There are a lot of cryptocurrency trading bots on the market but only a few of them work with in the futures markets.

We will review the top 3 futures trading bots that automatically trade with leverage.

What you'll learn 👉

Bitsgap Futures Bot

The Bitsgap Combo bot is designed to profit from both rising and falling prices and it works only with Binance Futures. It uses leverage, which allows you to trade at a higher margin than normal. This means that your trades will generate returns up to 1000% faster than normal. However, the volatility of the crypto market also means that there is a greater chance of losing money.

BitsGap’s trend following bot combines grid and DCA algorithms to operate on futures trading. The bot utilizes grid technology to execute trades when markets are moving. When markets are not moving, the bot will wait until there is a significant movement before executing a trade. DCA is an ultimate algorithm to apply the dollar cost averaging effect to optimize the entry point.

The bot will automatically adjust its entry price when the market moves in an opposite direction. If the market moves in the predicted direction, the bot will adjust its initial size and increase it up to 3x. The bot will also adjust its trailing stop loss level.

Read also our review on the Bitsgap arbitrage bot.

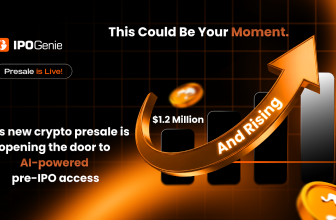

Kucoin Futures Grid Trading Bot

As its name suggests, the Kucoin Futures Grid bot combines grid trading and futures trading. It can help you earn grid profit when going long or short, depending on market conditions.

The bot will divide its investment into several grids and buy low and sell high within the price range you’ve set. The futures grid is a type of trading strategy where the trader tracks the price of the contract and continually reaps profit from the trades.

The Profit of the Futures Grid Bot are from funding fees, grid profits and futures profits.

How to set “customize” parameters?

Step 1: Pick a contract

Step 2: Pick long or short.

Step 3: Choose leverage. The higher the leverage, the higher the risk of liquidation.

Step 4: Set the price range. You can choose “Fill AI Parameters”, then change the parameters based on your needs. The lower price is the minimum price for the bot to buy a contract and the upper price is the maximum price for the bot to sell. When the market price is below the lower price, the bot will stop buying contracts; when the market price goes beyond the upper price, the bot will stop selling contracts. In other words, the bot will only trade within the preset price range.

Step 5: Set the number of orders, namely the number of grids. Under the same price range, the more the number of orders, the more the grids, and the more frequent the buy low and sell high.

Step 6: Enter the amount you’re willing to invest.

Step 7: Tap “Create” to run the bot.

Excellent built-in futures grid bot. Check the full review of the Kucoin trading bots here.

Pionex Spot-Futures Bot

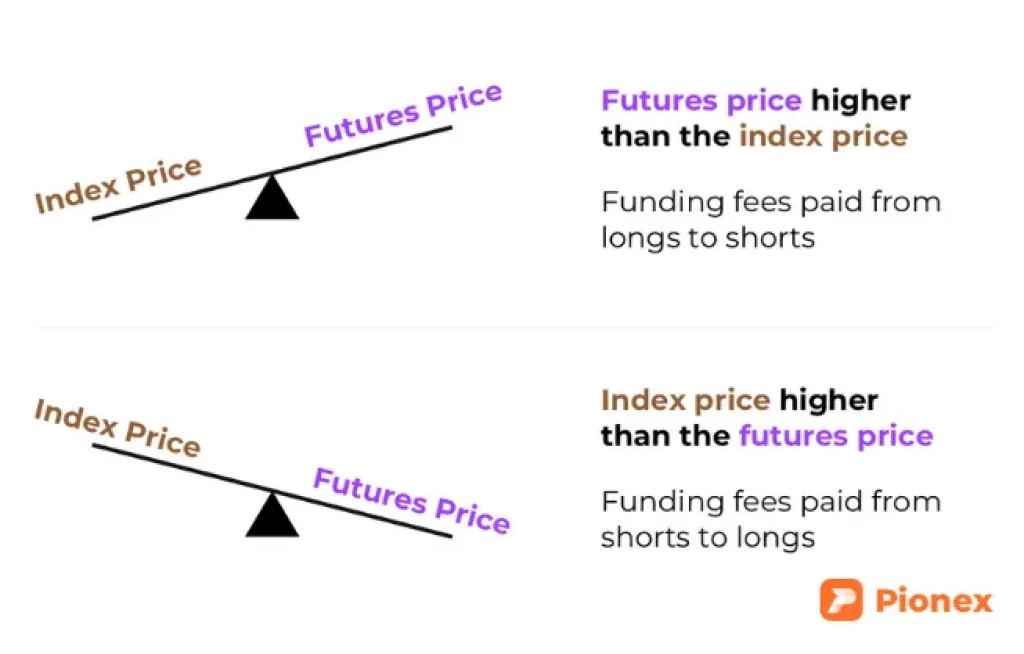

Pionex is an exchange with more than a dozen built-in bots. The came up with an interesting concept where you earn from the funding rates that are paid out to the shorting traders.

When you open a short position, you will be charged a trading fee when your order is executed.

More important than trading fees is funding rate (payment exchanged between traders who have short or long positions) that traders receive or pay every 8 hours. If the funding rate is negative, shorts are charged a funding fee and longs receive funding and vice versa.

In order to hedge against the risk of an unexpected price change, we hold a short position in the spot market and a long position in the perpetual futures contract. We receive the funding rate every eight hours.

If you do this type of strategy with $10k budget, you can earn a 27.375% APR, from funding rates only. Here is the math:

Let’s say we have 10000 USDT for the spot-futures arbitrage while bitcoin’s price is 10000 USDT. Here’s how we’re going to do:

- Transfer 5000 USDT to the futures account and the rest 5000 USDT to the trading account.

- Buy 0.5 BTC (5000USDT) in the spot market and short 0.5 BTC in the perpetual futures market with your 5000 USDT

- If the current funding rate is 0.05% right before the charges, then you’ll get 2.5 USDT.

0.5 * 10000 * 0.05% = 2.5 USDT - If the funding rate remains at 0.05%, we can receive 3 times a day, which means it’s 27.375% APR

2.5 * 3 * 365 = 2737.5 USDT

2737.5 / 10000 * 100% = 27.375%

What’s different about using a bot to trade futures?

Cryptocurrency trading is a lot like playing poker. You don’t want to play against someone who knows what he or she is doing because you’ll lose money. But you do want to play against people who know nothing about the game, because they’ll likely lose money too. Traders often complain about being “stuck in front of their screen,” waiting for the next move in the cryptocurrency market. Those who use automated trading platforms say there’s no better way to avoid this problem.

The basic idea behind trading bots is simple: let computers do the hard work while humans take advantage of the resulting data. There are many types of trading bots available, but one of the most popular ones today is called a ‘futures bot.’ Futures bots are designed specifically to help traders enter and exit trades quickly and efficiently no matter the trend – either the prices go up or down, futures bot are a tool to help you make money in both cases. They’re used by professional traders around the globe.

Which exchanges support futures trading bots?

Both of these bots work only with Binance Futures. Kucoin Futures has its own built-in bot.

As one of the largest and most popular crypto exchanges, Binance Futures is receiving positive reviews from the crypto community. Users who are already trading on the Binance Spot Exchange will find the transition to Future’s platform fairly easy. Users can trade over 90 different contracts with a leverage up to 125 times, funding is only available in USDT, and fiat withdrawals can be done using an easy payment method. On Binance Futures, the maximum fee is 0.04%. For maker trades or larger monthly trading volumes, the fees are usually lower. The Binance Futurs Fees are 0.04% per market order and 0.02% per limit order. The fee decreases the greater the trading volume, starting at 250 BTC per month and owning at lease 50 BNB.

Can trading bots be more accurate than human traders?

Before making any decisions, you need to understand the overall industry. Before choosing a trading assistance, you need to consider factors like ease of use, cost, reliability, and security. Many trading bots can provide relief, but they can also prove ineffective if you’re not knowledgeable about the generation and implementation of financial strategies.