The blockchain technology is a result of a revolutionary idea that Satoshi Nakamoto came up with which included combining cryptography, networking theory, computer science and economic incentives to create a fully individual, decentralized cryptoeconomy. This economy relies on a system of economic rewards and punishments and enables people to conduct decentralized transfers of wealth. Economic rewards are used to enlist miners to help verify the blocks and support the blockchain network. There are also economic penalties put in place which keep the miners “at bay” and prevent them from taking over the network by gaining more than half of its hashing (mining) power (the so-called 51% attack). Blockchain also relies on public-private key cryptography to give individuals safe, exclusive control of their bitcoin. Hash functions are used to “link” each block in the bitcoin blockchain, proving an order of events and the integrity of past data. It would be impossible for Bitcoin to keep its value and give people confidence that its blockchain data is authentic without the carefully calibrated sets of incentives/punishments and the difficulty behind cryptographic protocols it utilizes.

To understand cryptoeconomics better, we need a deeper understanding of both cryptography and how incentives affect the security and functionality of game systems. Cryptoeconomics make us think of money as a design or engineering problem. They also make us think of economic incentives as an essential component of allowing a new technology to break through. Finally, they require us to think about information security problems in economic terms. For this machine-like approach it is often compared to mechanism design, a practice opposite to classical game theory. Mechanism design focuses on starting with a desired outcome and then working backwards to design a game that, if players pursue their own self interest, will produce the outcome we want. Cryptoeconomics, like mechanism design, focuses on using economic theory to design “rules” or mechanisms that produce a certain equilibrium outcome. But in cryptoeconomics, the mechanisms used to create economic incentives are built using cryptography and software and the systems we are designing are almost always distributed or decentralized. Bitcoin is a product of this approach.

It is worth noting that mechanism design is not a universal solution for creating a quality blockchain system. Relying on incentives and quality programming only goes a certain way in predictably shaping future behavior. As Nick Szabo rightly points out, ultimately you are speculating about real people’s mentalities and assuming how they react to certain incentives. A cryptoeconomic system’s security depends in part on the strength of its assumptions about how people react to economic motivations. Thus, cryptography is used to prove past events – such as the authenticity of the blockchain, while economic incentives are used to encourage desired future behaviors. With backward looking security mechanisms and forward looking incentivization, cryptoeconomics allows us to build robust decentralized blockchain based protocols.

Explaining different kinds of incentives and how they affect people is where game theory comes into play.

What you'll learn 👉

What is the Game theory?

Game theory is the study of how rational people make strategic decisions in certain complicated situations. It represents an entire field of science, economy and math that focuses on analyzing and explaining your everyday social interactions. Based on the findings of this theory, many corporations make decisions regarding their products marketing strategies while keeping in mind that they operate in an environment full of competitors who will also have their own moves and decisions to make. Game theory was created in 1950s as the brainchild of a mathematician named John Nash. This man’s life and work were so important and interesting that even Hollywood gave it immortality through a motion picture called The Beautiful Mind. The science of game theory has certainly had its impact as it brought major breakthroughs and insights to the studies of social, political and economic behaviors of humans.

Game theory doesn’t look at a game in the usual way you would look at it, say as a fun activity you do with your friends. A game in game theory is any interaction between two or more people in which the payoff that each person receives is affected by the decisions that other people, who are a part of the interaction, make. This can apply to any situation where multiple people get together and interact; a game of poker or basketball, a bank robbery or investing. Given blockchains mechanics of multiple decentralized actors forming an interdependent network, it should be no surprise that game theory is critical for blockchain development.

A safe, functional blockchain needs to be completely decentralized and corruption free internally, as well as protected from potential external bad influences. The way it achieves this is by the incorporation of economics and game theory. Game theory in cryptoeconomics aims to build economic networks that mimic human reasoning and need no oversight yet produce positive outcomes for the greater good of everyone involved. However, mimicking complicated human decision making first requires understanding what motivations drive people, which is easier said than done.

A typical game theory model has at least 3 components:

- Players: The decision makers, criminals or managers in a company

- Strategies: The decisions they want to take to further their fortunes/companies

- Payoff: Outcome of the strategies they employ

According to game theory, two types of games can happen, based on their payoff:

- Zero sum game: A game in which the gain of one player comes at the expense of another player.

- Non zero sum game: A game where the gain of one player doesn’t come at the expense of another player.

Game theory deals with various game concepts which all have different implications for the blockchain. Let’s take a quick look at them all before delving deeper into the way they intertwine with the cryptocurrencies of today.

Payoff matrix

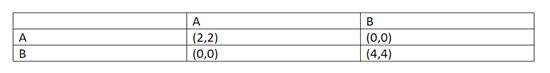

The simplest concept of the game theory is its payoff matrix. Here we have companies A and B which are deciding whether or not to advertise a particular product.

| Company B | |||

| Advertise | Don’t Advertise | ||

| Company A | Advertise | (4,3) | (5,1) |

| Don’t Advertise | (2,5) | (3,2) | |

The table above is the “payoff matrix” which showcases the payoff that each company gets from advertizing based on their own choice as well as the choice of the other company. The table basically reads like this:

- If company A and B both decide to advertise then the payoff is 4 for A and 3 for B

- If company A doesn’t advertise and B decides to advertise, then the payoff is 2 for A and 5 for B.

- If company A advertises and B doesn’t advertise then the payoff is 5 for A and 1 for B.

- If both A and B don’t advertise then the payoff is 3 for A and 2 for B.

So the question is, what decision should either A and B take to get the best possible pay off? To solve this, we need to look at the scenario that serves both A and B.

Firstly, let’s look at company B. If company A advertises, then company B has a payoff of 3 if they advertise and 1 they don’t advertise. So, obviously, their best payoff lies in advertising. If company A doesn’t advertise, then company B has a payoff of 5 if they advertise and 2 if they don’t advertise. In this case their best payoff lies in advertising.

- Conclusion: Regardless of what company A does, company B’s best strategy is to advertise.

Now, let’s look at company A. If company B advertises, the company A has a payoff of 4 if they advertise as well and 2 if they don’t advertise. So, once again, their best payoff lies in advertising. If Firm B doesn’t advertise, company A has a payoff of 5 if they do and a payoff of 3 if they don’t. Once again, their best payoff lies in advertising.

- Conclusion: Regardless of what company B does, company A’s best strategy is to advertise.

So, in this example, for both A and B, their most stable state will be the one in which they advertise while presuming the other side will do the same. This is the dominant strategy to profit in a zero sum game environment. A dominant strategy is the best course of action for a player regardless of what the opponent does. In this example, the combination of (4,3) also represents the Nash Equilibrium, another important postulate of game theory and by extension, cryptoeconomics.

What is Nash Equilibrium?

The Nash Equilibrium is a concept of game theory where the optimal solution of a game is one where each participant picks a strategy and has no incentive to change his pick upon considering the choices his opponents made. Overall, an individual can receive no incremental benefit from changing actions, assuming other players remain constant in their picks. This theory was formulated by John Nash, the mathematician mentioned above. One of the most often uses of the Nash Equilibrium can be found in another famous game theory concept, the prisoners dilemma.

The Prisoner’s Dilemma

Source: https://www.youtube.com/watch?v=t9Lo2fgxWHw

Here we need to address another postulate of game theory which says that there are two types of game theory: cooperative and non-cooperative. Probably the most famous non-cooperative game theory is the one we call the prisoner dilemma. This game is a social interaction which involves two people, Red and Blue, who were caught being naughty and doing criminal activities. The police are investigating them and suspect the pair was far naughtier in the past. Therefore in order to test out the waters, the investigating officers present Red and Blue with three options:

- Option 1: If they both don’t rat the other one out then they get 2 years in prison each.

- Option 2: If one of them rats the other one out then the person who confessed gets 0 years while the other one gets 10 years in prison.

- Option 3: If both of them confess then they get 5 years in prison each.

- Their payoff matrix would look like so:

| Red | |||

| Confess | Don’t Confess | ||

| Blue | Confess | (5,5) | (10,0) |

| Don’t Confess | (0,10) | (2,2) | |

Even though Red and Blue had some quality times together and people love a good “honor among thieves” story, behavioral psychology and game theory tell us that the situation where they both stay silent is impossible. If they both don’t confess, then the payoff matrix says that the outcome is (5,5), meaning they both get 5 years each. However, that is a very unstable state because they both know that there is a better deal on the table. If they do rat the other person out, then they will have 0 years to serve. They also know that if the other person talks and they stay silent, they are facing a lot more time than if they were to talk. So according to the dominant strategy of the Nash equilibrium, Red and Blue will pick the best possible solution while considering the opponents strategy, meaning that they will both confess their collective wrongdoings.

It is time to imagine the following conundrum: What if there is a scenario where the optimal solution for both the players lies in the scenario which has bad implication towards the society which surrounds them? Think of this scenario where Red and Blue are planning to add to their list of wrongdoings by committing a bank heist. Let’s make a matrix of positive payoffs that they will get in this scenario:

| Red | |||

| Steals | Doesn’t Steal | ||

| Blue | Steals | (10,10) | (6,0) |

| Doesn’t Steal | (0,6) | (0,0) | |

In this hypothetical scenario, the best payoff for our players lies in both Red and Blue stealing. While this might be good for both of them, it is not a good scenario for the society, as their bank is about to lose a lot of money. This is why society came up with the idea of “punishment”.

What is Punishment?

Games discussed by game theory are rarely kind and fair. Most players involved in them are very corruptible and, if not kept under check, capable of acting malicious to gain unfair advantages. In the real world games, people will generally have a lot of opportunities to act malicious without any consideration for the society in general. So it employs certain game rules which ensure that everyone gets an equal chance to achieve a favorable payoff. The players who decide they want to cheat the game and gain unfair advantages will, upon being found out, end up being punished.

Let’s imagine there is a punishment strategy which says the following: “For every 1 taken from the public a punishment factor of -11 will be applied to the player who takes it.” In other words, every act that is considered “bad” for the society will have their payoff deduced by 11 and that will cost -1 in payoff for the society. Now, you may be thinking why would society do anything like that? Applying the punishment will also result in added loss which can be money, time or work. Still, societies have always integrated these punishment systems in the daily cycles of their games. Adding the punishment factor reduces the payoff from “bad” activities and brings negative motivation into players’ heads regarding socially unacceptable behaviors. Now our payoff matrix will look like this:

| Red | |||

| Steals | Doesn’t Steal | ||

| Blue | Steals | (-1,-1) | (-5,0) |

| Doesn’t Steal | (0,-5) | (0,0) | |

As you can see, by adding the punishment factor, the Nash Equilibrium changes from something that could have been bad for the society to something that can potentially be good for the society. Blue and Red will, upon realizing how big the punishment factor is for playing the game against the rules, think twice about robbing the bank. This automatically means that the society is protected as a whole and every player is able to play the game with knowledge that there is a set of rules which levels the playing field.

These rules are usually decided upon democratically and are mandatory, meaning that every member of the society needs to follow them. In other words, if someone from the society doesn’t go along with the punishment, then they themselves become criminals and are subject to punishment. Paying taxes which fund the society’s police force is an example of this game. Everyone is forced to pay them and everyone is by proxy protected by the police. However if you do not pay your share of the taxes, you are going to be subjected to punishment.

As an extension of this we have the “punishing the non-punishable” form of punishment. Typical example of this is social outcasting. Say you have a friend who likes to do drugs and the word gets out around the society about his habit. Instantly he becomes an outcast and is punished by having his social status diminished. This is a scenario where everyone in that society is participating in the punishment. Now suppose you keep hanging out with that friend even though you don’t do drugs yourself. By the rule of association, some sections of the society will start considering you a “malicious” player in the same vein (no pun intended) as your friend. This sentiment could eventually spread and leave you ostracized by the society as well.

The concepts of Nash Equilibrium and Punishment are closely knitted into the way blockchain deals with potential malicious miners. We will explore that in a bit. But before doing so, we must go through some more basic game theory models.

The Schelling (Focal) Point

The great economist Thomas Schelling conducted an experiment with a group of students asking them a simple question: “Tomorrow you have to meet a stranger in NYC. Where and when do you meet them?” He found out that the most common answer was, “12 am at the Grand Central Terminus.” This happened because the Grand Central Terminus, for New Yorkers is a natural focal point. A focal point (also called Schelling point) is a solution that people will tend to use in the absence of communication, because it seems natural, special, or relevant to them.

This concept can be demonstrated on a simple example of two people sitting in separate rooms. They are given 4 numbers and asked to guess which number will the other person pick.

The numbers that are given are:

- 548657491, 3347162, 100000000 and 908712345.

Which number do you think they will choose? Which number would you choose? If you said 100000000, you were most likely correct. Why? Because that number it is different and jumps out when placed alongside the rest of the offered numbers. Being like that means that this number serves as a natural focal point, a Schelling point. Various places such as bars, churches, malls, squares are just some places which have historically been natural convergence points for humans, making them the most common Schelling points in the game of life.

Another example of the Schelling point in action can be seen between two people playing a game of Chicken.

Example of a game of chicken from a 1970’s classic Vanishing Point

You have two people driving their vehicles straight at each other. If they collide head on, they die. However, the first person who swerves away from the incoming rider is a “chicken”. In this game, there are two scenarios which can end in a crash:

Source: Mind Your Decisions blog

- Case 1: Both riders keep driving straight

- Case 2: Both drivers swerve to the same side of the road

Thomas Schelling analyzed this problem by utilizing focal points. He claimed that you will reach the best outcome if you “don’t look the other driver in the eye”. His solution implies that you need to cut off communication with the other rider and focus on your own instincts. Since most people drive on the right side of the road, letting your instinct take over will result in both you and the opponent swerving right, because that’s where your Schelling point lies. Just hope you didn’t decide to pick a fight with a British person.

Grim Trigger Equilibrium

Imagine a community where heredital rule still exists and it is believed that kings get to rule over others based on a divine right given to them by God. However the king is killed and the divine right becomes disputed because everyone realizes that the king is not a divine being. This will start an endless cycle of coups and revolutions where nothing can stop all the subsequent kings from getting murdered. The only way to stop this vicious cycle is by NOT killing the king in the first place and by maintaining the notion of the “divine right”. This is called a Grim Trigger Equilibrium. Grim trigger is a policy of tough love; you start by cooperating and continue to cooperate as long as everyone has cooperated in the past. If someone has broken the community agreement, then you defect forever. The threat of eternal conflict keeps everyone cooperating today as long as everyone cares enough about the future.

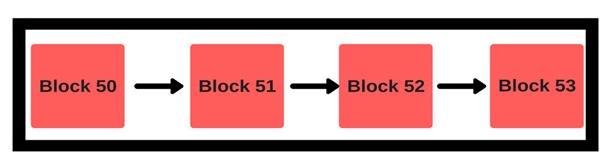

Coordination Problems

This matrix contains two Nash Equilibria: (A, A) and (B, B). The idea of this game is to convince people to go from (A, A) to (B, B), as any other state won’t benefit them as much as (B,B). A small group of people can be easily coordinated via phone or emails. But larger groups will become an issue.

While this game is similar to the prisoners’ dilemma there is an important difference between the two. The issue with the coordination problem is that in prisoner’s dilemma both the players had to choose the the Nash equilibrium position, even though there was a position which was morally better. In coordination problem the morality is put aside and what is considered is the incentive for a person or a group to go from one state to another. A coordination game fails when only a minority changes their state and inversely, it is a success when a majority of the group changes their state.

Say you want to change the language you type with into a symbol based language. While the original sentence you used might have went something like “Give me a percentage?”, the new statement in sign language would look something like “%?”. If you are the only one using this language, most people won’t understand what you are talking about and no one will communicate with you. This means that your payoff is very low and you ultimately have no incentive to change. However, if the majority of your society shifts to this language and use it exclusively, you will have to change your language as well since you won’t be able to communicate otherwise. This will make the incentive to switch states very high.

The concept of Bounded Rationality

This game can be observed if you look at a person trying to purchase a new pair of shoes. He will wear those shoes today to a wedding. Our man enters the first store and finds a nice pair of shoes but realizes they are a number too big. At that point he realizes he has two options available: he can either drive around 10 more stores in hope of finding the right pair of shoes in time for the wedding or he can purchase these shoes and go to the wedding in them, knowing that he won’t really wear them again anytime soon. He makes his choice based on which option is simpler and easier and decides to purchase the shoes right away.

The decision that our wedding crasher here made is called “Bounded Rationality”. Bounded rationality basically means that when given a choice, people will always follow a path that is simple and familiar. Decision-makers in this view act as satisficers, or people who are seeking a satisfactory solution rather than an optimal one. This path may not be the one which will give them the highest payoffs, yet they will always follow it due to its familiarity and simplicity. While it’s arguable that the man could have shopped around and found a better fitting pair of shoes, he went with the simpler option which ultimately caused him less hassle overall.

All of the abovementioned game theory models have found their application in the world of cryptoeconomics.

Blockchain and Cryptocurrency Game Theory

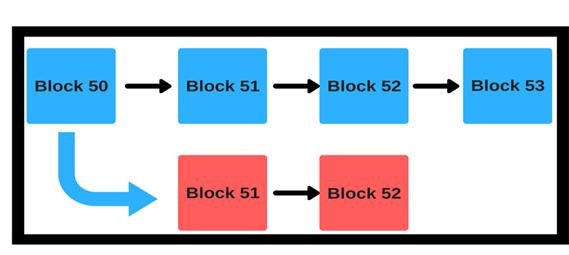

A blockchain is a public ledger that is made out of a series of blocks which contain individual transactions. Each block also contains the hash function of the previous block which is used to connect subsequent blocks to the previous ones, thus creating a chain. This is a rough visual representation of a blockchain.

In a system based on the blockchain there are two players:

- Miners

An important part of the system as they run expensive and energy consuming hardware which takes unverified transactions, verifies them, adds them into new blocks and transmits these blocks onto the blockchain.

- Users

Basically coin holders who make transactions.

You can already see how this relates to the game theory. One can observe the worlds of crypto mining and crypto transacting and easily realize that these are also games which have their own players. This also means that these games have strategies and potential payoffs, which we will go into now.

Block Mining

Through a series of computations, miners find a block and add it to the blockchain. In Ethereum, adding the block gives the miner(s) a reward of 5 ether and in bitcoin, the mining reward is 12.5 BTC. Miners have a lot of power and if they do decide to start gaming the system for their own personal gain, they can cause havoc and bring everything down. This is why blockchain employs the basics of game theory to make sure that the miners are never incentivized enough to start behaving maliciously.

There are a couple of ways in which miners can cheat:

- They can include invalid transactions and give themselves extra coins

- Add blocks randomly without worrying about Proof of work

- Mine on top of invalid blocks to get more BTC

- Mine on top of a sub-optimally scoring block

Regarding scoring, the first block of the blockchain is called genesis block and has a score of 0. The following block will be connected to the genesis block with a hash function. This block’s score is calculated with the following formula:

Score (Block) = Score (parent block) + Proof of work,

Where genesis block is the parent block and proof of work is the amount of computational work that was put into creating this block. The block with the highest score is the current state of the blockchain.

Above we see the typical blockchain. The blue chain is the actual blockchain. Now suppose there is a miner who, in blue block 51, spends a bitcoin to purchase some tether. Now if he wanted, he could create a parallel chain (a fork) with a new block 51 (marked red), which contains no data of the aforementioned transaction ever happening. As a result of that, he comes out of the ordeal with his original bitcoin intact lined up with some shiny new tether.

What just happened here is called “double spending.” Obviously now other miners can, theoretically, mine on top of the new red chain which would destroy the bitcoin system. The reason why they don’t do that isn’t their morality or their dedication to doing good things. The real reason why they stay loyal to the original chain is the fact that the blockchain is designed as a self-enforcing Nash Equilibrium, with its mining boasting a recursive punishment system.

The Nash Equilibrium/the punishment system at work

Blockchain mechanics contain a simple rule which prevents miners from mining on top of new chains created by invalid blocks. Any block that is mined on top of an invalid block becomes an invalid block itself, rendering the entire new chain useless. Thanks to this rule the miners will simply ignore the invalid block and keep on mining on top of the main chain. A similar logic is used for mining sub-optimally scored blocks. As the block with the highest score represents the current state of the blockchain, it is logical that the miners will decide to mine on top of it.

Any invalid blocks issue is quickly mitigated by the fact that miners aim to reach the state with a Nash Equilibrium. As the co-ordination game states, if a majority of people in the group are not changing their state, the minority will not have any incentive to stay in the new state. Seeing this, no sane miner will waste their computation power and risk ostracization with no future payoff. Obviously, you can make all the miners mine on the red block and create a new blockchain, however, the number of miners is so vast that an event like that requires too much resources to be coordinated.

Why will users use the main chain instead of the other chain?

The question remains, will the users follow suite and remain on the blue chain? Once again, game theory makes sure that this will happen.

First we need to remember that cryptocurrency has value because the people who want it, mine it and trade it give it value. So, why will a normal user assign a value to coins coming out of the blue chain and not to the coins coming out of the red chain? It’s related to the previously mentioned concept, the Schelling point. The blue chain is the default focus point from the user’s perspective and therefore they will naturally converge to it. They give its product (its coin) value because the main chain is natural to them. Another reason why users will value the main chain more is bounded rationality, meaning that they are simply more used to it. Like bounded rationality states, people will simply opt for the simplest solution every time.

The Proof of Work Takeover Problem

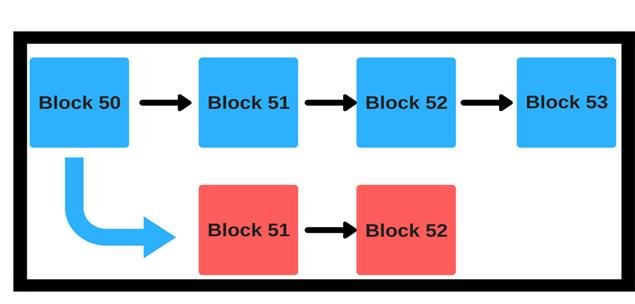

Before we start explaining this, let’s bring back our old diagram again for reference:

Vitalik Buterin gave a great example of the Takeover problem. This problem is also referred to as the 51% attack. Proof-of-work systems require miners to buy hardware and spend electricity to artificially raise the cost of mining and make them naturally de-incentivized to try to switch onto a new blockchain. This tactic also raises the cumulative cost of attempting to gain control over half of systems mining power (hashrate), making it economically unviable to perform a 51% attack. Vitalik came up with the proof-of-stake systems, which uses deposits of cryptocurrency to create the same disincentive, rather than real-world investments like hardware and electricity.

In order to mine in a proof-of-stake system, you must commit a certain amount of crypto into a smart contract “bond.” Let’s suppose we have a smart contract whose terms say the following:

- Any miner can join the activity by depositing a set amount of crypto into the contract

- The miners must send shares of the partially completed blocks that they have mined into the contract and the contract verifies it and also verifies that you are a miner and that you have sufficient hash power

- Before 60% of the miners in the system join you can leave anytime you want

- After 60% of the miners join, you will be bound to the contract until the 20 blocks have been added to the hard fork chain aka the red chain

Clearly there are takeover issues ingrained in this contract. Since 60% of the entire miner force is contractually bound to this new chain this will result in the blue chain losing relevancy. This will also result in double spending all over the place, people losing trust in the currency and the value dropping fast. The miners might have different motivations to join the takeover, the possible reward at the end and the relative lack of risk from joining. Their incentives to follow through with the contract can also be strong, with the huge amounts of money they have deposited in the beginning combining with the possibility of a great reward. Theoretically, a takeover like this can end any currency, game theory mechanics make this nearly impossible to happen.

Grim Trigger argument

Bitcoin can be subject to a takeover attack by a coalition of malicious miners. However, a defense mechanism rests partly upon a game theory principle called a Grim Trigger equilibrium, which suggests in this case that if miners were successful in ‘defeating’ the honest nodes, a new swarm of attackers will soon follow, creating an endless cycle of attackers, jeopardizing Bitcoin itself, and hurting everybody.

Thinking back to the king analogy, the only thing that will stop the new king from getting killed and from this becoming an endless bloody cycle is to not kill the original king in the first place. Similarly, if a blockchain is taken over and destroyed by its miners being diverted into a new chain, who’s to say that something similar won’t happen to the new chain anytime soon? To stop these endless hard forks from happening it is important to keep the integrity and “the law” of the original blockchain and avoid the takeover in the first place.

If the miners are bound to a particular currency it will be in their best interest to uphold and maintain the value and legitimacy of the currency. Some of the ways this bond is created include either being contractually bound or the currency requiring specialized ASICs. If a currency can only be mined by specialized software, then miners will honor their investment into said software and do everything to make sure that the currency doesn’t lose value. These are the reasons why the Grim Trigger argument will hold up. The argument won’t hold up if the currency can be mined using factory-made CPUs. These CPU’s are relatively inexpensive and can be used to mine other currencies, which means the miners using them aren’t invested directly into a cryptocurrency. However, if the miners who own these CPUs have a stake in the currency, the argument holds up because they don’t want to lose their investment.

Conclusion

All games must make certain assumptions about the players and the playing field. In game theory, we assume the model of human interaction and what does each player value (what is his utility function).

When choosing a model of interaction, we can pick between a coordinated or individual model. What the game creator seeks to understand is will people make individual choices, or will they instead coordinate and work together? These models exist both in the real world and in crypto and determine how a player will behave. He may choose to chase individual goals or he may coordinate and work with the “hive”.

Whichever model the player chooses, the game creators have to ensure that people who want to be a part of their blockchain behave and follow protocol rules. Protocol creators, assuming the way humans behave, will design games to reward or punish participating nodes depending on their behavior.

Bitcoin intentionally aims to make mining difficult and inefficient with its proof-of-work protocols, thus making it costly for malicious actors. Ethereum takes it a step further and not only rewards good behavior, but punishes bad through its proof-of-stake system. Proof-of-Stake (PoS) requires everyone to invest some money into the game. This means that the bad actors can be punished more efficiently, both by being thrown off the network and having their stake taken away. This game theoretical thinking of promoting good behavior and deterring bad one exists in everyday life, as we’ve built societies to reward work we value and deter behavior we don’t. It may cost society money to pay to enforce these rules but they are necessary to keep the game running for an unlimited period of time.

Another thing to consider is what actually motivates people from the get-go. In economics and game theory, we call this a utility function: how much payoff, use or value, someone receives and wishes to receive from a given outcome. In practice, it’s not as easy to specify different players’ utilities, and this becomes one of the most difficult challenges in designing games. The biggest mistake we can make is to over-assume players intentions. Bad-actor behaviors can be misidentified as misguided actions of normal individuals. At the same time normal but “suspect” behaviors could be perceived (under a more “paranoid” mind-set) as the action of moles within the community. Doing so might result in us perceiving others as irrational when they might just have a different utility functions than we predicted.

In the end, many protocols, security questions and games still rest on human judgment calls. Nonetheless, thanks to cryptoeconomics and game theory the understanding of human decision making process is getting better by the day, making it easier to build systems that align participant goals with outcomes that are desirable for the network.

Read more about other interesting coins

Social trading became popular in forex. Team from CoinDash (CDT) is trying to bring such platform live on blockchain.

Golem Network (GNT coin) is building world’s biggest supercomputer. A competition to them is XEL (Elastic coin).

NEM (XEM) crypto is building new movement in economy and blockchain.

As for the privacy coins – Monero coin (XMR) along with DASH (DASH coin) is most known. Right behind them, ZEC (Zcash cryptocurrency) and many forks of it are fighting for their place in the spotlight. Another well-known privacy coin is XVG (Verge) that generated lot of interest and hugh spike in its value back in January 2018.

One of the newer coins on the market is Po.et (POE) – a blockchain-based platform designed to track ownership and attribution for digital creative assets.

Kin is a cryptocurrency that will be used within the Kik messaging app, which is one of the world’s largest chat and social media platforms.

The Raiden Network is essentially Ethereum’s solution to scalability issues that will introduce high-speed asset transfers for the Ethereum network. Raiden is very similar to the Lightning Network, enabling near-instant, low-fee, scalable, and privacy-preserving payments.

Quantstamp – QSP cryptocurrency is a security audit protocol designed to find vulnerabilities in Ethereum smart contracts.