If you’re confused about Ripple (XRP), don’t worry because in this guide you will learn everything you need to know about it.

The term Ripple is often used interchangeably for the fast money transfer network, Ripple, and its associated coin, XRP, as well as the holding company.

Ripple is a privately held, cash flow positive company that aims to create a new payment infrastructure that improves reliability and speed while reducing the cost. Ripple calls this global network using Ripple software the “Internet of Value” – a new platform to reshape the world of business and transform the old order.

The XRP ledger is an open-source product created by Ripple to solve a major point of friction in international payments which is the pre-funding of nostro/vostro accounts. XRP can be used by banks to source liquidity on demand in real time, and also by payment providers to lower foreign exchange costs, provide faster payment settlements, and expand reach into new markets.

Ripple is essentially taking a stand against what they call “walled gardens” of financial networks consisting of credit cards, banks, PayPal and other institutions that restrict the flow of money with processing delays, currency exchange charges, and fees.

XRP can be bought or exchanged on multiple popular cryptocurrency markets.

Read here where you can buy Ripple and here where to store your coins (best XRP wallets).

What you'll learn 👉

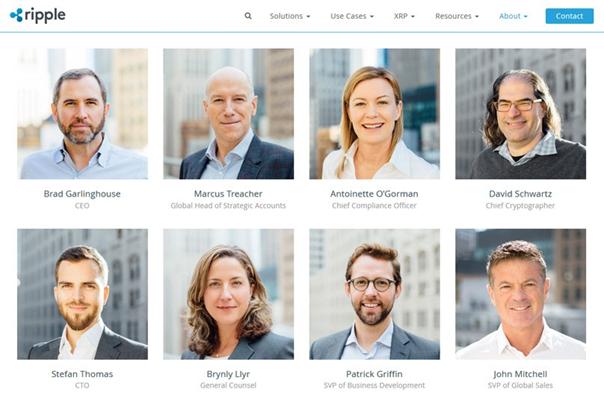

Who Runs Ripple?

Ripple is truly a global company. It has offices all around the world – New York, San Francisco, London, Luxembourg, Singapore, India, and Sydney. The leadership of the company combines experience in technology, compliance, and financial services that spans decades.

The team includes CEO Brad Garlinghouse, SVP of Global Sales John Mitchell, SVP of Business Development Patrick Griffin, VP of Finance Cameron Kinloch, CTO Stefan Thomas, Chief Cryptographer David Schwartz, Chief Compliance Officer Antoinette O’Gorman, and Global Head of Strategic Accounts Marcus Treacher. The board of directors has experience in finance, regulation, and policy.

Ripple’s Opportunity

The state of the global payments industry is weirdly behind.

We can stream and download entire artist discographies on our phone in the middle of a forest, yet sending a few digits of currency to your Grandpa in England requires fees and processing time.

The technology for easy global payments already exists. So why is the global payments industry so far behind?

Well, the financial institutions collectively making trillions of dollars over payment fees aren’t racing to innovate the traditional system that allows them to make so much money.

The financial industry has also tended to keep pertinent information shrouded in complicated financial jargon that might not be easy for average people. Words such as “quantitative easing” and “collateralized debt obligations” have established the financial realm in an esoteric curtain.

However, instead of taking a “burn it to the ground” approach that has been adopted by many cryptocurrency ideologists, Ripple aims to work with the current financial world, and its goal is to be a global settlement network, a platform to allow anyone to transfer money in any currency to any currency in a matter of seconds.

Every year, the equivalent of roughly $155 trillion is moved across borders. For example, let’s say that everyone used PayPal, which charges a 2.9% fee for each transaction. Granted, this would be way on the high end for payment fees. However, we’re all probably familiar with PayPal taking a cut of our payments at some point or another. This means that around $4.495 trillion of those global payments would go straight to PayPal, and to add insult to injury, these payments would probably even take days to process.

Where Does Ripple Come in?

So, the opportunity for Ripple to shake things up is there.

And I know, there are many of starry-eyed altcoins saying “If we could only grab X% of this market, we’d be a dominant player in the industry.”

Ripple was released in 2012. The thing is, Ripple is already a revenue-producing company with over 100 financial institutions on its blockchain network including BBVA, Banco Santander, Westpac, and Standard Chartered Bank.

In order to understand how Ripple functions, it’s useful to know about the Real-time Gross Settlement System (RTGS) and Ripple Transaction Protocol (RTXP).

For instance, when money is sent via Bitcoin, the value is settled in real-time (not counting any Bitcoin delays), and that’s what we mean by RTGS.

Ripple uses something that is called “gateways”. This is best described as something similar to a global ledger made up of something similar to private blockchains. This is essentially a digital portal that financial institutions, companies, and governments use to join the Ripple network. This is called the RTXP, formally known as RippleNet.

Once another financial institution, company, or government joins RTXP, it can transact with other gateways at a fraction of the cost and at a much faster speed. RTXP also makes it possible to receive payments from any cryptocurrency (BTC, ETH, etc) and fiat (USD, EUR, etc).

Ripple essentially made something for virtually any type of entity that regularly moves large amounts of money across borders, for instance companies such as Amazon and Apple are already spending billions across borders.

One more thing worth noting is that the Ripple Network also functions as a currency exchange between all types of fiat money, but to do this, it has to be able to guarantee liquidity. That’s where XRP comes in. XRP is the digital asset that was built specifically for enterprises as an on-demand choice for sourcing liquidity in cross-border payments. Banks can use XRP to source liquidity in real-time on demand without any need to fund nostro accounts in advance, while payment providers use it to reduce the cost of foreign exchanges, improve the speed of payment settlements, or reach into other markets.

As you can see Ripple’s infrastructure makes sense for large corporations. However, it doesn’t lend much to the average consumer. The Ripple Transaction Protocol (RTXP) doesn’t provide the average consumer much of a benefit. So, Ripple probably isn’t going to change how you personally receive and send money anytime soon. However, it is looking to revolutionize how money moves around the world on a larger scale.

Compared to other cryptocurrencies like BTC and ETH, XRP settles incredibly quickly, taking only four seconds. By comparison, BTC takes over an hour to settle and ETH takes over two minutes. Traditional systems take three to five days, which means that they are even worse. XRP is also highly scalable. ETH only has 15 transactions per second, BTC only handles three to six, whereas the XRP ledger can handle more than 1500 transactions per second.

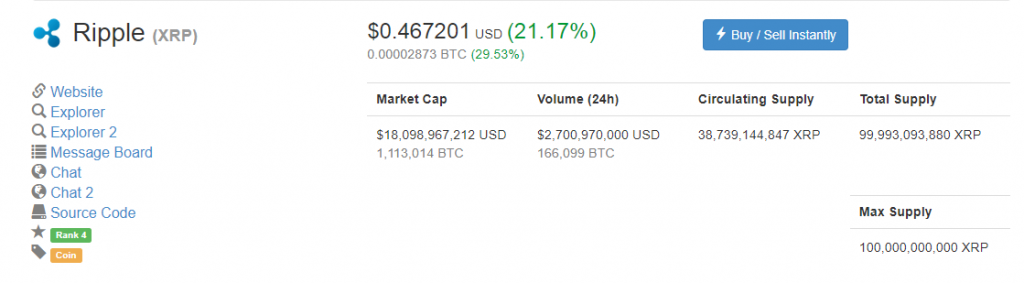

Ripple’s Supply Structure

The sheer amount of Ripple in existence is a key element to know about Ripple (XRP). All XRP has already been created with a total supply of 100 billion, and as of September 17, 2017, Ripple held 6,462,128,816 XRP with 38,531,538,922 XRP distributed.

In an announcement in May 2017, Ripple stated its plans to lock up 55 billion XRP in 55 different smart contracts, essentially putting billions of dollars in escrow. A contract then releases 1 billion XRP into the market each month.

Ripple is Kind of Centralized

Given the fact that around 61.4 billion XRP tokens are held by Ripple Labs, it could be said that Ripple is centralized, or at least more so than the majority of other cryptocurrencies.

However, Brad Garlinghouse (CEO and Founder of Ripple), views it differently, and he stated that “Ripple is not centralized. To be clear, if Ripple disappeared today, XRP would continue to function, and to me, that’s the most important measure of whether something is decentralized.”

Ripple released their decentralization strategy in May 2017, where they announced the plans to diversify the validators on the XRP ledger and expanded them to 55 validator nodes in July 2017. Ripple also shared plans that, over the course of the next 18 months, they will add third-party validating nodes, while removing one Ripple-operated validating node for every two third-party nodes, until no entity operates a majority of trusted nodes on the RCL.

I think that the answer to the question whether or not Ripple is centralized, is that it’s a weird mix of both. You’ve got this holding company that has more than half the tokens with plans to release the rest. This is likely prioritizing the acquisition and onboarding of new partners on the Ripple network.

Being centralized isn’t necessarily a bad thing. However, it does dissuade many “decentralized” ideologists within the cryptocurrency community.

How to Buy and Store Ripple?

Ripple can be bought at many of the most popular cryptocurrency exchanges such as Poloniex, Bitfinex, Kraken, and Bittrex, as well as through the exchange and wallet provider Gatehub, or through any brokerage platforms such as Changelly.

When I first purchased Ripple, I used GateHub just and it worked out pretty well, but I eventually moved to a more robust exchange. I recommend using a hardware wallet such as the Ledger Nano S or one that supports Ripple for those people who want to hold Ripple (XRP) for the long term.

Hardware wallets are generally much safer because they’re offline and have better security than other online wallets and exchange. But the problem is that these wallets aren’t ideal for someone trading frequently. Online wallets such as the ones hosted on Bittrex make it easier to trade. However, there is a risk involved because they are connected to the Internet.

Should I Invest in Ripple (XRP)?

That’s up to you.

Ripple’s success is ultimately tied to how effective XRP is, how many people use Ripple’s products, and the number of partners on RippleNet (which has been growing steadily over the past year).

Ripple seems to be doing pretty well on those fronts. However, it’s important to note the sheer supply of XRP on the market (a total supply of 100 billion). And as if that wasn’t a hard pill to swallow for investors, Ripple also holds around 62 billion Ripple, which means that they can technically inject massive amounts of their XRP into the market to control the price and keep it generally low.

However, beyond the investment metrics, what’s really important to understand is the position Ripple (XRP) is in.

- Do you recognize the opportunity Ripple (XRP) may have in front of them?

- Do you think the people behind Ripple (XRP) can pull it off?

- What are the people behind Ripple (XRP) doing every quarter to meet their goals?

You can also find more insights directly from Brad Garlinghouse, the Founder and CEO of Ripple, in a Quora Sessions. He talks about everything from how Ripple could revolutionize finance to whether you should invest in Ripple.

How Big Is RippleNet?

RippleNet is constantly growing all over the globe and currently there are over 100 customer and 75 commercial deployments. At the moment, you will find digital asset exchanges, banks, payment providers, and more, and all of these entities process and provide liquidity payments via RippleNet, enhancing their cross-border payment services.

The list of entities using RippleNet includes numerous financial institutions, including SBI Remit, UniCredit, Axis Bank, SEB, UBS, Credit Agricole, Westpac, Santander, Standard Chartered, BMO, RBC, and the Bank of Tokyo-Mitsubishi UFJ.

xVia for Sending Payments

xVia is the standard payment interface with a simple API. xVia is what businesses use to plug into the RippleNet and send payments, and with this feature users can seamlessly send payments all over the world in a completely transparent way. xVia allows for tracking as well as delivery confirmation, including in wallets and other nontraditional networks, and users can even attach rich information, such as invoices. xVia frees up the capital just sitting in foreign currency accounts thanks to the real-time, on-demand global payments.

xRapid for Liquidity

Using XRP, xRapid allows payment providers to source their on-demand liquidity, lowering the cost but still allowing emerging markets to take advantage of real-time payments. Since payments in markets that are still emerging typically require local currency accounts that are prefunded, liquidity costs tend to be high.

xCurrent for Payment Processing

xCurrent allows banks to instantly settle payments for their customers across borders, including end-to-end tracking. The banks send messages to each other. They confirm payment details in real-time before starting the transaction, and they also confirm its delivery.

Conclusion

Ripple is one of the very few legitimate viable competitors to the old guard financial system. Ripple and RippleNet can be a very useful tool for banks and other financial institutions, as well as businesses of all types, and could play a major role in how money moves around the planet. Ripple simplifies the payments for corporate entities, banks can use it to get new revenue, while payment providers will benefit from expanding their reach.

Useful Links

It seems to me that the purpose of bitcoin, etherum or litecom was to be stay out of the financial system. That does not mean that Ripple is a bad idea, but it does not seem to be an alternative. As long as bitcoin is small, the banks won’t need ripple, and when bitcoin will be too big, it will be too late for them to go to ripple. But, if people prefer ripple now, we can say good bye to the idea of the bitcoin. Isn’t it that ?