Decentralized finance (DeFi) has transformed how people interact with financial services on the blockchain. By eliminating intermediaries, DeFi platforms allow for transparent, permissionless, and decentralized trading, lending, borrowing, and more.

In this guide, we explore some of the leading DeFi protocols across two key categories:

- DeFi platforms for leveraged trading

- DeFi platforms for swaps and trading

For each platform, we’ll summarize its key features and value propositions so you can decide which ones are worth exploring further. Let’s dive in!

What you'll learn 👉

DeFi Platforms For Leveraged Trading

Leveraged trading allows traders to amplify their positions by borrowing funds. This increases profit potential but also risk.

DeFi leveraged trading protocols enable this functionality in a decentralized manner, with some offering leverage up to 150x. Here are some top options:

| Trading Platform | Description |

| Apex Omni | A decentralized exchange (DEX) developed by Bybit, offering up to 150x leverage for perpetual contracts and futures trading. It features a non-custodial, user-friendly interface with native tokens APEX and BANA for governance and incentives. |

| Mux Protocol | Enables leveraged trading on decentralized exchanges with up to 100x leverage. It focuses on enhancing the trading experience for retail DeFi traders. |

| dYdX | A decentralized platform offering perpetual trading with up to 20x leverage. It provides a non-custodial trading experience with a focus on security and transparency. |

| GMX | A decentralized spot and perpetual exchange supporting low swap fees and zero price impact trades. It offers up to 50x leverage on perpetual contracts. |

Apex Omni

Apex Omni is a decentralized exchange (DEX) developed by the crypto derivatives exchange Bybit. It aims to deliver a simplified DeFi experience tailored for leveraged trading.

Some key features include:

- Leveraged Trading: Apex Omni enables leverage up to 150x for perpetual contracts and futures trading. Traders can amplify their positions to bolster profit potential.

- Decentralized and Non-Custodial: As a true DEX, Apex Omni does not take custody of user funds. Trades occur directly between users in a decentralized manner through smart contracts.

- Smooth User Experience: The interface is intuitive and streamlined, focusing on key data like positions, lending/borrowing, and staking. This makes leveraged trading easy for beginners.

- APEX and BANA Tokens: Apex Omni has two native tokens that align incentives between traders and liquidity providers. They can be earned through trading activities and offer governance rights.

For traders interested in accessing the high leverage and potential profits of derivatives trading in a decentralized way, Apex Omni is worth exploring. As with any leveraged trading, manage risk appropriately.

Mux Protocol

Mux Protocol enables leveraged trading on decentralized exchanges with up to 100x leverage. Like Apex Omni, it aims to deliver an enhanced trading experience for retail DeFi traders.

Here are some notable features:

- 100x Leverage Trading: Mux Protocol allows traders to access up to 100x leverage on trades to increase profit potential. Numerous cryptocurrency pairs are supported.

- Zero Price Impact: Through its implementation of Virtual AMM, Mux Protocol is designed to prevent large trades from substantially impacting asset prices. This ensures smooth execution.

- Aggregated Liquidity: Mux aggregates liquidity from various sources, including platforms like GMX. This grants traders access to sufficient liquidity for leveraged positions.

- Intuitive Interface: The Mux Protocol interface shows key data like positions, leverage, lending/borrowing, and staking clearly and concisely. This simplicity enhances the trading experience.

- MUX Token: The MUX token aligns incentives between traders and the protocol. It can be earned through trading activities or staking. MUX holders can also participate in governance.

For experienced traders wanting to access the high-leverage trading of centralized exchanges in a decentralized way, Mux Protocol warrants consideration. Use risk management practices as leverage can amplify losses.

dYdX

dYdX is a decentralized derivatives exchange that facilitates margin, perpetual, and synthetic trading options with leverage up to 15x. It is targeted at both institutional and retail traders.

Here’s an overview of its key attributes:

- Variety of Leveraged Trading: dYdX offers a wide range of leveraged trading products including margin, perpetuals, and synthetics for cryptocurrencies like BTC, ETH, and SOL.

- Up to 15x Leverage: Traders can access up to 15x leverage on dYdX to increase profits, depending on the product and trade size. As always, leverage amplifies risk as well.

- Layer 2 Scalability: dYdX leverages StarkWare’s Layer 2 technology for faster and cheaper transactions. This supports institutional-grade trading infrastructure.

- dYdX Token: The dYdX token represents governance rights over the protocol. Holders can vote on operational decisions and earn a portion of protocol fees.

- Decentralized Control: dYdX is transitioning to a fully decentralized and community-controlled model after previously operating in a centralized manner.

Overall, dYdX offers advanced traders access to fast leveraged trading across a range of assets. Its Layer 2 scalability and mix of retail and institutional users give it an edge.

GMX

GMX is a decentralized spot and perpetual contract trading platform that offers low trading fees and price slippage. It provides up to 30x leverage trades optimized for retail DeFi traders.

Here are some key aspects:

- Spot and Perpetual Trading: GMX focuses on spot and perpetual trading in a decentralized manner without a central authority. Numerous trading pairs are available.

- Up to 30x Leverage: Traders can access up to 30x leverage to increase profit potential. As always, leverage also amplifies downside risk.

- Smooth User Experience: GMX provides an intuitive interface tailored for retail DeFi traders, displaying important data clearly and concisely.

- Multi-Chain Support: GMX is accessible through both the Arbitrum and Avalanche networks. This provides flexibility to users.

- Low Fees and Price Impact: By optimizing its Virtual AMM, GMX offers low trading fees and minimal price impact on trades.

- Upcoming Developments: GMX plans to launch its X4 AMM soon, which gives creators more control and flexibility for their liquidity pools.

GMX is worth evaluating for DeFi traders seeking a smooth and easy-to-use leveraged trading experience. Monitor upcoming changes as GMX continues enhancing its platform.

ApolloX

ApolloX is a decentralized derivatives exchange where traders can access margins and perpetual futures contracts with up to 150x leverage.

Let’s examine some notable features:

- Up to 150x Leverage Trading: ApolloX caters to traders looking for extremely high leverage. This allows experienced traders to maximize profits but also substantially increases risk.

- Perpetual Futures Contracts: ApolloX offers perpetual futures trading, meaning the contracts have no expiry and track the price of the underlying asset. Traders can go long or short to profit from price movements.

- Non-Custodial Trading: ApolloX is entirely non-custodial. Users maintain full control of their assets through Web3 wallet connectivity.

- Enhanced Privacy: ApolloX does not require sign-ups or KYC procedures. Traders can connect using their wallets and start trading anonymously.

- APX Token: The APX token represents governance rights and can be earned through staking and trading activities. It aligns incentives within the ecosystem.

ApolloX caters to advanced traders comfortable with very high leverage. Implement strict risk management as 150x leverage results in liquidations if positions move just 0.66% against you.

Read also:

- How to Bridge Bitcoin to Ethereum? A Guide to BTC-ETH Conversion Methods

- How to Trade on Shibarium: A Comprehensive Guide for Shiba Inu Enthusiasts

- Best DeFi 2.0 Coins to Buy: The Future of Decentralized Finance

DeFi Platforms For Swaps and Trading

In addition to leveraged trading, decentralized exchanges also enable regular cryptocurrency swaps and trading. Some leading platforms in this category include:

RocketXchange

RocketXchange is a hybrid decentralized exchange that combines liquidity from both centralized (CEX) and decentralized exchanges. It aims to deliver the best rates for crypto swaps and trading.

Key features include:

- Hybrid Liquidity Aggregator: RocketXchange aggregates prices and liquidity across over 250 exchanges, including leading CEXs and DEXs. This grants traders access to immense liquidity.

- Leveraged Trading: RocketXchange enables traders to access leveraged trading for derivatives like perpetual contracts. This allows for potentially higher profits.

- Best Prices: By compiling liquidity and prices across many exchanges, RocketXchange is designed to offer traders the most competitive rates on swaps and trades.

- Smooth Cross-Chain Transactions: RocketXchange makes it easy to make cross-chain transfers between blockchains like Bitcoin and Ethereum. This saves time and money.

- Non-Custodial: As a non-custodial platform, RocketXchange does not take custody of user funds. Users maintain control through integration with wallets like MetaMask.

For traders prioritizing the best prices and seamless multi-chain transactions, RocketXchange warrants a look. As usual, leverage trading comes with amplified downside risk.

RocketX is one of the best DeFi bridges.

Uniswap

Uniswap is arguably the most widely used decentralized exchange, operating on the Ethereum blockchain. It uses an automated market maker (AMM) system for trading ERC-20 tokens.

Key attributes:

- Automated Liquidity Pools: Liquidity providers deposit equal amounts of token pairs into pools. Trades are conducted through algorithmically determined formulas, ensuring availability.

- Ethereum-Based Trading: Uniswap enables trustless exchange of Ethereum-based ERC-20 tokens without intermediaries. A wide variety of tokens are supported.

- Decentralized Governance: Uniswap is governed by its community through the UNI governance token. UNI holders can vote on proposals to shape the protocol’s development.

- Intuitive Interface: Despite advanced underlying technology, Uniswap offers an easy-to-use interface. Users simply select token pairs, enter amounts, and trade.

- Liquidity Mining: Liquidity providers earn trading fees from their contributed pools. UNI token rewards provide an added incentive for providing liquidity.

With its robust liquidity and variety of ERC-20 trading pairs, Uniswap is a go-to decentralized exchange for the Ethereum ecosystem.

PancakeSwap

PancakeSwap is a top decentralized exchange on the Binance Smart Chain blockchain. It uses automated market making to facilitate trading of BEP-20 tokens.

Notable features:

- BEP-20 Trading: PancakeSwap enables fast and affordable trading of BEP-20 tokens native to the Binance Smart Chain. A broad selection of trading pairs are available.

- Yield Farming: Users can earn additional yield on their crypto holdings by staking LP tokens from liquidity pools into special yield farms.

- Lottery & NFTs: PancakeSwap offers a lottery game where users can win CAKE and NFTs. This gamifies the platform and provides extra incentives.

- CAKE Token: CAKE is the governance token of PancakeSwap. Holders can vote on proposals and earn staking/farming rewards. The token also reduces trading fees.

- PancakeSwap App: The PancakeSwap app provides an easy way for users to access its features on the go. The interface is intuitive with clear visuals and charts.

PancakeSwap brings the benefits of decentralized trading to the Binance Smart Chain ecosystem. Fast transactions and low fees make PancakeSwap appealing for BEP-20 traders and yield farmers.

Trader Joe

Trader Joe is a rapidly emerging decentralized exchange on the Avalanche blockchain. It offers trading, lending, yield farming, staking, and other DeFi services.

Notable attributes:

- DeFi Services Aggregator: Trader Joe aggregates a suite of DeFi services including trading, yield farming, lending, staking, and more under one platform on Avalanche.

- AMM Trading: As an automated market maker model DEX, Trader Joe facilitates fast and affordable token trading with algorithmically determined prices.

- Yield Farming: The platform offers yield farming opportunities to earn rewards and maximize returns on crypto assets. Joe tokens are provided as incentives.

- Lending & Borrowing: Users can lend assets to the protocol to earn interest or use their cryptocurrencies as collateral to borrow other assets.

- NFT Launchpad: Projects can launch NFT collections and token sales through Trader Joe’s NFT launchpad. Users can participate in exclusive sales.

By aggregating DeFi services on Avalanche, Trader Joe provides an essential hub for the ecosystem. Its comprehensive feature set promotes usage and adoption of the Avalanche blockchain.

Chainge Finance

Chainge Finance defines itself as “the ultimate DeFi dashboard” aggregating features like trading, derivatives, yield farming, and more.

Key features:

- DeFi Aggregator: Chainge Finance brings together a wide range of DeFi services across lending, swapping, staking, derivatives, etc. Traders appreciate the convenience of an all-in-one platform.

- Dex Aggregation: By aggregating various DEXs, Chainge Finance provides access to pooled liquidity from major exchanges like Uniswap and SushiSwap.

- Cross-Chain Swaps: Chainge enables trading across multiple blockchain ecosystems. This provides access to a much wider array of cryptocurrencies.

- Derivatives Trading: Chainge offers derivatives products like options and futures contracts. This caters to more advanced traders.

- CHNG Token: CHNG token holders can stake to earn yield and participate in governance voting. More adoption benefits token holders through potential appreciation.

Chainge Finance delivers a unified hub to access major DeFi functionalities. Its aggregated liquidity and array of services make it appealing to everyday DeFi users.

ParaSwap

ParaSwap is a platform aggregating features like trading, derivatives, yield farming, and more.

Key features:

- DeFi Aggregator: Chainge Finance brings together a wide range of DeFi services across lending, swapping, staking, derivatives, etc. Traders appreciate the convenience of an all-in-one platform.

- Dex Aggregation: By aggregating various DEXs, Chainge Finance provides access to pooled liquidity from major exchanges like Uniswap and SushiSwap.

- Cross-Chain Swaps: Chainge enables trading across multiple blockchain ecosystems. This provides access to a much wider array of cryptocurrencies.

- Derivatives Trading: Chainge offers derivatives products like options and futures contracts. This caters to more advanced traders.

- CHNG Token: CHNG token holders can stake to earn yield and participate in governance voting. More adoption benefits token holders through potential appreciation.

Chainge Finance delivers a unified hub to access major DeFi functionalities. Its aggregated liquidity and array of services make it appealing to everyday DeFi users.

1Inch

1Inch is a leading decentralized exchange aggregator that sources liquidity from various DEX protocols. It’s designed to find the most efficient swaps on Ethereum, BSC, Polygon and more.

Let’s examine some key aspects:

- DEX Aggregator: 1Inch aggregates over 120 DEXs across different blockchains to offer users better token swap rates by comparing rates across protocols.

- 1Inch Liquidity Protocol: The 1Inch Liquidity Protocol enables third-party DEXs to tap into 1Inch’s liquidity reserves, driving further adoption.

- Pathfinder Algorithm: 1Inch uses this algorithm to split orders across multiple DEXs to avoid high slippage and ensure users get the best token swap prices.

- Loyalty Program: Active traders can earn rewards and discounts on trading fees through 1Inch’s loyalty program. This incentivizes usage of the platform.

- 1INCH Token: The 1INCH token represents governance rights and can also be used for payments like trading fees. DeFi projects can partner with 1Inch and integrate the token.

1Inch stands out for its innovation in intelligently routing orders to optimize swap pricing. By compiling liquidity across networks, it saves users money on trades.

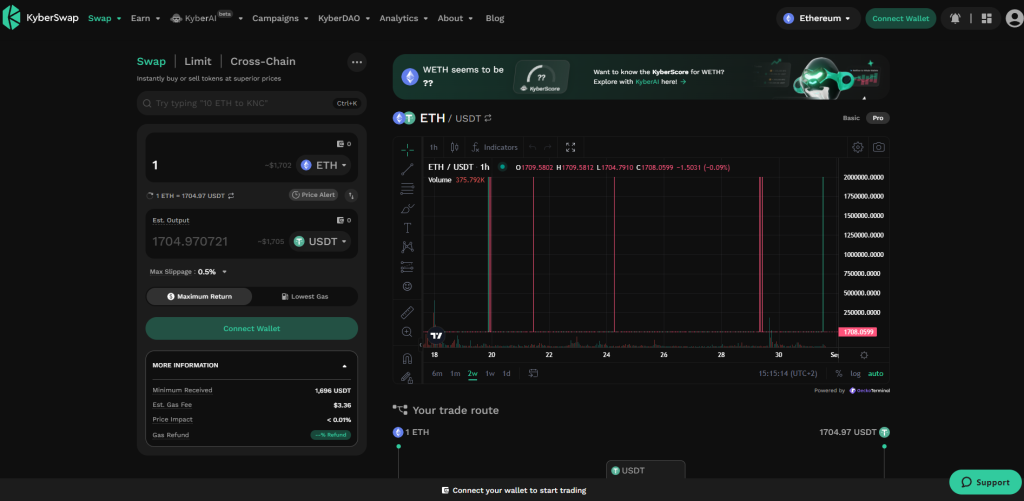

KyberSwap

KyberSwap brings together liquidity from various decentralized exchanges to enable seamless, affordable token swaps across different blockchains.

Examining the key features:

- Multi-Chain DEX: KyberSwap aggregates DEX liquidity across multiple networks like Ethereum, BSC, Polygon, Avalanche, and Fantom. This enables universal token swapping.

- Dynamic Rates: To get the best prices, KyberSwap analyzes rates across multiple DEXs and enables dynamic rate switching to optimize swap pricing.

- No Wrap Tokens: KyberSwap uses native tokens across chains, avoiding wrapped versions like WETH and improving efficiency.

- KNC Token: KNC is KyberSwap’s governance token. It can be earned through staking, trading, participating in liquidity pools and other platform activities.

- Future Roadmap: KyberSwap plans to introduce new features like derivatives, options, lending, on-chain price oracles, and more per its roadmap.

By delivering seamless cross-chain swaps at optimized rates, KyberSwap is ideal for DeFi users looking to efficiently move across different blockchain ecosystems.

Conclusion

Decentralized finance is expanding at a rapid pace, with innovative platforms launching to enable trading, speculation, lending, borrowing, and more in a trustless manner.

This guide provided an overview of some leading options across leveraged trading protocols and general swapping/trading platforms. While decentralized finance solves many issues of traditional finance by eliminating rent-seeking middlemen, it does come with distinct risks related to the nascency of the technology.

As with any cryptocurrency-based activities, conduct due diligence before using any DeFi platform. Start with small amounts to understand the mechanisms and risks associated with decentralized trading.

For experienced traders, DeFi presents a new playground of opportunities. The platforms above are worth tracking as the top DeFi leaders evolve.