Contrary to popular opinion, the crypto market isn’t as random as people think. Many factors affect the prices of coins and tokens. One of such is the activities of crypto whales.

The prices of cryptocurrencies change significantly because of these big players in the community.

Keeping tabs on their activities will help you anticipate the direction of the crypto market movements and make intelligent investments. “If you can’t beat them, join them.”, right? This article will go over how to track crypto whale wallets in great detail.

What you'll learn 👉

Crypto Whale Tracker – Quick rundown

| Tool | Description |

|---|---|

| Blockchain Explorers | Search engines for wallets that show the amount of money in a wallet, token transactions, and transaction history in real-time. |

| Arkham | Free analytics platform that tracks wallets of DAOs, influencers, traders and more, and helps find whales who bought tokens early. |

| Whale Alert | Tracks large and unusual transactions to and from wallets and exchanges, and shares updates on X and Telegram. Over 2.7 million followers on X. |

| Etherscan.io | Blockchain explorer that shows transaction history for any wallet address on the Ethereum network, as well as important details about the biggest transaction of the day. |

| Debank | Free NFT wallet tracker with filter and alert options that lets users view the portfolio of a wallet for more detailed analytics. |

| chainEDGE | A smart money signals and trading platform designed to help crypto traders track and follow the most consistently profitable DEX traders, providing real-time access to their movements across multiple blockchain networks |

| Zerion | A portfolio management tool that enables users to track whale wallets, view their holdings, and monitor transactions across multiple chains. You can read our Zerion review here. |

Who are crypto whales?

These are the big dogs of the crypto community. They are the largest crypto holders and traders swimming in the crypto ocean.

Crypto whales hold a significant amount of coins or tokens of a particular crypto.

To become a crypto whale, you must hold no less than a certain amount of cryptocurrency. The most important thing is that the amount you hold is enough to cause significant changes to the market.

For instance, a person can only be called a Bitcoin whale if he holds a massive amount of Bitcoin in his wallet, and every Bitcoin transaction he makes generally affects the Bitcoin’s value.

Why Track Crypto Whale Transactions?

Crypto Whales affect the crypto market significantly. They create large ripples that shake the crypto waters. They conveniently make huge gains while influencing how other investors trade.

The cryptocurrency market is a volatile world, and whales often use this to their advantage.

They try to confuse smaller investors by doing the reverse of what other investors think will happen.

A whale or group of whales could potentially stage a crash by selling a substantial amount of coins to stimulate a larger market sell-off, only to dive in then and buy more coins than they sold at a lower price. They can also create artificial inflation to increase the value of their holdings, only to sell them off at inflated prices.

Understanding and tracking these transactions will put you many steps ahead of other investors, surfing through the waves created by these whales with ease. You will save yourself a lot of money that one mistake can cost you.

How to Track Crypto Whales?

My favourite part of cryptocurrency is blockchain transparency. Thanks to the decentralization of the blockchain, you can track crypto whale activities and monitor their wallets and transactions.

On-chain analysis for whale tracking

Don’t be intimidated by the fancy name. With this method of whale tracking, you simply analyze or study the blockchain. A tool called blockchain explorer will help you explore the blockchain.

Many blockchain explorers rank wallet addresses in terms of the number of crypto tokens held. Analyzing the blockchain helps you see what investors and holders do with their tokens.

Millions of crypto transactions are documented on the blockchain. Small transactions are not the problem. However, when you notice transactions worth millions of dollars in cryptocurrency, then you’ll know that a significant change in value is about to occur.

Look out for any form of whale movement. There are three different types:

Wallet-to-exchange transactions

When you notice a large amount of a cryptocurrency being moved from a regular wallet to an exchange or trading wallet, this likely means that the holder may want to sell it.

This sell-out pressure will cause prices of such crypto to plummet as other smaller investors begin to panic and sell off their holdings while the whales use this opportunity to buy the dip.

With stablecoins, the effect is the opposite. For instance, if millions of dollars of stablecoins like USDC or USDT are moved from wallets to exchanges, this implies that whales are looking to buy, and thus, there will be a price increase.

Exchange-to-wallet transactions

On the other hand, when you notice a large sum of crypto being moved from the exchange or trading wallet to the average wallet, this means the individual behind the wallet does not plan to sell anytime soon.

This sudden decline in supply could cause prices to shoot up. The whales may take advantage of this and sell their crypto tokens at inflated prices.

Wallet-to-wallet transactions

This last type of whale movement is the most negligible. It may shock you that many large investors do not use crypto exchanges. Instead, they trade directly over the counter (OTC). This OTC trade allows them to buy or sell crypto in large amounts without disrupting the market prices.

For example, in February 2021, Tesla purchased $1.5billion worth of Bitcoin.

This significant purchase did not affect the value of bitcoin because it was an over-the-counter purchase.

Best whale wallet tracker tools

Blockchain explorers

Blockchain explorers are like crypto search engines that you can use to see what crypto whales are buying. They gather information from the blockchain through transactions and blocks and arrange them into searchable categories.

You can view the transaction history of any wallet address, view each block as they are mined on the blockchain, and the details about each block.

You can also see the largest transaction of the day and essential details about such transactions. This will help you quickly spot whale movements and track the affected wallets.

Whale Alert

This is one of the largest crypto communities with over 1.2million followers. Whale alert updates large and unusual transactions to and from wallets and exchanges.

These updates are posted on their X timeline and Telegram groups feed by crypto bots that provide remarkable insight into the blockchain. You can join this community on Twitter or Telegram to get the latest updates on blockchain transactions and whale movements.

Paid on-chain data analytics platforms

It takes an experienced trader to study and understand the blockchain. For many, it remains a mystery. This is where on-chain data analytics platforms come in.

These tracking services retrieve, analyse and graph thousands of transactions from the blockchain, presenting them in simple charts that are easy to view and understand. First, they inspect the blockchain. Then they identify all the required data. The data is then grouped and presented in simple charts.

Example of how to track a whale wallet with ethscan.io and debank.com

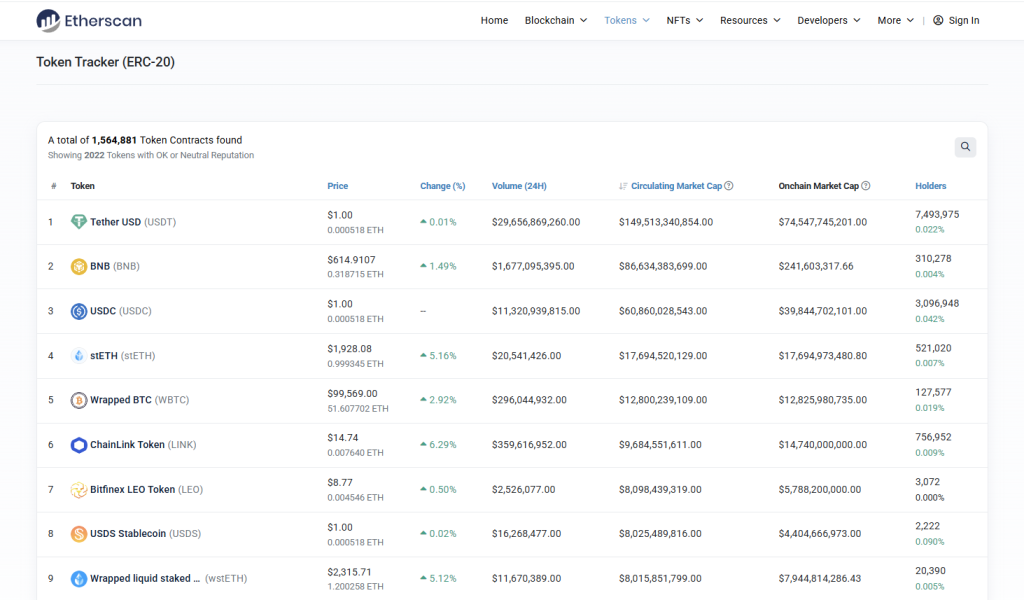

Using Etherscan.io

Let’s consider how you can track a whale wallet with Etherscan.io.

- Using any browser of your choice, visit etherscan.io/tokens to access a table with a list of tokens available on the Ethereum blockchain.

- After selecting a token, go to the holder’s section. Here, you will find a lot of helpful information for tracking a whale wallet. For clarity, you can view the token holders’ chart.

- Based on the size of the holdings, search for wallets that got significant positions in the first few weeks.

- Go through the transaction history to get more insight.

- Note down wallets that made early large transactions.

- Now, go to Coingecko and search for the coin in a relevant block explorer.

- Look out for large, unusual transactions starting from the oldest.

- If any particular transaction catches your eye, copy the wallet address, check the transaction history, and Etherscan data.

Use debank.com to check the wallet’s portfolio for more detailed and organized analytics.

If the address is not what you’re searching for, repeat the entire process and find another wallet address. This way, you can identify crypto whale wallets.

Conclusion

Some “investors” buy coins or tokens at their cheapest rates and then hope for the best, waiting for fate to happen to them.

How silly!

The crypto market is not reliant on chance.

Crypto whales have more information and leverage than an average investor. Closely following these big dogs of the crypto community and keeping tabs on their transactions can help you make decisions that will make you rich.