Are you looking for a peer-to-peer cryptocurrency exchange that allows you to buy and sell Bitcoin and Monero with ease? Look no further than AgoraDesk.

Launched in 2019, this British Virgin Islands-based platform operates as an online store for cryptocurrencies, allowing users to post ads with their exchange rate and payment methods.

One of the standout features of AgoraDesk is that it does not require any form of KYC/AML, making it a popular choice for those who value privacy and anonymity.

In this comprehensive review, we will explore the platform’s features, trading process, affiliate program, supported coins, reliability and safety, trading fees, customer service, and more, to help you determine if AgoraDesk is the right cryptocurrency exchange for you.

| Topic | Summary |

|---|---|

| 📌 Platform Overview | AgoraDesk is a peer-to-peer cryptocurrency exchange launched in 2019. It supports over 60 payment methods and multiple languages. The platform does not require KYC/AML, making it popular among users who value privacy. |

| 💱 Trading Process | AgoraDesk offers arbitration protection and an escrow service to ensure secure transactions. The arbitration deposit is equal to the transaction amount and is returned once the transaction is completed. |

| 🤝 Affiliate Program | AgoraDesk offers an affiliate program where users can earn commissions on referrals. Users can earn up to 40% on the transaction amount if they bring in two clients who conduct a transaction. |

| 💰 Supported Coins | AgoraDesk supports a wide range of cryptocurrencies, including Bitcoin, Monero, Litecoin, Ethereum, Dash, and Bitcoin Cash. |

| 🔒 Reliability and Safety | While AgoraDesk offers several security measures, it lacks mandatory verification and legal information, making it difficult to assess its reliability and safety. Users are advised to exercise caution and conduct due diligence. |

| 💳 Payment Methods | AgoraDesk supports more than 60 payment methods, including credit card options and PayPal. However, wire transfer limitations may apply depending on your location. |

| 📊 Trading Fees | AgoraDesk has a competitive fee structure with a maker fee of 1.00% and a taker fee of 0.00%. The withdrawal fee is only the network fee + 50%. |

| 📞 Customer Service | AgoraDesk offers multiple ways for customers to get in touch with their support team, including opening a ticket, sending an email, writing to Telegram, or contacting the company via Twitter. |

What you'll learn 👉

Platform Overview

In this section, we’ll take a closer look at the features and benefits of AgoraDesk, a peer-to-peer cryptocurrency exchange that prides itself on user privacy and security. The platform supports over 60 payment methods, making it accessible to users without access to traditional banking services. Its user-friendly interface is designed to provide a seamless user experience, whether you’re buying or selling Bitcoin or Monero.

AgoraDesk is available in multiple languages, including English, Russian, Chinese (simplified and traditional), Italian, Portuguese, and Spanish. The platform’s focus on user privacy and security is evident in its commitment to no KYC/AML, phone number, or blocked locations required. Only a valid email address is needed to sign up.

Additionally, the exchange’s use of 2FA, referral program, notifications via email and telegram, and MorphToken integration ensures that users’ transactions are protected and secure.

Trading Process

To ensure secure transactions, AgoraDesk offers an arbitration protection service. The seller posts an arbitrage deposit to protect the buyer, which is equal to the transaction amount. The deposit is returned to the seller once the buyer confirms payment.

AgoraDesk also provides an escrow service. The cryptocurrency is held in a secure account until the transaction is completed, providing additional protection for both the buyer and seller.

Arbitration Protection

Well, well, well, looks like we’ve stumbled upon the section that ensures we won’t get scammed – the Arbitration Protection. This feature is designed to protect both buyers and sellers from fraudulent activities during a transaction.

Here’s how arbitration works on AgoraDesk:

- When a buyer initiates a trade, the seller is required to post an arbitrage deposit that is equal to the transaction amount. This deposit is held in escrow until the buyer confirms that they have received the cryptocurrency and releases the funds to the seller.

- If there is a dispute during the transaction, the arbitrator steps in to resolve the issue. The arbitrator is an independent third party who is selected by both parties, and their decision is final.

The benefits of arbitration protection are clear – it ensures that both parties are protected from fraudulent activities during the transaction. Without this feature, there is a higher risk of scams and fraudulent activities.

However, it’s important to note that there are still some common scams to watch out for during arbitration. For example, scammers may try to impersonate the arbitrator or use fake identification documents to win the case. It’s important to always verify the identity of the other party and the arbitrator, and to report any suspicious activity to AgoraDesk immediately.

Overall, the arbitration protection feature on AgoraDesk provides an added layer of security and peace of mind for users.

Escrow service

You can rest easy knowing that your funds are safe during transactions thanks to the escrow service, which holds the cryptocurrency until both parties have completed the transaction and released the funds. This provides a layer of security for both the buyer and seller, as it ensures that the funds are not released until the agreed-upon terms of the transaction have been met.

In addition, the use of an escrow service can help prevent fraud and disputes in P2P crypto exchanges, as it allows for a neutral third party to handle the transaction. However, there are also some disadvantages to using an escrow service in cryptocurrency transactions.

One potential downside is that it can add an extra layer of complexity to the transaction process, which may be daunting for some users. In addition, there are legal considerations for escrow services in the crypto industry, as they may be subject to different regulations depending on the jurisdiction in which they operate.

Despite these potential drawbacks, many users find that the advantages of using an escrow service outweigh the disadvantages, and it remains a popular option for P2P crypto exchanges.

Affiliate Program

If you’re interested in earning some extra cash while trading cryptocurrency, the platform offers an affiliate program that allows users to earn commissions on referrals. The program is simple: users refer their friends or acquaintances to the platform and earn a commission on their transactions.

The earning potential is significant, with users able to earn up to 40% on the transaction amount if they bring in two clients who conduct one transaction to buy and sell cryptocurrency. The referral bonuses not only provide an opportunity for users to earn some extra cash, but they also contribute to the network growth of the platform.

As more users join the platform, the liquidity and trading volume increase, providing a better trading experience for all users. Additionally, the affiliate program incentivizes users to spread the word about the platform, which can lead to more users discovering the benefits of peer-to-peer cryptocurrency trading.

Overall, the affiliate program is a win-win for both the platform and its users, providing an opportunity for users to earn some extra cash while contributing to the growth and success of the platform.

Supported Coins

Now that you’ve learned about the affiliate program, let’s dive into the supported coins, which are as varied as a colorful bouquet of flowers.

AgoraDesk offers a wide range of cryptocurrency availability, with Bitcoin and Monero being the primary coins on the platform. In addition to these two, the exchange also supports other digital currency options, including Litecoin, Ethereum, Dash, and Bitcoin Cash. Users can buy or sell any of these coins on the platform, allowing them to diversify their portfolios and take advantage of market trends.

Furthermore, AgoraDesk’s coin selection is not limited to these popular cryptocurrencies. The exchange also offers lesser-known coins, such as Zcash, Vertcoin, and Bitcoin Gold. This variety of digital currency options gives users the opportunity to explore new coins and invest in emerging technologies.

Whether you’re a seasoned investor or just starting out, AgoraDesk’s coin selection provides a diverse range of options for all users.

Reliability and Safety

Before investing in any cryptocurrency exchange, it’s crucial to carefully assess its reliability and safety measures, especially given the lack of legal information and mandatory verification on AgoraDesk.

The platform’s website claims that it’s owned by Blue Sunday Limited, but there’s no information about its address, license, or other legal information. This makes it difficult for users to determine the exchange’s legitimacy and security. Furthermore, there are almost no reviews about AgoraDesk, which makes it challenging to assess its reliability.

While the platform offers a secure and easy-to-use platform that allows users to exchange cryptocurrencies anywhere, users should exercise caution and carefully study the company’s website and terms of service. It’s also essential to study feedback about the sellers and ask for identification documents if necessary.

In conclusion, due diligence is necessary when using AgoraDesk, and users should be aware of the potential risks involved.

Read also:

- LocalCoinSwap Review: Payment Methods, Available Cryptocurrencies, Fees, Pros, Cons

- Bybit P2P Review: Supported Coins, Payment Methods, Fees

- Kucoin P2P Review – How to Buy Crypto on Kucoin P2P Marketplace?

Payment Methods

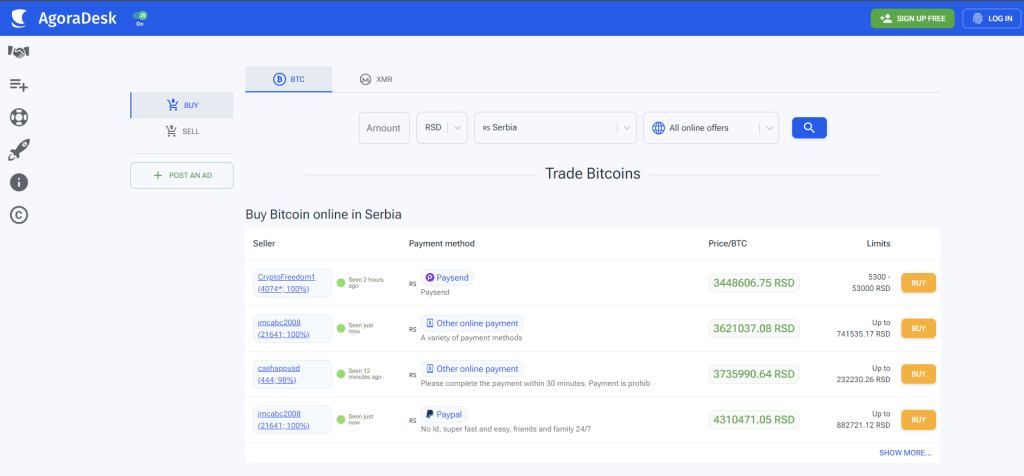

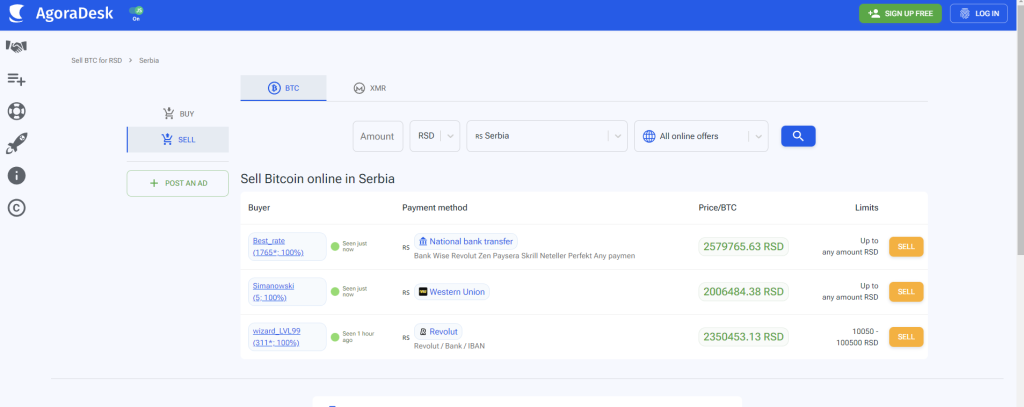

It’s crucial to assess the payment methods offered by any cryptocurrency exchange before investing, as this can greatly impact the ease and accessibility of transactions.

AgoraDesk supports more than 60 payment methods, including credit card options and PayPal availability, making it easier for users without access to traditional banking services to trade cryptocurrency. However, it’s important to note that there may be wire transfer limitations depending on your location.

AgoraDesk’s support for a wide range of payment methods makes it a more accessible platform for users looking to buy or sell cryptocurrencies. The availability of credit card options and PayPal can be especially helpful for those without access to traditional banking services.

However, it’s important to note that wire transfer limitations may apply depending on your location.

Overall, it’s important to carefully consider the payment methods offered by any exchange before investing to ensure that you can easily and securely make transactions. Don’t forget to prioritize ease and security in your transactions.

Is AgoraDesk Legit?

Imagine you’re standing at a crossroads, trying to decide which cryptocurrency exchange to trust with your hard-earned money. The question on your mind is whether or not the platform you choose is legit. Let’s explore the reliability and safety of AgoraDesk.

AgoraDesk has its pros and cons when it comes to user experience and security measures. While the exchange offers a user-friendly platform that supports more than 60 payment methods, it lacks mandatory verification and legal information. This makes it difficult to assess the reliability and safety of the company.

Additionally, the lack of reviews about the exchange adds to the uncertainty. However, the platform’s arbitration deposit protection and the fact that it doesn’t hold user funds in cold storage may offer some comfort to users. Ultimately, due diligence is necessary when it comes to trusting any cryptocurrency exchange with your funds.

Trading Fees

Get ready to save some money on your crypto trades because we’re diving into the trading fees of AgoraDesk!

When comparing AgoraDesk trading fees to other exchanges, you’ll find that they are quite competitive, making it an attractive option for those looking to maximize their profits.

The fee structure breakdown is simple and straightforward, with a maker fee of 1.00% and a taker fee of 0.00%. This means that those who create ads to sell their cryptocurrency will be charged a fee of 1.00% for every completed trade, while those who respond to the ads won’t have to pay any fees at all.

Furthermore, AgoraDesk charges a withdrawal fee of only the network fee + 50%, which is significantly lower than many other exchanges. This means that you’ll be able to move your funds off the platform without having to pay a hefty fee.

The platform also doesn’t charge any fees for deposits, making it a cost-effective option for users.

Overall, AgoraDesk’s fee structure is designed to be simple, transparent, and cost-effective, which is a refreshing change from the complex fee structures of many other exchanges.

Customer Service

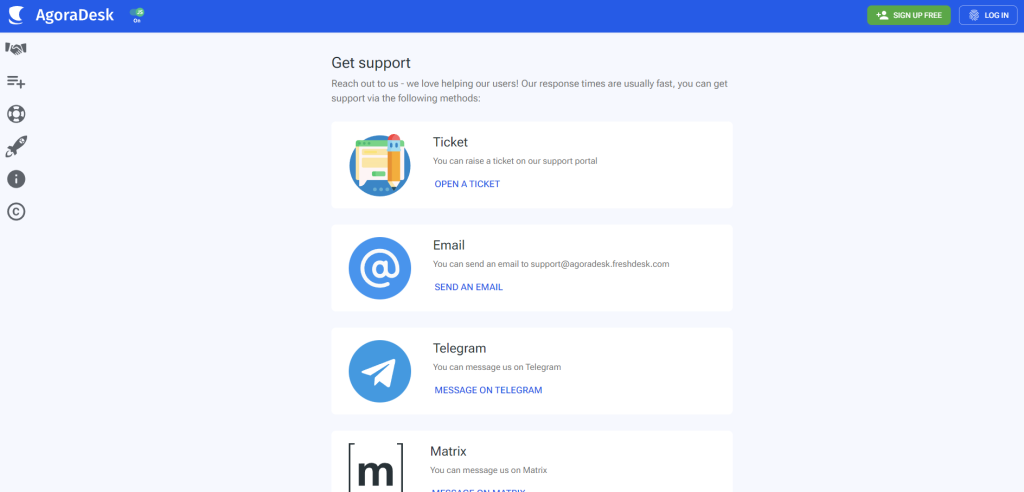

Looking for top-notch customer service when trading cryptocurrency? Well, you’re in luck because in this section, we’ll be diving into the customer service options available on AgoraDesk.

The exchange offers multiple ways for customers to get in touch with their support team, including opening a ticket, sending an email, writing to Telegram, or contacting the company via Twitter.

In terms of response to customers, AgoraDesk’s support team aims to respond to inquiries as quickly as possible. Support response time may vary depending on the urgency of the issue, but customer satisfaction is always a top priority.

Users can also find helpful information on the exchange’s website, including a FAQ section and a guide on how to use the platform.

Overall, AgoraDesk appears to have a solid customer service system in place to assist users with any issues they may encounter while trading cryptocurrency on the platform.

So, now that you know all about the customer service options available on AgoraDesk, you can feel confident that any issues you might encounter will be quickly and efficiently addressed. The platform offers multiple ways to contact support, including opening a ticket, sending an email, writing to Telegram, or contacting the company via Twitter.

Additionally, the user agreement specifies how to protect yourself when making transactions and provides clear guidelines on what is considered a violation of the agreement. While there are almost no reviews about the exchange, users can rely on the platform’s customer service options and user agreement to ensure a safe and smooth trading experience.

However, it is important to note that AgoraDesk does not employ any form of KYC/AML, which may be a concern for some users. Overall, the platform’s minimal fees, multiple payment options, and focus on user privacy make it a solid entry-level exchange for new crypto investors or those who prefer peer-to-peer trading.

Frequently Asked Questions

Conclusion

Overall, AgoraDesk is a promising peer-to-peer cryptocurrency exchange that offers a range of features and benefits for its users. With its easy-to-use platform, minimal trading fees, and support for various payment methods, the platform is an attractive option for anyone looking to buy or sell Bitcoin or Monero.

Additionally, the lack of KYC/AML requirements provides users with a level of anonymity that is not available on other exchanges. However, while AgoraDesk may seem like an ideal platform for some, it is important to consider the potential risks associated with using a peer-to-peer exchange.

Users should always exercise caution when trading on these platforms, as there is a risk of fraud, scams, and other fraudulent activities. As a final consideration, it is important to ask yourself whether AgoraDesk is the right platform for your needs.

With its unique features and benefits, it may be an excellent choice for some users, but not for others. Ultimately, the decision to use AgoraDesk will depend on your individual preferences and requirements. So, is AgoraDesk worth using? Only you can decide.