- What’s the Best Place to Buy Bitcoins Online?

Bitcoins are the “hot potatoes” of this decade and it’s the wagon everyone wants go get on. However, there are a lot of basic questions that still remain unanswered. Which are the best places to buy Bitcoins is definitely one of them.

There are a lot of Bitcoin buying/selling/exchange platforms existing on the web. But the problem is that a negligible fraction of them are actually trustworthy. Also, other factors like “fee” ‘security” “anonymity” join in too when you’re looking for the ultimate, best place to buy Bitcoins so even a lower percentile of that fraction is worth buying Bitcoins from.

What you'll learn 👉

How to Instantly Buy Bitcoin Online With a Credit Card?

Depending of your location in the world, there are cheaper options available per country and I want to tell you I look to the safest way to get my Bitcoin, security related, and also with the least Fees possible before we go into buying. Otherwise I would still use the original system in place what the banks use to send money.

Bitcoin has a status of elite underground, based on the anonymity, and the direct delivery. The transaction goes directly from person A to Person B without the need to need of intermediate people, institutions, etc.

You should never use PayPal directly to sell/purchase Bitcoins unless it is a person you know that you can trust. But even then, play safe. I recommend you to always use an intermediate because the risk exists that you will get backcharged, losing your money or your bitcoins.

The easiest and fastest way to purchase bitcoins instantly with a credit card or debit card is via Coinbase . On Cex.io you can acquire $50 or less of bitcoin fast and usually within 10 minutes.

Limits are raised to $200 in four days and $500 in seven days as you prove to be a reliable customer.

Other places where you can buy Bitcoins are:

- ChangeHERO

- Coinbase (Europe, USA & UK)

- Coinmama (worldwide)

- Cexio

However, you should be aware that purchasing bitcoins instantly with a debit or credit card will usually result in higher fees. The reason for that is because there are higher transaction and processing fees and a higher risk of fraud. Read a full guide on how and where to buy bitcoins with credit card.

What are best Coinbase alternatives?

Best Coinbase Alternatives for Buying and Selling Bitcoin

Buying Large Amounts of Bitcoin

I recommend following these simple steps to purchase larger amounts of bitcoins:

- You should find a Bitcoin exchange (Coinbase or Cex.io)

- You should purchase bitcoins by exchanging your local currency, like the Euro or U.S. Dollar, for bitcoin

- You should transfer the bitcoins to your wallet

- And finally, you should get a Bitcoin debit card for easy spending

Learning how to use Bitcoin will require you to get familiar with how things function and it is just like any learning any other technology.

I would like to stress that it is very important that you learn how to transfer bitcoins to a cold storage Bitcoin wallet.

Also, you should know that the Bitcoin price can vary throughout the world. That’s why I highly recommend you to do your research to make sure you are getting a fair deal.

How to Buy Bitcoin

Cex.io, Cryptopay and Coinbase are good places to start when purchasing bitcoins. However, there is no excuse for controlling your own private keys so I highly recommend you do not keep any bitcoins in their service.

I strongly recommend you to compare the exchange rate on your local exchange to a Bitcoin price index once you find a Bitcoin exchange in your country.

There are 4 types of Bitcoin exchange

- CFD (contract for difference) – This method is based on mirroring the movement of an asset. The trader can create profit or losses based on the position he takes on the real asset, however the trader doesn’t own the asset. This is an easy way to trade bitcoin without any fees and allows to leverage the position of the trader.

- Broker – A platform that allows to buy/sell bitcon from the broker for a commission or a fee.

- Trading platform – A platform allows traders manage market positions, buy or sell assets to other traders on the platform.

- OTC (Over the counter) – A peer-to-peer platform that allows to buy/sell bitcoin from an individual. Unlike a Trading platform that allows every trader to be exposed to the trades of other traders, OTC may not be that transparent.

What Makes a Bitcoin Exchange Best?

It’s only logical for me to explain what exactly makes one exchange better than the other before I can ask you to comprehend the best place to purchase Bitcoins.

Just because an exchange is offering no-signup required kind of features, or low buying fee doesn’t mean that it’ll necessarily be the best.

I wouldn’t directly point out which platform is the “best” because I’m not the most knowledgeable person on the planet on Bitcoins. They all have their own pros and cons.

Instead, I’ll walk you through what you should be looking for when you’re trying to land on the best place to purchase Bitcoins. After that you can compare all the available platforms based on your personal preferences.

When finding the best bitcoin exchange for trading bitcoins a number of factors must be considered. They will vary person-to-person depending on the factors below.

Fee

The first factor I personally consider before reaching a final verdict about any Bitcoin exchange is the fee it charges for the transactions because each Bitcoin exchange charges different fees for its services.

Most Bitcoin brokers sell bitcoins directly to buyers. They charge a flat rate of 1% per transaction, while exchanges with orderbooks are geared towards high volume trading, and often have fees of 0.25-0.50% per trade.

Also, it’s not advisable to keep Bitcoins permanently on any exchange for long so I also consider the fee I’ll have to pay in order to transfer the bits to my own personal wallet.

I highly recommend you to compare what’s the global price-index for Bitcoins. You can do it easily by simply Goggling “1BTC=$” (Or your currency!) and then compare what price the platform you’re on is offering. There’s considerable price difference between most of them so it’s best to compare 5+ platforms before zeroing in on any single one of them.

Once you find the lowest-priced platform you should wait because your hunt isn’t over yet. As I said, just the “price” isn’t what makes any platform the best place to purchase Bitcoins. That’s why we’ll dig in to the other aspects.

Exchange Rate

I highly recommend you to check how close is the exchange rate to the global average price found on an index. It is easier to get the best Bitcoin exchange rate if you compare a local Bitcoin exchange’s prices to a Bitcoin price index.

Payment Method

What mode of payment the platforms support is one of the primary factors when it comes to purchasing Bitcoins online. Different payment methods also incur varying fees so you’ll need to find a Bitcoin exchange that accepts your preferred payment method. Do they allow purchasing Bitcoins with Debit Card / Credit Card or/and purchasing Bitcoins with PayPal?

This also affects the fee structure. That’s why there might occur a fee difference based on which payment method you’re going with. Generally PayPal is the cheapest. Credit cards have a slightly higher fee and they are often charged a fee of 3-10%. The same goes for cash transactions. On the other hand most deposits with bank transfers are free.

Amount

Each Bitcoin exchange has different buying limits. This often varies depending on level of identity verification and if it’s not adequate and doesn’t suit your buying packets, it’s no use to you.

At Coinbase, for example, regular users may only buy up to $1,000 worth of bitcoins per day and fully verified users can purchase up to $50,000 per day. It is important to note that most exchanges offer a FAQ page online. The different levels of verification are explained there.

Speed

Buying bitcoins fast can be challenging, particularly when you want to buy them in larger amounts. When trying to choose the best place to purchase Bitcoins you should also consider how long it takes for the Bitcoins to arrive in your exchange wallet.

The speed might be influenced by your country, mode of payment and certain other factors. That’s why you should make sure to dig deep enough and get a clear picture of exactly how long the coins would take before arriving in your wallet.

Regulatory Compliance

In order to prevent money –laundering and fraud transactions most Bitcoin exchanges require some kind of verification these days. Local currency, like the U.S. dollar or Euro, must be exchanged for Bitcoins in order to purchase Bitcoins. In this process trust users must trust the Bitcoin exchange to secure money and not run away with funds and I highly recommend using a regulated Bitcoin exchange.

Most exchanges offer information about their regulatory compliance on their websites (for example Cex.io too requires identity verification via a national Identity card. It might also require a picture of the credit/debit card which you use for your transactions.)

If an exchange doesn’t offer information about who’s behind the site or information about regulation, I would recommend finding a different exchange.

Privacy

Bitcoins have the ability to be “anonymous” and this is the primary reason why Bitcoins are on the edge of overtaking traditional currency so I do not need to re-elaborate how important role “privacy” plays during Bitcoin transactions.

Exchanges that accept credit cards or bank transfers are required by law to collect information about users’ identities and you can check what kind of data or verification your Bitcoin buying platforms requires off you.

Some platforms simply require a real-life photo of yours while most require some kind of identity verification. The most private way to purchase bitcoins is purchasing them by cash, it be through a P2P exchange like LocalBitcoins or at a Bitcoin ATM.

Getting a Bitcoin Wallet

History is filled with Bitcoin exchanges running away with users’ funds and that’s why I would strongly recommend moving your bitcoins off the exchange once you purchase and store your coins in a wallet you own.

There are different types of Bitcoin wallets. Each of them is offering unique features and benefits and the wallet that’s right for you will depend on your specific needs and on how you intend to use Bitcoin.

Wallets like the Ledger Nano and TREZOR make it easy to protect bitcoins and that’s why they are great for secure storage. Also, for those with greater technical knowledge Paper wallets are another good option.

I would recommend hot wallets if you’ll be making Bitcoin transactions frequently. They work across many devices so they are a better option.

Best Cryptocurrency Exchanges To Buy and Sell Bitcoin and Altcoins

An ability to freely and quickly exchange currencies is one of the most important signs of a healthy, functional economy. Ease of access to various types of currency, near-instant transfer of value and low transaction fees are a must for any experienced currency trader out there. These rules of course apply to the releatively new market of cryptocurrency trading.

As of January 2018, the total number of available cryptocurrencies out there was 1384. This number grows almost by the day and with it grows the importance of having quality cryptocurrency exchange mechanisms. Internet cryptocurrency exchanges, while often differing in their key features, offer exactly these. They are important tools which you can use to either purchase cryptocurrency for fiat currency or to engage in crypto-for-crypto trading with other traers. Even though there are plenty of features and options that every exchange offers, you should focus on the following before deciding where you will take your crypto-trading business to:

- Reputation – The best way to find out if an exchange is trustworthy or not is to search through reviews from individual users and well-known websites. Also consider the fact that sometimes reviewers can be paid by a website (which is a crime if not disclosed) so you can go and ask any questions you might have on public forums like BitcoinTalk or Reddit. Keep in mind that there can be paid reviewers on these websites as well so try to get information from as many sources as you can.

- Payment Methods – What payment methods are available on the exchange? Credit & debit cards, wire transfer, PayPal are just some of the most common ones you should see on a legitimate exchange. If an exchange has limited payment options then it might not be an ideal place for you to trade on. Remember that purchasing cryptocurrencies with a credit card comes with a certain amount of risk. Most exchanges nowadays require identity verification and offer a premium price as there is a higher risk of fraud as well as higher transaction and processing fees that come with credit card based crypto purchases. Purchasing cryptocurrency via wire transfer can take significantly longer, from a couple of hours to a few days, as it takes time for banks to process and transfer money from your account to the seller.

- Fees – Most exchanges offer fee-related information on their websites. Before joining and engaging in trading make sure you understand deposit, transaction and withdrawal fees. Fees can differ substantially depending on the exchange you use and the people you are trading with.

- Exchange Rates – Different exchanges often times offer different exchange rates. It’s not uncommon for rates to fluctuate up to 10% and even higher in some instances. You will be surprised how much you can save if you shop around.

- Verification Requirements – The vast majority of Bitcoin exchanges, both in the US and the UK, require from each customer that wishes to make deposits & withdrawals to verify their accounts with some sort of ID verification. Some exchanges will allow you to engage in anonymous trading. Although verification, which can take up to a few days, might seem like a pain, it protects the exchange and yourself against all kinds of scams and money laundering.

- Geographical Restrictions – Most exchanges don’t offer full world coverage just yet. At the same time, some specific functions offered by exchanges are only accessible to customers from certain countries. Make sure the exchange you want to trade on allows full access to all platform tools and functions to people who live in the country you plan on doing your trading from.

This article will focus on explaining, in-depth, the pros and the cons of the most popular exchanges out there. Hopefully this list will help you, a crypto-trader in making, decide which safest crypto exchange can help you the most in your future crypto endeavors.

PrimeXBT

PrimeXBT stands as a beacon in the cryptocurrency trading world, offering a blend of versatility and efficiency. It’s not just a cryptocurrency exchange; it’s a comprehensive trading platform that caters to a wide array of financial interests. Beyond the expected array of cryptocurrencies, PrimeXBT extends its reach into forex, commodities, and indices, providing traders with a broad spectrum of trading opportunities. This multi-asset approach allows traders to diversify their portfolios without the need to juggle multiple accounts across various platforms, streamlining their trading experience and potentially maximizing their investment strategies.

Innovative Trading Features

At the heart of PrimeXBT’s appeal is its suite of innovative trading features, designed to empower traders at every level of experience. The platform’s up to 200x leverage on crypto futures is a game-changer, offering traders the opportunity to amplify their trading positions significantly. Additionally, PrimeXBT’s copy-trading service democratizes trading strategies, enabling less experienced traders to mirror the moves of seasoned veterans. This feature not only helps novice traders navigate the complexities of the market but also allows them to learn and grow their trading skills in real-time.

Uncompromising Security

Security is paramount in the digital trading space, and PrimeXBT understands this better than most. The platform employs state-of-the-art security measures to ensure the utmost safety of its users’ funds and personal information. From employing cold storage for the majority of digital assets to implementing two-factor authentication and robust encryption protocols, PrimeXBT goes above and beyond to create a secure trading environment. These rigorous security measures provide traders with peace of mind, knowing their investments are well-protected against potential threats.

User-Friendly Experience

PrimeXBT distinguishes itself with a user-friendly experience that caters to both novice and experienced traders. The platform’s sleek, intuitive interface ensures that users can easily navigate through various trading tools and features, making trading accessible to all. Whether it’s executing trades, analyzing market trends, or managing portfolios, users can do it all with ease and precision. Moreover, PrimeXBT’s educational resources and responsive customer support further enhance the trading experience, offering guidance and assistance whenever needed.

With a flat trading fee of 0.05% for all trades, PrimeXBT positions itself as an attractive option for traders looking for transparency and affordability in their trading costs. In terms of cryptocurrency offerings, PrimeXBT stands out with its robust selection of supported coins, catering to the diverse preferences of the crypto community. While the platform shines with its ability to offer trading in major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), it doesn’t stop there. PrimeXBT continuously expands its portfolio to include a variety of altcoins, providing traders with the flexibility to diversify their trading strategies and explore new market opportunities.

Binance

Binance is a founded Chinese based company, created by professionals with plethora of experience in the cryptocurrency space. The most recognizable name behind this project is that of Changpeng Zhao, former CTO at OKCoin.

Binance attracted its initial funding via an ICO (Initial Coin Offering) during which they launched their own cryptocurrency called BNB tokens. The BNB tokens can be traded on the exchange, or used as a method of paying your trading fees, which reduces said fees by 50% (If you have 0 BNB balance, a 0.10% trading fee is subtracted from whatever coin you’re trading.

If you buy BNB before you start trading, a discounted 0.05% trading fee is automatically subtracted from your BNB balance). Additionally a small portion of the coin can be paid to get the ‘privilege’ to cast your vote in a community poll which determines which altcoin will be added to the exchange next.

This preferential treatment has led to some intense backlash from the community, as some are accusing Binance of trying to use all these discounts to artificially increase the need for/the value of the BNB token. Still, purchasing the Binance coin might be a good investment for the future as the exchange plans to use their profits to quarterly buy back a portion of the coins from the market and destroy them.

This would result in decreased supply of the BNB tokens, making them more valuable for the remaining holders.

One of their most lauded features is their willingness to host ICO’s of up-and-coming altcoins. Binance offers a substantial number of coins, which are traded mostly against Bitcoin and Ethereum. Every time a new altcoin is launched Binance will reward the most diligent traders of said coin (usually by giving them extra of that same coin). Currently they support trading with over 200 different cryptocurrencies and are working daily on adding new ones.

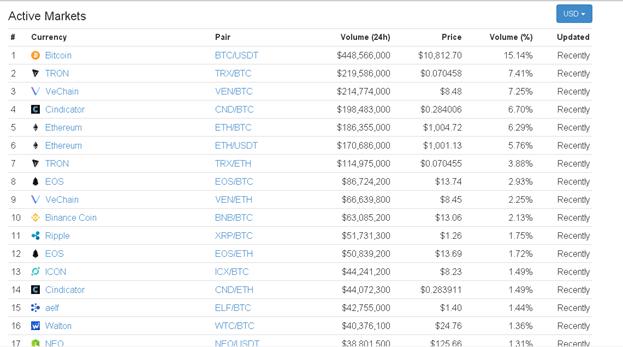

A list of active markets on Binance

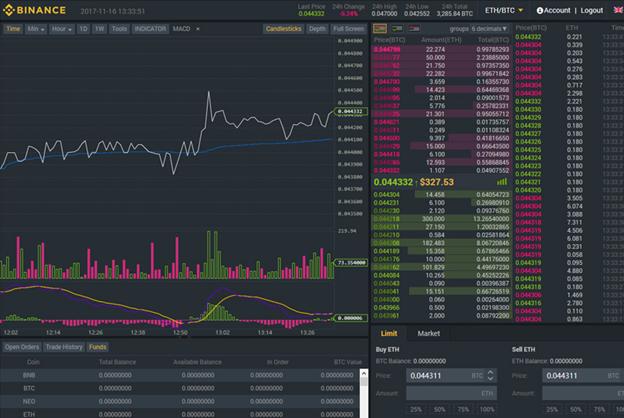

Binance offers its users two types of user interface, Basic and Advanced. You can toggle between these by clicking the Exchange button on the Binance home page. Both of those will be a bit daunting for a first time trader but if you are a crypto veteran you will not have any problems with navigating either. The main difference between these two interfaces is that the Advanced view, while being somewhat less pleasing to the casual eye, offers deeper insight into the value and the trade history of the presented coins.

‘Pro’ view

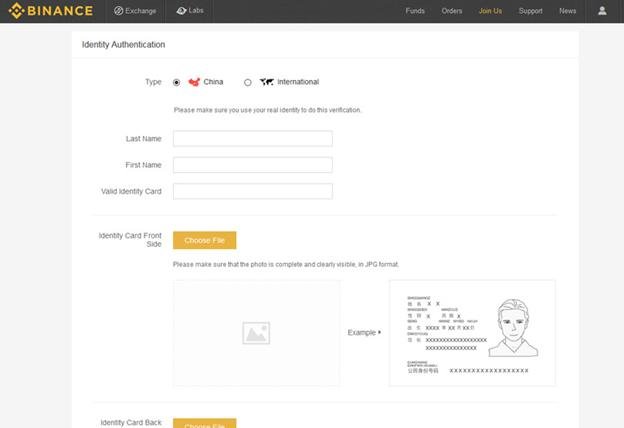

For you to be able to use Binance, you will first need to create an account on their website. The process is pretty straightforward and once you complete it, you will become a Level 1 user which will be able to withdraw up to two BTC per day. You can also submit your ID for verification and, once (and if) the verification passes, you will be given Level 2 privileges which allow trading levels of up to 100 BTC per day.

Level 2 verification screen

Now that you are officially a Binance user, you will need funds which you’ll use to conduct your trades. Binance is a crypto-only exchange so you cannot deposit fiat funds directly to your Binance wallet. What you can do is transfer cryptocurrency from your Coinbase/Bitfinex/Localbitcoins wallet/an offline wallet into your Binance wallet and get the required funds that way. You can deposit basically any cryptocurrency which is traded on the exchange. It is recommended that you use either Bitcoin or Ethereum, as these are the two coins with the most trading pairings on the exchange. This link will give you exact instructions on how to fund your wallet and after that you are free to start trading.

On Binance, you’re only able to make limit and market orders, even though its complex interface might suggest otherwise should be possible. One would presume that this lack of more advanced trading options is related to the company’s infancy so it is expected that said options will be added in the near future.

Binance pros:

- Ability to withdraw up to 2 BTC per day/100BC per day (for verified users)

- A wide and ever-growing variety of available coins for trading, including BTC, ETH, LTC, BCC, OMG, IOTA, ICN, MCO, SALT, KNC, IOTA etc.

- Low transaction fees

- Fast deposit/withdrawal times

- Two-factor account authentication

- Founded and run by knowledgeable industry people

- Exchange owned altcoin which can be used for on-site payments

- Promotional offers and discounts for traders

- Multi-language support

- Never hacked (so far)

Binance cons:

- Young company

- Based in China which recently started clamping down on cryptocurrencies

- Beginner unfriendly GUI

- Does not accept fiat deposits

- Sometimes slow ID verification process

- No live chat, badly translated sections of the website and in general bad customer support

- Lack of information on how (and if) the user deposits are secured

What Binance lacks in user-friendliness or ability to transfer fiat into crypto, it makes up with great fees and an unmatched digital currency support. As it keeps on overcoming its growing pains, chances are that Binance will continue to become better and better at offering good digital currency exchange services to its clients.

ChangeHERO

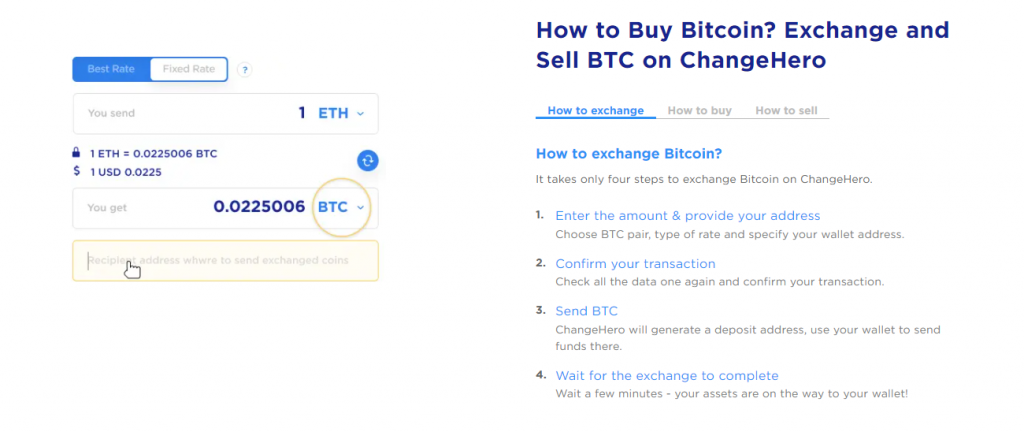

ChangeHERO is a platform for instant swaps of 80+ different crypto coins. The best part of their offer is the fact you don’t need to register on their site to use the exchange. They work as an aggregator that quickly queries multiple exchanges to find the best swap rate before doing the actual coin exchange.

You simply need choose the cryptocurrencies you want to exchange, select the type of rate and provide your recipient address. ChangeHERO will give you an estimate in a fraction of a second which you can then confirm. Once confirmed, you will get a deposit address where to send your coins for the swap.

In a few minutes, you will get your coins to the address you entered.

You can also buy crypto from them via credit or debit cards. In order to buy crypto for fiat, you will need to register and do a KYC verification as that is mandatory for anyone dealing with fiat currencies. Same goes for selling crypto via ChangeHERO.

Supported coins include:

- Bitcoin BTC

- Litecoin LTC

- Ethereum ETH

- Monero XMR

- Ripple XRP

- Tezos XTZ

- Bitcoin Cash BCH

- Tron TRX

- Bitcoin SV BSV

- Zcash ZEC

- Stellar Lumens XLM

- Tron TRX

- Algorand ALGO

- OKB + 20 others

Bittrex

Bittrex is a US based cryptocurrency exchange that has launched its initial operations in December 2014. Since then, it has steadily grown into one of the most preferred altcoin exchanges on the market. Bittrex was founded by Bill Shihara (cofounder and CEO), Richie Lei, Rami Kawach, and Ryan Hentz, a team of consisted mostly of experienced security professionals and former employees of such companies like Microsoft, Amazon and BlackBerry. With traders regularly hearing news of exchanges collapsing and getting hacked, Bittrex’ founding team and their business practices exude a rarely matched sense of security.

Bittrex operates out of Las Vegas, Nevada and it makes a point to comply with US laws (especially Anti-Money Laundering (AML) and Know Your Customer (KYC) programs). Bittrex was one of the first applicants for the famously hard-to-acquire New York Bitlicense. The exchange allows trading from almost all of the 180+ countries supported by the online payment and identity verification company, Jumio. Unfortunately Bittrex does not offer a in-house built mobile app. However, third-party applications like Blockfolio and TradeBit both allow access to Bittrex API and are well-received by users. As with any other exchange you can access all Bittrex services through the browser interface.

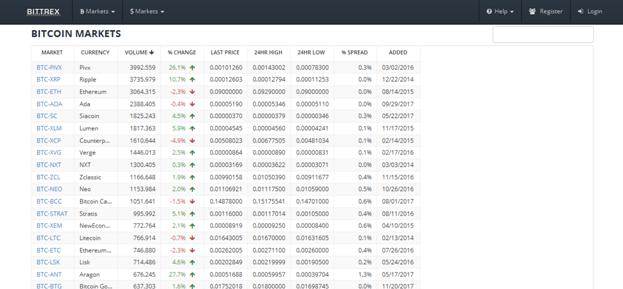

Bittrex interface

Signing up with Bittrex is a pretty straightforward process. All you need is a name, email address, date of birth and phone number verification. Filling out the sign up form and clicking on the confirmation e-mail link will supply you with a basic verified account which you can use to start crypto-for-crypto trading.

Obtaining an enhanced account (requires your ID and a selfie with said ID) will enable you to purchase (via wire transfer) crypto (BTC or ETH) for fiat, if the trade is worth more than $10,000. For most small traders this means that they cannot deposit funds directly from their banks or via credit/debit cards. The company is working on adding this functionality as well.

Bittrex’s biggest strength is that it supports trading of more than 250 cryptocurrency assets.

The site has one of the largest ranges of supported assets, dwarfing Coinbase – which supports only Bitcoin, Ethereum and Litecoin – and even Poloniex, which supports around 100 coins.

Just some of the markets available on Bittrex

Even with such a high number of coins available Bittrex offers no margin trading or lending, unlike other major exchanges. While Poloniex offers margin trading and lending to verified users, Kraken provides margin trading without lending, and Coinbase offers leveraged margin trading on Bitcoin, Ethereum, and Litecoin, Bittrex focuses solely on crypto pair trading.

Bittrex has implemented a number of competitive features and practices which launched into the top of the crypto exchange market. They use an elastic multi-stage wallet strategy which ensures that almost 100% of funds are stored safely, offline, in so called cold wallets. As any serious exchange out there, they require two-factor authentication for all withdrawals and API usage. They also offer a trading engine unmatched in speed which ensures for fast withdrawals and deposits of currency.

In the past, they have faced server and customer support issues related to rapid growth. However, Bittrex generally handles these issues better than most (which doesn’t say much).

Even though they faced complaints for slow responses to support tickets, accounts being disabled, verification issues and poor treatment of non-US members, they implemented a plethora of measures designed to increase customer experience. These measures include running a dedicated support page in addition to being active and responsive on social media. Among their stand out features are their fixed, transparent fees which stand at 0.25% for every transaction.

Bittrex pros:

- Unmatched security

- Almost global coverage

- Simple account verification requirements

- 250+ coins and 450 Bitcoin trading pairings available

- Fast withdrawal and order execution times

- Fixed, relatively low fee of 0,25%

- Secured deposits stored almost entirely on cold wallets

- Two factor authentication

- Ability to withdraw up to the equivalent of 3 BTC per day for Basic users/ up to 100 BTC per day for Enhanced (verified) users

Bittrex cons:

- Heavily regulated

- Sometimes invasive verification methods

- Doesn’t support advanced types of trading, like leverage or margin

- Some criticism of customer support and accountability issues

- Lack of fiat trading and payment options for small traders

- Lack of own mobile application/cold wallet

Bittrex is one of the largest cryptocurrency exchanges out there. Its security, sometimes top 3 trade volume and a massive list of alternative coins available are contrasted with a basic trade engine as well as a refusal to accept fiat money deposits (caused by their desire to stay compliant with US law). This focus on cryptoverse can be a limitation for inexperienced people, but overall Bittrex it is a very good trading platform for people with more experience (especially if they are US-based).

Bitstamp

Bitstamp is one of the most popular fiat to Bitcoin exchanges which has been providing their customers with an easy to use, secure and reliable service since 2011. It was founded by a software developer and part-time bitcoin miner Damijan Merlak and computer salesman Nejc Kodrič. Back in 2011, they decided that they want to get in on the Bitcoin train but realized that for doing so, they would need to sent their funds to a Japan-based exchange called Mt. Gox. This was a lengthy process which, thanks to Bitcoins volatility, usually resulted in losses. Therefore these two Slovenians decided to set up Bitstamp, whose aim was to offer a fast, reliable Bitcoin purchase service to people from Europe. Their first major explosion in popularity, as with many other exchanges, came after the collapse of Mt. Gox.

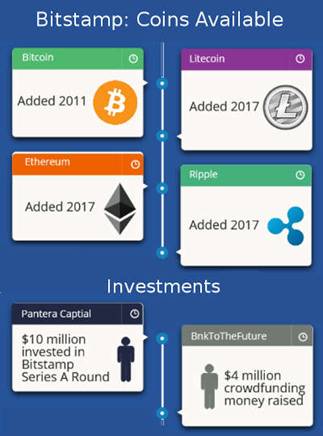

Bitstamp, based in London/Slovenia/Luxembourg, allows its users to use USD and EUR to purchase a variety of cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Ripple.

This European-based exchange is very popular among many European cryptocurrency traders as it allows them to deposit funds via SEPA transfers for free. Bitstamp also offers its API to allow users to create custom software to access and use their accounts. Talking about Bitstamps location can be a bit confusing, as they moved their headquarters a few times in the past. Their initial move from Slovenia to London in April 2013 was made in search of better financial and legal conditions for their business. At that time, even though UK was yet to regulate the cryptocurrency-related businesses, it was still a more fertile ground for growing such a business than Slovenia. Bitstamp took the regulation matters into their own hands and self-regulated their activities on a very high level by complying to the industry-standard Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. As UK lawmakers were still unable to follow the rapid growth of the crypto markets, Bitstamp decided to move again, This time they set their HQ up in Luxembourg, where the government granted them a license to operate as a payment institution.

This license meant that Bitstamp became the first EU licensed exchange which gave it the legal ability to conduct its business in all 28 EU member states. Nowadays Bitstamp has expanded the list of countries it supports to 50, including the US, China, South Korea, South Africa, Brazil and Australia.

Account creation process is similar to that of other industry caveats. After you fill out the registration form, an email will be sent to the address you provided containing your unique customer ID and a password. You will use said ID/password combo for your initial login. Before your account is given the ability to trade on the platform, you will need to verify the account by providing your full name, postal address and date of birth. This will be done by you uploading a government-issued ID and a no more than three-months-old utility bill to prove place of residence. After you submit the requested images, it will take three days for Bitstamp support to verify your account. Bitstamp allows users to access their website via either regular browsers or mobile applications. Most user reviews of Bitstamp website give it a very good score. The praise is usually directed at the simplicity of the user interface which allows for easy buy/sell/deposit/withdraw actions.

The exchange does offer its own mobile app for both Android and Apple. However these mobile applications have received more negative feedback than positive. Users also have the option to develop their own software to access and manage their accounts as Bitstamp has decided to make their API publicly available.

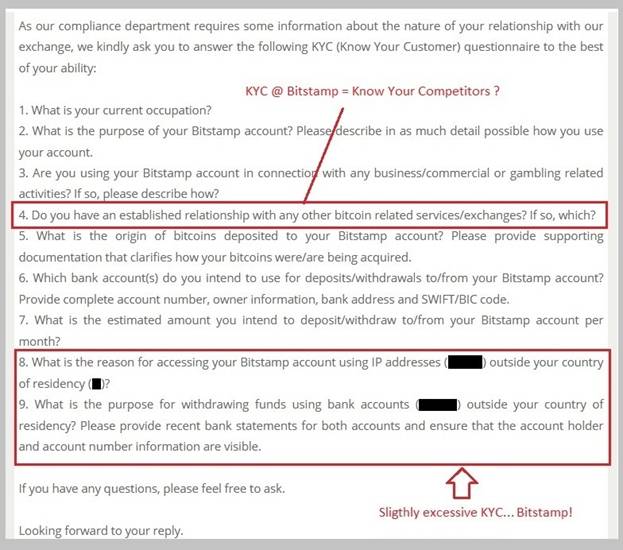

Major issues raised by users-reviews include slow customer support, difficulty in executing orders —especially those involving Ripple —and poor trading charts. People also claim that Bitstamp can be very invasive when asking for personal information used to verify accounts. Besides the usual exchange practices where they ask for a passport & utility bills to verify real names and locations, Bitstamp goes further by requesting information on competitor usage.

Also, at times requests are made that could endanger customers’ banking security & privacy. These requests don’t happen too often though and are only aimed at users who wish to trade over 10 thousand dollars worth of value per day.

Like most first-generation centralized exchanges, Bitstamp holds user’s private keys on its platform. Bitstamp decided to secure its business with some of the best security practices available in the industry. MultiSig technology for its hot-wallet and an insured cold-storage (where over 98% of their customer BTC are kept) are two of their most noted site-related security measures. Thes also allow the usual customer-related measures like the two-factor authentication and confirmation emails. The exchange accepts debit and credit card fiat (EUR or USD) deposits. You can also deposit fiat through Single Euro Payments Area (SEPA) bank transfer. As for the cryptos supported, until January 2017, Bitstamp was exclusively a Bitcoin exchange. It has since added three new cryptocurrencies, namely Ripple, Litecoin and Etherum. This limited selection of cryptos can be seen as a detriment by some users.

Bitstamp charges three types of fees—on deposits and withdrawals, for trading, and for various services. Depositing and withdrawing is free for all cryptocurrencies. However, withdrawing using BitGo Instant will cost you 0.1%. Also transferring Ripple IOUs between accounts costs 0.20% of the value involved. SEPA deposits are free, but withdrawals are charged 0.90 EUR. International wire transfers cost 0.05% to deposit, with the minimum fee of $7.5. Withdrawals cost 0.09%, with the minimum fee of $15. Charges for credit card purchases vary depending on the amount involved. It costs 8% for amounts less than $500, 7% for amounts between $500 and $1,000, and 6% for purchases above $1,000 but less than $5,000. It costs 5% for purchases above $5,000. Withdrawing funds from your Bitstamp account using a credit card costs a flat fee of $10 for amounts not exceeding $1,000. For transfers exceeding $1,000, you are charged a fee of 2%. Fees for trading various available crypto pairings vary from 0.10% to 0.25%, depending on the volumes involved. The higher the amount traded, the lower the percentage cost you incur. Bitstamp also charges a long list of service and operational fees, which include declined cash withdrawals ($0.55), a monthly account fee ($1.95) and a dormancy fee ($5). All in all the complete list of fees is impressive and a bit daunting, but if you take a look at the industry average fees Bitstamp is on the cheap end of total fee expenditure.

Bitstamp had a fair share of controversies happening to it in the past. On February 2014, Bitstamp suspended its withdrawals for a few days due to threats of a DDOS attack. The people responsible supposedly sent CEO Nejc Kodrič a ransom request demanding 75 bitcoins which Kodrič refused to fulfill, claiming that his company will not negotiate with terrorists. After a few days of suspended withdrawals, full Bitstamp service was restored. On January 2015, Bitstamp chose to suspend its service for about a week after it was hacked for 19,000 bitcoins. Said hack reportedly happened by malicious people sending malware to Bitstamp employees via Skype/e-mail communications. All these events are part and parcel of a new crypto exchange learning how to conduct its activities. In reaction to them, Bitstamp implemented security precautions to ensure that something similar wont happen in the future. It seems that said precautions have had the desired effect and since the hack in 2015, things have been relatively smooth for Bitstamp.

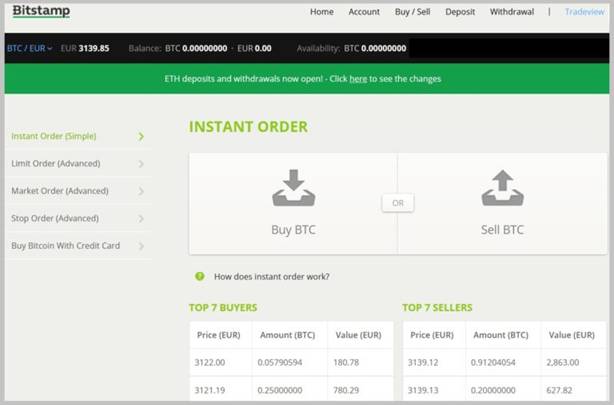

The Bitstamp Exchange allows you to execute instant orders at the best bid or ask price as well as place limit orders, stop loss, and trailing stop orders. Business and individuals from all over the world can buy and sell bitcoins 24/7.

Bitstamp pros:

- A simplified user interface for relative beginners as well as a more advanced one for experienced traders containing detailed graphs and trading parameters

- Supports using debit and credit cards to purchase crypto (support recently extended to multiple countries)

- High trading volumes suitable for traders who want to make large purchases or sales

- Regulated by the CSSF (Commission de Surveillance du Secteur Financier) giving it a stellar security record and backing

- Lower fees and faster transactions than the industry average

- A controversy regarding some user funds being stolen (similar to what happened with Bitfinex) was successfully handled and didn’t affect their reputation much

Bitstamp cons:

- As with all centralized exchanges, private keys controlled by the exchange operators and susceptible to exposure if the exchange is hacked

- No affiliate program to encourage people to try and recruit new users

- Long account verification times

- So far its services are not available worldwide, with coverage being among the lowest in the industry

- Support for only 4 cryptocurrencies and is (very slowly) adding major altcoins such as Bitcoin Cash & Ethereum

- A large amount of personal information is required to verify users who wish to make transactions larger than 10 thousand US dollars

- A lot of unusual fees (which, when summed up, are still better than the industry average)

Bitstamp has been around for a while now and has went through a lot. Most of the challenges it faced it handled admirably so if you are looking for a secure and reliable exchange with good liquidity, high trade volume and a robust infrastructure, then Bitstamp is a good choice.

Bitfinex

Bitfinex is one of the world’s largest and most advanced Bitcoin trading platforms. Access to multiple altcoins, deep liquidity and advanced trading features make Bitfinex perfect for serious traders looking to make money from cryptocurrency.

Bitfinex also offers a customizable interface that allows you to personalize your workstation. The platform is fully equipped with ten different order types and margin trading that give their users the opportunity to trade the market without limitation.

The exchange is incorporated in the British Virgin Islands and their executive team is based around the world. They also maintain their offices in London, Taiwan, and Hong Kong.

The exchange was hacked in August 2016, leading to the loss of 120,000 BTC and this is the second largest hack in Bitcoin history (after Mt. Gox). After the hack, Bitfinex moved from a hot wallet to a cold storage system. Bitfinex created BFX tokens after the hack (each token represented $1) and gave them to customers to represent their stolen equity. By April 2017, Bitfinex had bought back all of the BFX tokens from customers, which means that Bitfinex had paid their users back for every dollar stolen during the heist.

Poloniex

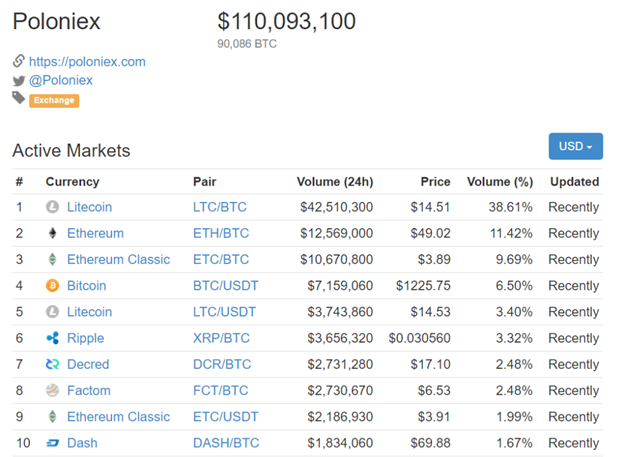

Poloniex is a crypto-for-crypto global exchange which began operating in the US in January 2014. There isn’t much information available online about the ownership of the company, which may worry people who value transparency in that area. All the traces available lead to someone named Tristan D’Agosta whose Linkedn profile claims he is the founder and CEO of Poloniex. The fact that the information on co-founders, top management, and company ownership is so lackluster, as well as the fact that Poloniex has no actual physical offices registered have raised questions about the and legitimacy of their business. There has been plenty of talk online, especially on sites like Bittalk and Reddit, about the safety of user funds on the exchange. Still, Poloniex website gets over 50 million non-unique visitors each month which puts it at the top of the world in that area. While they can thank mostliy their world-wide coverage for this success, some of it is related to Poloniex’ biggest rival, Cryptsy, folding in 2016 and allowing ‘Polo’ (as some like to call it) to take over the remaining market share almost entirely. Its nearest competitor in terms of visitors is Coinbase which clocks about 45 million monthly visits.

Poloniex’s largest sources of traffic are the United States (24.84%) and Russia (6.06%). Other top sources include the United Kingdom (4.65%), Brazil (3.14%) and Vietnam (3.67%).

Poloniex is one of rare exchanges which lacks any support for fiat currency. You can neither deposit fiat here via wire transfer/credit card nor can you transfer it from a different wallet and use it to trade for crypto. This exchange is crypto-only. While this does allow for it to be free from heavy government regulations it does limit the liquidity of assets which are tradable on it. That being said, Poloniex supports a large number of crypto assets, with the number of listed coins standing at over 100.

Poloniex doesn’t offer an official mobile application, but the exchange has made its engine code available which allows third-party developers to design tools for data analysis and account management. Alternatively it has a very serviceable browser interface. Poloniex has a smooth user interface which will suit any experienced as well as most new traders alike.

The interface redesigning in 2015 was met with plenty of praise from the community

What positive points it gains for its interface it loses (with some people) for its server related issues. One of the most common complaints is that it takes a long time for deposits to be shown in the user account, if they ever show up at all. Furthermore some users accuse the exchange’s customer support of being poor and slow to respond, with tickets sometimes taking months to resolve.

Signing up for an account on Poloniex is among the easiest on the market, mostly due to its crypto-only orientation. Once your signup is complete (this takes less than five minutes) you are ready to deposit and start trading. Each account offers exchange (an ability to exchange one crypto for another), margin trading (an ability to leverage your cryptos and earn gains from price changes)and lending (risk averse option which allows you to put up your cryptocurrencies for others to borrow and trade with, for a guaranteed interest) services. You automatically have access to all three services when you sign up for an account on Poloniex.

Poloniex also offers three levels of account verification. You get to the first level of verification by providing an email address, your name and country of residence. The level one verification allows you to withdraw/deposit up to $2,000 worth of cryptos. You can exchange, trade and lend with this level of verification. You can apply for level 2 verification if you want to increase your daily limits. You do this by providing a physical address, postal address, phone number, date of birth and passport ID. Upon the confirmation of your credentials your daily limit for deposits and withdrawal grows to $25,000 worth of cryptos.

To reach level 3 account, which allows for withdrawals/deposits of over 25 thousand dollars worth of crypto, you will need to speak directly to Poloniex support. All in all, the limits set on deposit/withdrawal on Poloniex are relatively higher than those on exchanges like Coinbase, Kraken and Bitstamp.

The fact that they only accept crypto deposits and withdrawals allows Poloniex to be one of the cheapest exchanges to use. No extra regulatory requirements, no KYC vetting and no bank transfer fees makes the entire process of crypto trading much more wallet-friendly. Both the person putting up an offer to buy or sell (the maker) and the person picking and accepting an offer (the taker) pay transaction fees. The maker will usually pay fewer and lower fees than the taker. Maker fees range from 0% to 0.15%, while those for the taker range between 0.05% and 0.25%. In both cases, the higher the amount involved in a trade, the lower the fees they pay are. At the same time every lending offer includes its own lending fees which are set by those putting the funds up for borrowing. As per standard market competitiveness rules, the lower the fee that the lender charges, the more likely that a trader will pick up their offer. Average loan offer fees on the platform charge at least 0.2%, of which Poloniex takes 15%.

Being a centralized exchange, Poloniex controls all private keys to their users cryptocurrency wallets. This results in a high custodial risk where a hack to the centralized network could endanger a lot of deposits. As a counter-measure, most of the user funds are stored in cold wallets. In 2014, Poloniex suffered a minor security breach where 12% of all customer bitcoin deposits were stolen. In a relatively successful attempt to gain back its user base trust, Poloniex promised that users damaged by this theft will be fully reimbursed. The exchange carried through said promise several months later. Let this be a lesson to any user of a centralized exchange to keep only the assets you wish to trade on the exchange wallet while storing the rest on a private one.

Poloniex pros:

- Excellent place for crypto traders who profit by seeking new & trendy coins for speculation

- World-wide coverage

- Over 70 largest crypto currencies available for trading

- Largest Ethereum trade volume in the world

- Low crypto deposit and withdrawal fees compared to the industry average

- Lax government regulation

- Fast account creation

- User friendly

- Two factor authentication as well as browser verification options

- Detailed data charts as well as efficient data-analysis tools

- Trading interface code is open source and available for coding enthusiasts to examine and possibly improve

- Good option for users who seek margin trading and lending possibilities

- History of accountability and being user friendly as it refunded affected users after a minor security breach

- Active social media presence which tries hard to answer any customer support related question it gets

Poloniex cons

- Inability to deposit fiat funds

- History of users reporting inability to to withdraw funds from Poloniex

- Private key management is centralized, exposing funds to custodial risks

- Slow customer support ticketing system, suffering from all the usual issues related to the exchange being undermanned

- Doesn’t have actual physical headquarters

- Doesn’t offer insight into the identities of their managers, owners and investors

- No mobile app

- Requires users to create accounts and go through a lengthy identity verification process in order to allow them access to high-volume activity

- Server downtime & slowness issues related to the recent influx of customers

- Had an open chat system which recently got deactivated as it was mainly used for price manipulation

Against all the doubts, Poloniex has continued to grow in terms of its user base, transaction volumes and the number of cryptos it supports. If you can get over the fact that they are more anonymous that your usual exchange, Poloniex offers a wide variety of coins and trade options which will satisfy maybe even some of the pickiest traders out there.

Kucoin

KuCoin is a cryptocurrency exchange based in Hong Kong. It was launched on September 15, 2017 and it operates on a crypto-to-crypto basis, which means that no fiat currencies are supported. Nonetheless, its digital assets portfolio is pretty extensive and besides, the platform uses KuCoin Shares (KCS) in a similar way to Binance.

KuCoin does not offer margin trading and they aim to be a more user-friendly exchange than traditional exchanges available today. It’s important to note that they have not disclosed whether there is any minimum investment required. They also offer 24/7 customer service and they have also been known for posting coin pairs before they hit other major cryptocurrency exchanges.

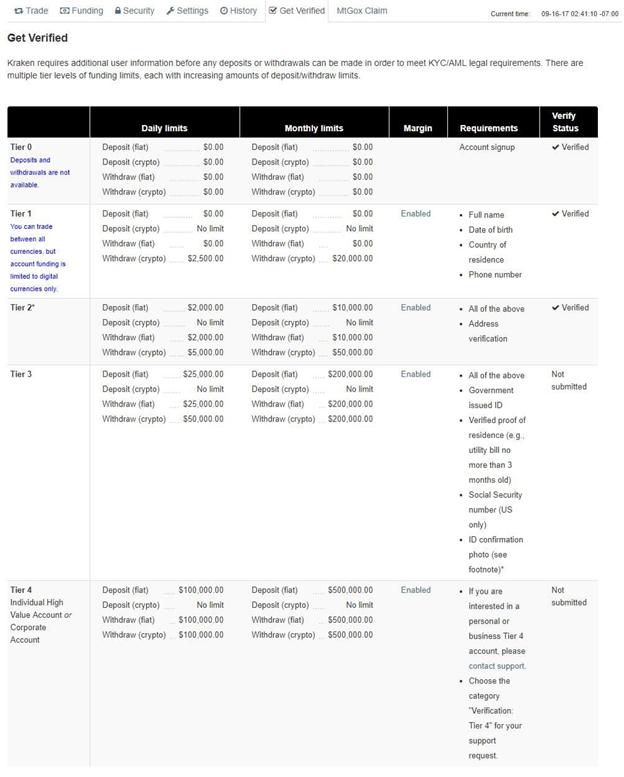

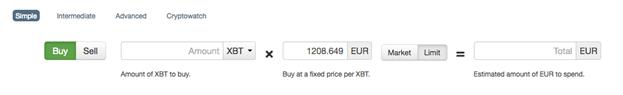

Kraken

San Francisco-based and founded by Jesse Powell in 2011, Kraken is known for its low transaction fees, wide range of features and overall security. Many people consider Kraken as the largest bitcoin exchange based on the euro volume, liquidity, and the trading of Canadian dollars, US dollars, British pounds, and Japanese yen. This list of currencies may have suggested to you that Kraken operates across the EU, USA (except in New York, due to the Bitlicense), Canada and Japan. With daily average visits regularly going near 500 thousand visitors and daily trade volume shooting over 10 million euros it is rightfully considered among the biggest exchanges out there. Its first major shot at mainstream popularity happened following the bankruptcy of Mt. Gox, when the trustees of the receivership picked Kraken as the platform through which claimants could apply to receive their lost funds. There it grabbed a large piece of Japanese market share and has kept on growing ever since.

Kraken is a publicly traded company and has so far raised $6.5 million in capital from 13 investors, among which are the likes of Money Partners Group and Digital Currency Group. It also actively trades on the market, so far acquiring shares in crypto market visualization platform Cryptowatch, Bitcoin exchange Coinsetter and Dutch exchange Clevercoin.

Kraken offers services of buying/selling cryptos, as well as margin trading options. You can make fiat deposits (in either USD, EUR, JPY, CAD or GBP) with SEPA, Swift or wire transfers and use that currency to purchase a paired crypto. Kraken also currently offers 17 various Bitcoin trade pairings, among which are Ethereum (ETH), Monero (XMR), Dash (DASH), Litecoin (LTC), Ripple (XRP), Stellar/Lumens (XLM), Ethereum Classic (ETC), Augur tokens (REP), Iconomi (ICN), Melon (MLN), Tether (USDT), EOS (EOS), Gnosis (GNO) and even the infamous Dogecoin (XDG).

Signing up for an account on Kraken is similar as with most online exchanges. Inputing your email address and creating a password will give you an option to share a PGP (Pretty Good Privacy) public key that the platform can use for added security when sending you emails. You are also asked if you wish to create a master key which gives your account a second layer of security that includes two-factor (2FA) login protection. This is especially useful when changing passwords or switching devices. The master key can be a password, a Yubikey password or public/private key pair, or Google authentication. After this you’ll receive an email with an activation key that youll copy and paste into a second form and your Kraken account is ready for use. Kraken exchange offers five types of accounts which are separated into special tiers. By signing up you will automatically get the tier 0 account. The main difference between tiers 0 to 4 are the daily and monthly limits on fiat and cryptocurrency deposits and withdrawals. The different tiers also expose you to different fees. The higher the account tier, the lower the fees you pay per trade. Upgrading to a higher tiered account is relatively easy but might require some time to complete.

Similar to Poloniex, Kraken is a centralized exchange which holds the private keys of their users on-exchange wallets. Therefore, as a user you have to trust their honesty and capacity to keep your cryptos safe. So far they have largely managed to stay out of any hacking related controversies. However, in July 2016 several users reported having their accounts hacked and their funds stolen. Kraken distanced themselves from responsibility for this hack, claiming that after an extensive investigation they concluded how almost all the hacked users didn’t have the two-factor verification enabled.

Kraken’s website and trading interface has developed a daunting, beginner unfriendly reputation. They have implemented the ‘Simple’ option which offers the newbies a relatively easy access to trading on the platform. That being said, most advanced users don’t seem to have many issues with Kraken’s interface.

Kraken also offers a mobile app for IOS users which has been universally panned (Apple store rating below 3) for its buggy-ness and unresponsiveness, even though it has been launched way back in 2014.

Kraken pros:

The following are the advantages of using Kraken:

- A popular platform used by beginner, intermediate and professional crypto traders alike

- Among the world’s leading exchanges in terms of daily trade volume and visits

- Robust trading tools offering good source of information

- Solid number of high volume cryptocurrencies as well as fiat currencies supported

- Lower fees than industry average

- Free deposits for Euro, Canadian dollar, and Japanese Yen with some forms of payment

- Cheap withdrawals (0.09 cents) for SEPA bank transfers

- Two-factor authentication via Google’s 2FA app as well as various other security measures

- Supports margin trading which gives advanced users more options

Kraken cons:

The following are the disadvantages of using Kraken:

- Beginner unfriendly user interface

- Slower account verification times than the industry average

- Reports of unexplained account closures

- Centralized exchange which holds access to your wallets private keys

- Fees of up to $15 for every fiat deposit and withdrawal through SWIFT (international banks)

- Slow, buggy, clunky engine which sometimes takes up to 30 seconds to verify a transfer, sometimes even failing to complete an order at all

- Unresponsive and undermanned customer support suffering from the recent large influx of new users.

Kraken has been a mainstay in the the cryptocurrency world for quite some time and it has developed a reputation as a reliable exchange. While it has faced a fair share of growing pains itself Kraken, mainly thanks to its robust trading engine, low fees and a variety of liquidating options, still provides a solid option for international crypto traders.

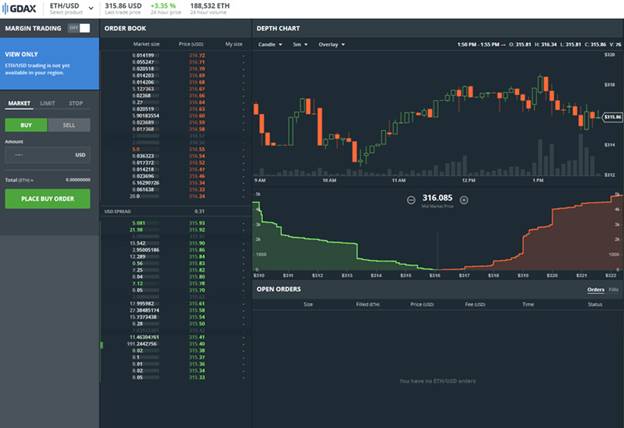

Coinbase/Coinbase Pro

Any list of Bitcoin exchanges would be uncomplete without Coinbase, the world’s largest and one of the oldest Bitcoin exchanges out there. It was founded in 2011 by Brian Armstrong and Fred Ehrsam and launched its buying-Bitcoin-for-fiat-currency service in late 2012. Coinbase is based in San Francisco and at this moment also offers crypto-for-crypto exchange services, its own wallet, and a well-documented developer API. It is often recommended to newcomers as one of the easiest ways to acquire their first Bitcoin. They are often lauded for having a very smooth and painless interface which is suited for even the biggest crypto layman out there. They also possess an extensive banking partnership network which allows for transactions to be made via EFT payment, ACH / SWIFT / SEPA transfer and, as of recently, major credit cards and PayPal. Its important to note that Coinbase is just a ‘front’ of sorts for the average cryptotrader like yourself as you can use Coinbase simply for regular, fiat for crypto trading. The website separated the more professional crypto-for-crypto trading services back in 2015 and moved them to an offshoot exchange called GDAX and now Coinbase Pro. All Coinbase customers automatically have an account on Coinbase Pro and their login credentials are the same as the ones they use on the Coinbase website. Coinbase Pro user interface is a bit clunkier but any experienced crypto trader wont have much problems with it. GDAX gives its users some more advanced trading features such as margin trading and Market, Limit, & Stop Orders. Coinbase Pro also has lower fees than Coinbase so any experienced trader will prefer conducting his trading there.

Gdax’ user interface

Coinbase is often cited as one of the most secure crypto exchanging platforms out there. The company is US based so it is required to comply with US State and Federal laws on monetary exchanges. In contrast, many of their competitors operate in countries like China or even in the off shore tax havens that may have lackluster regulations when it comes to such platforms. Coinbase has been actively involved in discussions with regulators and is promising to provide an open and innovative financial system that stays within the bounds of law. This ‘play-by-the-book’ approach of Coinbase is considered by many to have restored confidence in cryptocurrencies following the famous collapse of Mt. Gox, the most popular exchange in the days before Coinbase. At the same time many commentators have complained about a lack of decentralization in the way the Coinbase operates. It certainly behaves more like a bank, which, according to a large part of crypto community, is against the fundamental nature of a decentralized cryptocurrency. In addition, Coinbase has received investment from a number of high-profile backers, including the Bank of Tokyo and BBVA, which gives it ‘real-world’ legitimacy and significantly boosts its future business outlook. These are just some of many reasons which popularized this exchange as the most prominent Bitcoin exchange in the world and the best place to buy cryptocurrency.

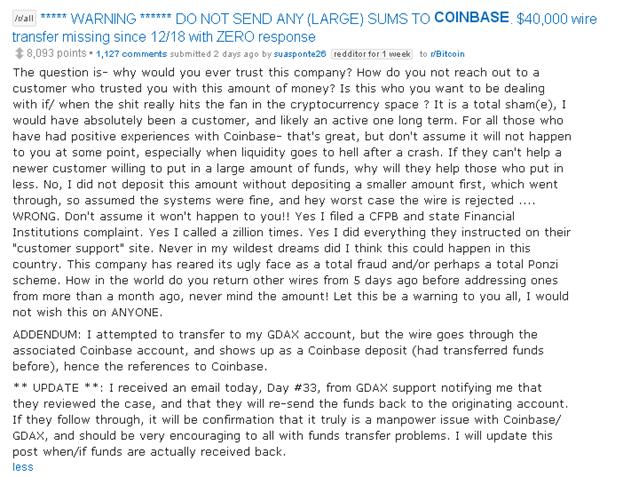

Even though there is an extensive list of positives related to Coinbase, they come accompanied by a somewhat large list of controversies as well. Just go ask Reddit how they feel about Coinbase and you will get an extensive list of negative replies. Throughout the years the exchange has gotten itself into hot waters with their customers many a time and has developed somewhat of a ‘investors first, customers last’ reputation. For example, its rapid rise in popularity and membership has unfortunately caused quite a lot of down time for both their website and their app.

The infamous Coinbase downtime message

The limited Coinbase servers were at times unable to keep up with the growth of their user base and this has made plenty of people (especially daily crypto traders who kept their funds on Coinbase wallets) unhappy and unable to access their coins. But a few hours of server downtime aren’t the worst of issues that Coinbase faced in the past. Many users cite the bad, undermanned customer support which often sends out pre-prepared responses (if it sends them out at all) barely related to people’s actual issues.

An example of Coinbase customer support being inefficient

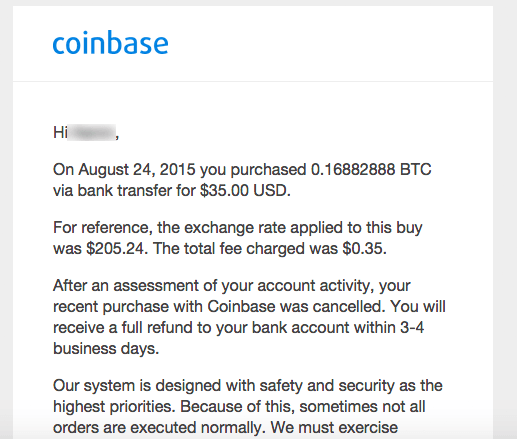

One of the most famous criticisms from the online community about Coinbase is that it has been known to track where its customers send their cryptocurrency, and may ban users from making certain transfers (for example transactions to gambling websites, adult or darknet purchases). There has been a plethora of reports by former Coinbase users speaking of shady transaction cancellations as well as unexplained account freezings/deletions.

It is also no secret that Coinbase received large sums of venture capital funding in the past. These close ties with the world of ‘classical’ financing (especially the fact that one of the founders is a former Goldman-Sachs trader) do not bode well with some parts of the crypto community. For some time Coinbase has been involved in a long tug-of-war with the American IRS during which, to somewhat of a credit to them, they decided to stand behind their customers. This has helped restore some of the public trust in Coinbase, especially among their user base which is being specifically targeted by the taxman.

Coinbase pros:

- Ability to instantly purchase up to $1000 worth of Bitcoin each week, if you are a verified user

- Full service available in 36 countries of the world, including the United States and countries of the Eurozone

- Ability to make up to $50000 (US customers)/ $30000 (EU customers) worth of transactions, for fully verified users

- Some of the lowest charge fees on the market, namely 1.49% for crypto for crypto transactions and 3.99% for credit/debit card transactions

- A wide variety of ways to deposit and withdraw fiat currency, including credit cards and bank transfers

- An online wallet as well as a downloadable mobile one

- Instant transfer of funds between Coinbase users

- Excellent GUI which allows cryptocurrency beginners to easily navigate their website/app

- Access to top cryptocurrencies like Bitcoin, Litecoin, Ethereum and Bitcoin Cash

- Insured customer deposits which are stored separately from the company’s funds

- Cooperation with Shift Payments which allows you to have a debit card linked to your Coinbase account

- US based so needs to comply with the US state and federal laws, unlike other exchanges that are based in law-lax areas

- two factor authentication system which insures your accounts safety

- Backed by a number of high-profile investors

Coinbase cons:

- Occasional server overload issues

- Limited number of currencies (both fiat and crypto) that they support

- Limited number of countries in which they offer their services

- History of interfering with their users transactions and shady account deletions

- Bad customer support

- Close ties to the financial establishment

- Abuse and false advertising of the rewards system for their affiliates

- Plenty of PR blunders, including falsely promoting the superiority of Ethereum, attempting to patent parts of the Bitcoin ecosystem and detecting insider trading during the launch of Bitcoin Cash support

- Complicated Coinbase Pro interface unsuitable for beginners

- History of restrictive, user unfriendly behavior

Even though it has had a fair share of issues in the past, Coinbase is still a useful tool, maybe even the best available one to get started with the world of cryptocurrency. If you can get over the negative press it has received, Coinbase offers a practical, simple way of purchasing your first cryptocurrency. Just make sure to transfer this currency to a private wallet because you never know how moody the Coinbase algorithms will be on the day.

Gemini

Gemini is a digital platform which allows you to buy, sell, and store Bitcoin and Ether while enjoying benefits like good trading features, security, and regulatory oversight. Launched in 2015, it is a young exchange that is slowly becoming a popular choice for various businesses and investors. Gemini is owned by Gemini Trust Company, LLC which is regulated by the New York State Department of Financial Services (NYSDFS). Therefore Gemini isn’t regulated as an exchange platform under the infamous BitLicense but rather as a trust. This assures that Gemini has good legal background while removing the hassle of complying with Bitlicences unpopular, strict and user invasive practices. It currently operates in USA, Canada and a couple of other countries with plans to expand their services to a larger user base.

The name Gemini stems from the owners of the company, the Winkelvoss twins. Previously famous for suing Facebook creator Mark Zukerberg over their idea for a social networking site, these two Harvard grads have developed an interest for the crypto-world. There is a shade surrounding their initial ventures into said world as they were involved in Bitinstant, a company which used to facilitate transfers for drug deals. The brothers claimed they were only passive investors and were not aware of the platforms illegal operations.

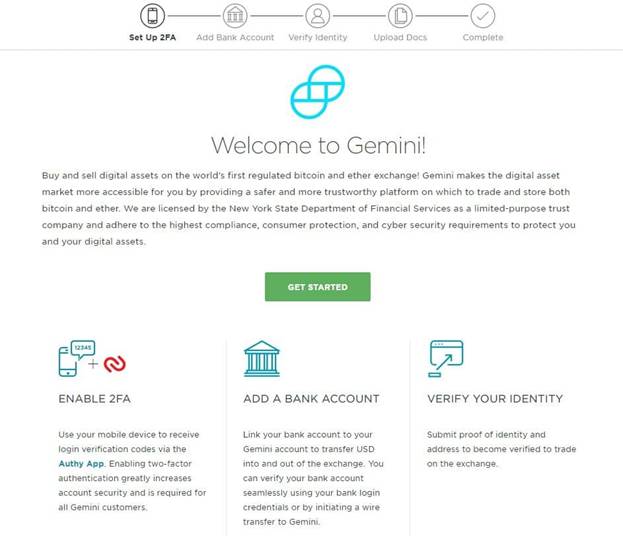

Signing up on Gemini is a straightforward process. After you’ve verified your email, you’ll be required to enter your location and phone number, then enable 2-Factor Authentication (2FA) which will help keep your account secure. Next step will be to add the bank account you want to use to deposit, as bank transfers and wires are the only deposit methods currently accepted at Gemini. Then youll need to verify your identity by uploading your government issued ID, a standard practice with cryptocurrency exchanges that allow users to deposit, withdraw and trade in fiat currencies.This final verification can take up to a few days, depending on the application volume and the staff availability. That being said, Gemini is often cited as the example of how quality customer support should be ran, as they have a history of quick and efficient handling of support tickets. Still, a direct way of contacting support like an integrated chat system would be a nice addition.

Once your account is created and verified, you are free to make your first deposit (Gemini accepts only USD transfers at this time). You will do this by going to Transfer Funds > Deposit Into Exchange > Bank Transfer. There you will have the option to enter the amount you’d like to deposit , which will be limited to $500 if using bank transfer. If you are a US customer and if you make an ACH deposit, your funds will immediately become available for trading. This means that you don’t have to wait for the bank transfer to clear before you start buying Bitcoin/Ethereum. Otherwise for non-US customers, the funds will become available as soon as the transfer is cleared. There are no limits on the size of initial deposits.

Gemini user interface

You can use your funds to perform six different types of trades:

- Market Orders: Filled immediately against resting orders.

- Limit: Filled at or more favorably than the specified price against resting orders. If a quantity remains unfilled, it rests on the continuous trading order book until traded against.

- Immediate or Cancel (IOC): Just like a Limit Order, an IOC order is filled immediately at or more favorably than the specified price against resting orders. If any quantity cannot be filled, that remaining quantity is canceled and does not remain on the continuous trading order book.

- Maker or Cancel (MOC): Similar to Limit Order, MOC orders rest on the continuous trading order book at the specified price. However, if any part of the order can trade against resting orders, it’s immediately canceled instead.

The final two trade options on Gemini are its auctions, which are held twice a day. These auctions give buyers and sellers a period of high liquidity and usually include high volume transfers. Therefore they aren’t suitable for beginners. They function similarly to the auctions which occur at the opening and closing transactions on a stock exchange (not to be confused with “the highest bidder wins the item” auctions). During one of these auctions, traders can place buy or sell orders which are then matched at a single price. After seeing the pending orders for the auction (known as the “imbalance”) traders can speculate on them moving the market in the short term. For instance, if a relatively large buying imbalance is placed, most will expect the price to rally. That being said, this type of trading is very risky, as new orders may come to meet the imbalance, even in the last second. Furthermore the initial imbalance creator may have set a limit price for his order, above (in the case of buying) he does not want to participate. Trading on imbalances is tricky and there are plenty of stories about people losing money on it. It is worth noting that Gemini doesn’t offer the margin trading option which might come as a negative surprise to the more aggressive traders who want to use their platform.

So far Gemini only offers trades for Bitcoin and Ethereum. Both coins can be traded against the US dollar and against each other. This lack of cryptos as well as the lack of fiat currencies are very limiting and there are plans to expand in the future. The owners and the staff have stated that any new currency introduction needs to be done slowly and meticulously and are obviously sticking to that principle.

When it comes to security, Gemini has their US Dollar Accounts insured by the FDIC, and funds held in a New York-chartered bank. Gemini also keeps almost all of their digital assets in cold storage, while online assets are hosted on Amazon Web Services. As Amazon Web storage also utilizes security features such as multi-factor authentication, tiered-access controls and dedicated hardware security modules, this adds a completely new layer of security to their assets. Gemini hasn’t experienced any large-scale hacks or DDOS attacks yet. This is generally a good sign which implies that Geminis creators took note of the security issues that plagued other exchanges and made sure to implement measures designed to prevent similar issues happening to them. Customers from all walks of crypto can make their transactions on Gemini knowing that their funds are very well protected.

Gemini operates a low fee policy which allows its users to deposit Bitcoin, Ether, and make bank and wire transfers free of charge. However, individual banks may charge their standard fees for wiring money onto your Gemini account. As for withdrawals, all customers receive 30 free withdrawals per calendar month. Any withdrawals above this amount will result in fees equal to the mining fees payable on either network. This is estimated to be approximately 100,000 satoshi (0.001 BTC) per transaction on the Bitcoin Network and 0 GWei (0 ETH) per transaction on the Ethereum Network. Trading fees are set at 0.25% for both sellers (makers) and buyers (takers) and are subject to variability if you reach certain volume thresholds. More information on fees can be found here.

Gemini pros:

- Compliant to US trust laws

- Secure

- Beginner friendly with good UI

- Good customer support

- Fiat deposits and withdrawals

- Ability to use wire transfers

- Low fees

- Variable trading options

- Auctions for high-volume traders

Gemini cons:

- Only available in US and a few other countries

- Only two supported cryptos

- Only supports USD bank transfers

- No margin trading option

- No option to directly contact customer support

This exchange, even though its relatively new and lacks in certain areas, is a viable option for new entrants to the market as well as more established traders. Its support of direct wire transfers as well as its low fees will make it attractive for low volume traders. At the same time, its various trading options and its ability to make high volume transfers will suit more advanced traders. For anyone looking to trade Bitcoin and Ether, Gemini is one of the best options available. They just need to make sure that its services are available in their country.

Cex.io

Cex.io started out in 2013 in London as a Bitcoin exchange and cloud mining provider. There was a point in time where its mining pool, known as Ghash.io, was so big that it was responsible for 42% of the total network mining power. But on January 2015 the company shut down its mining platform and decided to focus on running the Bitcoin exchange related activities. Its global coverage allows users from all over the world to trade on the platform. Even though its trading volume isn’t among the top dogs of the industry it boasts a very large following in Russia. CEX.io is incorporated as a private limited company and registered with FINCEN. It applies KYC and AML policies, trying its best to ensure a quality and safe trading experience for everyone. However, recently the platform got into some hot waters regarding the invasiveness of their verification policies which will be talked about later on.

The company, initially meant as a mining pool, was founded by Ukranians – Oleksandr Lutskevych and Oleksandr Ushchapovskiy. The exchange feature was added later to help users sell and buy shares of the mining pool with Bitcoin. Through its cloud mining services, the exchange made it easier and more convenient for users to enter and leave mining operations. By September 2014, the exchange decided to start accepting deposits in US dollars (USD), euros (EUR), british pounds (GBP) and Russian rubles (RUB). These currencies could be deposited via wire transfers, credit cards and SEPA transfers by anyone who wanted to purchase Bitcoin or shares in the Ghash.io mining platform. Soon after they enabled selling and buying of the new BitcoinCash (BCH) on their platform the company announced that its ceasing all cloud mining operations, citing a desire to better focus on the job of being a quality cryptocurrency exchange and trading platform.

Cex.io allows user access through their browser-suitable website, a mobile application and an API. When compared to other industry standouts, the website design is louded as one of the best available. You can register on Cex using a Facebook, Google, VK, or Github account and avoid e-mail confirmation. However, before being allowed to use your credit card to purchase cryptocurrencies, you will need to verify it. This will require you to fill out a form in which you will provide the name on the card, the card number and its expiration date. In addition you will need to upload three pictures: the first being a selfie of you holding the card with its information clearly visible; the being another selfie of you holding both the credit card and a government-issued ID; the third being a selfie of you with the back of the ID visible. Upon the submition of these photos and the form you will be prompted to confirm that the information you have provided is up to date and valid while also giving permission to a company staffer to inspect your data and verify it. If the Cex.io staff confirms your documents, you will receive an email which will notify you that your credit card is ready to be used on the exchange. The verification process can take a few hours, a day, or longer, depending on the staff availability. For a full instruction on how to verify your credit card, check here.

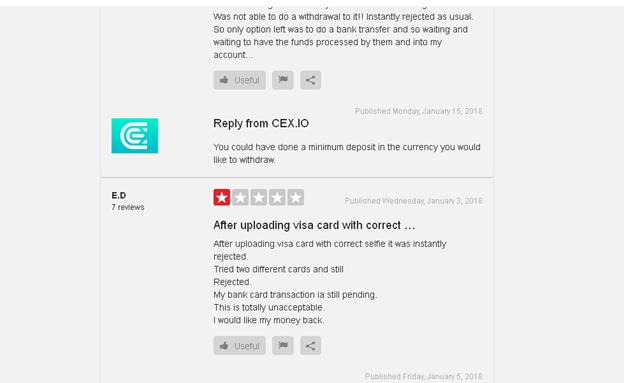

This invasive verification process hasn’t sat well with some sections of the community. Alongside various customers reporting withdrawal issues this has resulted in plenty of negative reviews online, especially on websites like Reddit and Trustpilot. However, most of these can be summarized as people not understanding the terms of trading on the exchange. Also it is worth noting that Cex.io staff replies to most of these reviews and tries to help its users solve the issue at hand. Their social media team is very active and responsive on Twitter, Reddit and their blog which allows you to contact them if you have any questions.

Cex.io staff replying to a negative review on Trustpilot

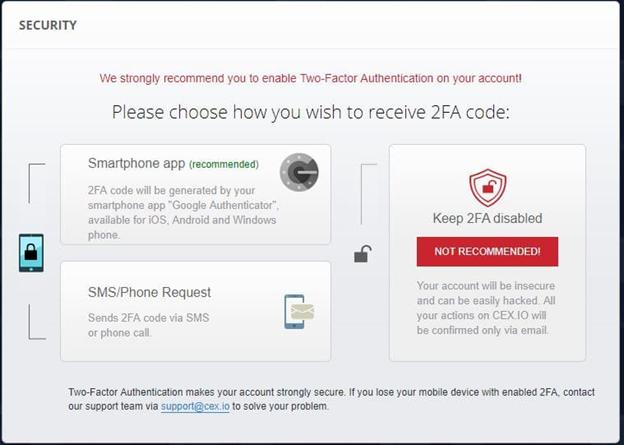

Cex.io website allows its users to easily navigate from the sign-in page to the trading panel, making it beginner friendly. Security measures like SMS & email two-factor authentication (2FA) are automatically enabled but its worth noting that some industry experts like Andreas Antonopoulos remain skeptical about the level of security provided by SMS 2FA. It is recommended by many to use the Google Authenticator app for your 2FA needs.

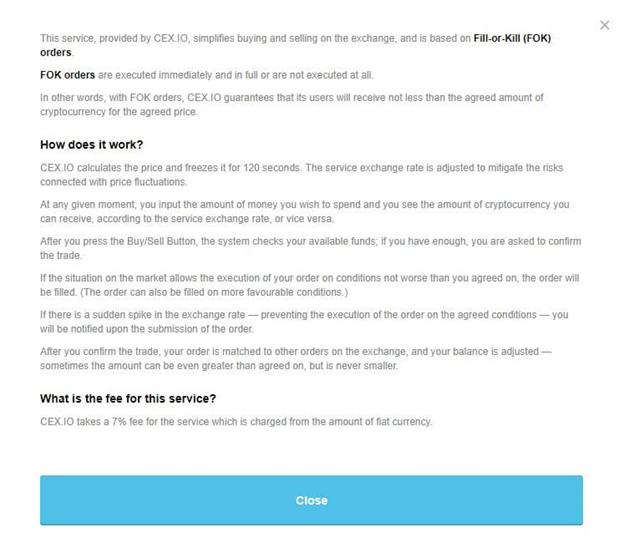

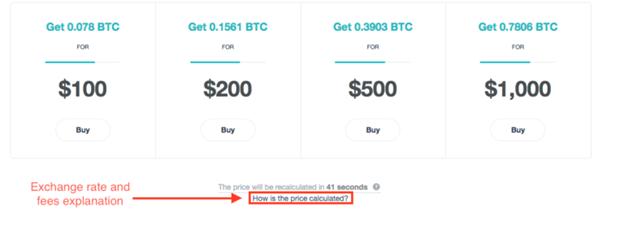

Cex also implemented the fill-or-kill (FOK) model of executing orders which means that when you place an order, it is fulfilled immediately in its entirety. If the order cannot be fulfilled immediately for some reason, it is cancelled (the implementation of FOK system does come at a cost of higher fees).

How FOK works

The Cex mobile app is available for both Android and iOS. Said app allows you to deposit Bitcoin, Ethereum and Litecoin using a QR code. You can also view your balance, place limit market orders, track your current orders and changes in price. You can also initiate, manage and cancel orders as well as use real-time data to analyze cryptocurrency markets. Some users consider this app to be a useful tool while others express disappointment related to app failing to execute orders, display detailed graphs and allow users to even login in. The app also offers a fraction of the full service available through the website. For example, you can’t do margin trading through the app. Cex.io development team have made their application programming interface (API) available for tech savy users to create customized applications for trading and managing funds which comes in three types: Rest for accessing market data, WebSocket for professional traders and Fix for institutional traders. The trading API download is limited so potential developers will need to contact customer support in order to get the required data once the limit is reached.

Aside from buying and selling cryptocurrencies, Cex offers a robust trading platform with options for margin trading of cryptocurrencies (BTC/USD, BTC/EUR, ETH/BTC, ETH/USD) with 1:2 and 1:3 leverages. They offer options for market, limit and stop orders which are used by an average of 400000 users each month. It also implements features like automatic funds borrowing and negative balance protection which make margin trading more beginner friendly.

Cex.io interface