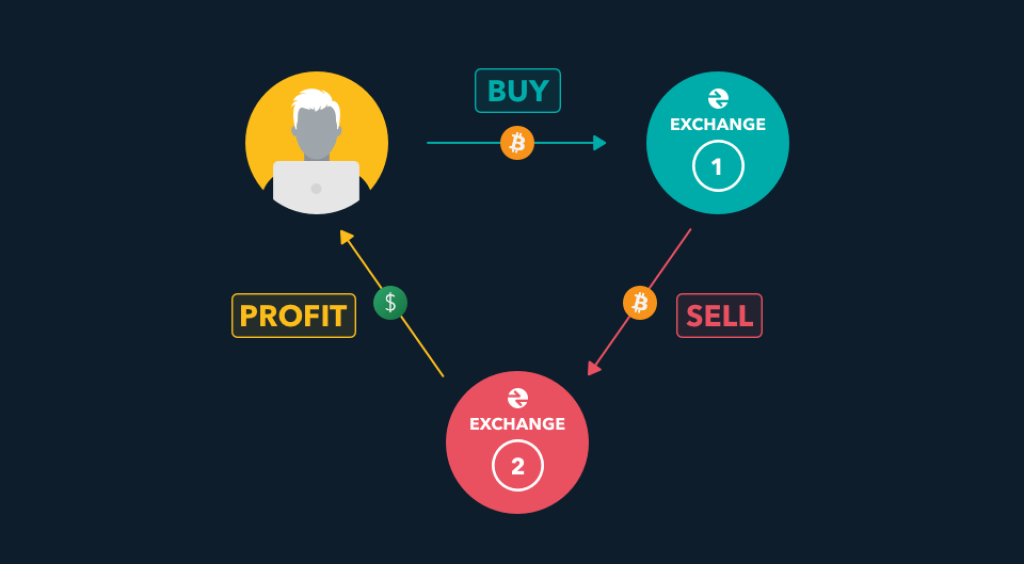

The volume of crypto exchanged across major exchanges is very small compared to the overall market value of each coin. This means that people can buy up large quantities of coins without affecting the price. This is called arbitrage.

When you buy something at a cheaper price from one seller and sell it to another buyer at a more expensive price, you’re doing arbitrage.

Since there are a lot of automatic solutions that do the arbitrage for you, these bots essentially peg the Bitcoin price to similar levels on all exchanges. They iron out all the differences. How do they do it?

Whenever a bot spots a price of a coin that diverges from its price on other exchanges, it goes to work. If the coin is lower on exchange 1, it buys it there and sells the same coin on exchange 2 for a higher price.

There are many opportunities for making money through arbitrage when trading cryptos. However, the volumes available are limited since all the coins that are being mined are only coming from online exchanges, so they constitute a small subset of the actual coins that were actually mined, meaning that the price quotes are usually from a smaller subset of coins than the total number of coins out there.

People don’t seem to take full advantage of the arbitrage opportunities available. There isn’t any good way to know how much a single coin costs relative to another, so people are looking around for whatever deals they can get.

Entry Price

Bitcoin is considered one of the best investments you could make today. There are many reasons why people consider Bitcoin to be such a good investment. One of the main benefits of investing in Bitcoin is that it is relatively inexpensive to enter the market and buy Bitcoins. In fact, some investors say that buying Bitcoin is cheaper than buying a house.

The reason why it is so easy to invest in Bitcoin is that the technology behind it makes it very simple to purchase. For example, anyone with a computer can use Coinbase to easily buy Bitcoins without having to go anywhere else.

Another advantage to purchasing Bitcoin is that crypto is extremely volatile.

One of the biggest challenges that come along with investing in Bitcoin is that the crypto market is highly speculative and irrational. Many people speculate that there will be a bubble burst and that the value of Bitcoin will crash. However, others believe that the value of Bitcoin is bound to skyrocket, regardless of whether the market crashes or skyrockets, the price of Bitcoin is still relatively low compared to traditional assets.

What are cryptocurrency pairs?

Crypto trading pairs are basically just combinations of different coins. They help you trade one coin for another based on what each currency is worth compared to the others.

The order of the currencies in the pair always matters because they determine how much of the value of the pair goes into buying the first currency and how much goes into the second. So if you anticipate that Bitcoin will rise against the USD in the near future, for example, you should buy the Bitcoin/USD pair, where Bitcoin comes first, and the USD comes second. If you think that Bitcoin will fall against USD, you will buy the USD/Bitcoin pair, where USD comes first and Bitcoins come second.

Can I profit from price differences at various exchanges?

During a normal trading day, the price of Bitcoin on five main exchanges may vary by 1% or 2%. On active trading days with bigger volumes, the gap can exceed 5%; volume increases when prices rise or fall drastically.

When selling your Bitcoin on an exchange for a higher value than buying it back again from another exchange, be sure to check if the transaction fees and the exchange fees don’t exceed the value difference.

So, It’s not impossible for a small profit to be made if the price difference covers the exchange fees.

I want to trade, where do I start?

The answer is simple: Buy some crypto first.

To open an account on a crypto exchange, you must deposit funds into your account. This can be done either through sending funds from a bank account, credit card, or PayPal account or buying cryptos on one of the many exchanges out there.

After you have bought some cryptos, you need to transfer them to an exchange account. You’ll then receive a confirmation email from the exchange where you can check the details of your transactions.

Once logged into your account, you’ll be able to access your balance and recent transactions and even check out the current market value for various cryptos.

Select the coin you want to sell and enter the price. Click “Buy.” After the trade, you’ll get an email.