What you'll learn 👉

Introduction

In the dynamic world of financial markets, having the right tools at your disposal can make all the difference. Two charting platforms that have made a significant impact in this space are TradingView and TrendSpider.

Both platforms offer a plethora of features for technical analysis, but they approach the task in fundamentally different ways. This article will delve into the similarities and differences between these two platforms, helping you decide which one suits your trading needs best.

| Section | Summary |

|---|---|

| 📝 Introduction | The article compares TradingView and TrendSpider, two popular charting platforms for financial markets. |

| 📊 About TradingView and TrendSpider | TradingView is a well-established platform with over 50 million users, while TrendSpider is newer but offers powerful automated charting features. |

| 🔄 Similarities Between TradingView and TrendSpider | Both platforms offer data and charts for a variety of markets, advanced scanners, alert capabilities, backtesting modules, and support for automated trading using bots. |

| 🎯 Differences Between TradingView and TrendSpider | TradingView stands out for its active trading community and custom technical indicators. TrendSpider excels in chart-based automation features and offers alternative data for stocks and crypto. |

| 💰 Pricing Options | TradingView offers a free option and paid plans ranging from $155.40 to $599.40 per year. TrendSpider starts at $384 per year, with higher-tier plans offering more features. |

| ❓ Which Service is Better? | The choice depends on the user’s trading approach. TradingView is better for those who rely on technical studies and want to create custom indicators. TrendSpider is better for those who rely on chart patterns and visual analyses. |

| 🔄 Alternatives to TradingView and TrendSpider | Thinkorswim, free with a TD Ameritrade brokerage account, could be a low-cost alternative for TradingView but not for TrendSpider. |

| 🎉 Conclusion | Both TradingView and TrendSpider are top platforms for advanced technical analysis. The choice between the two will depend on the user’s personal trading style and needs. |

About TradingView and TrendSpider

TradingView, launched in 2011, has grown to become the most-visited investing website online, boasting over 50 million active users. It’s a platform that has gained popularity thanks to its robust tools and social network, which are available for free to a large extent.

TradingView’s charts and commentary are also integrated into many major brokerage platforms, making it a go-to resource for many traders.

On the other hand, TrendSpider, launched in 2018, may have a smaller user base, but it has positioned itself as one of the most powerful automated charting platforms on the market. Despite its relatively short existence, the company has continued to release new features and has carved a niche for itself in the trading community.

Similarities Between TradingView and TrendSpider

Despite their different approaches to technical analysis, TradingView and TrendSpider have quite a lot in common. Both platforms offer data and charts for a wide variety of markets, including US stocks, forex, cryptocurrencies, US commodity futures, and major global indices. This wide range ensures that traders have access to real-time data across a broad spectrum of financial markets.

Both platforms also provide advanced scanners, which are highly visual and enable you to mix and match technical indicators. This feature eliminates the need to deal with coding to create a complex scan, making the process more user-friendly.

In terms of alert capabilities, both platforms excel. You can create fully custom alert parameters using multiple indicators, ensuring that you never miss a trading opportunity.

Backtesting is another feature where both platforms shine. They include a module for backtesting custom trading strategies, a critical feature considering that these platforms are designed to help you create your own sets of indicators and alerts.

Lastly, both TradingView and TrendSpider support automated trading using bots. This feature allows you to create a bot that sends buy and sell instructions to your broker or crypto exchange, automating your trading process.

Differences Between TradingView and TrendSpider

While the shared features in TradingView and TrendSpider are impressive, the two platforms put them to work in very different ways.

TradingView stands out for its active trading community. The platform bears some resemblance to Twitter in that any member can post trading ideas, annotated charts, or new indicators to the whole community. This social aspect of the platform is very active, with a steady stream of new ideas every trading day.

Another strength of TradingView is in its breadth of indicators. The software ships with hundreds of premade technical studies, and you can find thousands more by searching through indicator posts from other traders. TradingView uses Pine script, a fairly intuitive coding language, to enable traders to build their own studies from scratch or to create more complex trading signals.

TrendSpider, on the other hand, excels in its chart-based automation features. This platform doesn’t just allow you to draw on charts – it will draw on them for you. You can, for example, have TrendSpider automatically suggest Fibonacci retracements on a chart using an AI-powered algorithm. Or the software can use AI to identify potential areas of support and resistance on a chart. TrendSpider can even identify candlestick patterns.

Another unique thing that TrendSpider offers is alternative data for stocks and crypto. The platform offers a financial newsfeed from Benzinga Pro, data about insider trading, analysis of social media sentiment on Reddit, an unusual options flow tracker, and more. Most of this data can be displayed as widgets alongside your charts and incorporated into scans and alerts. This alternative data is not available in TradingView.

Read also:

- Pionex vs Bitsgap – Crypto Trading Bots in Comparison

- Pionex vs Bitsgap – Crypto Trading Bots in Comparison

- Coolwallet PRO vs Ledger Nano – What Hardware Wallet Is Better?

- Ledger Nano S Plus vs Nano X – Which Hardware Wallet is Better?

Pricing Options

When it comes to pricing, TradingView offers a free option that’s surprisingly robust. You can access most community posts and the scanner, but you do lose out on advanced indicator customization. Paid plans start at $155.40 per year and range up to $599.40 per year.

They vary in how many indicators you can overlay on a chart, how many alerts you can set up, whether you can use indicators on indicators, and more. Also, note that international exchange data costs extra.

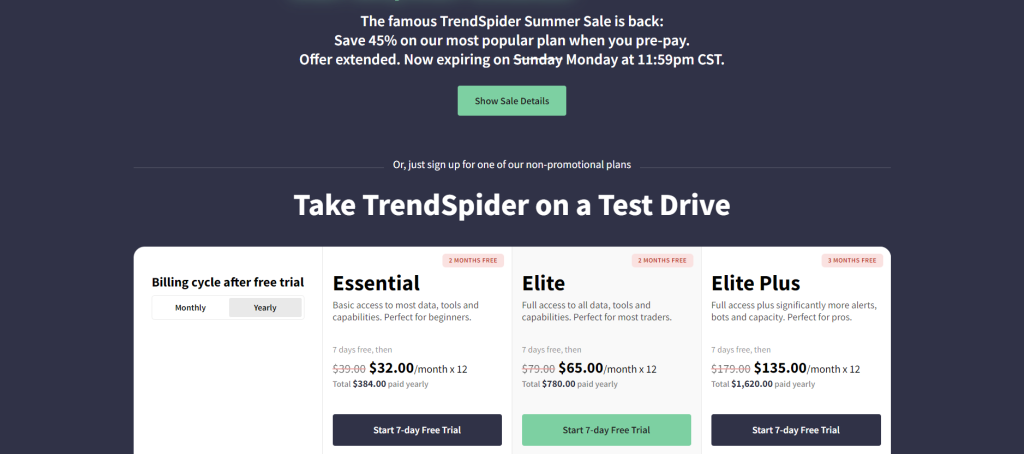

TrendSpider starts at $384 per year, although this plan limits you to daily candles for scanning, doesn’t let you set up multi-indicator alerts, and doesn’t include trading bots.

An Elite subscription costs $780 per year and gives you second-interval scanning, complex alerts, bots, and access to alternative stock and crypto data. A Master subscription, for $1,620 per year, extends the lifespan of your alerts and gives you more results per scan and more trading bots.

Which Service is Better?

The choice between TradingView and TrendSpider depends on your trading approach. If you rely primarily on technical studies and want the option to create your own highly complex indicators, then TradingView is the better option.

TradingView is also the better option if you want to trade international stocks or bonds, since TrendSpider doesn’t offer data for these assets.

If you rely on chart patterns and visual analyses like Fibonacci retracements, then TrendSpider is the better service. While TrendSpider is pricier, the added cost is reasonable given that it’s one of the only platforms that offers reliable AI-based chart annotation.

Alternatives to TradingView and TrendSpider

Thinkorswim, a comprehensive trading platform free with a TD Ameritrade brokerage account, could be a low-cost alternative for TradingView but not for TrendSpider. Thinkorswim matches most of TradingView’s charting and backtesting capabilities, and like TradingView, it gives users access to a code editor for creating custom technical studies.

However, Thinkorswim doesn’t replicate TrendSpider’s automated chart annotation features, which remain relatively unique.

Conclusion

TradingView and TrendSpider are two of the top platforms for advanced technical analysis. TradingView offers a social network and virtually unlimited customization of indicators, while TrendSpider integrates automated chart annotation with screeners and alerts to give traders more flexibility in spotting opportunities.

Both platforms cover a wide range of markets and come with critical features like backtesting, so either can benefit experienced traders. The choice between the two will ultimately depend on your personal trading style and needs.