Nexo Pro Review – How Good Is This Crypto Exchange for Spot, Futures & Margin Trading

What you'll learn 👉

Nexo Pro Overview

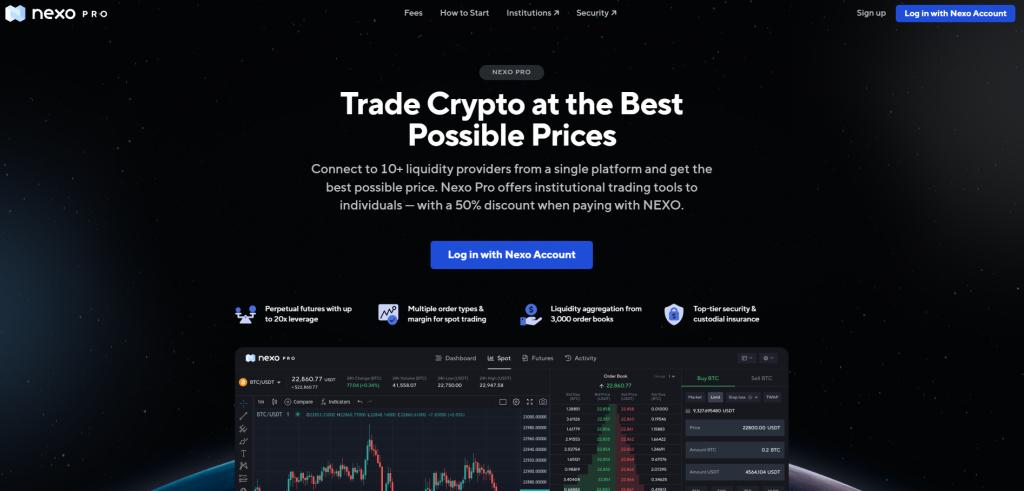

Nexo is a cryptocurrency exchange that allows users to spot trade, trade futures contracts, and utilize margin trading. As the crypto markets have exploded in popularity in recent years, many new exchanges have emerged looking to capture a share of this growing industry.

In this Nexo Pro review, we take an in-depth look at Nexo’s platform and evaluate its offerings for spot trading, futures, and margin trading. We examine aspects like available coins and market pairs, trading fees, leverage options, platform interface and design.

You can use Nexo to loan fiat money and stablecoins, by using Bitcoin and other supported digital assets as collateral.

Nexo Pro is an institutional-grade trading platform that offers access to spot, margin, and futures trading. Launched in September 2022 as an addition to the existing Nexo platform, Nexo Pro aggregates liquidity from 10+ large providers, including Nexo exchange, Binance, Coinbase, Kraken, and other crypto exchanges and market makers.

The Nexo Pro trading platform uses over 3,000 order books and hundreds of liquidity pools, with the exchange feature supporting swapping 40+ crypto assets.

| 🌐 Nexo Pro Aspect | Description |

|---|---|

| 🔍 Nexo Pro: Overview | Nexo Pro is a highly regulated advanced cryptocurrency trading platform offering spot, futures, and margin trading. It’s tailored for professional investors with a suite of advanced tools and features. |

| 📈 Nexo Pro Fees: | Provides spot trading for various cryptocurrencies with competitive fees. The base fee is 0.10% for up to $10,000 monthly trading volume, decreasing to 0.09% for $10,000 to $50,000 volume. |

| 📊 Nexo Pro: Futures Trading | Offers perpetual futures contracts settled in USDT for over 400 cryptocurrencies. |

| ⚖️ Nexo Pro: Margin Trading | Allows up to 5x leverage trading. Margin trading involves amplified potential gains and risks, including the risk of liquidation. |

| 🔧 Nexo Pro: Advanced Orders | Supports market, limit, stop-loss, take-profit orders, and TWAP trades on over 400 pairs. |

| 💧 Nexo Pro: Liquidity | Aggregates liquidity from approximately 3,000 order books, ensuring access to the best market prices. |

| 💸 Nexo Pro: Fees | Features a tiered fee structure, with more favorable rates for active traders. The base spot trading fee starts at 0.10% for up to $10,000 monthly volume. |

| 🛡️ Nexo Pro: Regulation | A highly regulated platform, ensuring compliance with relevant regulations and a secure trading environment. |

| 🚫 Nexo Pro: Drawbacks | Margin and futures trading are not available in Canada, the USA, and Australia due to regulatory restrictions. Users must pass a questionnaire test before trading perpetual futures contracts, highlighting the associated risks. |

Nexo Pro Services & Features

- Nexo Pro allows you to buy and sell over 40 cryptocurrencies (brokerage) – through its spot trading feature.

- Futures trading – allows users to speculate short-term price movements in either direction using leverage.

- Nexo Pro fully integrates with Nexo’s platform and services, including lending, savings, or sending funds to your Nexo credit card.

- API access – useful for arbitrage trading, automated bots, reports, and other purposes.

- Nexo Pro uses its proprietary trading technology called “smart order routing”, a system that allows it to connect to multiple exchanges and find the best price available on the market for a digital asset.

- The Nexo Pro swap feature currently has over 400 market pairs available for trading.

- Nexo crypto wallet – Nexo offers a secure hot wallet for digital assets available as an Android and iOs app, which connects to your Nexo account.

Buying & Selling crypto

Users can buy crypto on the Nexo platform using credit and debit cards or via SEPA or Swift bank transfers. If you live in the USA, you will have to provide a routing number instead of an IBAN and a BIC or SWIFT code. You can also withdraw fiat money to a bank account in three currencies (EUR, GBP, and USD).

Spot exchange

The Nexo exchange allows users to trade assets using 300+ pairs, such as BTC/USDT or ETH/USDT. The trading operation represents the interaction between a base asset and the quote asset. A buy order involves acquiring a base asset like BTC or ETH by selling the quote asset (USDT), while a sell order is when you sell BTC for USDT.

To use the spot exchange feature to buy Bitcoin, for example, log in to your Nexo Pro account dashboard, go to the spot tab, select the trading pair from the upper left section of the menu (BTC/USDT), and click either the buy or the sell button. You can choose between one of the following order types: Market, limit order, stop loss or take profit, and TWAP (time-weighted average price).

Nexo Pro Spot Exchange – Margin Trading

Margin trading, also known as “buying on margin”, is a trading method based on the leverage principle that involves trading assets using funds borrowed from a broker or a lending company. In other words, the margin is the initial amount of assets in your balance and the leverage represents the ratio at which your margin will be multiplied before the trade.

The assets you borrow will be shown in your account as active debt, whereas the assets you purchase are used as collateral for this debt, so do not mistake the 5x leverage with profit or return on investment (ROI). Leverage means you get a more significant amount to trade with, resulting in a significantly larger profit when a successful trade takes place.

As an example, you can open a short position on BTC with $1000 as collateral and the 5x leverage will allow you to sell $5000 worth of BTC, hence the term “leverage”. However, both in margin and futures trading there is a high risk of liquidation (your balance can go to 0) if the price drops, so although the potential gains are high, these strategies shouldn’t be tried by beginner traders.

Unfortunately, margin and futures trading is not available on Nexo Pro for Canada, USA, and Australia.

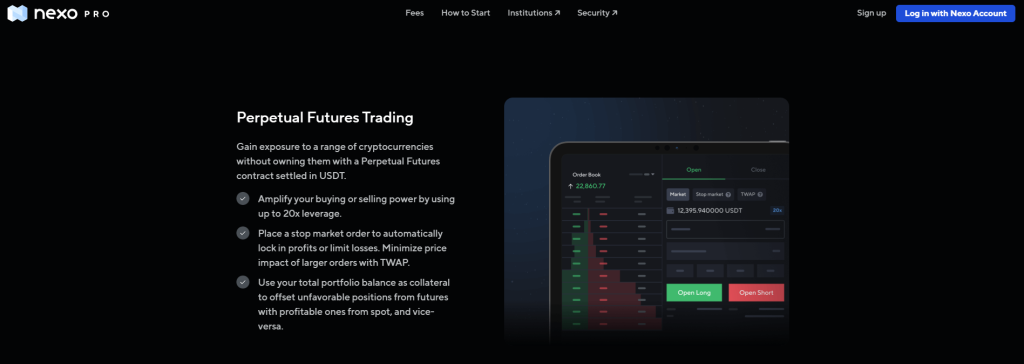

Perpetual Futures Trading

Due to the high risks involved with futures trading, Nexo Pro requires users to pass a questionnaire test before being able to trade perpetual (never-expiring) futures contracts.

What are cryptocurrency futures?

In crypto, futures are contracts representing the value of a digital asset. When you buy a futures contract, you don’t own the asset itself, instead, you own a contract under which you agree to either buy or sell that asset at a specific date in the future. Trading crypto futures has a lot of benefits, including solid liquidity, and 2x leverage for Nexo Pro.

Other platforms like Binance offer up to 100x for futures contracts, but the risks of losing your funds are much higher. Another advantage of Nexo Pro futures trading is that you can use stable coins like USDT to trade futures and earn profits in other cryptocurrencies like BTC or ETH.

Futures trading is beneficial for offering the ability to speculate on short-term price movements, by allowing you to bet in either direction for the price of an asset and earn profits even when the market is declining, a key feature unavailable with classic spot trading. The perpetual nature of futures contracts makes them a good choice for long term trades.

Advanced Orders

An advanced order on the Nexo Pro spot exchange is an order type carried out once the market price of an asset you specify is reached or exceeded. To place an advanced order, you first have to log in to the Nexo Pro platform.

Go to spot exchange, under the market tab enable the advanced option, enter the amount of cryptocurrency you want to buy or sell, and set the exit position in either direction – stop loss or take profit. Before the final step for placing an advanced order, the system will show a summary containing the potential profit and loss and other details like the price triggering amount, fees, or risk/rewards ratio.

Nexo Pro supported coins

The Nexo Pro trading platform supports 52 cryptocurrencies, including BTC, ETH, NEXO, USDT, USDC, LTC, BCH, MATIC, XLM, and others. For a full list of coins supported, click here.

Read also:

- Best DeFi Trading Platforms: What Are the Top DeFi platforms?

- Best Crypto Arbitrage Scanners – Free & Paid Arbitrage Scanners Online

Nexo Pro deposits & withdrawals

All transfers between your Nexo and Nexo Pro accounts are free-of-charge. You cannot withdraw digital assets or fiat money from Nexo Pro to an external exchange or crypto wallet. Instead, you will have to send it to your Nexo savings wallet and withdraw it from there. There is no amount limit for topping up your Nexo Pro account.

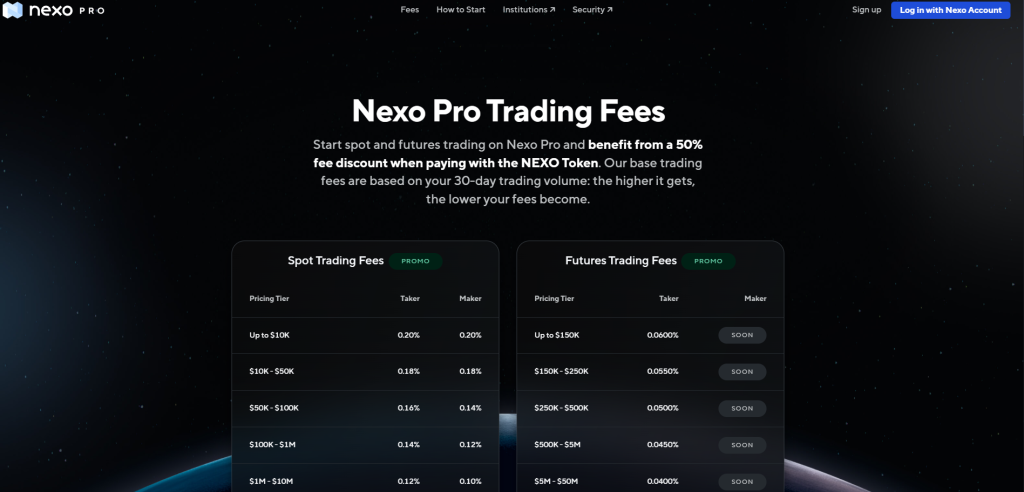

Nexo Pro Trading Fees

Traders are charged a 0.10% spot trading fee on Nexo Pro for a volume of up to $10,000 per month. A larger trading volume will give you access to a lower fee. The fee for futures trading on Nexo Pro is 0.03% for up to $150,000 in monthly trading volume, with lower trading fees available for bigger amounts.

Does Nexo Pro require KYC?

Yes. Identity verification is required to be able to use the Nexo Pro. Since the platform is licensed in 200+ jurisdictions, it requires KYC verification to comply with the laws.

Nexo Pro supported countries

Nexo Pro allows customers from hundreds of countries, including the United States, Australia, Canada, the United Kingdom, Italy, Norway, France, India, Thailand, Germany, Sweden, Denmark, Qatar, and others.

How to start with Nexo Pro?

To start trading on Nexo Pro, you need to register, activate, and verify your Nexo account first. The second step is to fund your Nexo account with digital assets from an external wallet or exchange or by buying cryptocurrency with a credit card or a bank transfer.

👉 The third and final step is to transfer assets to your Nexo Pro account from your Nexo savings account and start trading using one of the many methods and strategies available.

Does Nexo Pro have a Native Token?

Yes. Nexo has a native token called NEXO, which unlocks benefits such as discounts on loan interests or dividends from Nexo’s profits. At the time of writing NEXO token sits at NEXO with a daily volume of $4.6M.

Is Nexo Pro legit and safe?

Yes. Nexo is one of the safest crypto trading platforms on the market and offers increased security to its users – as it is audited by Armanino LLP in real-time and has advanced security features for transactions, such as 2FA.

Is Nexo Pro Regulated?

Yes. Nexo Pro is a highly regulated platform that complies with the laws. Nexo owns licenses to operate in over 200+ jurisdictions. For a list of licenses owned by Nexo, click here.

Is Nexo fully insured?

Nexo has its users’ digital assets insured for $775M (custodial insurance) in partnership with Ledger, Bakkt, BitGo, and others.

Conclusion

Fully integrated with the existing Nexo infrastructure, Nexo Pro is one of the leading cryptocurrency trading platforms on the market. It offers access to margin and futures contracts trading with up to 5x leverage, automated trading strategies, and advanced order types such as limit, stop loss, take profit, or TWAP.

FAQs

Yes. Although you can only top up your Nexo Pro account using your savings account, you can use a credit/debit card or a bank transfer (SEPA or SWIFT) to buy assets on Nexo, which you can transfer to Nexo Pro for free.

Nexo Pro is a cryptocurrency-based trading platform that works with digital assets and does not support fiat currencies. Nexo on the other hand offers loans in stablecoins and over 40+ fiat currencies.

No. Since your Nexo Pro account can only be topped up using your Nexo savings account and the assets can be transferred between the two accounts, another crypto wallet is not needed.

Yes. Futures trading with up to 2x and margin trading with up to 5x is available.

The Nexo company is based in Zug, Switzerland.

You can buy crypto assets like Bitcoin or Ethereum by creating a market order using one of the available trading pairs, such as BTC/USDT.

How do I withdraw crypto from Nexo Pro❓

You can transfer crypto assets from Nexo Pro to your Nexo savings account. To start a withdrawal transaction, go to your dashboard tab and click on the withdraw button in the upper-right corner of the page, then select the asset to withdraw.

Nexo has over 5M users from 200+ countries around the world.

Nexo Pro is a trading platform with advanced trading features, while Nexo exchange is a feature with basic swap functionality between 300+ cryptocurrencies.

Yes. Coinbase offers significantly lower interest rates for loans and lacks other advanced features compared to the Nexo platform.

Yes. As with any other crypto exchange, small or large, the platform may contain vulnerabilities that make it prone to hacking. Other popular crypto exchanges have been hacked in the recent past, causing billions of dollars in losses.