The Ethos crypto wallet has been popular for many years, but the project has become interesting again since its integration with Voyager. It was one of the first mobile wallets to really take off back in the day. We’ll have a quick look at the wallet first, then analyze the Voyager ecosystem and what it means for the Ethos wallet.

What you'll learn 👉

Ethos Wallet

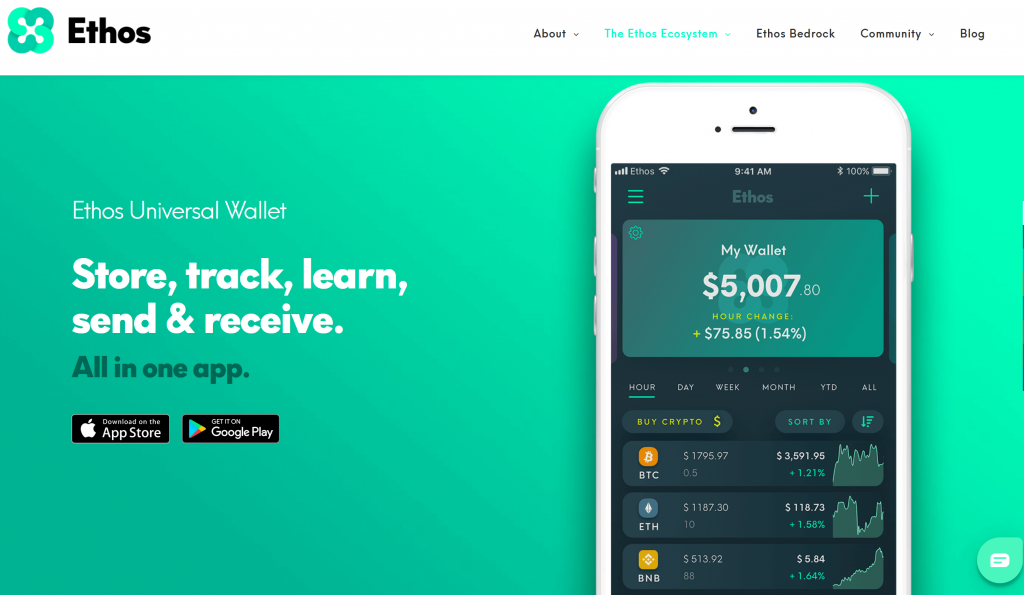

It’s a standard mobile wallet application with a portfolio manager, exchange, and all the usual functions to manage crypto from your phone. I wouldn’t recommend keeping significant quantities of crypto on any mobile wallet, but you could easily run your day-to-day crypto operations from the Ethos wallet.

Initial Setup

Installation involves a standard application download for Android or iOS from the usual places – you all know the drill by now. Enter a username, email address, and a suitable password, then click the link in the ensuing confirmation email. Now you can log in. You will be asked to remember and confirm a 24-word seed phrase. This is your security key and only you should possess this, so guard it well. If you lose your phone or need to recover a wallet, your seed phrase is your way back in.

User Interface

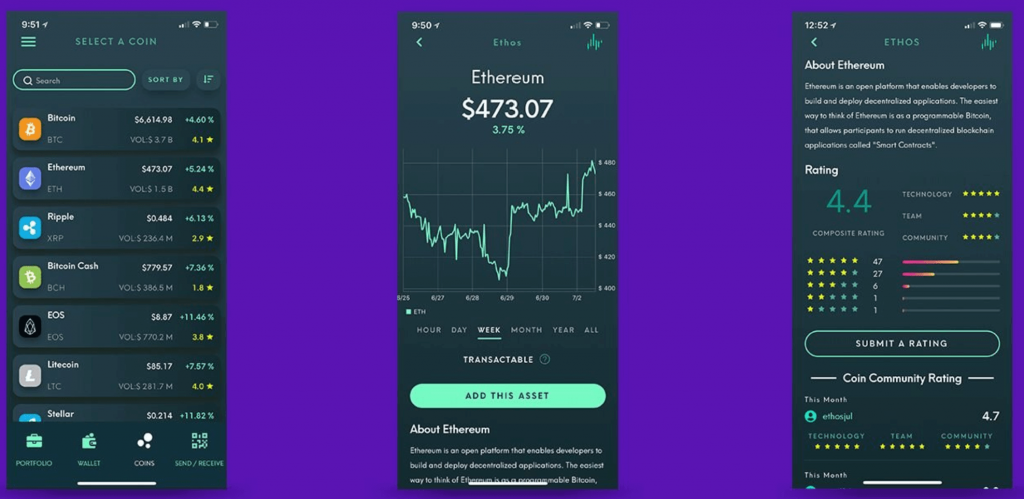

In everyday operation there are four main pages to navigate – Portfolio, Wallet, Coins, Send/Receive. This is all self-explanatory and the prompts will guide you through anything you attempt. It’s well presented and has some neat features. For example, you can add both hardware and software wallets, and display all your balances from within the app.

This is available for all the supported tokens, each of which is claimed to be fully transactable on the exchange. I say ‘claimed’ because as of yet my account has not been activated. I have tried a few times to re-install the Android version, but it’s still pending after 48 hours.

There’s an impressive roster of tokens you can manage from this wallet. To add a new one to your portfolio, from the Wallet page, click the ‘+’ sign it will generate a wallet address specific to your new token. There’s an informative page for each token, accessible from the Coins page with price charts, technical and fundamental information, and some background material.

Privacy and Security

Ethos wallet is non-custodial which means you maintain control of your private keys. Always remember, “Not your keys? Not your crypto.” Yes, It’s a much safer way of storing your crypto. but it’s not open-source code so you can never be 100% certain there are no backdoors into your wallet.

For sure, the Ethos wallet has a great reputation and has been around for a long time, but there would always be a nagging doubt. That’s why I would never store a substantial amount of crypto with this wallet. With proprietary software, you just never know.

Your private keys are stored only on your device, but your device is still vulnerable to attack. Ethos is a great mobile wallet, but it’s not a solution for storing your wealth.

Voyager is licensed by the Financial Industry Regulatory Authority, Inc. (FINRA). I thought the ‘Inc.’ at the end was curious, and I’d never heard of FINRA. It turns out that FINRA is not a government authority, but a private American corporation. It acts as a bespoke regulator for various brokerage firms who pay for their seal of approval.

Disapproving as I am of governmental financial regulators, private ones have a clear conflict of interest. It’s not that I don’t trust the financial ratings industry, but they have been known to reck the entire financial system. Auditors and regulators should be independent of the people they investigate, to avoid moral hazard.

Voyager Token

In September of 2018,the Voyager project came galloping over the crypto horizon and things changed for the Ethos wallet. So what’s the connection? The CEO and Co-Founder of Voyager, Steve Erlich has a long history in the trading space. He was part of the eTrade team that innovated online share trading durin the internet boom. He’s also responsible for the Ethos wallet, so integrating with his newest concern, Voyager was a natural step.

Voyager’s killer application is providing high-speed cryptocurrency markets for both retail traders and institutions. Their brokerage leverages smart order routing technology to transact with multiple crypto exchanges. Finding the deepest liquidity and therefore the tightest spreads makes for much more profitable trades. Voyager takes a cut of whatever discount it finds. It sounds to me like a massive arbitrage opportunity!

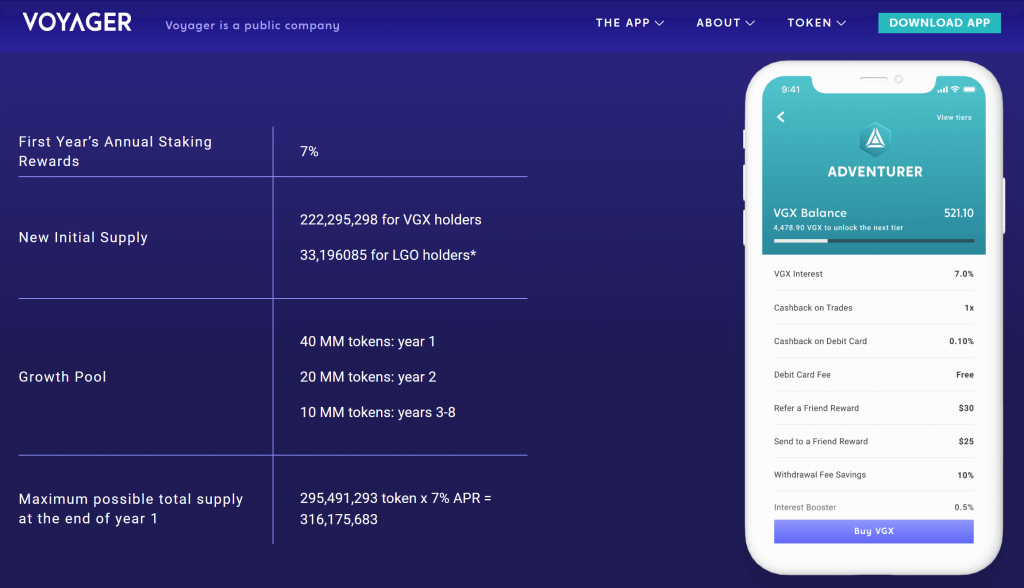

As usual, where there’s a cryptocurrency exchange, there’s normally an exchange token – VGX, (BQX on Binance).

VGX Tokenomics

The ERC-20 Voyager Token (VGX) has a market cap of over half a billion dollars, ranking 101st overall. All of the 222 million tokens are in circulation, but only 1% are traded each day. Almost all of the liquidity for VGX is on Binance where the token has the assignment BQX. It attempts to be deflationary by burning withdrawal fees, but there’s no technical reason why more VGX couldn’t be minted.

Holding VGX in the voyager app earns 7% interest, but this changes depending on the demand for the token. The best returns are around 10% per year which is far better than a traditional bank. Be warned, however, nothing is guaranteed with these advertised interest rates. Also note that you are paid interest in VGX, the future value of which is anyone’s guess.

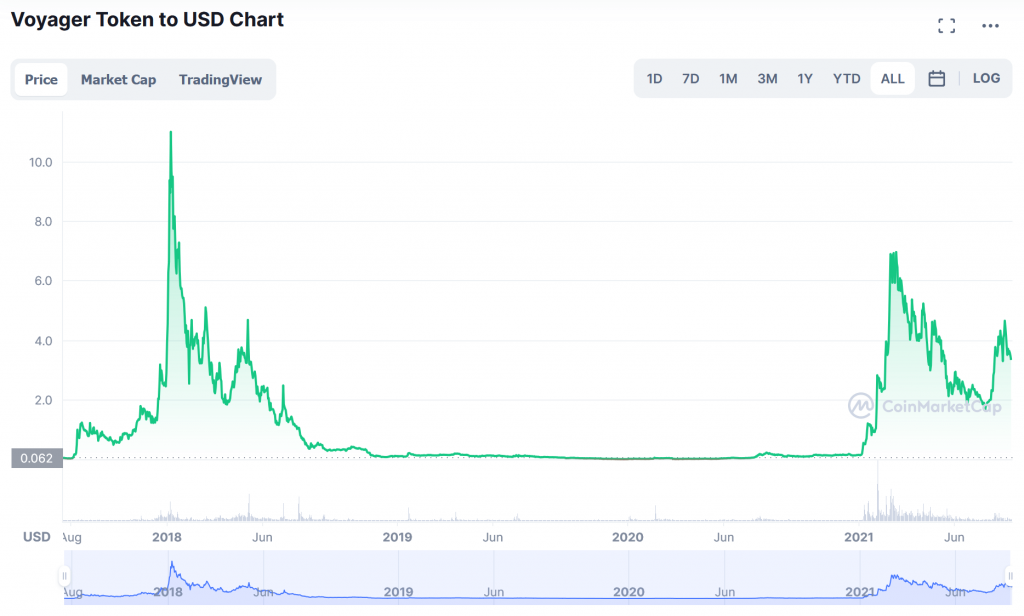

The success of the VGX token is tied to the expansion of the Voyager network. The more brokerage business Voyager can drum up, the higher the price will likely climb. The all-time high for VGX is an over-exuberant $11, but that was back in early 2018 at the peak of the last bull run. This time around, it has failed to approach anywhere near that, topping out at around $7.

For some, it still hasn’t fulfilled its potential in this bull market and will at some point make an inevitable new high. For others, it has performed less well than the new generation of DeFi platforms, and it’s past its best. Whichever side you take, history shows that an exchange token is driven by the success of the underlying exchange, the size of the network, and the growth of its associated ecosystem. The price action is all about Voyager winning market share and not getting hacked.

Market Price Prediction

● Wallet investor

Based on the last 30 days Wallet Investor is bearish on VGX Token. Longer-term they see a recovery and a surge to three times the current price by the middle of 2022. According to their price-prediction charts, the beginning of July should be the start of a steady rise, but that reflects the prevailing market. It’s not for any Voyager-specific reasons.

● Digital Coin Price

From the current price of $2.31, Digital Coin Price calls for a four-fold increase between now and 2028. That’s a long way in the future, but Voyager has the team, skills, and reputation to pull it off. I noticed a curious flat-spot in the charts throughout 2027 and I am not sure why this might be. Perhaps Digital Coin Price knows something we don’t?

● TradingBeasts

Public sentiment is low according to TradingBeasts. That’s a reflection of the current general market FUD rather than any comment on Voyager in particular. Again, they are calling for a several hundred percent increase over the next few years. The verdict is unanimous amongst the experts.

Social Media and Community

VGX Token is on around 39,000 watch lists on CoinMarketCap and they have an up-to-date presence on Twitter. Most of the tweets are about the interest rates and feel like an ongoing sales pitch. The account doesn’t focus heavily on technical achievements or milestones. Their Reddit presence is patchy at best and hasn’t been active for 8 months.

The Voyager Facebook page is active with daily posts and comments. Most of it is advertising the products, but there are announcements about maintenance and upcoming additions to the Voyager Network.

Conclusion

Do we really need a token for every project in the crypto space? I understand that it’s an important funding mechanism for crypto projects, but we now have more than 10,000 cryptocurrencies. It makes it tricky to pick a winner, so should you buy VGX? I’d say probably. The project is professionally run by experts with great reputations.

Assuming Voyager’s centralized order flow algorithm continues to compete against DeFi atomic swap platforms, institutional money pouring into crypto over the next few years will benefit Voyager along with the whole market.

Back in the early internet days, nobody could know whether MySpace or Facebook would prevail. I think it would have made sense to own a piece of both and HODL.

Make sure to check out our guides on other cryptocurrency wallets:

- Best Ripple Wallet – How do I get XRP wallet?

- Best Litecoin Wallet – What wallet can I use for Litecoin?

- Best Monero Wallets – What wallet holds Monero?

- Best Tron Wallets – Which wallet is best for TRX?

- Best VeChain Wallets – What wallet supports VET?

- Best Chainlink Wallets – How many Chainlink wallets exist?