Vela Exchange Review: Features, Fees, Team, Tokemonics, Pros, and Cons

What you'll learn 👉

What is Vela Exchange?

Vela Exchange is a decentralized trading platform built on the Arbitrum network, one of the best Layer 2 chains on the market. It offers users a secure and efficient way to trade cryptocurrencies.

As a decentralized exchange (DEX), Vela Exchange operates on a peer-to-peer network, eliminating the need for intermediaries and central authorities.

| Topic | Summary |

|---|---|

| What is Vela Exchange? | – Decentralized cryptocurrency exchange – Built on Arbitrum network for speed and scalability – Offers spot trading and advanced perpetuals trading – Uses Vela liquidity pools and incentivizes market makers |

| Features | – Leveraged positions up to 100x – Collateral management with USDC – Advanced position management e.g. trailing stops – Multi-chain deposits from ETH, BNB, MATIC etc. – Vela Stream provides price feed data – Fiat on/off ramps via Banxa |

| Team & Backers | – Founded by Travis Skweres and Dan Peng – Advisors include reps from Balancer, BlackRock, Polygon etc. – Backed by Coinbase Ventures, Blockchain.com, DeFiance Capital etc. |

| How It Works | – Uses AMM model and liquidity pools – Traders interact with smart contracts, not order books – External price feed from Chainlink for mark price of perpetual swaps – Decentralized infrastructure provides leverage without custodial risks |

| Platform Fees | – Funding fees to maintain balanced exposure – Borrow fees on amount leveraged when opening positions – Position fees on closing position based on size – Fees reduced based on VELO holdings |

| Tokenomics | – VELA token used for fees, staking rewards, governance – Staking provides kickbacks on fees – Fee revenue used to buyback and burn VELA |

| Final Thoughts | – Robust professional trading experience coupled with on-chain security – Strong financial backing and proven product-market fit – Significant potential to lead decentralized derivatives exchanges |

| VLP Improvements | – Add more analytics and management dashboards for LPs – Offer partial withdrawal options for smoother rebalancing – Improve overall VLP analytics, automation and control |

| Artificial Slippage | – Excessive slippage eating into trader profits – Need to debug and optimize AMM performance – Audits can identify issues causing inflated slippage |

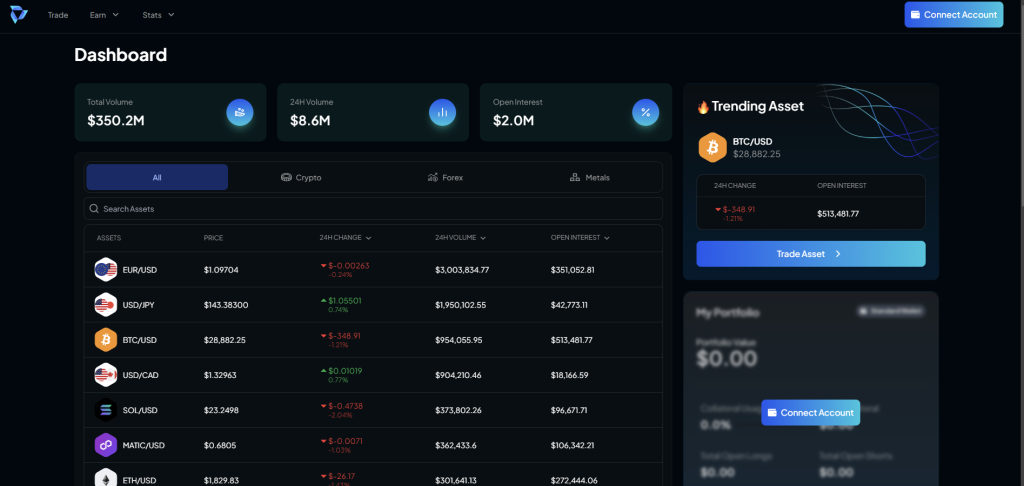

By leveraging the power of the Arbitrum network, Vela Exchange ensures fast transaction speed and a scalable infrastructure, facilitating seamless trading activities for users. The platform supports a wide range of digital assets, including both popular cryptocurrencies and synthetic assets, providing users with diverse trading pairs.

Vela Exchange aims to provide an efficient trading experience with advanced perpetuals trading capabilities and spot trading. With its intuitive trading charts and user-friendly interface, traders can easily navigate the platform and execute trades with ease. Additionally, Vela Exchange offers competitive trading fees and incentives for market makers to ensure ample liquidity in its liquidity pools.

Currently, Vela Exchange is in the beta phase, with a team of experienced beta testers providing valuable feedback to enhance the platform’s functionality. The team behind Vela Exchange, along with its advisory board which includes prominent names such as Balancer and BlackRock, are committed to continuously improving the platform and providing users with a seamless trading experience.

Features

Vela Exchange offers a range of features that make it a standout decentralized exchange (DEX) in the crypto market. With its focus on perpetual trading and high trading volume, Vela Exchange provides users with a comprehensive and efficient trading platform.

The exchange’s decentralized nature eliminates the need for intermediaries, ensuring secure and transparent trading processes. Vela Exchange supports a diverse selection of digital assets and synthetic assets, allowing for a wide range of trading pairs. The platform’s advanced perpetuals trading capabilities and spot trading options provide traders with a seamless and intuitive trading experience.

Additionally, Vela Exchange offers competitive trading fees and incentives for market makers to ensure liquidity in its liquidity pools. With its scalable infrastructure and fast transaction speed enabled by the Arbitrum network, Vela Exchange is poised to become a leading player in the decentralized exchange space.

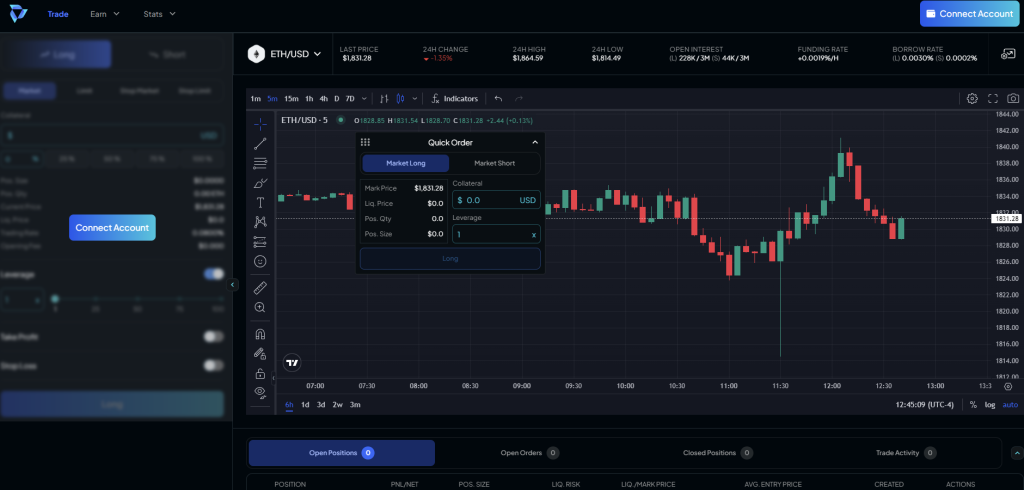

Leveraged positions

Leveraged positions on Vela Exchange offer traders the opportunity to amplify their trading strategies and potential gains. On this innovative trading platform, traders can open both long and short bets with up to 100x leverage on a variety of asset classes, all valued in USD.

With leveraged positions, traders can increase their exposure to the market and potentially benefit from price movements. They can open long bets, anticipating an asset’s price to rise, or short bets, expecting the price to decline. This flexibility allows traders to profit from both bullish and bearish market conditions.

To ensure accurate and real-time asset valuations, Vela Exchange utilizes the vStream price feed store. This powerful technology aggregates data from multiple sources to provide traders with reliable and up-to-date information. This enables traders to make informed decisions while taking advantage of the leveraged positions available on Vela Exchange.

Whether you are a seasoned trader or just starting in the crypto market, Vela Exchange empowers you with the tools and resources to make efficient and profitable trades. Open leveraged positions today and experience the benefits of trading with up to 100x leverage on a diverse range of asset classes in USD.

Collateral Management

Vela Exchange takes collateral management seriously to ensure a secure and efficient trading experience for its users. The platform utilizes a vault backing system, where the collateral is held in secure storage to support leveraged trading positions.

Traders can easily deposit USDC, a stablecoin pegged to the US dollar, into their Vela Exchange account as collateral. USDC provides a stable and reliable form of collateral, minimizing the risk of price volatility. The process for depositing USDC is simple and seamless, allowing traders to quickly fund their accounts and start trading.

If you are wondering how to send USDC to Ledger Wallet, click here.

In addition to USDC, Vela Exchange is also exploring the potential introduction of other stablecoins to further diversify the collateral options available on the platform. This will provide traders with more flexibility and options when managing their collateral.

As Vela Exchange continues to grow, its collateral management practices will evolve to ensure the safety and security of user funds. The platform is committed to maintaining a strong and scalable infrastructure that supports the increasing demands of the crypto market.

By effectively managing collateral and offering a variety of stablecoin options, Vela Exchange aims to provide traders with a robust and reliable trading platform that empowers them to confidently engage in leveraged trading activities.

Advanced Position Management

Vela Exchange takes trading to the next level with its advanced position management features. Traders can utilize sophisticated trading methods to effectively manage their positions on the platform.

One of the key tools available is Limit Orders, which allow traders to set specific price levels at which they want to enter or exit a trade. This helps them strategically enter positions at desired prices, maximizing their potential profits.

Trailing Orders are another powerful tool offered by Vela Exchange. Traders can set a trailing stop order that adjusts as the market moves in their favor. This allows them to secure profits while still giving their trades room to grow.

Stop Loss orders are crucial for risk management. Traders can set a predetermined price level at which their positions will be automatically closed to limit potential losses. This feature helps protect their capital from significant downturns in the market.

To enhance flexibility, traders can change their collateral on Vela Exchange. This means they have the option to switch between different assets as collateral, offering greater diversification and risk management opportunities.

For those seeking higher leverage, Vela Exchange supports leveraged positions of up to 100x. This enables traders to amplify their potential returns, although it’s important to note that higher leverage also comes with increased risk.

With Vela Exchange’s advanced position management tools, traders can navigate the crypto market with confidence, harnessing the power of Limit Orders, Trailing Orders, Stop Losses, and Trailing Stops to optimize their trading strategies and achieve their desired outcomes.

Multi-chain Deposits

Vela Exchange takes the concept of decentralized trading to the next level with its innovative Multi-chain Deposits feature. This functionality allows users to seamlessly transfer their assets across different blockchain networks, providing an interoperable trading experience like no other.

With Multi-chain Deposits, traders have the ability to swap tokens from various chains for USDC, mint VLP tokens, and acquire gas tokens, all within a single unified platform. This eliminates the need for users to navigate multiple exchanges or platforms to execute these actions, saving them both time and effort.

One of the standout benefits of Multi-chain Deposits is the efficiency of the transaction process. Swaps into USDC can be completed in 30 seconds or less, ensuring that traders can quickly access their desired assets and take advantage of trading opportunities in a timely manner. This fast and seamless process enhances the overall trading experience, allowing users to capitalize on market movements without delays.

Furthermore, Multi-chain Deposits on Vela Exchange are designed to be cost-effective and time-saving. By consolidating various functionalities onto one platform, traders can streamline their trading activities and avoid unnecessary fees or transaction costs associated with multiple exchanges.

In summary, Vela Exchange’s Multi-chain Deposits provide traders with a truly interoperable and efficient trading experience. By enabling seamless token swaps, fast transaction processing, and cost savings, Vela Exchange is revolutionizing the way traders navigate the crypto space.

Vela Stream price feeds

Vela Stream price feeds are an integral part of the Vela Exchange platform, providing a reliable and accurate data price source. These price feeds are powered by Chainlink, a renowned decentralized oracle network, ensuring the highest level of data integrity and security.

The purpose of Vela Stream price feeds is to generate price stability and facilitate the creation of new assets with trading demands on the Vela Exchange platform. By leveraging data from various centralized exchanges (CEXs) and corporate data providers, Vela Stream price feeds provide real-time and reliable market data for a wide range of trading assets.

With price stability being a crucial factor in the crypto market, Vela Stream price feeds play a vital role in ensuring that users can make informed and confident trading decisions. These price feeds provide accurate and up-to-date information on trading pairs, enabling traders to accurately assess market conditions and execute trades accordingly.

In addition, the availability of reliable price feeds enhances liquidity on the Vela Exchange platform, attracting more market participants and facilitating the creation of new assets. This ultimately contributes to a vibrant and active trading ecosystem on Vela Exchange.

Overall, Vela Stream price feeds serve as a key foundation for efficient and secure trading activities on the Vela Exchange platform, enabling users to experience a seamless and reliable trading environment.

Fiat On/Off Ramps

Vela Exchange understands the importance of providing users with convenient and straightforward options to exchange between fiat and cryptocurrencies. To achieve this, they have collaborated with Transak, a trusted fintech company specializing in fiat and cryptocurrency exchanges. This collaboration has resulted in the Fiat On/Off Ramps feature on Vela Exchange, simplifying the trading process for users.

With Fiat On/Off Ramps, users can seamlessly transition between traditional currencies and cryptocurrencies without the hassle of going through multiple exchanges or complicated processes. The integration of Transak’s services on Vela Exchange ensures a secure and reliable platform for fiat and cryptocurrency exchange.

The benefits of this feature are numerous. Firstly, it provides users with a one-stop solution for their trading needs, eliminating the need to navigate multiple platforms. Additionally, it saves users time and effort by simplifying the fiat-to-cryptocurrency conversion process.

By having Fiat On/Off Ramps on Vela Exchange, users can enjoy a seamless and efficient trading experience. They can easily deposit and withdraw funds in their preferred fiat currency, making it more accessible for individuals new to the crypto space or those who prefer to trade using traditional currencies.

In conclusion, the collaboration between Vela Exchange and Transak through the Fiat On/Off Ramps feature simplifies the trading process by allowing users to easily exchange between fiat and cryptocurrencies. This straightforward solution provides a convenient and user-friendly experience, ensuring that trading on Vela Exchange is accessible to all.

Team & Backers

Vela Exchange boasts a formidable team of industry veterans and strategic partnerships that contribute to its success in the highly competitive crypto space. Founded by Travis Skweres and Dan Peng, Vela Exchange combines their extensive backgrounds in the technology and consulting industries with Skweres’ deep understanding of the cryptocurrency space.

Travis Skweres, one of the co-founders, has a wealth of experience in the crypto industry, having previously founded and served as CEO of Cryptos.com. His expertise and insights into the market have been instrumental in shaping Vela Exchange’s vision and direction.

Apart from its talented founders, Vela Exchange also benefits from the expertise of its team and the guidance of its advisory board members. Key team members from companies like Balancer, Black Rock, BCG, and Polygon bring invaluable insights and knowledge to the platform. These experienced professionals contribute to the development and growth of Vela Exchange, ensuring it remains at the forefront of innovation and industry best practices.

In terms of funding, Vela Exchange has successfully secured multiple funding rounds, demonstrating investor confidence in the project. The backing from strategic investors has played a vital role in enabling the platform’s development and scalability.

With a stellar team and strategic partnerships, Vela Exchange is well-positioned to revolutionize the crypto market and provide traders with an efficient and secure trading experience.

How Vela Exchange Works

Vela Exchange is a decentralized trading platform that offers a secure and transparent environment for buying and selling cryptocurrencies. The platform operates on a decentralized trading process, ensuring that transactions are executed directly between users without the need for intermediaries.

At the core of Vela Exchange is its order book, which aggregates supply and demand from multiple liquidity providers. This enables users to access a wide range of trading pairs, allowing them to trade various cryptocurrencies with ease. The order book is updated in real-time, providing users with accurate and up-to-date market information to make informed trading decisions.

To buy or sell cryptocurrencies on Vela Exchange, users simply need to connect their digital wallet to the platform. This allows them to securely deposit their desired cryptocurrencies and initiate trading activities. The platform’s transparent nature ensures that users have full visibility into the trading process, including the execution of their orders and the settlement of funds.

Vela Exchange also offers various features that enhance the trading experience. Traders can take advantage of advanced trading capabilities, such as spot trading and perpetual trading, to suit their investment strategies. Additionally, the platform provides incentives for market makers, promoting liquidity and efficient trading.

With its decentralized trading process, real-time order book, and flexibility for traders, Vela Exchange provides a reliable and user-friendly platform for buying and selling cryptocurrencies securely.

Platform Fees

When it comes to trading on Vela Exchange, users can enjoy a cost-effective experience with competitive platform fees. The team at Vela Exchange understands the importance of keeping transaction costs low for traders, especially in the fast-paced and dynamic cryptocurrency space. By offering affordable fees, Vela Exchange aims to attract more users and provide a seamless trading experience.

The platform’s fee structure is designed to be transparent and straightforward, ensuring that users are aware of any costs before initiating their trades. This commitment to fair and reasonable fees enables traders to maximize their profits and manage their portfolios efficiently. Whether you are a seasoned trader or just getting started in the crypto market, Vela Exchange offers a reliable and cost-efficient platform for all your trading activities.

Funding fees

At Vela Exchange, funding fees are an essential aspect of maintaining balanced open interest in perpetual trading. These fees, which can be positive or negative, are calculated every 8 hours based on the difference between the perpetual trading price and the spot index price. The purpose of funding fees is to incentivize traders to align the perpetuals’ trading prices with the spot prices, thus preventing the market from becoming imbalanced.

During the Beta phase, Vela Exchange introduced funding fees that were designed to encourage traders to participate actively and provide valuable feedback. However, it is important to note that the funding fee structure may differ after the official launch, as it is subject to continuous evaluation and optimization by Vela Exchange.

In conclusion, funding fees play a crucial role on Vela Exchange by ensuring open interest remains balanced. These fees incentivize traders to align perpetual trading prices with spot prices, creating an efficient and fair trading environment. During the Beta phase, the specific structure of funding fees may vary, but these fees will continue to serve their purpose in maintaining a healthy and balanced perpetual trading market.

Borrow fees

Vela Exchange charges borrowers with borrow fees, which are calculated based on the borrowed amount and the duration of the position. These fees are an important aspect of the platform’s funding structure, incentivizing traders to actively participate in the market and provide valuable feedback.

Previously, Vela Exchange did not have negative funding rates. However, now the funding fees are determined using a new calculation method. They are based on the difference between the long and short open interest per index token and the USDC balance held in the vault. This new approach ensures that funding fees accurately reflect market dynamics and provide a fair borrowing experience for users.

By incorporating these factors into the funding fee structure, Vela Exchange aims to create a more efficient and transparent borrowing system. The platform continuously evaluates and optimizes the fee structure to provide a seamless and rewarding trading experience for its users.

Please note that the specific details of the funding fee structure may be subject to change after the official launch of Vela Exchange as the platform remains committed to delivering the best possible trading environment.

Position fees

Position fees on Vela Exchange are calculated using a comprehensive fee model that takes into account various factors. These fees are charged to traders who hold open positions on the platform. During the beta phase, Vela Exchange tested different fee structures to ensure the best possible trading experience for its users.

With the official launch of Vela Exchange, adjustments have been made to the fee structure. The platform has refined its fee model to provide a more competitive and attractive pricing for users. These adjustments aim to strike a balance between affordability for traders and sustainability for the platform.

The income generated from position fees is distributed in a way that benefits the Vela Exchange community. A portion of the fee income goes towards supporting the platform’s operations and development, ensuring a stable and scalable infrastructure. Additionally, some of the fee income is allocated for incentives to market makers, which helps to enhance liquidity on the platform.

Compared to the beta phase, Vela Exchange has made changes to the fee structure to make it more favorable for traders. These adjustments reflect the feedback and insights gathered from beta testers and aim to provide a more efficient and rewarding trading experience.

Overall, Vela Exchange’s position fees and fee structure are designed to promote fairness, transparency, and sustainable growth in the decentralized exchange space.

Read also:

- Best Decentralized Exchanges For Leveraged Trading

- ApolloX Finance Review: Fees, Supported Coins & Countries, Pros & Cons

- Mux Protocol Review: Features, Fees, Tokens, Backers, Pros, and Cons

Tokenomics

Vela Exchange has a robust tokenomics model that revolves around the VELA token, which plays a vital role within the platform. The VELA token holds various functions that encompass governance, staking, liquidity provision, trading fees, and access to premium features.

In terms of governance, VELA token holders have the power to participate in decision-making processes and shape the future of the platform. Through voting mechanisms, holders can propose and vote on key platform updates, ensuring a decentralized and community-driven ecosystem.

Staking VELA tokens provides token holders with additional benefits. By staking their tokens, users can earn rewards such as a share of the trading fees generated on the platform. This incentivizes long-term participation and helps to stabilize the overall liquidity of Vela Exchange.

Furthermore, VELA tokens are essential for liquidity provision on the platform. Liquidity providers can stake their tokens to help enhance liquidity pools and facilitate efficient trading activities. In return, they receive a portion of the trading fees as incentives, creating a symbiotic relationship between users and the platform.

Currently, the total supply of VELA tokens stands at X. The allocation for each category is as follows: Y% for governance, Z% for staking and liquidity provision, and W% for other premium features. The current price of VELA tokens is $X.

With such robust tokenomics and the upside potential of VELA, the upcoming opening of access to the entire community presents an exciting opportunity for users to delve into a decentralized and rewarding trading experience.

VLP improvements

Vela Exchange has made significant improvements to its Value Liquidity Provider (VLP) system, enhancing the overall trading experience on the platform. One of the key enhancements includes the adjustment and auditing of the calculations related to VLP value, ensuring accuracy and transparency.

These calculations have undergone thorough audits to provide users with confidence in the fairness of the system. The auditing process ensures that VLP value is calculated accurately, taking into account factors such as trading fees, liquidity provision, and market conditions.

To track the pricing of VLP, users have multiple options available to them. They can access the Vela Exchange platform, where real-time pricing information is provided. Additionally, users can utilize external platforms and tools that track the VLP market, allowing them to stay updated on the value of their holdings.

For partners building on the VLP system, Vela Exchange offers comprehensive consulting and integration resources. These resources provide guidance and support in understanding the intricacies of VLP and integrating it into their projects. Partners benefit from Vela Exchange’s expertise and experience in the decentralized exchange space, ensuring a seamless and successful integration process.

With the improvements made to VLP, including adjusted and audited calculations, transparent pricing tracking options, and robust consulting and integration resources, Vela Exchange continues to solidify its position as a leading decentralized exchange in the crypto market.

Artificial Slippage

Artificial slippage is a unique feature of Vela Exchange designed to simulate an order book and provide users with a more realistic trading experience. This mechanism ensures that users have a more accurate representation of market conditions and helps them better understand the potential impact of their trades.

The slippage percentage in Vela Exchange is determined based on two key factors: vault utilization and position size. Vault utilization refers to the percentage of the available funds in the vault that are being used for trading. A higher vault utilization indicates a more active trading environment, leading to higher slippage percentages. On the other hand, position size refers to the total value of the position being traded. Larger position sizes will have a higher slippage percentage to reflect the increased impact on the market.

In addition, each index token on Vela Exchange has its own slippage factor based on historical volatility. Historical volatility measures the price fluctuations of an asset over a given period. Index tokens with higher historical volatility will have a higher slippage factor, indicating greater potential price impact during trading.

By incorporating artificial slippage into its trading process, Vela Exchange provides a more realistic and efficient trading experience for its users. Traders can make informed decisions based on accurate market conditions and understand the potential impact of their trades, ultimately leading to better trading outcomes in the decentralized exchange space.

VELA token

VELA Token is the native token of Vela Exchange, a decentralized trading platform. VELA Token plays a crucial role in the trading process and offers various benefits to users. As a decentralized exchange, Vela Exchange aims to provide a scalable infrastructure and efficient trading experience for traders in the cryptocurrency space. The platform offers a wide range of trading pairs, including spot trading and advanced perpetuals trading capabilities.

With a focus on liquidity, Vela Exchange incentivizes market makers by offering rewards and fostering a robust liquidity model through its liquidity pools and liquidity providers. Furthermore, VELA Token holders also have access to additional perks such as marketing rewards, EVela rewards, and consulting from industry experts. With its competitive landscape and advisory board comprising prominent figures from the crypto space, Vela Exchange is set to revolutionize the way traders engage with digital assets.

Please note that the information provided here is based on the time of writing and the current price and terms of the VELA Token may vary.

VELA token key metrics

The VELA token is an integral part of the Vela Exchange ecosystem, providing various benefits to holders and stakers. As of the time of writing, the VELA token operates on the Ethereum blockchain. Its token contract is ERC-20 compliant, allowing users to easily interact with it through supported wallets and exchanges.

The VELA token, identified by the ticker symbol VELA, has a total supply of X tokens. The circulating supply represents the number of tokens currently available in the market for trading and other activities. This ensures liquidity and facilitates efficient trading experiences for users.

Holders and stakers of the VELA token can reap numerous advantages. By owning VELA tokens, users gain access to discounted trading fees on the Vela Exchange platform, reducing costs and enhancing profitability. Additionally, VELA holders can participate in various reward programs, earning incentives like VELA token rewards or other related perks.

The utility of the VELA token extends beyond trading activities. It plays a vital role in the platform’s governance mechanism, empowering token holders to actively participate in decision-making processes and shaping the future of Vela Exchange.

Overall, the VELA token provides a multitude of benefits to its holders, such as discounted trading fees and rewards, while serving as a governance tool within the Vela Exchange ecosystem.

Token Allocation

The Vela Exchange token, VELA, follows a well-defined token allocation strategy to ensure a fair distribution and sustainable growth of the platform. The total token supply is allocated across various categories as follows:

- Public Sale: X% of the tokens are set aside for public sale, allowing retail investors to particiate in the project’s success and benefit from its growth potential.

- Team and Advisors: A certain percentage of the token supply is allocated to the Vela Exchange team and advisors. This allocation ensures the commitment and dedication of the team in building a successful and sustainable platform.

- Liquidity Pools: To increase liquidity and facilitate efficient trading, a portion of the tokens is allocated to the liquidity pools. These pools contribute to the overall trading volume and provide a seamless trading experience for users.

- Development and Marketing: Another portion of the tokens is allocated for development and marketing purposes. This enables Vela Exchange to continuously improve its features, enhance user experience, and expand its reach in the competitive landscape of the cryptocurrency space.

The token allocation strategy for VELA Exchange is designed to strike a balance between incentivizing users, supporting the team, and ensuring adequate liquidity and growth of the platform.

Additionally, Vela Exchange introduces eVELA tokens that serve as an important component of the token ecosystem. These tokens go through a linear vesting period, unlocking VELA tokens gradually over time. This mechanism encourages long-term commitment and ensures a fair distribution of tokens.

By staking both VELA and eVELA tokens, users can enjoy several benefits. Firstly, stakers can earn protocol rewards for their active participation in securing and maintaining the Vela Exchange network. These rewards incentivize users to actively contribute to the ecosystem.

Secondly, staking VELA and eVELA tokens enables users to unlock discounted trading fees on the Vela Exchange platform. This incentivizes users to hold and stake their tokens, contributing to the overall liquidity and growth of the platform. Staking not only provides financial benefits but also empowers token holders to actively engage in shaping the future of Vela Exchange.

Final Thoughts

In conclusion, Vela Exchange is positioned for future success in the highly competitive cryptocurrency space. With its decentralized and community-driven ecosystem, Vela Exchange offers a unique platform for traders to engage in efficient and advanced perpetuals trading.

The recent beta version of Vela Exchange has garnered positive feedback from beta testers, further solidifying its potential as a leading trading platform. As the project moves towards its official launch, investors should take note of the upcoming opportunities, such as the eligibility for the DXP airdrop.

With its scalable infrastructure and focus on providing a seamless and efficient trading experience, Vela Exchange is well positioned to attract a significant trading volume in the crypto market. The platform’s innovative liquidity model, with incentives for market makers and liquidity providers, ensures a robust and liquid trading environment.

For investors looking for investment opportunities in the cryptocurrency space, Vela Exchange presents a promising prospect. Its native VELA token offers benefits such as governance participation, staking rewards, and the ability to enhance liquidity provision. With the backing of reputable investors and an experienced advisory board, Vela Exchange is poised to make a mark in the competitive landscape of decentralized exchanges.

Overall, the future looks bright for Vela Exchange, and savvy investors would do well to keep a close eye on its progress and the upcoming DXP airdrop eligibility.