Crypto.com Tax Tool Review – Free Tax Calculator by Crypto.com

What you'll learn 👉

What is Crypto.com tax tool?

Crypto.com is a payment and cryptocurrency platform with a whole ecosystem of different products and services. It is constantly expanding its variety of services and of the most recent ones, established back in the spring of 2021, is their tax tool. This is still a relatively new feature on crypto.com, however it has already shown that it is pretty great actually.

The main purpose of Crypto.com tax tool is simply to reduce the complexity of filing cryptocurrency tax returns. Sounds pretty useful, isn’t it? Let’s jump into the details.

How does it work?

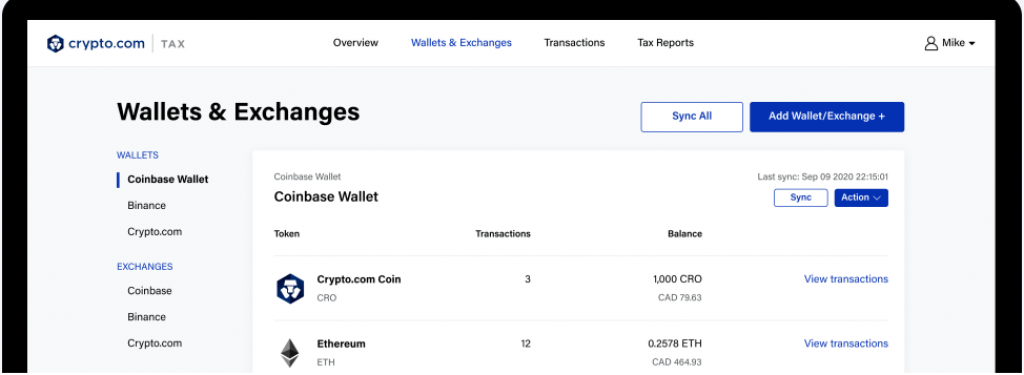

First of all, it is worth noting that Crypto.com tax tool has a very user-friendly interface. Furthermore, this feature is completely free! It allows users to easily create well-organized and reliable crypto tax reports. These reports have a complete transaction history as well as full crypto gains and losses information. Amazing, if you ask me.

Before tax reports are generated, users have a possibility to review them, just to check if everything seems fine to them. Crypto gains are calculated thoroughly.

What I found very interesting is that Crypto.com tax tool’s actually partnered with experienced tax advisors in each country they currently support. These advisors ensure that the calculation logic complies with existing guidance and laws from country to country so that users do not make any tax-related illegal moves.

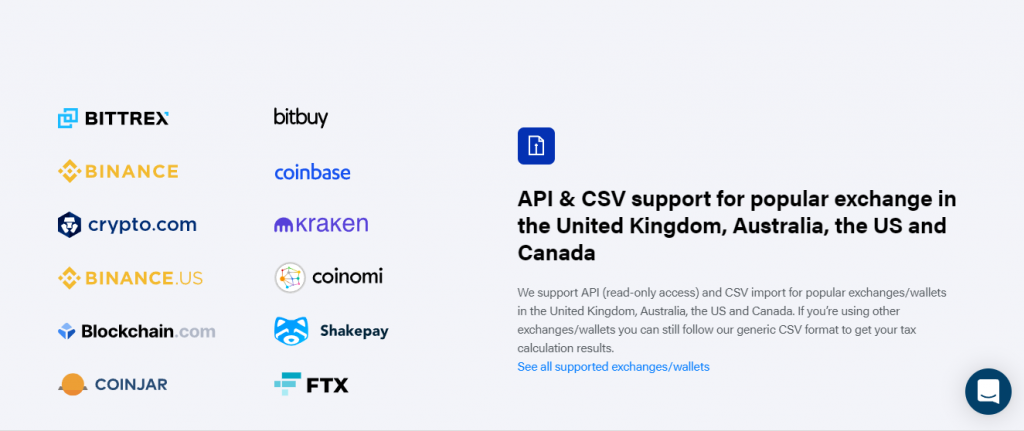

On Crypto.com tax tool, users have an option to upload a CSV file or use API synchronization from supported major platforms (e.g. crypto.com app) so that they can show their crypto transaction records from different approved wallets and crypto exchanges.

Since Crypto.com tax tool has a complete integration with common wallets and crypto exchanges, it might help the majority of cryptocurrency holders to get the job done quickly.

Supported countries

Currently, Crypto.com tax tool can be used in the following countries: USA, UK, Canada and Australia. Canada was the first supported country, followed by the US a few months later. As per the team around the feature, the plan is to expand to even more countries in the future.

Crypto.com tax tool has country-specific tax calculation formulas. This is very important since crypto is treated sometimes differently from country to country. For example in Canada it is treated as a commodity, and in the US as property.

Supported Wallets & Crypto Exchanges

Crypto.com tax tool currently supports some of the most popular crypto exchanges and wallets. Here are the lists:

Supported Walles:

Supported crypto exchanges:

- Crypto.com Exchange

- Binance

- Binance US

- Bitbuy

- Bittrex

- Blockchain.com Exchange

- Changelly Pro

- Coinbase

- Coinbase Pro

- CoinJar

- CoinSpot

- FTX

- Gemini

- Kraken

- KuCoin

- Shakepay

I do think that Crypto.com tax tool will expand these lists. For example, theMetamask wallet as well as the Math wallet should be added in the near future. These 2 wallets have over four million users between each other, respectively.

If you are using crypto exchanges or wallets that are not on the supported list above, you can still follow the tool’s generic CSV format, fill it out manually so that you can get your tax calculation results.

Pricing

We come to the point in the article where pricing should be explained and that’s probably the most interesting thing about Crypto.com tax tool since as per their website, it is an “entirely free service”.

Crypto.com tax tool is actually widely considered as the first completely free crypto tax platform. They will calculate your crypto gains and how much is your tax obligation at no cost, no matter how many transactions you have in the past years.

It remains to be seen if crypto.com will actually charge this in the future, like its main competitors Crypto tax trader, Koinly, Zenledger, TokenTax, Cointracking who charge their crypto tax calculation hundreds of dollars.

Read also:

Thanks