What you'll learn 👉

How to Do Your Kraken Taxes?

Kraken taxes are easiest done via crypto tax calculators like Koinly or Zenledger.

Other option is to hire a tax accountant, but that could be costly.

Third option is to do it yourself, manually, which makes sense if you did little trading.

Well-known crypto exchange for “serious and professional traders,” Kraken ranked second in the world in terms of volume as of January 2017. With the sophisticated trader in mind, the website offers access to several popular features like deep liquidity, leverage trading, and fast execution speed.

The platform provides complete services for crypto investors, including spot and leveraged trading as well as staking certain digital tokens directly on the platform.

In addition to providing a high level of security and proof of reserve checks, Kraken is transparent and led by the bitcoin OG Jesse Powell.

Now, after you got an idea how great Kraken is, let’s move onto the less pleasant part of the article – paying taxes.

Wherever you live, your local tax office wants to know what you earned and spent during the previous calendar year. They’ll use that information to calculate how much money you owe them.

If you bought cryptos, chances are you sold some of those coins during the year. This is called a capital gain, and it’s taxable income. You’ll have to pay taxes on whatever amount you made selling your crypto.

Kraken doesn’t have a dedicated tool for reporting your transactions, so to prepare your Kraken taxes, you’ll need to export complete transaction history from your account. This includes your transactions, gains/losses, and income. You might want to make sure you keep a copy of this file somewhere safe in case something goes wrong during the process.

You can then send this information off to your local tax office to ensure that you’ve done everything correctly.

In order to do your Kraken taxes, we recommend you use one of the crypto tax calculators like Koinly, Coinledger, or Zenledger. For these tools to work, they need the data from the exchange. And you can get your trading data in 2 ways described below.

Integrate with a crypto tax tool via Kraken API

The Kraken API gives an option to integrate with tax tools. By integrating with the tax tool, you’ll gain access to real-time data about your financial transactions, including deposits, withdrawals, payments, and transfers.

Create an API keys on Kraken

An API Key can be thought of as a username that is generated to facilitate data access. In this case, the Kraken exchange generates it, which you then pass on to another application. Based on the permissions you grant, the application will import your data.

An API Secret, also known as an API Private Key, is just a password that is used in conjunction with an API Key.

The Kraken makes it easy to create API keys. Follow these simple steps to create:

1. Log in to your Kraken account.

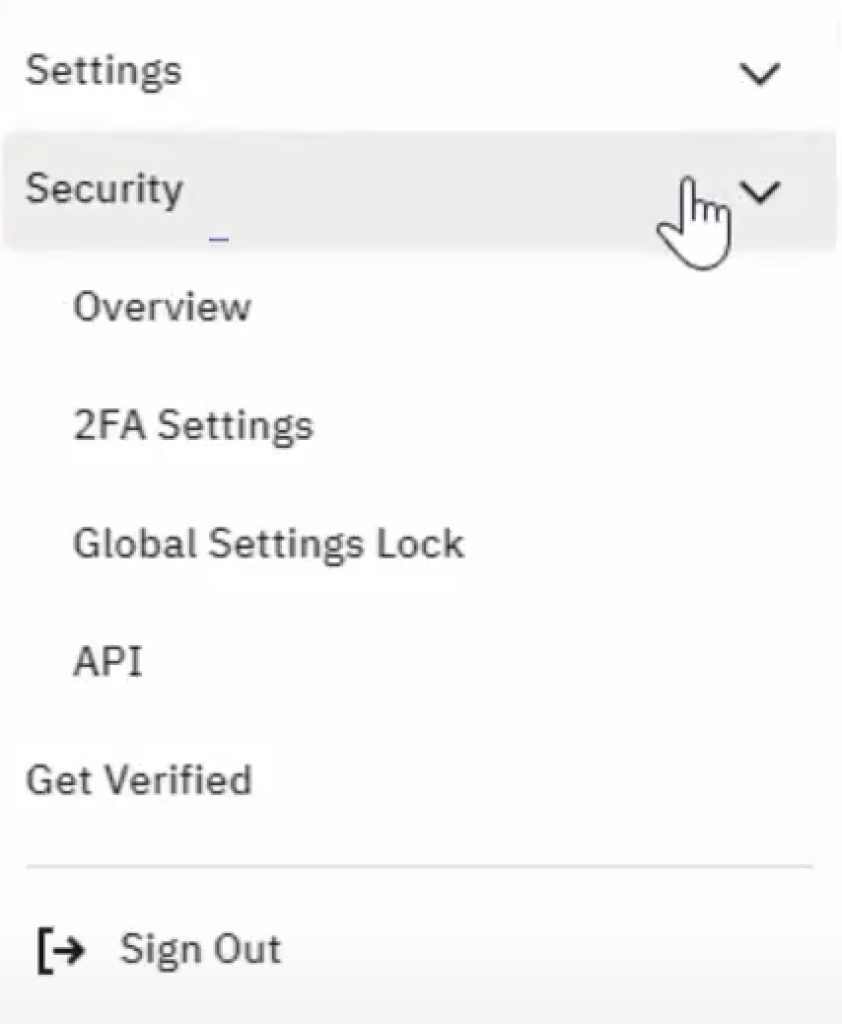

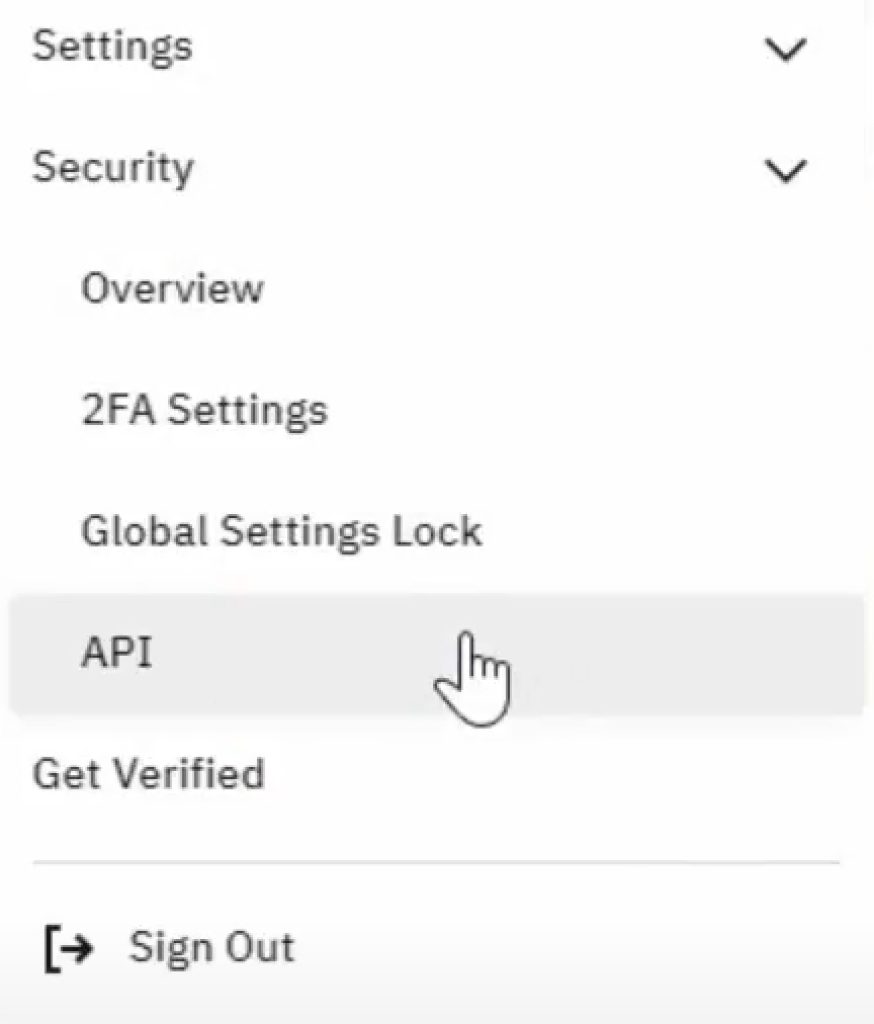

2. Click on “Security“.

3. Select “API” from the drop-down menu.

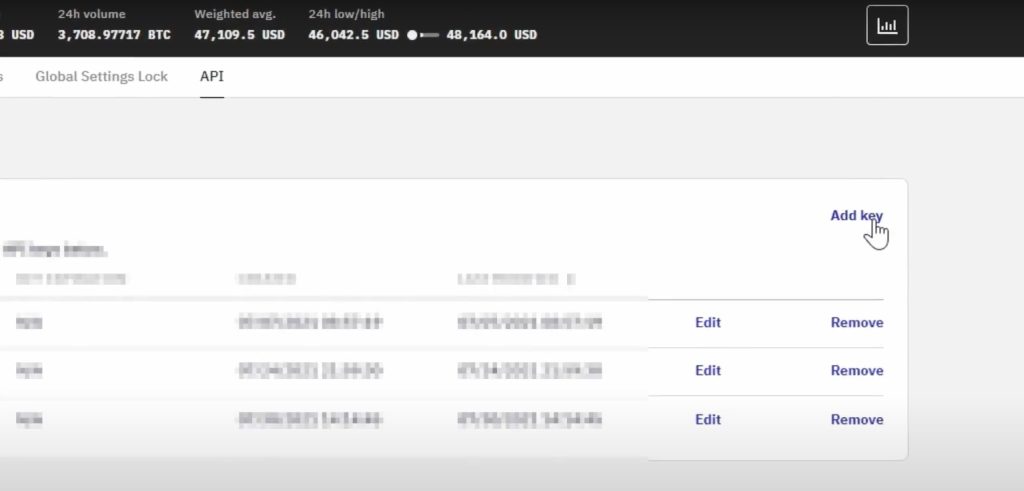

4. Choose “Add Key“.

5. Enter your API credentials, how wish you want to give them the name

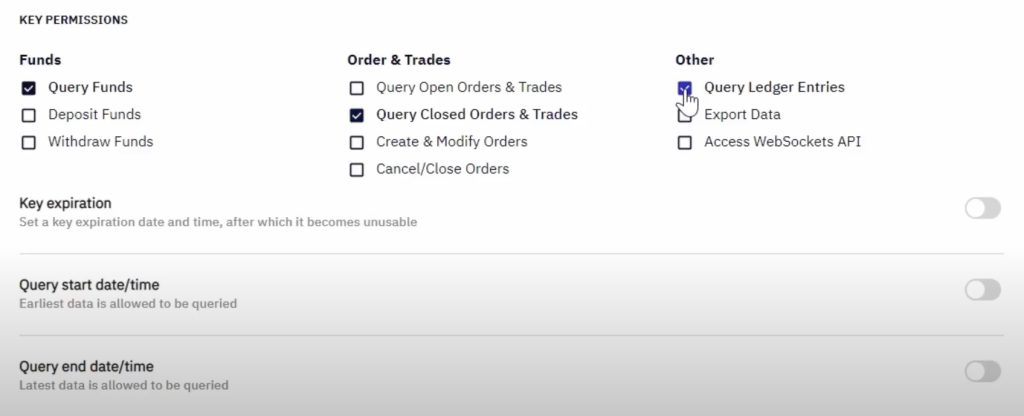

6. Check that the Query funds, Query closed orders and trades, Query ledger entries, and Export data checkboxes are selected.

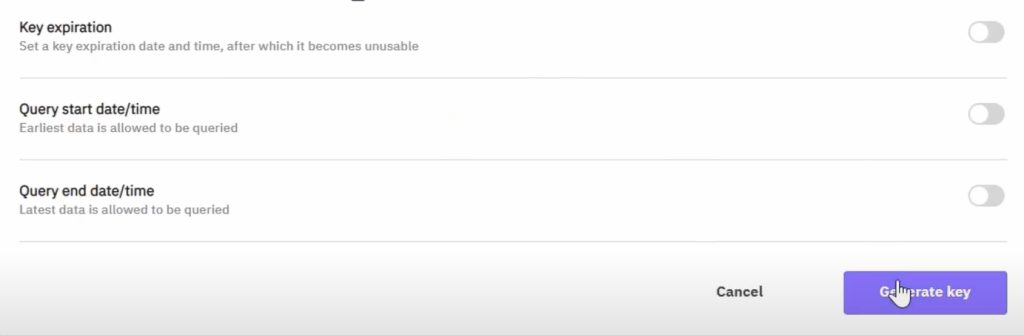

7. Click the “Generate key” in the bottom right corner. Copy the displayed API key and secret key and save them for future use.

Add the API keys into a tax tool

To add the API keys to a tax tool, follow the steps in the text below (it is almost identical for all tools as they all work pretty similarly):

1. First, go to the tax tool and sign in to your account.

2. Choose your cursor to the “Exchanges” field, and then click on the “Add Exchange” button.

3. In the field for searching, type Kraken and choose it from the list.

4. Click on “Continue” after you have chosen the first automatic option.

5. Put the name of the exchange as Kraken.

6. Into appropriate fields, paste API and secret keys, which you previously generated.

The API integration does not activate instantly. Your account activity may not be accessible for several hours.

Pulling your transaction history from Kraken automatically

The tax tool is able to keep tabs on your gains, losses, and income, as well as provide accurate tax returns in a matter of minutes, thanks to its ability to integrate with your crypto exchanges and wallets and consolidate your data. To pull your transaction history automatically, follow two steps in the text below:

1. To import all transaction history data from Kraken, choose the option “All to import“.

2. To finish the integration, click on “Save“.

Integrate with a tax calculator via the Kraken CSV/XLSX file

An alternative to connecting your Kraken account to the tax calculator via the API is to import a CSV file including your trade, withdrawal, and deposit activity.

Downloading CSV Files with transaction history from Kraken

You can export CSV files from your Kraken account fast and easily. To do that, here are some quick steps to follow:

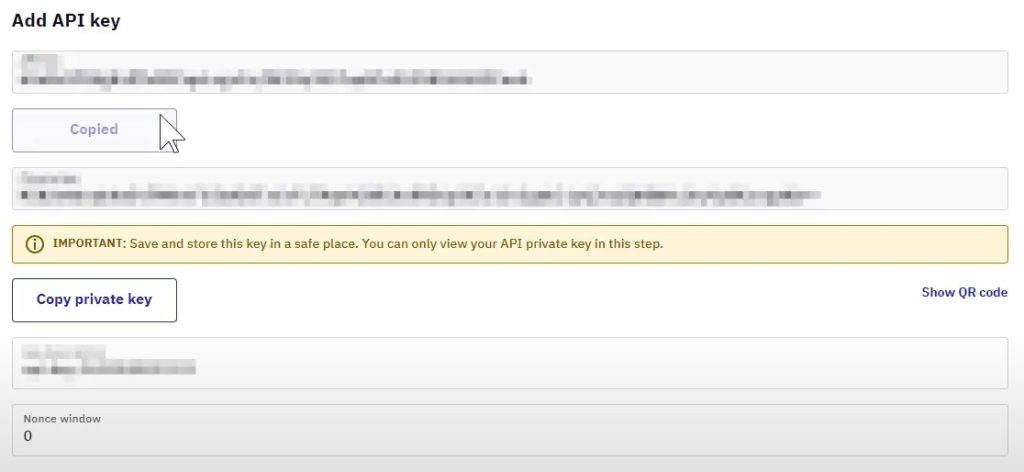

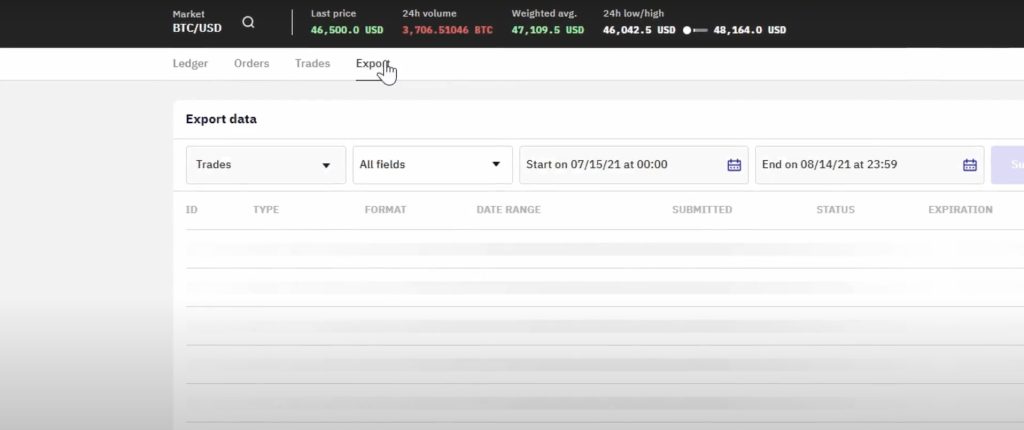

1. Log into your Kraken account. Once logged in, go to the “History” tab. Then find the tab titled “Export” and click it.

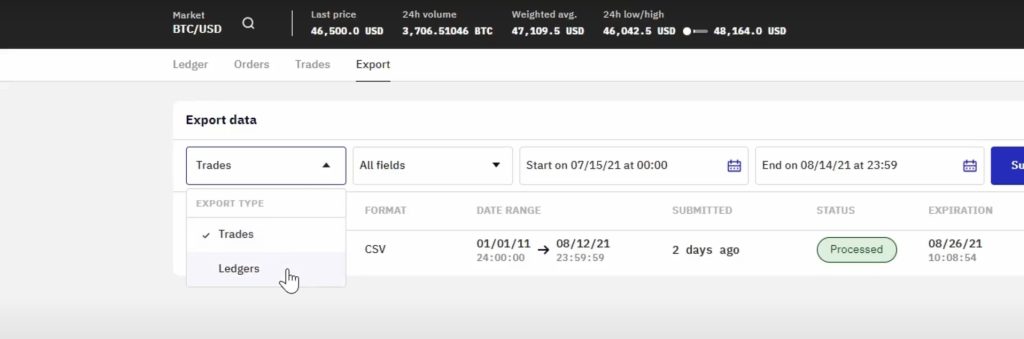

2. You will have three options to choose Trades or Ledgers, All fields, and Data Period.

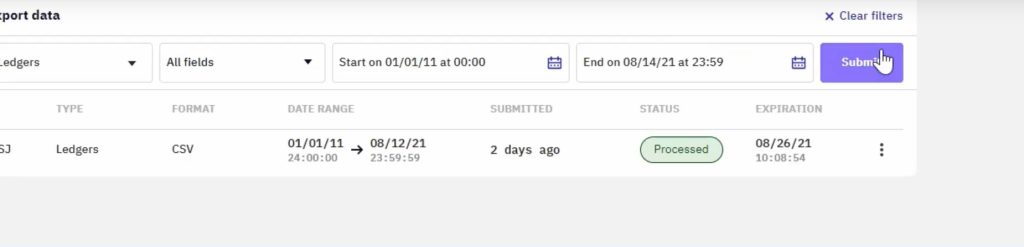

3. Choose “Ledgers” and set a date range.

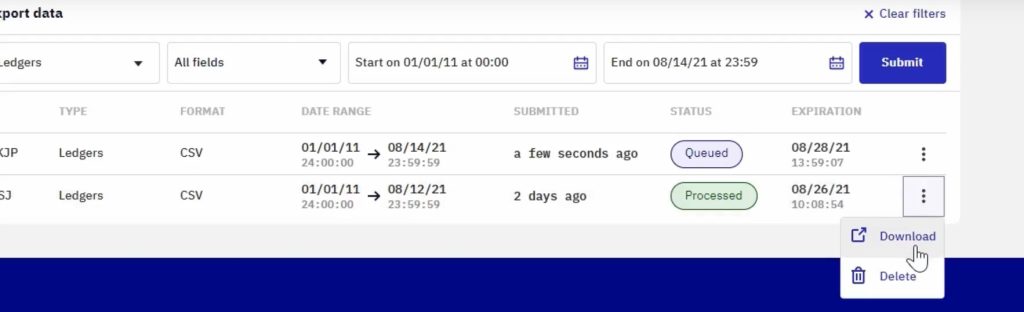

4. When you choose everything you want, click on the “Submit” button. The state of your request will be “Queued“.

5. Once when your request changes state to “Processed“, you can download the document to your computer. The document will have a CSV extension.

As you can see, downloading the CSV file takes some time during the Kraken export process. Your request has been added to a queue. It may take several days until the status changes to “Processed,” at which point you will be able to download. You won’t be notified through email when Kraken is complete. To be safe, you should check it every so often by hand.

Importing CSV files into the tax calculator

All major tax tools support importing CSV files via the Import/Export feature. This allows you to quickly and easily import large amounts of data without having to manually enter each record. You can use the following steps to import a CSV file into a tax tool:

1. Log in to your tax tool account.

2. Click on the “Exchanges” menu item.

3. Select “Add Exchange“.

4. In the Input box, type “Kraken” and select it to import data from.

5. As the wallet name, type “Kraken“.

6. Find the location of the downloaded CSV File and import it.

7. Choose a start date or select “All” to import all the data.

8. To start importing, click “Save“.

Best tools to do your Kraken taxes

Best crypto tax calculators that will tremendously help you with your Kraken taxes are:

FAQs

Kraken gives you tax documents only if you are a citizen of the USA. Currently, it only offers the US Forms 1099-MISC, 1099-INT, and 1099-NEC, which are submitted to the US Internal Revenue Service (IRS) and of which you receive a copy (if you are eligible). Due to the ongoing changes in tax reporting requirements, this could change in the next years.

Yes, absolutely, Kraken reports gains to the IRS. When a user’s transaction volume exceeds $20,000, Kraken provides information about that user to the IRS. As a result of the U.S. infrastructure bill, Kraken will also start delivering 1099s to the IRS in the future that detail your crypto transactions.

The tax software is able to keep tabs on your gains, losses, and income, as well as provide accurate tax returns in a matter of minutes, thanks to its ability to integrate with your crypto exchanges and wallets and consolidate your data.

This is different from country to country. You might be required to pay taxes on capital gains from trading digital assets or on the value of your digital asset portfolio, depending on the legislative environment in your nation. Taxes may also be due on any additional income you receive, such as that from staking or lending your crypto.

Yes, Kraken supplies a financial statement. It can create a Kraken tax statement using your whole trading history.

No, Kraken doesn’t provide an end-of-year statement automatically. However, if you’d want to make your own Kraken end-of-year statement, you can do so by using the date range feature when exporting your CSV file from it.

Yes, Kraken report to the tax office. In addition to users, it also sends 1099 forms to the IRS. Additionally, in order to ensure tax compliance, it may be required to submit additional client information to the IRS.

Kraken doesn’t generate a tax form because many crypto investors use other exchanges, wallets, and platforms.

Read also: