Crypto Whales, also known as big players or large holders of cryptocurrencies, have a significant impact on the coin market. They can change the market by buying and selling a lot of coins or by using other methods to manipulate the market. In this guide, we will explain who Crypto Whales are and how they affect the coin market.

We will also explore the strategies they use to control the market, and how they can impact the prices of various coins. Keep reading to find out more about Crypto Whales and their impact on the coin market.

In simple terms, Whales are people of group of people working together to hold a huge share of a single coin. These are usually the large players such as Hedge Funds and Bitcoin Investment Funds. They can use their advantage to manipulate the price of a coin to the desired price.

Some of these funds have announced their presence on the market such as Pantera Capital, Bitcoins Reserve, Binary Financial, Coin Capital Partners, Falcon Global Capital, Fortress, Bitcoin Investment Trust, and Global Advisors Bitcoin Investment Fund.

Whoever is involved in the cryptocurrency trading for some time, must have heard the term Whale. For instance, when you see a huge drop in a coins price, people will sometimes blame it on whales that are dumping on the market. If you think about it, whale is the biggest creature in the ocean and can probably defeat any other fish. Same is with the crypto market.

Massive hedge funds and investment funds that have a large percentage of a coin volume can be compared to a whale. The smaller the volume of a coin, the easier for a whale to manipulate it.

The moves made by whales can cause waves and if you are careful enough, you can ride them also and make some profit. But just as easily, a whale can crush you, so you have to be very cautious.

What you'll learn 👉

How to Ride Crypto Waves

According to popular web site babypips.com, spotting a whale early could allow smaller traders to go along for the ride and profit alongside the whale as well as avoid being crushed by the whale and being left with losses.

If you are looking to go long (buy) altcoin, you should wait for the whale to appear. Let’s take a look at some early signs to spot a whale.

Unusual increase in the bid size

For instance, let’s say that a normal order book for a coin has the average bid size 1,000 and average ask size also 1,000. If there is a whale on the market, the order book would change, and average bid size would rise enormously for more than 500 times.

Increase in volatility and price during a quiet period

If a coin has been trading within a narrow range in a recent period and all of a sudden there is an unusual increase in volatility and price spikes upwards, there could be a whale or whales in the house.

Read also:

Acceleration of buying volume versus selling volume

In a normal market, you’d usually see volume split evenly between the bid and the ask orders. This means 50% of the volume is buyers and 50% of the volume is sellers. If price is an uptrend, buyers may be 60% of the volume, while sellers are 40%. And vice versa, if price is in a downtrend. But if a whale is in the house, you’ll see an acceleration of volume on the buying side. For example, if 90% of the volume is on bids within a short window of time, there’s probably a whale there.

On the other hand, if you want to go short (sell), here are the signs.

Sudden cancellations of big buy orders

If you see large bid sizes starting to quickly disappear in the order book, there might a whale in the house who is about to take a massive dump (sell in large quantities).

Strong momentum in price

When a coin has skyrocketed in price in a short amount of time, it’s considered to have very strong momentum. But it’s very likely that this momentum will quickly disappear just as fast as it appeared. Why? Because the price was probably not driven by any new material information or real news, but due to a whale in the house driving up the price. Once price has reached a certain level, the whale will stop eating (buying large quantities) and will want to take a massive dump (sell in large quantities).

Very strong acceleration in volume

If there is a sudden surge in volume and the amount of trading volume is abnormally high relative to recent volume (e.g. 3x larger than usual); there might be a whale in the house.

Final Words

It is important to note that whales don’t always buy coins the traditional way through exchanges. It is possible for them to use Over the Counter Trading or Dark pools. In this way, they are able to buy large sums of digital currency far from the watching eyes of the public. They are doing this because they do not want other to spot the early signals and that the market is getting manipulated.

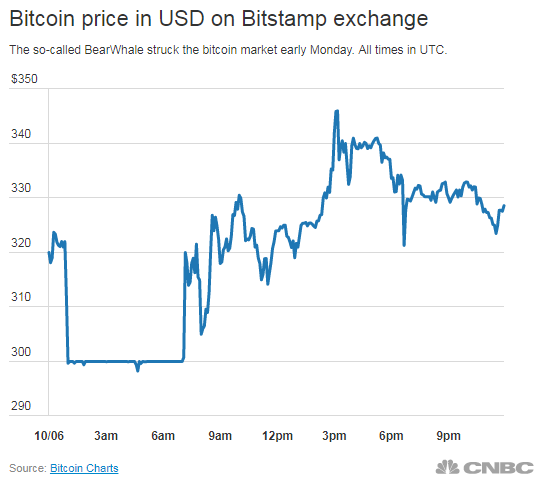

In 2014, someone posted a limit order to sell 30,000 bitcoins at $300 each—well below the mid-300s price level the cryptocurrency had been trading at throughout the weekend. In the still-nascent market, an order of that size spooked the market, sending prices plummeting to levels not seen since November 2013.

Bitcoin traders almost immediately named the seller “BearWhale,” and the name proliferated quickly throughout social media. And although he was eventually defeated – the order was cleared after making a remarkable pattern in the bitcoin price chart (below) – the community of cryptocurrency enthusiasts has begun to mythologize the incident, creating artwork and poetry in honor of the battle. Not only are they proud of successfully pushing against this perceived bearishness, but also no one can really figure out why the BearWhale emerged to begin with.