What you'll learn 👉

What Is Mux Network?

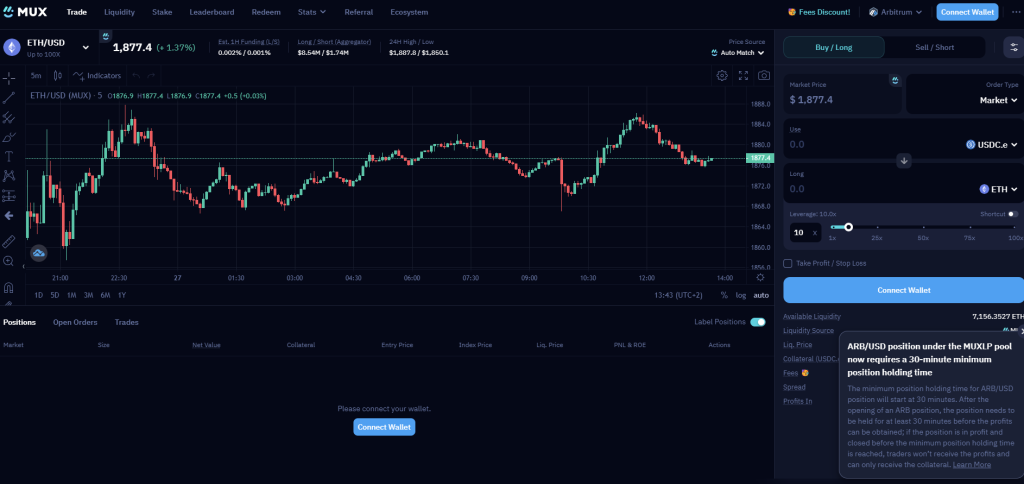

Mux.Network is a decentralized exchange that offers a unique trading experience with its innovative features. As a non-custodial platform, Mux.Network allows users to trade directly from their wallets, eliminating the need for intermediaries and reducing counterparty risks.

One of the key features of Mux.Network is its zero price impact trading, which ensures that large orders do not affect the market price. This provides traders with a seamless and efficient trading experience, without worrying about the impact their trades may have on prices.

In addition, Mux.Network offers up to 100x leverage, allowing traders to amplify their gains and take advantage of market opportunities. With this leverage, traders can maximize their position size and potentially increase their profits.

Aggregated liquidity is another standout feature of Mux.Network. By aggregating liquidity from multiple sources, Mux.Network ensures that traders have access to a deep and diverse pool of liquidity, resulting in competitive trading fees and enhanced trading experiences.

Backed by reputable organizations like Binance Labs and Multicoin Labs, Mux.Network provides a secure and reliable trading platform for crypto traders. Its non-custodial approach and focus on enhancing liquidity for traders make it a promising option for those looking for a seamless and efficient trading experience.

| Topic | Summary |

|---|---|

| What is Mux Network? | – Decentralized exchange for leveraged trading. Uses innovative mamms to aggregate liquidity across multiple DEXs |

| Key Features | – Liquidity multiplexing to combine liquidity across platforms <br>- Universal liquidity via integration with any DEX Optimized trading execution and pricing |

| Mux Fees | – 0.3% fee on all trades, 0.25% to LPs, 0.05% to treasury |

| Staking | – Stake MUX tokens to earn rewards and LP tokens. Locked staking also provides governance rights |

| Competitor Comparison | – Lower fees than alternatives like GMX. Additional fee discounts not offered by others <br>- Better liquidation prices than competitors |

| MUX Tokens | – MCB: Governance token MUX: Core protocol and fee token veMUX: Boosted rewards and governance for locked staking MUXLP: LP receipt token earning pro rata fees |

| Benefits | – Traders get minimized slippage and gas costs. LPs can maximize yield across DEXs. DEXs gain access to expanded liquidity |

| Team & Backers | – Led by anonymous team with backing from top crypto VCs |

| Final Thoughts | – Emerged as a game-changer in the leveraged trading market, offering immense potential in the ever-competitive and fast-paced world of perpetuals. |

Key Features:

Mux.Protocol is a revolutionary trading protocol that offers a wide range of key features designed to enhance the trading experience for crypto traders. With its innovative approach, Mux.Protocol aims to address the challenges faced by traders in terms of liquidity, leverage, and price impact trading.

By providing zero price impact trading, up to 100x leverage, and aggregated liquidity, Mux.Protocol enables traders to execute trades seamlessly and efficiently, maximize their gains, and access a deep and diverse pool of liquidity. Let’s dive deeper into these key features and explore how they contribute to a better trading experience on Mux.Protocol.

Liquidity Multiplexing

Liquidity multiplexing on Mux Network is an innovative approach that dynamically shares liquidity between margin trading and DEX mining, providing a seamless and efficient trading experience. By utilizing an 80% overlap, the platform ensures that liquidity is maximized and available for both activities.

When traders engage in margin trading on Mux Network, they can take advantage of leveraging their positions with up to 100x leverage, capitalizing on potential gains. Simultaneously, the platform allocates a portion of liquidity from the multi-asset pool to DEX mining, allowing users to earn rewards by providing liquidity and contributing to the network’s overall liquidity.

However, in case total open positions exceed the available liquidity, Mux Network’s advanced broker module steps in. The broker module reserves liquidity from DEX mining to cover the deficit, ensuring that margin trading can continue seamlessly.

This liquidity multiplexing system on Mux Network not only ensures that there is sufficient liquidity available for margin trading, but it also allows traders to benefit from participating in DEX mining and earning rewards from their contributed liquidity. It is a unique and efficient solution that addresses the liquidity needs of both activities, making Mux Network a comprehensive and robust trading platform.

Universal Liquidity

Universal Liquidity is a key feature of MUX Protocol, which achieves this by unifying liquidity across different networks through its innovative broker module. This decentralized protocol enables traders to access liquidity from multiple liquidity pools without the need to move pooled assets.

With MUX Protocol’s broker module, liquidity is seamlessly allocated from various liquidity pools to fulfill the demand for margin trading. This mechanism ensures that traders have access to a deep and diverse pool of liquidity, improving trading efficiency and reducing price impact.

One of the significant benefits of this approach is the higher capital efficiency it offers. Traders can now leverage their positions and maximize their trading opportunities without the need to manually move assets between different pools. This eliminates the downtime associated with asset transfers and allows traders to capitalize on market movements swiftly.

By unifying liquidity across networks, MUX Protocol provides traders with a more seamless and cost-effective trading experience. Traders can confidently engage in leveraged trading without worrying about the availability of liquidity. Additionally, the use of liquidity pools helps to mitigate counterparty risks, as traders interact directly with the protocol rather than relying on third-party liquidity providers.

In summary, MUX Protocol’s broker module enables universal liquidity by unifying liquidity across different networks. This approach offers higher capital efficiency and reduces the friction and costs associated with moving pooled assets. Traders can confidently engage in margin trading while benefiting from a more seamless and secure trading experience.

Optimized DEX Trading

MUX Protocol is a groundbreaking solution that optimizes DEX trading by addressing critical issues such as liquidity fragmentation, high price impact, low capital efficiency, and counterparty risks.

Traditionally, decentralized exchanges (DEXs) suffer from fragmented liquidity across different networks, making it challenging for traders to find sufficient liquidity for their trades. MUX Protocol tackles this problem by unifying liquidity from various pools, ensuring that traders have access to a deep and diverse pool of liquidity. This significantly improves trading efficiency and reduces price impact, enabling traders to execute larger orders without disturbing the market.

Moreover, MUX Protocol enhances capital efficiency by allowing traders to leverage their positions up to 100x. This means that traders can maximize their potential gains and take advantage of market opportunities without needing to manually move assets between different pools. This eliminates downtime and enables traders to capitalize on market movements swiftly.

In addition, MUX Protocol mitigates counterparty risks. Instead of relying on third-party liquidity providers, traders interact directly with the protocol. This ensures that trades are executed reliably and reduces the chances of encountering issues with liquidity providers.

Furthermore, MUX Protocol’s aggregator module plays a crucial role in optimizing trading costs. It selects the best liquidity route from the available pools, ensuring that traders can access liquidity at the lowest possible cost. This helps minimize trading fees and enhances the overall trading experience for users.

In conclusion, MUX Protocol optimizes DEX trading by addressing liquidity fragmentation, reducing price impact, improving capital efficiency, and mitigating counterparty risks. With the ability to leverage up to 100x and access better liquidation prices, traders can confidently engage in leveraged trading and seize profitable opportunities.

Mux Fees

Mux Protocol operates on a fee structure that ensures the sustainability and growth of the protocol while providing benefits to its users. There are two main types of fees within the Mux ecosystem: protocol fees and staking fees.

Protocol fees are generated from trading activities on the platform. These fees are collected on each transaction and help fund the protocol’s development and maintenance. They also contribute to the daily protocol fees pool, which further enhances the protocol-owned liquidity. Traders benefit from this fee structure as it provides them with a reliable and continuously improving trading platform.

Alternatively, staking fees are incurred when users stake their MUX tokens to earn rewards and gain governance rights within the MUX network. These fees incentivize users to participate actively in the protocol’s governance, thus enhancing decentralization and ensuring effective decision-making.

On a daily basis, the Mux Protocol generates substantial protocol fees from its trading volume. These fees are distributed to users in the form of rewards. Traders and liquidity providers can earn a share of these fees based on their participation and contribution to the protocol.

With its transparent fee structure and fair distribution mechanism, Mux Protocol offers users an opportunity to benefit from the platform’s growth while creating a thriving and sustainable ecosystem.

Staking

Staking MCB tokens on the Mux Network is a straightforward process that allows users to earn veMUX tokens and support the platform. Here are the steps to stake MCB tokens:

1. Purchase MCB tokens: Before staking, users need to acquire MCB tokens, which can be obtained through various exchanges.

2. Select a lock time: Once the MCB tokens are in your possession, you can stake them by choosing a lock time of your preference. The lock time refers to the period for which you are willing to hold your MCB tokens without selling or transferring them.

3. Earn veMUX tokens: By staking MCB tokens and committing to a specific lock time, users become eligible to earn veMUX tokens. These tokens are a representation of your staked MCB tokens and act as proof of your contribution and commitment to the Mux Network.

4. Higher rewards for longer lock times: The duration for which you lock your MCB tokens has a direct impact on the rewards you earn. Generally, the longer you lock your tokens, the higher the rewards you can expect to receive.

By staking MCB tokens on the Mux Network, users not only have the opportunity to earn veMUX tokens but also actively support the platform and contribute to its growth and development.

How does MUX compare to other players in the perp protocol space?

MUX Protocol stands out in the competitive perp protocol space with its unique offerings, setting it apart from other players such as GMX and GNS. One of MUX’s notable advantages is its lower fees, ensuring cost-effective trading experiences for crypto traders.

In addition to lower fees, MUX provides additional discounts, further enhancing its appeal. These discounts enable traders to optimize their trading cost, making it an attractive option for those seeking a cost-efficient and profitable trading platform.

Furthermore, MUX outshines its competitors in terms of better liquidation prices. This means that traders who engage in leveraged positions on MUX Protocol are likely to experience improved liquidation prices, reducing their risks and potential losses compared to alternative perp protocols.

To enhance its competitive edge, MUX recently secured a grant from Optimism, a leading layer-two solution provider. This grant allows MUX to offer an additional 20% fee discount, solidifying its cost advantage over its competitors in the perp protocol space.

In summary, MUX Protocol distinguishes itself from other players in the perp protocol space through its lower fees, additional discounts, and better liquidation prices. With the recent grant from Optimism, MUX is well-equipped to provide traders with an unparalleled trading experience, enabling them to maximize their gains while minimizing their trading costs.

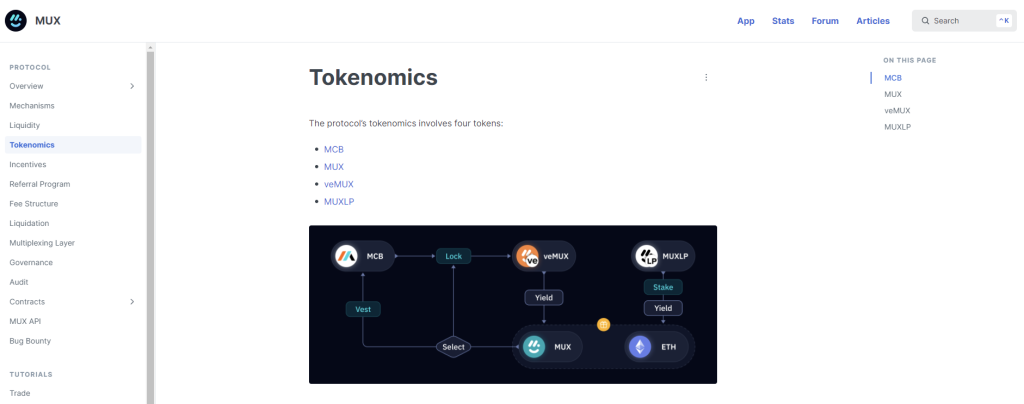

MUX Tokens

MUX Tokens play a crucial role in empowering traders and driving the MUX network forward. As the protocol’s governance token, MUX Tokens grant holders the power to participate in key decisions regarding the protocol’s future development and direction. This gives traders and token holders a sense of ownership and control over the platform they rely on for their trading experiences.

Additionally, MUX Tokens serve as a tool for protocol fees, allowing traders to pay for their trading activity and access the platform’s features. But MUX Tokens offer more than just utility. They also serve as a means to earn rewards through the protocol’s non-transferable reward token, providing traders with additional incentives to actively engage and contribute to the MUX network.

Overall, MUX Tokens not only empower traders but also foster a sense of community and participation in shaping the future of decentralized leveraged trading.

MCB

MCB token, the native governance token of the MUX protocol, plays a crucial role in the platform’s ecosystem. With a capped supply limited to 100,000 MCB, this token brings in various functionalities and benefits for users.

One notable feature of MCB is its ability to be locked to obtain veMUX tokens. Users who lock their MCB can earn veMUX tokens, which grant them voting power and enable participation in the protocol’s governance. This locking process ensures that the MCB supply remains more stable and avoids sudden sell-offs that may disrupt the protocol’s functioning.

Furthermore, MCB holders can also vest their veMUX tokens back into MCB through a vesting process. By doing so, users can regain the MCB tokens while also receiving protocol fees and accumulated earnings derived from the protocol’s trading activities.

As an integral part of the MUX protocol, MCB token holders have the power to propose and vote on governance decisions, such as protocol upgrades or modifications. This enhances the decentralized nature of the MUX protocol, where stakeholders actively contribute to its development and decision-making processes.

In summary, the MCB token offers users the opportunity to earn veMUX tokens, participate in governance, and benefit from protocol fees. With its capped supply and versatile functionality, MCB strengthens the MUX protocol and creates a vibrant ecosystem driven by its community.

MUX

MUX protocol is a cutting-edge trading protocol that offers a multitude of key features and functionalities to revolutionize the trading experience for crypto traders. One of its notable aspects is the utilization of pooled liquidity, which combines liquidity from multiple chains, including Arbitrum, BNB Chain, Avalanche, and Fantom. This ensures that traders have access to a vast and diverse pool of liquidity, resulting in enhanced trading efficiency and opportunities.

Another standout feature of the MUX protocol is its ability to offer zero price impact trading. This means that traders can execute large trades without significantly affecting the price of the asset they are trading. This is particularly beneficial for traders seeking to execute high-volume transactions without negatively impacting the market.

Additionally, the MUX protocol provides traders with leveraged trading capabilities, allowing them to amplify their positions by up to 100 times. This enables traders to maximize their potential gains from price movements and capitalize on market opportunities.

With its support for multiple chains and its innovative features like pooled liquidity, zero price impact trading, and leverage, the MUX protocol is poised to transform the trading experience for crypto traders, offering them greater efficiency and flexibility in their trading strategies.

veMUX

As a decentralized trading protocol, MUX offers its users a unique opportunity to participate in the governance and decision-making processes. At the heart of this governance system lies veMUX, the protocol’s governance token. By holding veMUX, users have the power to influence the direction and development of the MUX protocol.

Obtaining veMUX is straightforward. Users can acquire veMUX by locking MCB and/or MUX tokens. This not only grants them voting power within the protocol but also unlocks a range of benefits. One such benefit is the ability to earn protocol income. By actively participating in governance decisions, users can access a share of the protocol’s fees and revenue. This enables them to earn passive income while simultaneously contributing their insights and ideas.

Moreover, holding veMUX grants users the opportunity to receive MUX rewards. These rewards come in the form of the protocol’s non-transferable reward token, further incentivizing active participation within the MUX ecosystem. With veMUX in hand, users gain both a say in the protocol’s operations and the ability to earn additional rewards.

In summary, veMUX serves as the governing force behind the MUX protocol. By locking MCB and/or MUX tokens, users can obtain veMUX and gain influence over protocol decisions. The benefits of holding veMUX extend beyond voting power, allowing users to earn protocol income and receive MUX rewards. With veMUX, users become active contributors to the evolution and success of the MUX trading protocol.

MUXLP

In addition to the veMUX governance token, the MUX protocol also features MUXLP, a liquidity provider token designed to incentivize and reward liquidity providers. MUXLP is minted and burnt based on the amount of liquidity that users provide to the protocol.

When users deposit liquidity into the MUX protocol, they receive a corresponding amount of MUXLP tokens. These tokens represent the user’s share of the liquidity pool and can be utilized in various ways. Firstly, by staking their MUXLP tokens, liquidity providers can earn a portion of the protocol’s income. This includes fees and revenue generated by trading activities within the protocol. By participating in the protocol’s liquidity provision, users can passively earn a share of the profits.

Additionally, holding MUXLP tokens also offers the opportunity to receive MUX rewards. These rewards are distributed to liquidity providers as an additional incentive for their participation. By staking MUXLP tokens, users can earn both protocol income and MUX rewards, maximizing their potential earnings.

Overall, MUXLP serves as a valuable tool for liquidity providers, allowing them to actively participate in the protocol’s operations, earn income, and be rewarded for their contribution to the MUX ecosystem.

How can crypto participants benefit from MUX?

Crypto participants can benefit from MUX in two main ways, offering them opportunities to earn yield from their participation.

The first method is by buying MCB, the governance token of the MUX protocol, and locking it up to receive veMUX. VeMUX represents voting power and allows users to participate in the protocol’s governance. By locking MCB for veMUX, participants can earn yield from the protocol’s liquidity. This means that they are paid out from the fees and revenue generated by trading activities within the protocol. It provides an avenue for participants to passively earn a share of the profits generated by the MUX protocol.

The second way to benefit from MUX is by using collateral to mint MUXLP tokens. MUXLP tokens represent the user’s share of the liquidity pool. By minting and holding MUXLP tokens, participants can receive yield from their involvement. They earn a portion of the protocol’s income, including fees and revenue generated from trading activities. This provides an opportunity for participants to maximize their potential earnings by utilizing their collateral to earn yield from the MUX protocol.

Overall, crypto participants can benefit from MUX by either buying MCB and locking it for veMUX to be paid out from the protocol’s liquidity or using collateral to mint MUXLP and receiving yield from it.

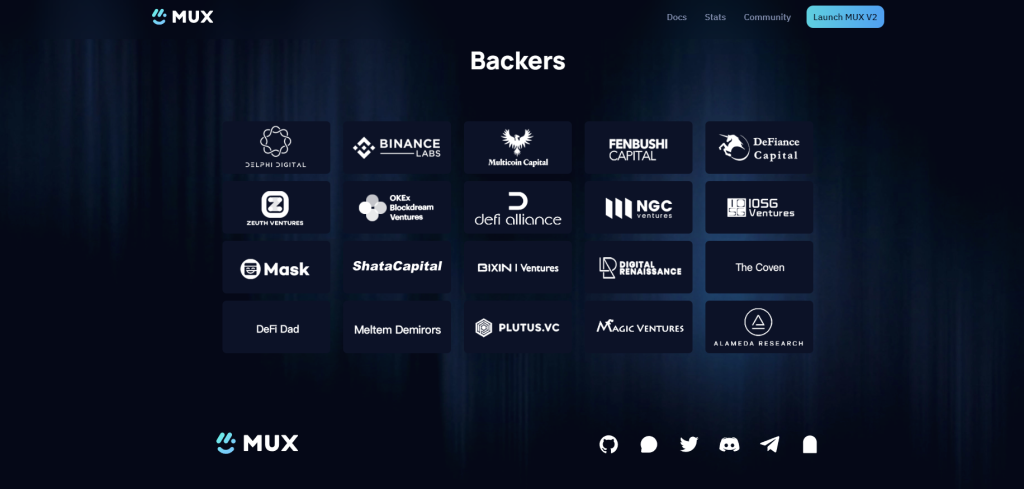

Team and Backers

The MUX protocol is backed by a talented team of individuals who have chosen to remain anonymous, yet are committed to delivering innovative products to the market. Despite their preference for anonymity, the MUX team has garnered notable support from industry leaders.

Recently, MUX successfully closed a funding round led by prominent venture capital firms, Delphi Ventures and Alameda Research. These leading investors have recognized the potential of MUX and are confident in the team’s ability to revolutionize the trading landscape.

In addition to Delphi Ventures and Alameda Research, MUX also received participation from Multicoin and Defiance Capital, further validating the project’s potential. With these influential backers, MUX is well-positioned to drive the adoption of its leveraged trading protocol and provide traders with a robust and secure trading experience.

Despite their choice to remain anonymous, the MUX team’s dedication to building and delivering products is evident. With the support of industry-leading backers, MUX is poised to make a significant impact on the trading industry and bring new opportunities to crypto traders worldwide.

Protocol Performance

The MUX protocol has demonstrated impressive performance since its launch, establishing itself as a leading player in the trading landscape. With a trading volume of $554 million, MUX has facilitated a significant amount of transactions, providing liquidity and extensive trading opportunities to its users.

This strong performance has translated into substantial revenue generation for the protocol. Through protocol fees and DEX mining rewards, MUX has generated approximately $470k thousand in revenue. This impressive financial success underscores the value that MUX brings to traders seeking leveraged trading options.

In addition to its impressive trading volume and revenue generation, the MUX protocol has also experienced significant user growth. Currently, the platform boasts a user count of 356 and continues to attract new traders seeking a secure and efficient trading experience.

With its exceptional protocol performance, extensive trading volume, substantial revenue generation, and steady user growth, MUX is poised for continued success in revolutionizing the trading landscape and meeting the needs of crypto traders.

Read also:

- Top 10 European Crypto Exchanges – Best Crypto Exchanges in Europe

- ApeX Pro Exchange Review: Unparalleled Leverage and Perpetual Market Trading on a Decentralized Platform

- Apex Pro vs dydX vs GMX – A Comprehensive Comparison of Derivatives DEXs

Final Thoughts

MUX Protocol has emerged as a game-changer in the leveraged trading market, offering immense potential in the ever-competitive and fast-paced world of perpetuals. With its unique approach, MUX tackles the issue of liquidity fragmentation head-on, providing traders with an aggregated liquidity pool that significantly reduces price impact and slippage.

One of the standout features of MUX is its commitment to offering a complete user experience. The team behind the protocol boasts extensive experience in shipping products, ensuring that traders have access to a reliable and seamless trading platform. This expertise is evident in the platform’s user-friendly interface, robust performance, and plethora of features tailored to meet the needs of both novice and experienced traders.

In a market where liquidity is often dispersed across multiple platforms, MUX Protocol stands out by bringing together liquidity from various sources into a single multi-asset pool. This not only enhances trading efficiency but also minimizes trading costs for users. By providing a comprehensive solution to liquidity fragmentation, MUX Protocol empowers traders to access deep liquidity without encountering the usual hurdles associated with fragmented markets.

With its potential to reshape the leveraged trading landscape and its dedication to delivering an exceptional user experience, MUX Protocol is undoubtedly a force to be reckoned with. As the team continues to drive innovation and expand its offerings, MUX Protocol is poised to lead the way in the perps market, offering traders unprecedented opportunities and a seamless trading experience.