Bitcoin has been touted as many things – a store of value, a means of exchange, and crazy magic computer money. Certain South American nations have considered BTC as legal tender. Online retailers are setting up crypto payment options as the most convenient way to trade internationally. Whatever the use case, payments need to be transferred securely between businesses and their customers.

For private individuals, a simple Bitcoin wallet address is fine. Occasional large transactions on the slow and expensive Bitcoin network are tolerable. However, if your business accepts a high volume of customer payments, you need a mechanism in place to expedite these transactions efficiently. We’ll take a look at some of the options.

What you'll learn 👉

Layer 1 or Layer 2?

Bitcoin is often referred to as digital gold. Gold used to be the store of value that underpinned transactions made with cash. Gold was layer 1 and Cash was layer 2. How is that reflected in the Bitcoin ecosystem? Bitcoin is layer 1, and like gold, is cumbersome and inefficient to pay for goods and services. Layer 2 solutions, like the Lightning Network, have been developed to enable multiple frictionless small payments, just like cash.

On-Chain vs Off-Chain Transactions

Layer 2 solutions process transactions quickly and efficiently without bothering the main Bitcoin blockchain. Groups of smaller transactions can be bundled together and confirmed later on the Blockchain for final settlement. This takes the pressure off the Blockchain main-net and speeds up the transaction process. Everyone’s a winner, right?

Well, there’s a pay-off between security, speed, and cost. The prevailing wisdom tells us we can only choose two of the three options. The best security is slow and expensive, but the fastest cheapest method is not as secure. However, for businesses that accept hundreds of small payments, speed and cost are much more important than security.

If a coffee shop gets stung for a couple of Frapaccino Butterscotch Moca Lattes, it won’t be fatal to the business. However, if an investment bank gets swindled, it could bring down the whole economy.

So Which Method is Right for Me?

This depends on how much you receive, from who, and how often.

Online Retailers

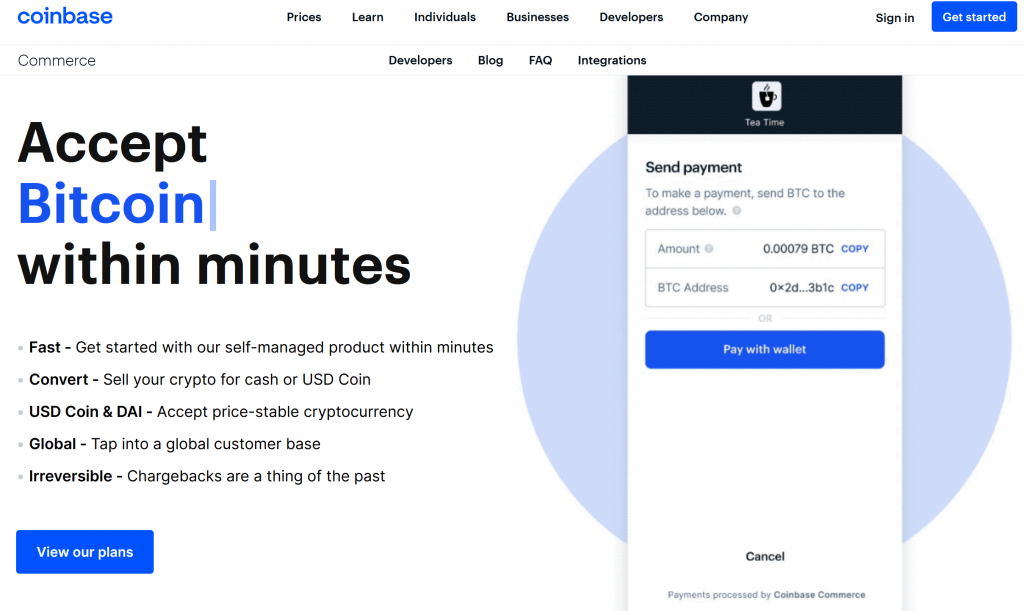

If you have lots of Customers each with a low net spend, then there are multiple platforms that enable crypto payments. The easiest to use is commerce.coinbase.com. Owners of retail stores on the popular Shopify platform can integrate with Coinbase Commerce directly through APIs. There are lots of advantages for the smaller retail traders such as auto-generated tax reports and easy access to your financial information.

The downside to services like Coinbase Commerce is that you don’t control your private keys so you never take possession of your Bitcoin. Remember, “Not your keys? Not your cheese!”

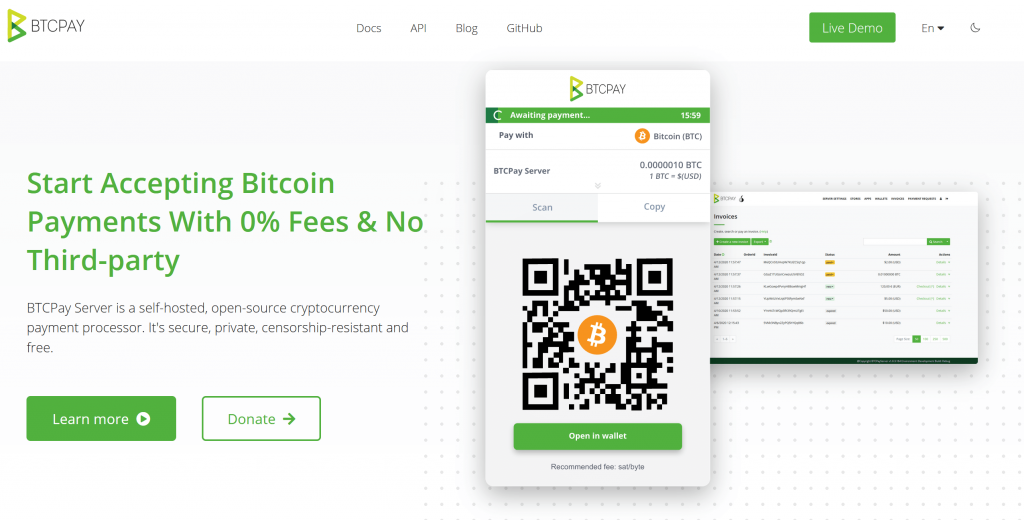

Non-custodial services like BTCPay Server can also be integrated into your website or online store. You retain control of your keys, and therefore your crypto. You are also much less likely to be a victim of a scam or an exchange hack. Further, services like Binance and Coinbase will hand over your account data to the IRS and legal authorities, without a second thought.

If I was using a non-custodial service, I would withdraw my cryptocurrency to my hardware wallet at least once per day, or whenever it grew to more than a few hundred bucks. For successful retailers, that will not be practical.

Consultants, Contractors, and Freelancers

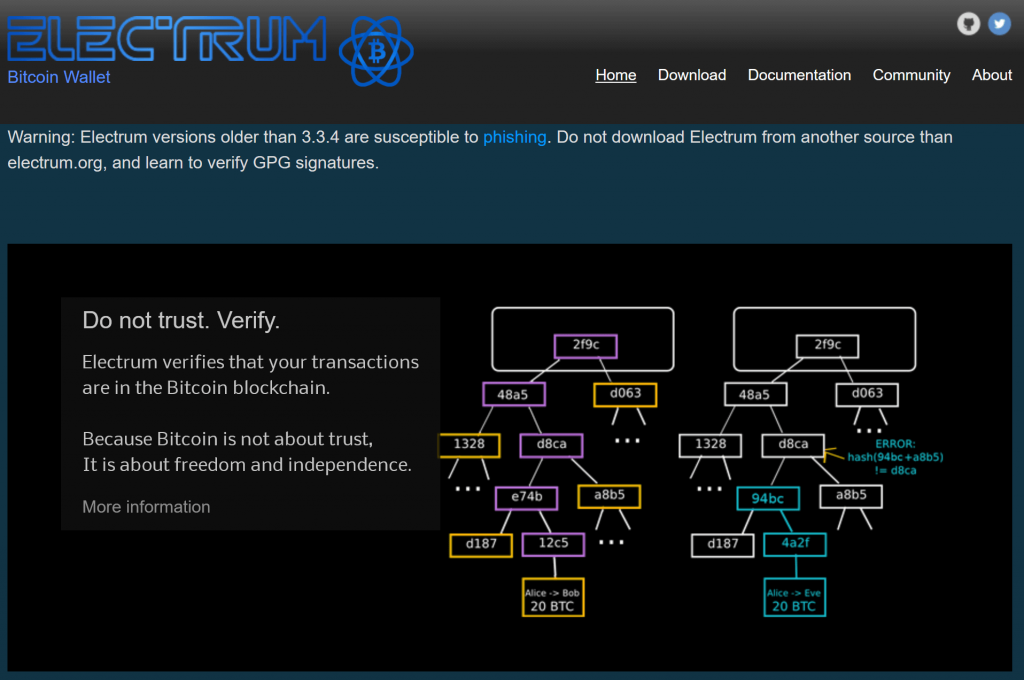

For those invoicing substantial amounts less frequently, there’s no need to automate the receipt of your payments. It’s feasible to use a trusted software wallet such as Electrum. There are a few things to note, however. Good crypto housekeeping says we should generate a new wallet address for each invoice we send. Ideally, each wallet address should be used only once, then discarded.

This helps obfuscate our private financial transactions, but always remember, a competent blockchain sleuth will still be able to see where our money goes if they’re determined enough.

El Salvador and Strike

What about the mass adoption of Bitcoin for payments? An interesting case study of how an entire economy might embrace Bitcoin arose recently. The last day of this year’s Miami Bitcoin Festival of Geekery saw Jack Mallers’ presentation about El Salvador’s adoption of Bitcoin. I recommend watching the video. It’s a refreshing antidote to all the DOGE/MOON nonsense.

Clearly, a $20 fee and a 2-hour wait for confirmation are not going to cut it in any domestic economy. Jack’s solution, based on the lightning network, is Strike. You can make payments to other Strike application users free of charge, and almost instantly. There’s an option to convert part or all of your wages into BTC for this very purpose.

Read also:

- Where To Spend Ethereum – Places That Accept ETH

- How to Earn Bitcoins – 7 Legit Ways to Make Money With Bitcoin

- How to Make Money off Ethereum – Earn Passive Income with ETH

- How To Short Bitcoin? 3 Ways To Do It

It’s a noble endeavor, trying to bank the unbanked, usurp the rapacious remittance businesses, and free entire countries from the tyranny of the US dollar. It sounds like a cool idea, but will it actually work? We shall see, but the early signs are good. If Strike is successful, it could quickly become the go-to global option. It’ll be interesting to see what resistance the legacy financial system can put in their way. Popcorn at the ready!

Other Blockchains are Available

Vitalik Buterin recognized the lack of technical development possibilities for Bitcoin so co-created the Ethereum Network to take up the slack. Without the potential to support enough transactions, Buterin saw that the main Bitcoin blockchain was never designed for retail applications.

His Ethereum network functions as an operating system engineered precisely to support Layer 2 solutions written in their proprietary language, Solidity. Most new crypto services and platforms are built on the Ethereum network and this is where we will likely see most of the innovation in the field of commerce.

There are now lots more blockchains that offer fantastic speed, scalability, and security. Take your pick. I have no clue which will fizzle out like MySpace, and which will explode like Facebook. In the meantime, I hold small interests in several of the most likely looking candidates. Solana, Ethereum, Cardano, and V-CHain are popular hedges against the total dominance of the Bitcoin network.

Privacy and Security

Of course, if you publish a Bitcoin wallet address to accept BTC for payment, there are things to be aware of. Anyone with your public BTC wallet address can use a block-explorer to peer into your wallet. They can see your balance, payments received and sent, to and from where, when, and how much.

Imagine allowing this level of access to your bank account; to every store, gas station, or restaurant, whenever you settle a bill. That would be an outrageous imposition. There are things we can do to rectify this problem. During a recent visit to Panama, I saw Monero (XLM) is popular but has a stigma attached, and major exchanges are being pressured not to list it (or other privacy coins).

There are Bitcoin Mixers and Sharding services that can disguise the link between you and your wallet addresses. Again, these are not perfect protection and some of them are legally questionable. In the end, as long as you’re doing nothing illegal and you control your own private keys, there’s no reason for most people to hide behind these cryptographic confections.

Conclusion

- For small retailers with online shops, I would go with Coinbase Commerce.

- For larger retail enterprises, I would implement BTC Pay Server.

- As a contractor or freelancer, I would use Electrum to handle crypto stored on a hardware wallet (like Nano X).

- If I was a Bond villain, international terrorist, or drug cartel boss, I would use Monero, though the US Dollar remains the currency of choice for most supervillains.