ApeX Pro Exchange Review: Unparalleled Leverage and Perpetual Market Trading on a Decentralized Platform

Looking to redefine your crypto trading strategies without getting bogged down by exorbitant fees? Welcome to our comprehensive review of Apex Pro Exchange, a decentralized trading platform that puts you in the driver’s seat. With Apex Pro DEX, you gain unparalleled control over your assets, backed by a transparent and user-friendly interface. But what sets this platform apart from the rest?

For starters, Apex Pro fees are remarkably low, making it a cost-effective choice for traders of all levels. Moreover, the Apex Pro trading fees are designed to offer you the best value for your trades.

In a market flooded with options, Apex Exchange stands out for its commitment to efficiency and security. From the moment you connect your Web3 wallet, you’ll notice the difference—speed, transparency, and a robust social trading framework that lets you copy the moves of seasoned traders. So, if you’re tired of hidden Apex Exchange fees and looking for a platform that offers both affordability and functionality, Apex Pro Exchange is the one-stop solution you’ve been searching for.

Read our review about best decentralized exchanges for leveraged trading.

What you'll learn 👉

What is Apex Pro Exchange?

Users of the non-custodial, decentralized ApeX Pro Exchange can trade cross-margined perpetual contracts directly with one another.

| 📊 ApeX Pro Exchange | Overview |

|---|---|

| 💰 Fees | – Free crypto deposits & withdrawals – Expedited ETH network withdrawals: higher gas fee + 0.1% total withdrawal amount fee – Maker Fee: 0.02% Taker Fee: 0.05% |

| 🔧 Features | – Non-custodial, permissionless, decentralized – USDC-denominated, cross-margin, perpetual contracts – Compatible with Arbitrum, Ethereum, Binance Chain, and Polygon networks – Up to 30x leverage – Trade-to-Earn rewards program – Buying APEX: Available on Bybit and Uniswap exchanges |

| 👍 Pros | – Enhanced security and privacy – Easy access, control, and use – Intuitive dashboard and trading interface – Unique Trade-to-Earn rewards program |

| 👎 Cons | – Limited trading instruments – Supports only USDC withdrawals |

It is made to help participants in the perpetual swap market with speed, efficiency, security, and transparency. ApeX Pro Exchange gives its users access to the perpetual swap market by providing a social trading architecture and order book mode.

Social trading framework and copytrading

ApeX Pro Exchange’s social trading framework and order book mode are designed to enable access to the perpetual swap market with speed, efficiency, security, and transparency. The order book mode provides visible asks and bids that help users take more informed trading actions, while the social trading framework enables users to follow and copy the trades of more experienced traders on the platform.

ApeX Pro Exchange’s copy trading feature allows users to follow and copy the trades of more experienced traders on the platform. Users can set limits, and the primary trader receives a portion of the profit or establishes a cost of service for each transaction. While copy trading can be profitable, it does not entirely eliminate the risk with trading, and it is highly critical for investors to assess the risks attached to copy trading before indulging in such strategies.

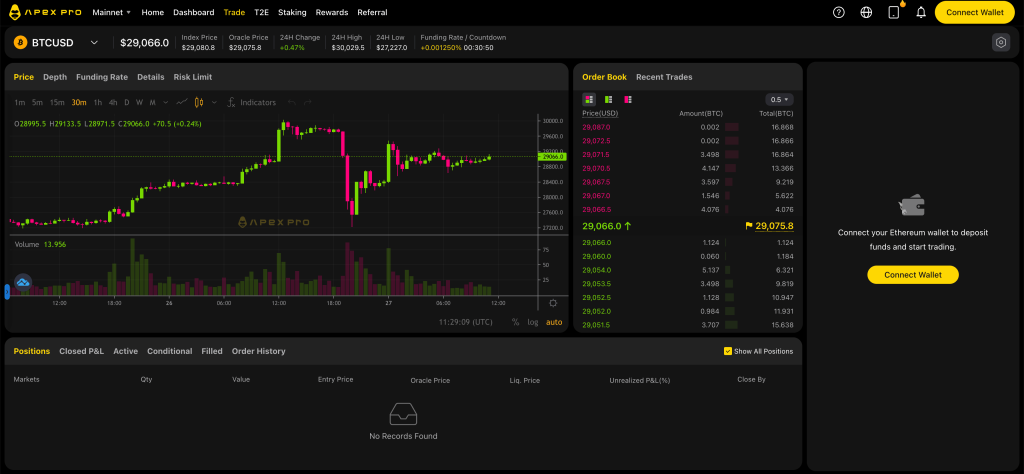

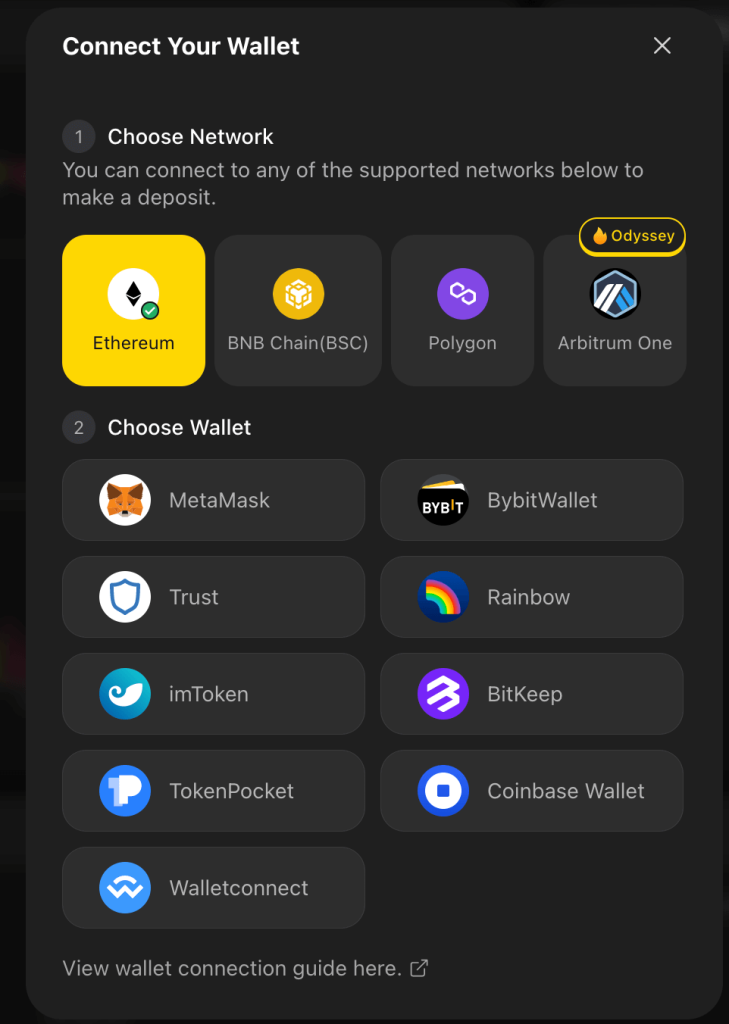

How To Get Started with Apex Pro Exchange

It takes less than ten seconds to connect to the exchange and has an intuitive UI. All it takes to connect to an exchange is to have your Web3 wallet open and then navigate to the URL pro.apex.exchange. It will prompt you to download the app if you are on mobile or connect with browser wallet if you’re on desktop.

Advantages of DEX like Apex Pro vs CEXes

DEX benefits:

Decentralization: DEX is not centralized like CEX. Transactions are transparent, secure, and censorship-resistant.

DEX traders have full control over their funds. They can trade directly on the blockchain using their wallets without depositing funds on the exchange. This prevents hacking and money loss.

Privacy: DEX does not demand KYC or personal information from traders. Users can trade anonymously and privately.

DEX has no single point of failure, making it less vulnerable to hacking and system failure. This keeps the exchange running through server outages and cyberattacks.

CEX benefits:

Liquidity: CEX outperforms DEX. Traders can buy and sell assets instantly. CEX’s wider client base guarantees a buyer or seller for any asset.

CEX is simpler for novices. It lets non-technical traders trade quickly. CEX offers several order types for different traders.

Security: CEX maintains traders’ cash in offline, hack-resistant cold storage, while being centralized. CEX also insures dealers against hacking and cyberattack losses.

Other Services: CEX offers margin trading, earn products, and launchpad offerings to allow new projects launch coins directly on their exchanges. CEX and market makers offer traders deep liquidity.

Who is behind Apex Pro Exchange?

Bybit, a top-tier exchange with more than 4 million customers, supports ApeX Pro Exchange. This affiliation provides a greater sense of safety for users than anonymous projects. The platform is very secure and provides traders with a professional, straightforward interface and lower fees than rivals like GMX.

Apex Pro Exchange Fees

The gas fees are zero and the maker-taker fees are 0.02% and 0.05%, respectively. The charge for a rapid withdrawal is $5 and the processing time for a slow withdrawal is up to 4 hours when using L2.

Earn rewards with Apex Pro T2E and Staking Programs

ApeX Pro Exchange provides its users with Trade-to-Earn options, BANA airdrops, and other incentives. According to rankfi.com, users have multiple ways to get money: staking, referrals, trade-to-earn, and more. The platform’s popularity can in part be attributed to this specific feature.

ApeX Pro Exchange’s staking program allows users to share in revenue incentives generated from the platform’s transaction fees. Users can stake APEX or esAPEX in the staking pool to begin and can earn more rewards by staking more assets and being active on the Trade-to-Earn program.

Staking rewards are tabulated at the end of every week beginning every Monday at 8AM UTC, and users can claim their rewards at their convenience after each week’s Thursday at 8AM UTC and can be claimed by users at their convenience, and users can check their staking rewards and history on the platform.

Supported Coins

Nevertheless, there are just five trading pairs available on ApeX Pro Exchange at the moment (BTC, ETH, XRP, ATOM, DOGE). This will be expanded in the future.

Is Apex Pro available for USA users?

According to rankfi.com, it’s also inaccessible to anyone in the United States.

What is the max leverage on Apex Pro?

Apex Pro offers a maximum leverage of 30x.

Bybit offers 100x leverage, whereas competitors like GMX or dYdX offer 50x.

Apex Pro vs dydX vs GMX

dYdX is a leading decentralized exchange that supports spot, margin and perpetual trading. GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades and works on a multi-asset AMM model. And finally, ApeX Pro is a non-custodial derivative DEX that delivers limitless perpetual contract access with an order book model.

| 🛡️ Security & Privacy | |

|---|---|

| dYdX | Self-custody of funds, StarkEx integration, forced fund retrieval, STARK proofs, KYC in selected campaigns, community governance |

| GMX | Self-custody of funds, Arbitrum and Avalanche safety provisions, fully non-KYC, community governance |

| ApeX Pro | Self-custody of funds, StarkEx integration, forced fund retrieval, STARK proofs, fully non-KYC, community-dedicated space under development |

| ⚡ Transaction Cost & Efficiency | |

|---|---|

| dYdX | Orderbook interface, Mid-Market Price, no gas fees, tiered fees, greatest number of perpetual contracts, spot and margin trading, Layer 1 Ethereum |

| GMX | Multi-asset AMM model, network execution fees, less perpetual contracts, new trading pairs introduced frequently |

| ApeX Pro | Orderbook interface, Last Traded Price, no gas fees, low maker and taker fees, VIP program, fewer perpetual contracts, multi-chain deposits and withdrawals |

| 💰 Tokens & Rewards | |

|---|---|

| dYdX | Trading Rewards program, 2,876,716 $DYDX distributed in 28-day epochs, staking $DYDX for additional rewards |

| GMX | Escrowed tokens in staking program, community rewards, revenue-sharing programs |

| ApeX Pro | Escrowed and liquidity tokens, 1,000,000,000 $APEX total supply, 25,000,000 $APEX minted to create $BANA, Trade-to-Earn event, $BANA-USDC Pool, Buy & Burn Pool, $190,000 worth of $BANA distributed weekly for a year |

Conclusion

In conclusion, ApeX Pro Exchange is a decentralized, non-custodial exchange platform that prioritizes its users’ need for speed, efficiency, security, and transparency in the perpetual swap market. It’s easy to navigate, and there are incentives for using it. According to rankfi.com, however, its limited trading pairings, inaccessibility to US citizens and residents, and lesser leverage than competitors make it a less attractive option.

- ApeX Pro Exchange: decentralized, non-custodial, permissionless Web3 trading platform

- Operates on Arbitrum Layer 2 network for Ethereum

- Offers USDC-denominated, cross-margin, perpetual contracts

- Up to 20x leverage available

- Compatible with multiple networks: Arbitrum, Ethereum, Binance Chain, and Polygon

- No fees for crypto deposits and withdrawals (excluding expedited ETH withdrawals)

- Maker Fee: 0.02%, Taker Fee: 0.05%

- Intuitive, easy-to-use dashboard and trading interface

- Security provided by STARK proof ZK rollup smart contracts

- 100% private and anonymous trading

- Trade-to-Earn rewards program with native APEX and BANA tokens

- Limited trading instruments and USDC-only withdrawals as drawbacks