What you'll learn 👉

Best crypto tax calculator in the UK

Crypto tax calculators come in handy when you deal with a lot of different crypto transactions (trading, staking, airdrops, mining etc). Here is a list of crypto tax software that have ability to create dedicated reports for the UK citizens.

The crypto market is growing exponentially daily, and investors are making huge profits. However, with those profits come tax liabilities. Understanding crypto taxes is not as easy as it seems, especially since there isn’t much information about how cryptos are taxed. In fact, most people don’t even know what crypto taxes are.

This is where crypto tax software help comes in handy. These programs make managing your crypto taxes very easy and convenient. They help you prepare your taxes, file them online, and send them to the HMRC. Here are our picks for the best crypto tax softwares in the United Kingdom.

Koinly

Koinly is one of the best at filing crypto taxes. Data may be imported from more than 400 crypto exchanges and more than 100 crypto wallets, and your transaction data is automatically synchronized.

Koinly also supports reporting for NFTs, DeFi activities like liquidity mining and pooling, yield farming, staking, airdrops and many other crypto ventures.

Its distinctive tax report templates include those that are made specifically for UK taxpayers and include information about your income and allowable deductions. Even a complete PDF file is produced for archiving purposes.

The platform offers a free pricing plan that allows for a maximum of 10,000 transactions (which are free to calculate but you need to pay in order to be able to download them). Depending on the number of transactions it offers, yearly memberships may cost anywhere from $49 and $279.

Coinledger

Any nation, including the United Kingdom that accepts FIFO, HIFO, or LIFO accounting may utilize CoinLedger as their crypto tax reporting system.

Over 300,000 crypto investors are utilizing this crypto tax software because of its simple design. They work with over 10,000 different cryptos and a wide range of wallets, exchanges, NFTs, DeFi protocols, staking platforms and other services.

Your previous transactions may be easily imported because it syncs with your favorite platforms. Whether you trade, earn interest or buy NFTs, you can effortlessly import your transactions and figure out your taxes.

There is no free pricing plan available. The cost of an annual subscription varies from $49 to $299 based on how many transactions it offers.

Zenledger

One of the most well-known platforms for crypto tax software is ZenLedger. It is intended to make managing crypto transactions and tax filing simple with its user-friendly interface.

The procedure is simple to follow. Simply integrate the tool with your platform or service (or download transactions in the form of a CSV) and import the data into Zenledger. There are more than 400 exchanges and wallets it supports and more than 30 different De-Fi protocols.

Another thing that sticks out is the outstanding standard of customer service provided by ZenLedger. Every day of the week, its pros are available via phone, chat, and email at all times.

The platform offers a free pricing plan that allows for up to 25 transactions each month. Prices for an annual subscription start at $49 and go up to $999, with the difference reflecting the number of transactions the tool will calculate.

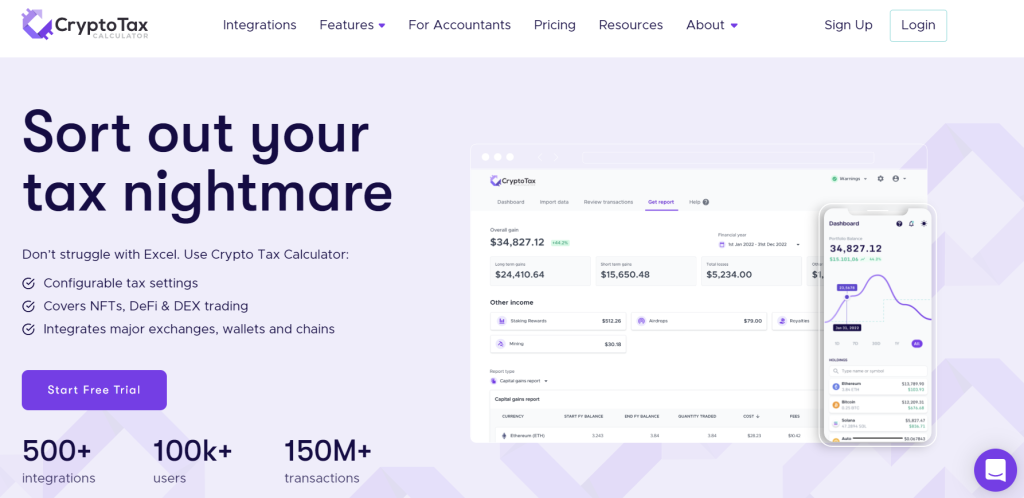

CryptoTaxCalculator

Cryptotaxcalculator is tailored to the needs of accountants and bookkeepers, and it includes support for tax regulations in the United Kingdom and worldwide. This makes it perfect for accountants and anyone who wants to keep tabs on their crypto holdings.

Present in almost 20 countries. Over 100,000 users have utilized the platform’s more than 150 million transactional activities.

It looks at the addresses of your digital wallets and automatically creates reports based on your past transactions. Without leaving the app, the data may be exported to a CSV file or converted to a PDF document.

There is no free pricing plan available. The cost of an annual subscription varies from $49 to $299 based on how many transactions it offers.

Visit Cryptotaxcalculator.io Now

Is crypto taxable in the UK?

Although cryptos are a relatively young asset, their rules are still being developed. Whether they are exchange tokens, utility tokens, or security tokens, crypto assets are not regarded as a form of money by HMRC. However, how the tokens are utilized will determine whether they are subject to tax.

Bitcoin is an exchange token used as a payment mechanism, much like many other exchange tokens. You will still be responsible for paying Capital Gains Tax on any profits you generate, even if you hold crypto investments like Bitcoin for personal use.

How is crypto taxed in the UK?

Regardless of whether you believe in the reliability of cryptos, any earnings you make from investing in them are subject to taxation. In the United Kingdom, tax is due on capital gain above £12,300.

Gain, total taxable income, and allowable deductions all play a role in determining your tax liability. A person’s Crypto Capital Gains Tax rate is determined by their Income Tax bracket. Below is a table displaying the various rates of the Capital Gains Tax:

| Capital Gains Tax Rate | Income Tax Band |

| 10% | Basic Rate (£12,301 – £50,270) |

| 20% | Higher Rate (£50,271 – £150,000) |

| 20% | Additional Rate (more than £150,000) |

For example, if you pay taxes at the basic rate and earn £30,000 in crypto profit, you must subtract the £12,300 in capital gains tax-free allowance. The remaining £17,700 will be subject to a 10% capital gains tax after that.

When we talk about income, things are different. The amount of income on which you are not required to pay taxes is known as the Personal Allowance, which is £12,570. Below is a table displaying the various rates of Income Tax:

| Tax rate | Tax Rate Band |

| 0% | Personal Allowance (up to £12,570) |

| 20% | Basic (£12,571 – £50,270) |

| 40% | Higher (£50,271 – £150,000) |

| 45% | Additional (over £150,000) |

Scottish Income Tax rates are different from other parts of the UK. Tax rates are listed in the table below.

| Tax rate | Tax Rate Band |

| 0% | Personal Allowance (up to £12,570) |

| 19% | Starter (£12,571 – £14,732) |

| 20% | Basic (£14,733 – £25,688) |

| 21% | Intermediate (£25,689 – £43,662) |

| 41% | Higher (£43,663 – £150,000) |

| 46% | Top (over £150,000) |

If your adjusted net income is over £100,000, your personal allowance will decrease by £1 for every £2 over that amount. If you make over £125,140, your allowance drops to £0.

When do you pay tax on crypto?

Both income and capital gains from cryptos are taxable in the United Kingdom.

Depending on how much the value of your crypto has increased or decreased since you first acquired it, you may realize a capital gain or loss when you dispose of it. Events of disposal are:

- if you bought things with cryptos

- if you earn fiat money from crypto selling

- if you gifting crypto (excluding to spouse)

- or if you trade one crypto for another

When you have income, such as when you earn crypto, you are liable to income tax. The following situations are subject to income tax:

- if you stake in cryptos

- if you earn crypto as recoupment for a job done

- or if you mine cryptos as a hobby

Buying and selling crypto

Will you pay tax when you buy crypto in the UK depends on do you do that with fiat money or with crypto?

If you buy your crypto using fiat currency, like GBP, you’re not taxed.

Trading cryptos is subject to taxation in the United Kingdom. As with selling or spending, HMRC considers exchanging Bitcoin for Ethereum or any other crypto to be a form of disposal. It is the asset you dispose of, and you’ll pay Capital Gains Tax if you’ve made a gain.

You will pay tax when you sell crypto in the Uk. The value of your debt for tax will vary depending on your income.

Depending on how much recurring income you make, you will pay 10% or 20% of the earnings on the sale. Of course, you will subtract the sum, which is Capital Gains tax-free allowance, e.i. £12,300 from the total earn sum.

Paid in crypto

For tax purposes, getting paid in crypto is the same as getting paid in a traditional currency like pounds because crypto can readily be converted into cash. The crypto payment will be subject to income tax and national insurance contributions. The value of the money you receive will be determined by the market price of the crypto used to make the payment at the time of the transaction.

Crypto you inherit

👉 Cryptos are subject to inheritance tax like any other asset included in a decedent’s estate. For instance, in the United Kingdom, the current threshold for imposing an inheritance tax is £325,000, and the rate rises to 40% for estates worth more than that. Charity donations are always exempt from taxation, regardless of their value, and estates bequeathed solely to spouses are also normally exempt from taxation.

Mining and staking

Income can be in the form of crypto, whether it be mined, staked, earned as interest, or waged. The value of the crypto at the moment you acquire it determines the amount of revenue you will recognize.

Keep in mind that if you are mining for cryptos as a hobby rather than a company, your earnings from mining and staking will be taxed differently.

Mining as a business

Profits from mining operations are company income, will be added to trading profits, and are subject to income taxation. It is also possible to write off appropriate costs.

Mining as a hobby

👉 Income earned from mining as a hobby must be included under “Miscellaneous Income” on a tax return. It is possible to reduce taxable income by the number of certain costs.

The HRMC has declared that if you have earned less than £1,000 mining cryptos, you do not require to file a tax return.

Airdrops

In the case of airdrops, you will be subject to both income tax and capital gains tax.

You must pay income tax on any money you receive as a result of airdrops, even if you did nothing more than share a social media post or make some earlier trades on a certain blockchain. When you sell, exchange, spend, or give away airdropped coins or tokens in the future, you’ll be subject to Capital Gains Tax.

Crypto Savings Accounts

The crypto you keep in a savings account is not taxable, but the interest you earn on your savings account is income, and that income will be subject to Income Tax. How much you pay will depend on your income and the tax rates that will be applied to that income.

How Do NFTs Fit Into the Crypto Tax Landscape?

Capital gains or losses may be incurred when purchasing an NFT using crypto due to market fluctuations in the value of the crypto used to make the transaction. Furthermore, if you sell an NFT, you may be subject to capital gains or losses based on how the price of your NFT has changed since you first obtained it.

Thus, buying or selling NFTs is subject to Capital Gain Tax.

How is DeFi staking rewards taxed?

Depending on the circumstances, capital gains or income taxes may be applicable to a DeFi transaction.

An asset staked using DeFi can be viewed as a taxable crypto-to-crypto exchange. For instance, if you get stETH after depositing ETH, you will either make a profit or lose money on your investment, depending on how the value of your crypto has changed. It’s important to remember that any winnings you accrue through staking will be treated as taxable income.

Users can get loan funds from many different DeFi protocols. As collateral, users can lock up their existing crypto and get tokens in exchange. As an example, you could pledge LTC as collateral in return for SOL. When you pledge assets to a DeFi protocol, you create a taxable transaction. If the value of your collateral has increased since you first obtained it, you will experience capital gains.

How Does HMRC Know About Your Crypto Assets?

With data requests to crypto exchanges in the United Kingdom, HMRC may learn who holds crypto assets. That, it is hoped, will prompt holders of crypto assets to double-check their tax filings to ensure they are properly accounting for income and capital gains.

UK Cost Basis Method

For crypto cost basis approaches, often known as share pooling, the UK’s HMRC has extremely precise rules. This is done to prevent crypto traders from gaming the ACB cost basis approach by rapidly buying and selling assets at a loss to inflate their profits or losses.

There are three different cost-basis methodologies available in the UK, and you must determine which one best fits your assets by going through each one in turn:

- Same-Day Rule: Gains or losses incurred from the purchase and sale of coins on the same day must be applied to the cost basis established on that day. Forget about this guideline and go on to the next one if your daily sales are more than your daily purchases.

- Bed and Breakfasting Rule: Gains or losses from the sale and subsequent purchase of the same coins or tokens within a 30-day period are determined by the purchase price paid for those coins or tokens within the same 30-day period. Proceed to the last rule if you are selling more this month than you are purchasing.

- Section 104 Rule: For any crypto transactions when none of the above two exceptions applies, the cost basis technique must be used. Similar to the ACB approach, this method determines an asset pool’s average cost basis by dividing the entire amount spent on assets by the total number of coins and tokens held.

Is Crypto Interest Taxed?

Tax authorities will treat crypto interest the same way they would do dividends or bonuses and tax it as income. The value of the crypto at the time of sale is used to determine profits and taxes owed, and this sum is then reported as additional income on your annual tax return.

Claiming losses on worthless assets/lost keys

A capital loss can be claimed if you own crypto and it has lost value, or you have lost access to the private keys. A capital loss might balance any annual capital gains and lower your total tax burden.

If you own crypto that has lost all value, you may submit a claim for “negligible value.” Because of this, you may pretend that you sold the asset even if you still own it. The resulting capital loss might be deducted as well.

The following details should be included in your assertion of trivial value:

- What type of crypto asset is it

- At what price the asset shall be considered disposed (typically £0)

- Date by which ‘disposal’ should occur

A request for negligible value also can be submitted if you lose your private keys. This request must be submitted in the same year when you lost the approach to your crypto.

Learn more about how to report taxes on other crypto activities:

- How to do DeFi taxes

- How to report NFTs on your tax return

- Best crypto tax tools in Australia

- Best crypto tax calculators in Canada

FAQs

Spending crypto as transaction fees and gas fees is considered disposal of a capital asset, which requires reporting capital gain or loss from the disposal.

For example, if you want to submit a tax report for the 2022/2023 financial year, you must do that by the 31st of October 2022 if you will submit it by post or by the 31st of January 2023 if you submit it online.

Yes, Koinly works in the UK. It helps UK citizens to calculate their taxes and create tax documents for HMRC.

Yes, HMRC can track crypto. The HMRC has taken action in recent years to stop crypto tax avoidance. In order to persuade crypto investors to pay capital gains and income tax, the HMRC has sent “nudge” letters and sought and collected customer data from significant exchanges.

While Koinly offers this right away for free, along with support for futures, forks, and loans, CoinTracker will require you to upgrade your subscription in order to handle margin trading and DeFi. Koinly is the finest option if you’re serious about trading cryptos, in short.

Crypto tax in the UK is free if you have capital gains below £12,300 or your income is below £12,570.