CryptoQuant Review – Pricing, Coupons, Metrics in Overview

CryptoQuant is a cryptocurrency market data and analytics platform that provides information and insights to both retail and institutional clients. Founded in 2018, the company has quickly grown to monitor over 500 exchanges and provide advanced on-chain metrics and analytics.

This CryptoQuant review will provide an overview of the platform’s pricing plans, available coupon codes, and highlight some of the key metrics and data visualizations available.

Whether you’re a casual crypto trader looking for market signals or a large fund performing due diligence, CryptoQuant aims to deliver the most comprehensive on-chain and exchange data in one centralized location. Through a mix of proprietary indicators, comprehensive datasets, and customizable dashboards, CryptoQuant looks to help users better understand on-chain activity and market movements.

| 📊 Topic | Details |

|---|---|

| 🌐 CryptoQuant Overview | CryptoQuant is a data analysis platform established in Korea in 2018, specializing in cryptocurrency market and on-chain data for traders. It’s recognized as a leading software in crypto trading. |

| 🔍 Features: Charts Overview | Offers comprehensive filters and metrics for analyzing various cryptocurrencies, including network and flow indicators, miner flows, fund data, and market data. |

| 💹 Features: Exchange Flow | Analyzes fiat and cryptocurrency inflows and outflows around exchanges, aiding traders in predicting market movements like pumps or dumps. |

| 📈 Features: Pro Chart | Provides access to and customization of pre-made trading view charts, along with a social feature for sharing and editing charts with others. |

| 🔔 Features: Alerts | An alert system integrated with Telegram, email, and browser pop-ups, notifying users about significant market events. |

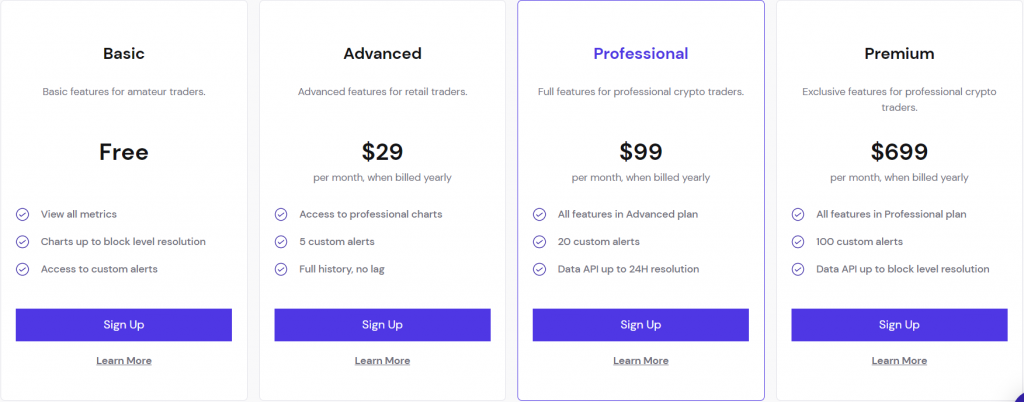

| 💰 Pricing: Advanced Plan | Priced at $39 monthly or $29 yearly, offering Pro charts, five custom alerts, and full historical data access. |

| 🏅 Pricing: Professional Plan | Available for $109 monthly or $99 yearly, includes all features of the Advanced Plan plus twenty custom alerts and Data API up to 24H resolution. |

| 🔝 Pricing: Premium Plan | The most comprehensive plan at $799 monthly or $699 yearly, offering all Professional Plan features plus 100 custom alerts and Data API up to block-level resolution. |

| 👍 Pros: Detailed Analysis & User Interface | Provides detailed analysis with numerous metrics and indicators, and features a user-friendly interface suitable for beginners. |

| 👍 Pros: Alert System & API Integration | Efficient alert system across multiple platforms and API integration for customized software development. |

| 👎 Cons: Limited Free Plan | The free plan offers limited features, necessitating payment for full access, which might be discouraging for retail investors. |

What you'll learn 👉

ABOUT CRYPTOQUANT

Cryptoquant is a data analysis platform that provides research-driven cryptocurrency market and on-chain data for crypto traders. It was founded in Korea in 2018 and has since grown to be one of the top software for crypto trading.

As a testament to its influence in the crypto world, it raised $3M in a seed funding round in August 2021, showing evidence of serious backing and signs of more growth in the future.

CRYPTOQUANT FEATURES

Charts Overview

As you can guess from the name, this feature enables users to employ different filters and metrics to decipher information about various cryptocurrencies.

Some of those metrics are network indicators, flow indicators, miner flows, fund data, market data, etc.

They are used to chart out patterns for cryptocurrencies categorized under four sections: BTC, ETH, Stablecoins, and Altcoins.

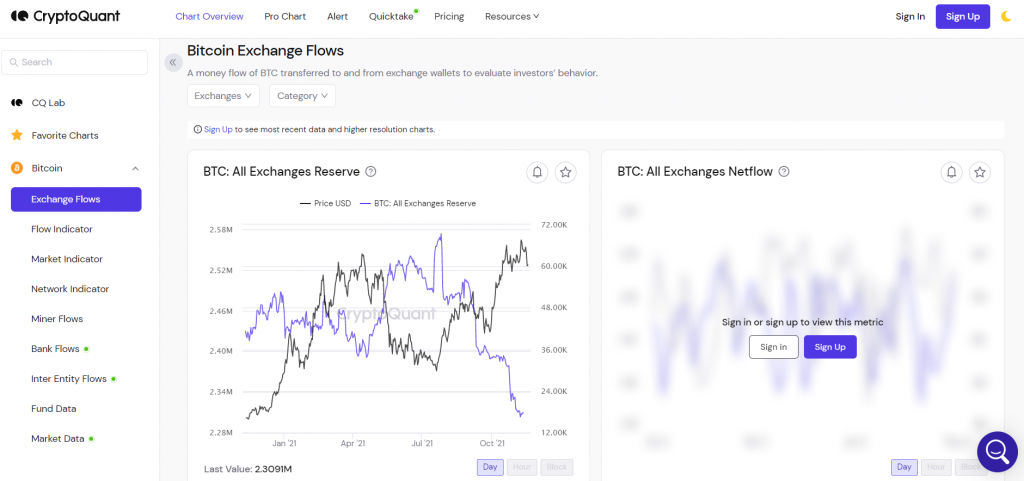

Exchange Flow

This is another important feature of the platform. It analyses the inflow and outflow of fiat and cryptocurrencies around cryptocurrency exchange. Why is this important?

If a significant amount of crypto(BTC, for example) is moved into an exchange, that might be a bearish sign because it may mean that whales have decided to cash out on their large holdings.

On the other hand, if a significant amount of crypto is moved out of an exchange, that may mean whales are accumulating and holding, which is a bullish sign.

Therefore this metric makes you anticipate when there might be a pump or dump and act accordingly.

Pro Chart

With this feature, you can get access to and edit ready-made charts drawn out with a trading view. It also has a social feature that allows you to share your charts with others and edit theirs too.

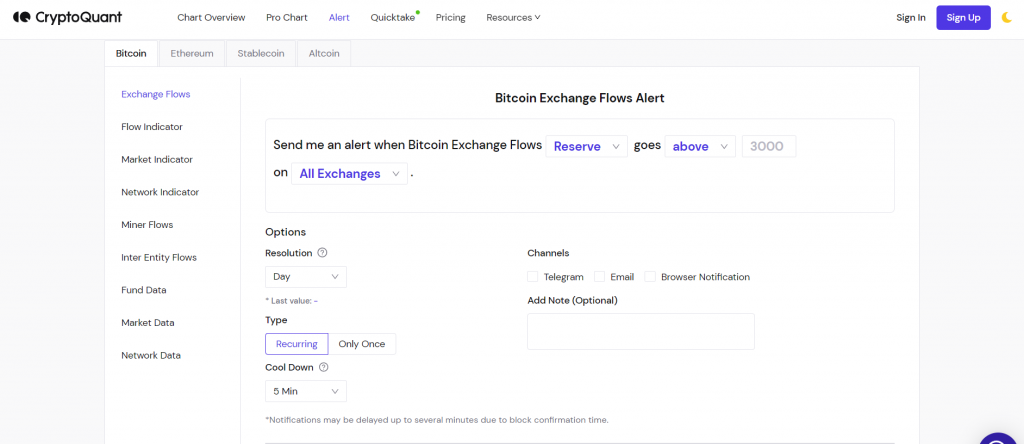

Alerts

Like many other data analysis platforms, Cryptoquant has an alert system that notifies you of significant current market events that you may be interested in. It goes a step further by integrating these alerts with your telegram account, your email address, and a browser pop-up.

CRYPTOQUANT PRICING

There are three different paid packages on Cryptoquant. There is also a free version which is severely limited in terms of what it provides access to. This may be discouraging to retail investors.

The other plans are:

Advanced Plan

This goes for $39 monthly(or $29 if you pay once yearly). With this plan, you can access the Pro charts and five custom alerts as well as full historical data.

Professional Plan

You can get this plan for $109 monthly(or $99 if you pay yearly). It gives you access to everything you can get with the advanced plan. In addition, you also get twenty custom alerts and Data API up to 24H resolution.

Premium Plan

This is the most expensive at $799 monthly(or $699 if you pay once yearly). It gives access to all the features in the professional plan. In addition, it allows you to make 100 custom alerts with a Data API up to block-level resolution.

EDUCATIONAL RESOURCES

As a data analysis platform, Cryptoquant provides many educational resources that can turn a novice into an expert in little time. These include:

- Exclusive reports that give insights into unique information about the markets

- On-chain research, employing publicly available data on the blockchain

- Technical support for those having technical issues on the platform

- Investigation into various crypto market events

- A ‘frequently asked questions’ section consisting of fifty-three articles written under six sections

- Quick take: These are short articles that provide precise and concise, qualitative viewpoints on market events. The reports come with taglines that describe what it is about. Examples of those taglines are ‘Bullish‘, ‘TA‘(short for technical analysis), ‘FA‘(Fundamental analysis), ‘SA‘(Sentiment Analysis), etc.,

CONCLUSION

The world of crypto has become increasingly complex as more people are now interested in this fast-expanding ecosystem. Whether you’re a trader or a holder, you need a qualitative guide to help you make smart decisions and know when to enter and when to exit a cryptocurrency market or trade.

Traders and analysts in digital asset markets are constantly improving their understanding of how to monitor activity on the Bitcoin blockchain, scouring the network for clues on where the largest cryptocurrency’s price might go next.

Cryptoquant is a good option for this as it provides detailed analysis employing various metrics to present matters as they really are in the markets. I hope this article has helped you to decide if it works for you. If it doesn’t, check out the list of alternatives that come at the end of this article.

Read also:

- How to Measure Your Crypto Trading Performance?

- Best ChatGPT Prompts For Crypto: How to Use ChatGPT in Crypto?

- How to Use ChatGPT to Research Crypto?

ALTERNATIVES

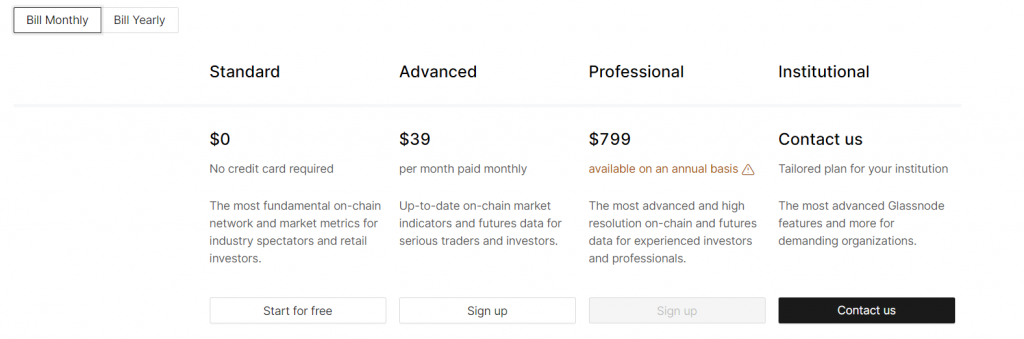

Glassnode

This cryptanalysis platform was formed in Germany in 2018, the same year as Cryptoquant. Just like Cryptoquant, it also comes with a free plan which is limited in its features. Apart from that, it has two other plans(one going for $39 and the other for $799).

The Glassnode platform is one of the best with customized metrics like UTXO value, entity-adjusted MSOL, etc.; altogether, it comes with over 200 metrics that provide reliable information about the markets.

Unfortunately, it doesn’t come with an alert system, neither does it offer users the ability to create and manage watch lists.

Coinmetrics

Coinmetrics is an open-source crypto analytics platform founded in 2017 in Boston, Massachusetts, USA. It employs over three hundred metrics(some of them unique) for over one hundred crypto assets.

It is a reputable platform with backings from some of the biggest names in the industry, like Goldman Sachs, Dragonfly Capital Partners, etc. It also raised $15M in seed funds in its latest funding round held in May 2021, evidence that it has not come to play.

One unique thing about Coinmetrics is its Pro plan. Unlike other crypto analytical platforms, you’ll have to contact the Coinmetrics team for an API key which you’ll use to upgrade to a paid plan to access more features.

In addition, Coinmetrics allows users to import and export charts in three formats – CSV, Microsoft Excel, and PNG. However, even though it is simple to use, it doesn’t allow users to edit charts and customize them for their own uses.

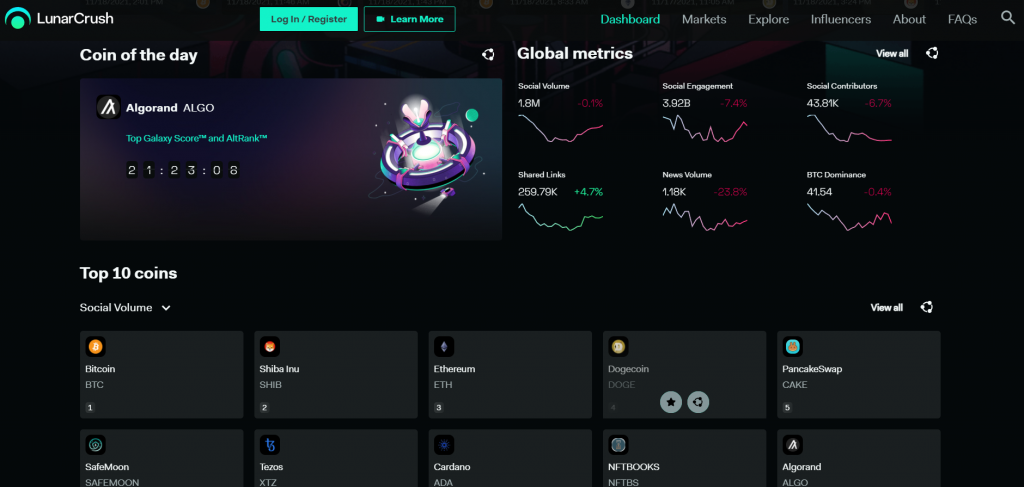

Lunar Crush

Lunar Crush is an analysis platform that focuses more on community insights as a way to track the performance of a coin. It was founded in the United States in 2018.

With social, trading, and other vital metrics in place, users can use the platform to track and compare the activities of favorite cryptocurrencies over different time frames. It has several plans ranging from a free plan to the most comprehensive at $699 per month. However, unlike Cryptoquant and a few others, the free plan is good enough and contains most of the essential features.

In addition to those mentioned above, it provides portfolio tracking for a more personalized experience as well as API integration for developers.

Read also:

- Santiment Review – Onchain & Crypto Social Platform Analysis Tool

- Messari Review – How To Use It & What Does It Cost?

While it is not impossible to get back your assets, it is not as easy as just asking, blockchain analytics trace the movements of the assets and using attribution technology can identify whether wallets are known to be associated with particular types of fraud or with exchanges. That’s Melmac-solutions approach.