What you'll learn 👉

What is rebalancing?

Rebalancing is a very common investing practice that is utilised in order to reduce the level of risk in your portfolio and not over or under expose yourself to certain assets, this way you can make the best profit possible. It is done by either selling or buying assets in your portfolio in order to balance them against each other at a level you are comfortable with. Overtime, your assets will move up or down, and outpace each other in doing so, it is important to put them back to their original levels or another level of your choice in order to not risk being over exposed to a specific asset.

The Best Crypto Rebalancing Bots

Before we go through each of these (and some of their competitors) in detail, let’s have a quick look at 3 best options.

How does rebalancing work?

Periodically, whether it is every week, month, or quarter for example, you sell and buy the necessary assets to have them at a level of portfolio allocation that you desire.

👉 For example, if you have two assets, each holding 50% of your portfolio and asset A increases by 100% which Asset B remains at its original level, your portfolio now consists of 66.67% Asset A and 33.33% Asset B. To rebalance your portfolio, you would simply sell some of Asset A, buy some of Asset B, or both in order to get it back to the desired level of 50% of your portfolio in each asset.

Why rebalancing a crypto portfolio?

Rebalancing is a popular investing practice and has been for a long time, way before crypto was ever concieved, though despite this, the cryptocurrency market is a market that can benefit from it greatly. Due to the intense and often unpredictable volatility of the cryptocurrency market, especially in smaller coins, it is not uncommon to see anything from a 10% to a 1000% rise over a period of time. If you are managing a large portfolio especially, it can be very important to rebalance your coins so that your portfolio isn’t wiped out by a coin that you have become over-exposed to due to price increases.

Common Rebalancing Strategies

Calendar Rebalancing

Calendar Rebalancing is one of the simplest and most common forms of rebalancing out there. Using this method, you rebalance your portfolio after a certain period of time, usually a week, month or even a quarter depending on factors such as the industry, risk tolerance and more.

👉 This is a very easy strategy to manage as you simply make a few transactions at a set time every interval, and you don’t need to pay any other attention to your rebalancing strategy other than that one rebalancing session. Some facilities and programs can even automate this process, making it easy for you to sit back and know you will be exposed to coins or assets in the way that you want to be.

Percentage-Of-Portfolio Rebalancing

P-O-P Rebalancing is when you rebalance your portfolio in accordance with the original weights (e.g. An asset representing 10% of total portfolio.) This method is very common and is more than suitable for the crypto market, due to how fast the market can change, it’s good to rebalance so you are prepared for the next major change in the market, or more specifically, a change in the prices of the coins you hold changing.

👉 Often in crypto you can see one of your coins fly all the way to the moon, but too often people will let it fall all the way back down without selling, this is why rebalancing is important, as if you don’t put your holdings to their original weights, you are set to lose a lot from one coin.

Both this strategy and the previously mentioned Calendar rebalancing strategy are “Constant-mix” strategies. This simply means that the weight of the holdings/the percentages of your portfolio that your assets take up don’t change.

Constant-Proportion Portfolio Insurance

This strategy is quite different to the ones that we have looked at previously, rather than keeping the weights the same, the CPPI strategy assumes that as the portfolio grows in size, so does the investor’s risk tolerance.

👉 CPPI works off the idea that the investor has a certain amount of money they are wanting to risk more or less than the rest of their portfolio. Using mathematical equations, we can determine how much of their assets should be put in riskier assets such as stocks or crypto and how many in no-risk assets such as risk-free securities.

CPPI strategies are very subjective, and the fine details are often defined by the user and the market in which they are investing. Certain factors must be determined such as the rebalancing period, and just how risky their risk tolerable assets are.

Tax Implications (US Specific)

It may seem obvious, but it is worth mentioning that if you conduct your investments in a non-taxable account such as an IRA or a 401(k), you are able to rebalance at whatever strategy is most beneficial to your portfolio and not worry about any sneaky tax costs creeping up. Therefore, we heavily recommend this for those looking to minimise taxes as it completely removes you from any tax responsibilities on these assets.

One good way to try and minimise the tax implications on your crypto portfolio is to put new contributions into your account, on smaller, less appreciated assets. This will reduce transactions and will charge you less tax overall. Though by putting your money into your underappreciated positions, it might be a while before those positions start moving.

Another way is to reinvest any dividends or profit you make into your smaller, less-appreciated positions, rather than your overinflated ones. This will help boost up your positions which are still yet to rise, without having to pay as much tax spreading them out.

Rebalancing frequency

The frequency of your rebalancing is largely influenced by the market that you are trading. Cryptocurrency is an extremely volatile, fast moving, emotional market. This means that it is good to rebalance often, as although you could make it fast, you could lose it too, so it’s good to rebalance often and bank those gains by spreading them across the profile.

A lot of people in the crypto space who rebalance their whole portfolio do it on a weekly basis. Though often in crypto, people will rebalance a coin once it hits their price goals. This means that once a coin they have invested in has hit its target price, they will sell the coin and rebalance that over their existing positions, and or invest some of the profits into a new position.

Read also:

- Best Cryptocurrency Portfolio Trackers – Altcoin Management Apps

- Best Crypto Screeners Apps RIGHT NOW

- Best Apps for Trading Crypto– Trade On The Go!

- Best Anonymous Bitcoin Exchanges

When Does Rebalancing Outperform hodling

The cryptocurrency social trading platform Shrimpy did a study on the benefits of HODLing your coins compared to the benefits of rebalancing, and it found that in a large majority of portfolios that rebalancing was more profitable. They tested the results of buying a random selection of 2-10 cryptocurrency assets of a period of time and found that most scenarios were beneficial to rebalancers. For example, one of the better performing experiments was rebalancing every hour. The report states that portfolios that select 10 cryptoassets at random and rebalanced the portfolio every hour, had a median average of performing 234% better than their hodl equivalents. With the same experiments except the rebalance period is once per month; you would have a 99.75% chance of outperforming hodling.

This is an incredible figure which illustrates how much a of a powerful tool rebalancing is.

Best Crypto Rebalancing tools:

Quadency

Quadencyoffers a rebalancing bot with their services, which will automatically rebalance your portfolio, so you don’t need to think about it. You have a great level of control over the bot’s parameters. You are able to select the specific assets that are eligible for rebalancing, their allocations, the interval at which you wish to rebalance (anywhere from hourly to one-time), and lastly the threshold.

As Quadency facilitates more than just portfolio rebalancing, they sell their services in packages. The cheapest package that contains their rebalancing bot is the “Pro” plan, coming in at $49 per month.

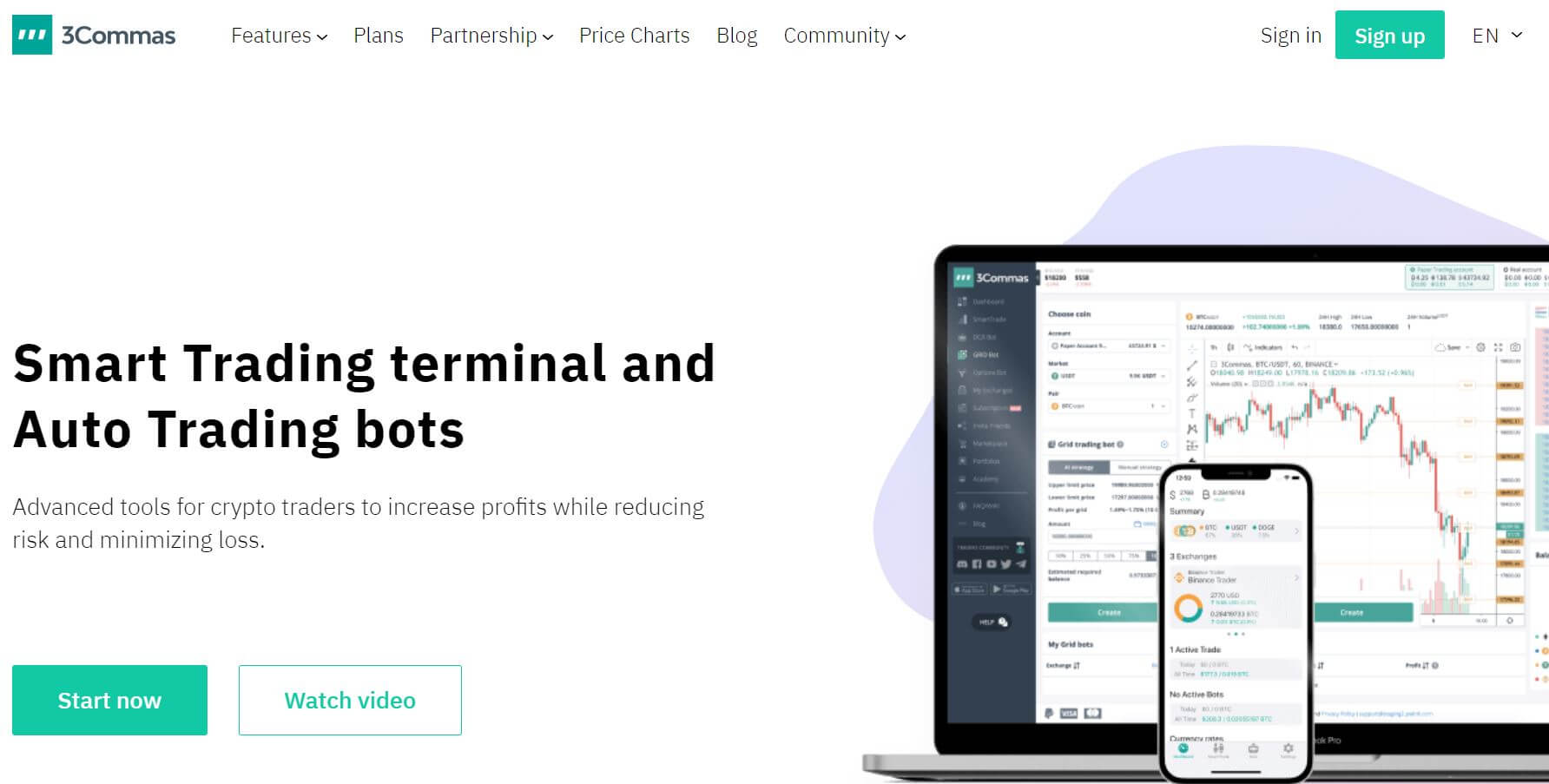

3commas

3Commas.io offers a simple rebalancing tool on the portfolio section of their platform. Here you can setup the program so that after a certain period of time, your portfolio will automatically buy and sell assets to rebalance your portfolio.

With 3Commas.io you can sign up using their free trial, once this has concluded you can purchase any of their plans in order to gain access to the portfolio tools. The cheapest plan available to purchase is the “Starter” plan which comes in at $14.50 per month.

Shrimpy

Lastly, we have Shrimpy. Unlike Quadency and 3Commas, Shrimpy is a tool that was created for the sole purpose of portfolio management, you simply open the web app, add your portfolio and start customizing your rebalancing periods, your weighting, etc. All on their simple and smooth UI! Making this a great program for beginners looking to automate their portfolio and step back from any kind of trading.

Shrimpy’s cheapest plan that offers you their rebalancing services is the “Proffesional” package, coming in at $19/month.

Conclusion

As you can see, auto-relabalancing tools can help you grow your crypto portfolio and beat a simple HODL strategy that most crypto users consider a safe bet.