What you'll learn 👉

5 Reasons for having Accounts on multiple Crypto Exchanges

Bitcoin and cryptos, an entirely new asset class used for buying and selling online, have become a $2 trillion market, slowly rivaling the size of traditional finance.

Buying and selling cryptos are done mostly on crypto exchanges like Coinbase, Binance, Kraken, etc. Crypto trading is accessible to everyone worldwide (some countries have banned it, but there are ways to bypass those bans), and many traders find themselves in need of multiple accounts on different crypto exchanges.

Is it, however, ok to have an account on multiple crypto exchanges? Good question, with a simple answer.

Yes, having an account on different crypto exchanges is a good idea. Read on to see why.

Reasons for having accounts on multiple Crypto Exchanges

When it comes to buying crypto, you don’t necessarily have to purchase everything on one single exchange. In fact, it makes sense to diversify your portfolio across multiple exchanges. There are many advantages to owning digital assets on multiple exchanges.

One reason why people might want to use multiple exchanges is due to the differences in commissions. Some exchanges charge lower fees while others charge much higher fees.

Another advantage to having accounts on multiple exchanges is that each exchange offers different trading pairs. You can easily switch between exchanges depending on what pairings you prefer.

Finally, another benefit of diversifying your portfolio across multiple exchanges is security. Having accounts on multiple exchanges gives you access to different wallets and enables you to store your funds in separate locations. This way, if one exchange gets hacked, the attacker won’t be able to steal your entire balance.

The most important thing to remember about having multiple accounts on multiple exchanges is to make sure that you’re doing it for the right reasons. Don’t do it just because everyone else does it. Instead, think about whether or not it’s worth it for you. If you’re just a holder that plans to buy BTC, ETH, and some other large-cap coin, one exchange is enough for you.

If you are a trader or gem hunter, then you’ll probably register accounts on new exchanges almost daily.

Avoid a single point of failure – Spread the security risk

The crypto market has been growing rapidly over the past few years. The number of failed and hacked exchanges has risen equally. There are risks involved when you put money into just one account. You could lose it all if the platform goes down. And while most exchanges try to protect their customers, some fail miserably.

If you use a single platform, then your entire balance becomes vulnerable.

If you’re looking to dilute your security risk, it makes sense to spread your funds across several accounts. A good way to go about doing this is to open a second account at another exchange.

If anything goes wrong with one exchange, you won’t lose everything.

Ability to trade specific altcoins

There are thousands of different crypto tokens out there, with new ones popping out every hour. Some of them are going to become major players in the years ahead.

You can trade hundreds or even thousands of coins in the crypto market. Given the sheer number of new coins, even huge sites like Binance, Kucoin, or Coinbase don’t list every coin. They actually raised the bar for new tokens to be listed on their platforms.

For this reason, people who bet on these smaller projects and chase high returns (known as gem hunters in crypto slang) register on smaller exchanges that are not too strict with a listing of new tokens.

Cash-out crypto for money

Let’s say you’ve been successful in trading bitcoins. You want to take the profits or cash out. However, the exchange you used for trading doesn’t offer a withdrawal method of your choice.

You check which exchange does have it and send the coins to it in order to cash out with your preferred withdrawal method.

Different features available

Some of the crypto exchanges offer different services than others. For instance, there are crypto exchanges that focus solely on trading. Most of the bigger ones, however, offer additional features such as margin trading, lending, staking, savings, launchpads, mining, automated bots, etc.

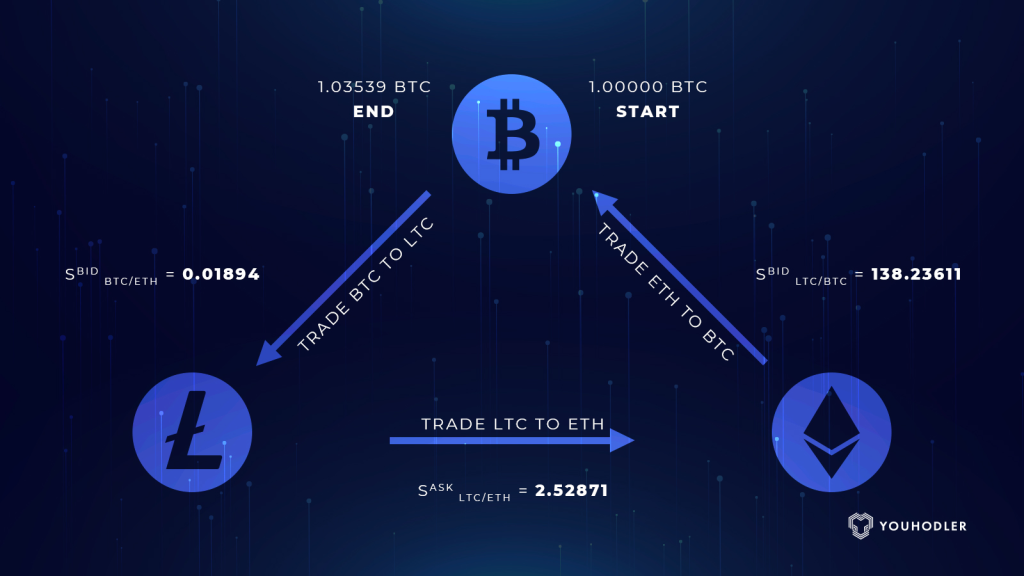

Crypto arbitrage trading

Arbitrage trading is when a person buys something in one market and immediately sells it in another. You might think that you can just buy something cheap on one exchange and sell it for a high price on another.

Some people use this strategy to make money off small differences in prices. For example, let’s say you bought Bitcoin on Coinbase for $10,000 and sold it on Bitfinex for $10,100. Then you’d end up with a profit of $100.

This is called crypto arbitrage trading because you’re essentially buying low and selling high. And it’s pretty simple to do.

You simply need to find an exchange where you can buy crypto cheaply and one where you can sell it for a higher price. Once you’ve found such an opportunity, you’ll need to act fast, though. Crypto arbitrage bots like Bitsgap or Pionex are good for automating this process.

Maintaining numerous exchange accounts is not easy – enter trading terminals

Having two, three, or a dozen of different accounts can be a bit tiring – logging into each account, confirming it is you by clicking an email link, entering 2FA, etc., is a dull and nerve-wracking process. The solution for it is trading terminals.

These crypto trading terminals can be used by traders to access multiple exchanges from a single dashboard and implement advanced crypto trading methods because they are connected via an API to numerous exchanges at once. Using a professional crypto trading terminal is preferable to trading on individual exchanges since it provides access to more powerful tools, research data, technical analysis, advanced order types, automated trading, trailing stop losses, and other features not found on exchanges.

Below are some examples of good trading terminals for crypto users:

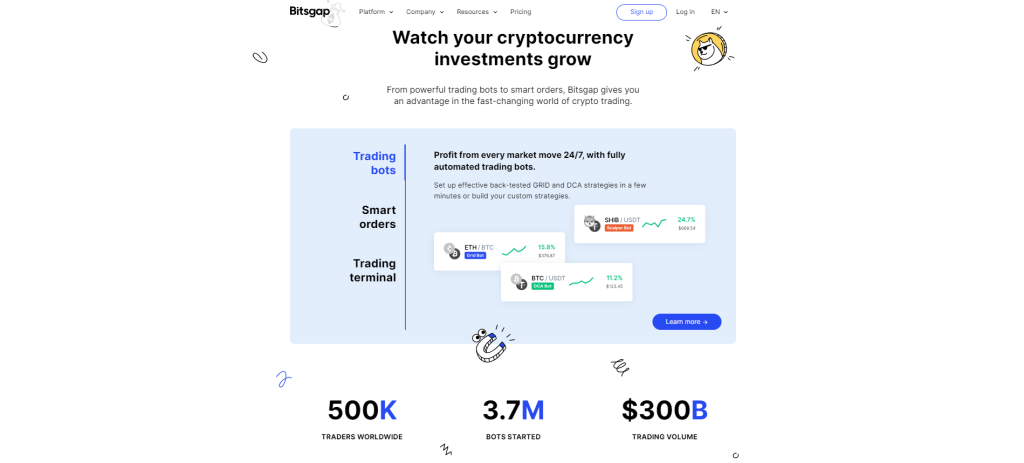

Bitsgap

Using Bitgsap, you can manage all of your crypto-related activities from a single interface: trading, portfolio tracking, arbitrage, trade based on external signals, and use automated bots to trade your setups.

The platform allows users to trade crypto assets across numerous markets, eliminating the need to open separate tabs for each exchange. Open positions and balances on all linked exchanges are also supported by the terminal.

The most prominent features of Bitsgap are its automated crypto bots which can be used for scalping, grid trading, arbitrage, and even futures trading.

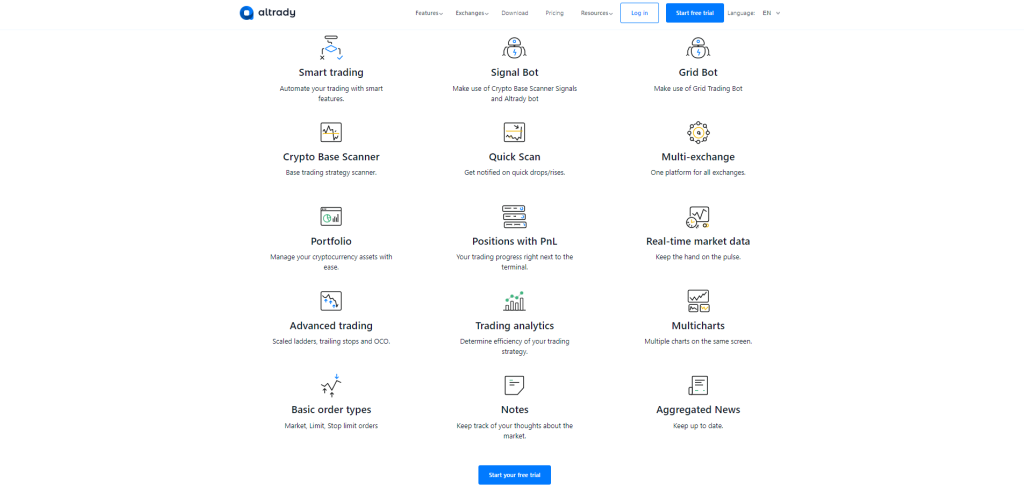

Altrady

Altrady is an easy-to-use trading terminal that also lets crypto investors trade across multiple exchanges at once.

It also offers investors a wide variety of customizability tools and features that can help them create their own personalized trading platform. Some of these tools, but not all, are strategic market scanning, identifying trading opportunities, multiple account management, multi-exchange trading, etc.

Altrady’s system is a bit overwhelming for new traders, but its platform offers a wealth of training materials and instructional videos to help ease the transition into the world of algorithmic trading.

Coinigy

Coinigy aims to simplify the process of tracking and trading a diverse range of cryptos that can be found on several different exchanges. It simplifies crypto portfolio management by combining a variety of tools seen on other exchanges into a single, user-friendly interface, eliminating the complexity normally associated with it.

Traders can access real-time data streams through Coinigy’s real-time API, which supports over 70 technical indicators. Additionally, it provides a wide range of web, desktop, and mobile applications and plugins.

Coinigy’s service gives extensive charting, price notifications, app integration, and the option to trade from numerous exchange accounts linked via API.

With one account, you’re able to manage and monitor all your crypto assets across multiple exchanges at once.

Is it Difficult to Manage accounts at multiple Crypto Exchanges?

It is not difficult, but it is cumbersome. Especially if the exchange uses short session time and logs you frequently. Logging back in, typing the 2FA numbers, confirming the device, etc., is all a time waster.

Creating an account on a crypto exchange is easy. Most of the major platforms offer a simple registration process that requires little information.

However, verifying an account on multiple exchanges is another story entirely. Some exchanges ask for personal identification documents such as passports, driving licenses, bank statements, etc. Others request proof of residence, employment, and even social security numbers.

Final words

The most important thing about trading cryptos is to spread the risk. This means you should have an account at multiple exchanges in case one of them goes down. But even so, don’t keep too much money on exchanges – just the amounts you want to trade. Your long-term holdings are best kept in hardware wallets.