What you'll learn 👉

Is Cryptocurrency Taxed in India?

Currently, there is no regulation of cryptocurrencies or non-fungible tokens (NFTs) in India, but you still gotta pay taxes on cryptocurrency activities if you’re an Indian resident.

The Reserve Bank of India (RBI) attempted to ban cryptocurrencies in 2018, but the Supreme Court struck down the proposal, placing cryptocurrencies in a legal limbo that is neither formally unlawful nor legally acceptable. NFTs suffer from the same ambiguous legal status as cryptocurrencies but do not seem to have drawn the same level of regulatory ire.

However, in April 2022, India’s government pushed a law regarding cryptocurrency taxes.

How is cryptocurrency taxed in India?

Beginning on April 1, 2022, the Income Tax Act was changed to include provisions for the taxation of gains and/or income from VDAs. VDAs are as defined by the Income Tax Act:

- The lack of Indian or foreign cash in cryptocurrencies (the proposed digital Rupee would seemingly be exempt as a result)

- NFTs or comparable tokens as specified by the Central Government; and

- Any further digital assets that the central government may make known.

When Do You Have to Pay 30% Tax on Crypto?

The tax rate for profits from VDAs, including crypto and NFTs, will be a flat 30%. The top income tax bracket in India is the same as this rate. Private investors, professional traders, and anybody who transfers digital assets during a particular fiscal year are subject to the flat tax rate.

Can We Avoid 30% Crypto Tax in India?

Since the declaration that income from cryptocurrencies and other virtual digital assets will be subject to a flat 30% tax, this is likely one of the things that Indian cryptocurrency investors have the most questions about. Many investors are still searching for tax-evasion strategies. They are falling prey to numerous so-called experts in their effort to save tax. One of the tips offered by these so-called experts is that by investing in foreign exchange, you can avoid paying 30% in taxes.

However, according to legal experts, investing on international exchanges would not allow you to avoid paying a 30% tax on cryptocurrency revenue. It’s crucial to realize that Indian investors may earn money from cryptocurrencies or other VDAs, which are subject to a 30% tax. This is unrelated to the place or point of origin of the exchanges.

Beginning with the FY 2023–24 Assessment, a 30% tax will be imposed.

You must submit your income to the tax authority even if you acquire or sell cryptocurrency on exchanges outside India. According to experts, failing to pay tax on any such income would be the same as evading taxes, which might make your life more difficult due to legal complications.

1% Tds on Crypto Assets

If your crypto transactions total more than 50,000 INR (or 10,000 INR in some situations) in a single financial year, you must also pay a 1% tax deducted at source in addition to the 30% flat tax.

Can you harvest Crypto losses in India?

Regrettably, taxpayers in India are not permitted to deduct capital losses from cryptocurrencies in their tax returns. When you sell bitcoin at a loss, you won’t owe any taxes on the transaction, but you also won’t be able to use the loss to offset profits from cryptocurrencies or other sources of income.

Nontaxable crypto transactions in India

It’s still not clear which crypto transactions are taxable in India.

There are numerous situations in which paying tax on cryptocurrency may be necessary, and the finance minister of India needs to clarify these. But taxable transactions could involve:

- Purchasing cryptocurrency with INR or another fiat cash

- Trading stablecoins and other cryptocurrencies

- Using cryptocurrency to buy goods and services

- Giving cryptocurrency as a gift—if you’re the one getting it

- Earnings from other sources, such as currency mining

- To receive a wage in cryptocurrency.

- Stake benefits.

- Tokens for mining

- Airdrops

Additionally, there are numerous possible tax repercussions from DeFi operations.

How to calculate tax on crypto – best crypto tax calculators in India

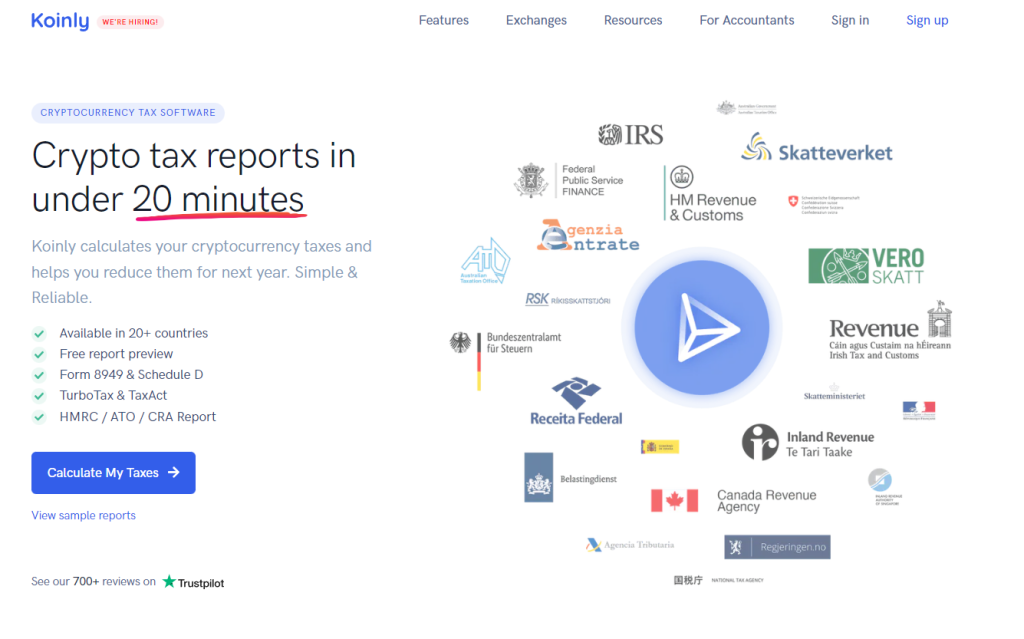

Koinly

Koinly is an accounting and crypto tax reporting tool designed to make it easier for people to keep track of their capital gains and losses. Users simply connect their exchanges and wallets and let Koinly do the rest. Then, you’ll receive a personalized crypto tax report, ready to submit to your tax authority.

You can easily see all your balances, trades, and portfolio information in one place.

Koinly offers a free plan that allows you to make up to 10,000 trades per month. To unlock everything else, there are three different paid plans ranging from $9/month to $29/month. You can try out the free version here.

With over 700 integrations, including popular exchanges like Binance, Coinbase, Kraken, Bitstamp, etc., Koinly connects thousands of exchanges, blockchains, and wallets to help you better understand your investments and compile a tax report.

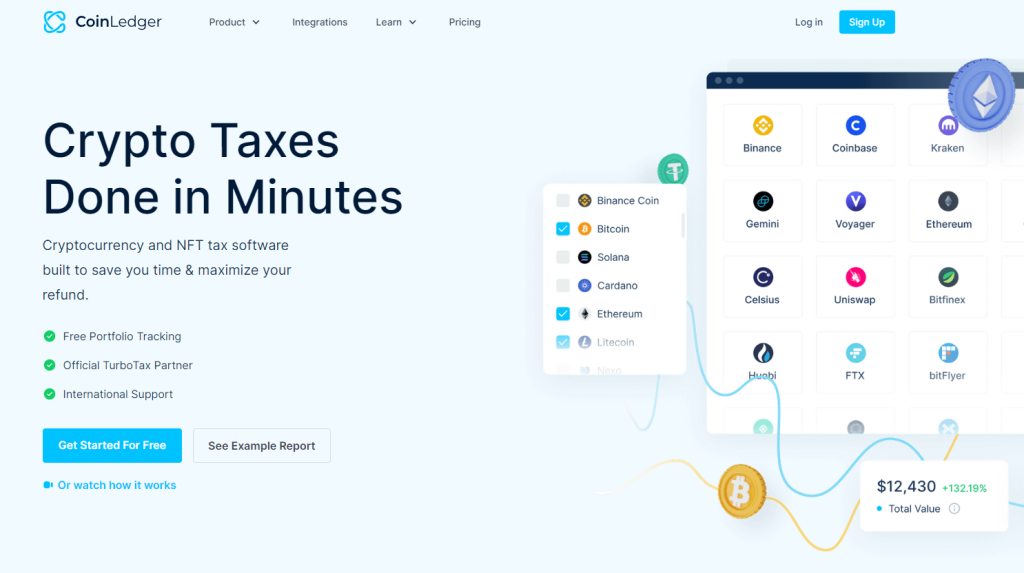

Coinledger

The CoinLedger is a cryptocurrency tax report calculator that allows users to track their crypto transactions and file a report in one of the three different types of reports: FIFO, HILO, and LIFO. These are commonly used accounting terms to describe how money moves into and out of business.

Any nation, including India that accepts FIFO, HIFO, or LIFO accounting may utilize CoinLedger as their crypto tax reporting system.

Over 300,000 crypto investors are utilizing this crypto tax software because of its simple design. They work with over 10,000 different cryptos and a wide range of wallets, exchanges, NFTs, DeFi protocols, staking platforms and other services.

Your previous transactions may be easily imported because it syncs with your favorite platforms. Whether you trade, earn interest or buy NFTs, you can effortlessly import your transactions and figure out your taxes.

There is no free pricing plan available. The cost of an annual subscription varies from $49 to $299 based on how many transactions it offers.

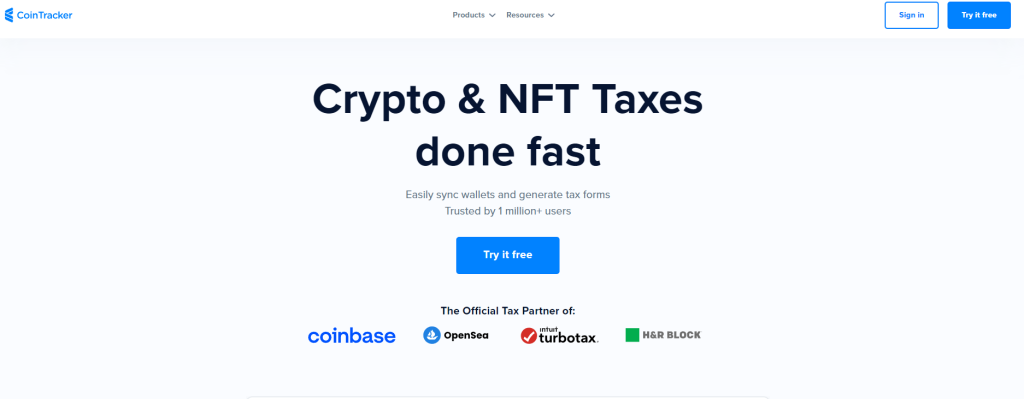

Cointracker

One of the oldest tax calculators in the crypto world. Cointracker came into the scene in early 2017. They managed to help so many with the 2017 ATH period and then the following 2018 crash as well. This is why they are usually the most used ones in the tax calculating world.

For a very long time, they offered free services for a large portion of the traders unless you traded multiple times a day for long time. However, their free version is pretty limiting these days. Cointracker free calculator lacks DeFi calculations as well, which in today’s world is not something people could be fine with considering how many of us invest in the DeFi world.

If you are a long-term investor with no DeFi investment then you can’t get any better than cointracker. Their paid version is so unlimited, they have options for as high as $3k for full service. Obviously, that is for people who trade tens of thousands of times per day, and not a very common thing.

The free version on the other hand can handle only 25 transactions per month. Which is usually the industry standard to offer for the free version in almost every place.

The basic version of this platform allows you to track prices of around 8,000 coins/tokens. The premium version allows you to track over 3,500 coins/tokens, and you don’t have to pay extra for it. With this feature, you can access historical data and charts.

In terms of market analysis, CoinTracker provides real-time graphs and statistics. These include volume, open interest, high/low, and many others. You can view the graph in either bar or column format.

Read also:

- best crypto tax tools for Australia

- best crypto tax tools for Canada

- best crypto tax tools for UK

- how to pay taxes on DeFi

- how to pay taxes on staking rewards

Do you pay tax when you buy crypto in India?

No, just purchasing and owning cryptocurrency does not make you taxable in India. The tax is frequently paid after you sell and the gains are “realized.”

Will you pay tax when transferring crypto?

Cryptocurrency transfers between wallets are tax-free. Indian tax authorities have not yet provided instructions on how to tax cryptocurrency transfer fees. Transfer fees may therefore be viewed as disposal. Transfer charges could be considered an investment expense rather than a cost.

How are airdrops and forks taxed in India?

Airdrop in the cryptocurrency sector functions similarly to how brands taste-test new items by delivering samples to retail merchants. Some new tokens or NFTs are airdropped to investors whenever they are introduced.

This can be split into two pieces because it is not a direct investment. First off, the assets that were airdropped will qualify for taxation as “other incomes.” If investors keep the assets after the airdrop event and make a profit from them, that will be subject to the updated 30% cryptocurrency tax.

Crypto & NFT gifts and donations tax in India

We’ll have to wait and watch how India taxes NFTs. NFTs, or Non-Fungible Tokens, are also considered Virtual Digital Assets under the new tax laws. In other words, if you purchased an NFT and made a profit off of it, that profit will be taxably coupled with a surcharge and a 4% cess.

Mining and staking tax for Indians

There are two different types of taxation that apply to cryptocurrency mining in India. The cryptocurrency tokens you earn through mining will be subject to business income tax. The second type appears after you’ve profited from HODLing the cryptocurrency. When you sell the asset, you must then pay the 30% tax.

How is DeFi taxed in India?

The new tax framework for cryptocurrencies will be governed by section 285BA and subsection (k) of the IT Act, even though the ITD has not yet provided guidelines on DeFi transactions specifically. Profits will probably be taxed as income at a flat rate of 30%.

How do you file your crypto taxes with the ITD?

You’ll need the Income Tax Return AY 2022-23 ITR-2 Form to submit your cryptocurrency taxes.

Cryptocurrency profits shall be declared and subject to a flat 30% tax beginning on April 1st, 2022, according to the 2022 Finance Act. This is just outside of the fiscal year (2021-2022) that you will be reporting on.

However, reporting your cryptocurrency gains and income is a prudent course of action to prevent an unwanted audit from the ITD. For specialized advice, you should speak with an expert crypto accountant. Until the ITD releases a form specifically for crypto tax reporting or updates the ITR-2 Form, you can report crypto activities in Schedule OS, line 2s of the ITR-2 AY 2022-23 Form.

Where to report cryptocurrency gains Income Tax Return (ITR) forms?

There is no specific place on the AY 2022-23 ITR-2 form for reporting cryptocurrency gains and income, at least not at the time of writing.

FAQs

To save your crypto tax in India, the process is the following:

1. Keep your cryptocurrency for the long run.

2. Get a sideways look at cryptocurrency.

3. Sell during a year of low income.

4. Maintain your gains in stablecoins.

To file your bitcoin taxes, you’ll need the Income Tax Return AY 2022-23 ITR-2 Form. To avoid an unnecessary audit from the ITD, it is important to record your bitcoin gains and income. You should get counsel from a qualified crypto accountant if you need specific information.

You can disclose your cryptocurrency operations in Schedule OS, line 2s of the ITR-2 AY 2022-23 Form until the ITD issues a form expressly reporting your cryptocurrency tax obligations or modifies the ITR-2 Form.

Yes, the income from cryptocurrencies is taxable in India; according to the Income Tax Act of 1961, there is currently a tax of 30% plus a surcharge and cess on the transfer of any VDA, including Bitcoin and Ethereum (Income Tax Act).