What you'll learn 👉

Table Of Contents

Over the last few years, a wide range of digital currencies, such as BitCoin, LiteCoin, PeerCoin, AuroraCoin, DogeCoin and Ripple, have emerged. The most prominent among them is BitCoin, both in terms of an impressive price development and market capitalization.

BitCoin is a peer-to-peer payment system created in 2009. It is the first open source digital currency, and BitCoin is managed by an open source software algorithm that uses the global internet network both to create the BitCoins as well as to record and verify transactions.

Compared to a standard fiat currency, such as dollars or euros, the key distinguishing feature of BitCoin is that the quantity of units in circulation is not controlled by a person, group, company, central authority, or government, but a software algorithm controls the amount of BitCoins issued.

BitCoins can be used to buy goods or services worldwide, provided that transaction partners accept BitCoin as a mean of payment. A transaction implies that BitCoin owners transfer their ownership of a certain number of BitCoins, in exchange for goods and services. An increasing number of companies accept BitCoins as payments for their goods and services. BitCoins can be also exchanged for other currencies.

To summarize, BitCoin is a cryptocurrency without an intrinsic value. In contrast to standard government backed fiat currencies, e.g. dollar, euro, BitCoin is developed outside of an underlying economy or issuing institution, implying that there are no macroeconomic fundamentals that would determine its price formation.

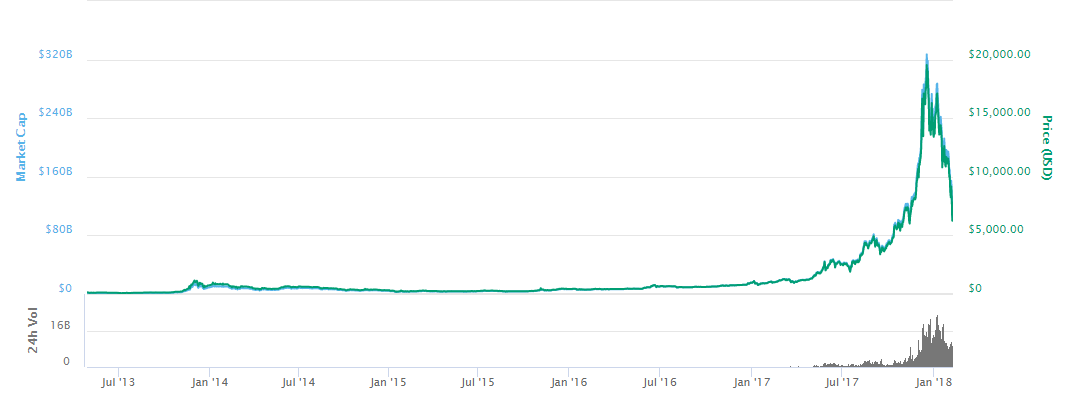

Bitcoin sure looks like it’s a bubble. For one thing, there’s that chart:

A bubble is created by a surge in asset prices unwarranted by the fundamentals of the asset, there’s the unsettling reality that this particular asset has no fundamentals. That is, there’s no stream of income or collection of assets attached to ownership of a Bitcoin. Bitcoins have no intrinsic value.

Due to the recent surge of Bitcoin’s popularity, people around the world started asking question such as „What is fiat money? What is cryptocurrency such as Bitcoin? What determines the value of Bitcoin?“.

What Determines the Value of Bitcoin?

After extensive research of the subject, the conclusion was that there are 6 factors that define the value of Bitcoin.

- Bitcoin has all the characteristics of gold

Like gold, Bitcoin is also scarce: its supply is limited. There are currently just over 16.2 million Bitcoins in circulation and the maximum that will ever exist is capped at 21 million. This set cap is well known, making its scarcity transparent. Like gold, Bitcoin is perfectly fungible (one Bitcoin is similar to another), it is divisible (you can pay someone a small fraction of Bitcoin, should you want to) and easily verifiable (via the Blockchain). Today, there are already thousands of merchants around the world accepting Bitcoin as a means of payment, thus proving the growing usefulness of it. Not only does it currently have value as a payment system, but also as an asset class (a store of wealth).

- Demand and Supply

One of the key drivers of BitCoin price is the interaction between BitCoin supply and demand on the BitCoin market. The demand for BitCoin is primarily driven by its value as a medium of exchange (i.e. by value in future exchange). The supply is given by the stock of BitCoins in circulation, which is publicly known and is predefined in the long run.

There are aggregators like CoinDesk, which look at what’s happening on multiple exchanges and then average them to get a number. Each exchange might show a slightly different amount, depending on the last trade price, while a place like CoinDesk is looking at multiple sources.

- Network Value

The Bitcoin network is a decentralized peer-to-peer network that, ideally, is both distributed and diverse. It also enables users to bypass intermediaries and trade freely. The more widely the peer-to-peer nodes are distributed, the more decentralized the network. The more diverse (non-similar) the nodes are, the broader the representation on the network and, hence, it is more resilient and secure. The Bitcoin protocol is designed to seek consensus amongst nodes, and greater decentralization means a healthier, more robust network. All of these factors contribute to a more valuable blockchain.

- Distributed & Decentralized P2P Node Network

Up to this moment in history, Bitcoin is the most distributed and decentralized project in the world. There are more than 20 thousands computers or nodes protecting the network where they maintain an independent copy of the Bitcoin’s blockchain or ledger so that nobody is able to double spend their funds. Because Bitcoin is decentralized via a distributed peer-to-peer network, there is no central server that the Bitcoin protocol depends upon for its existence. Like BitTorrent, Bitcoin is, therefore, censorship-resistant – it cannot be shut down. This aspect of Bitcoin is critical since it means that Bitcoin’s continued usage is not subject to any external authority’s approval, opinion or action. Being a censorship-resistant alternative to official currency and payment systems makes Bitcoin an irreversible disruptive technology.

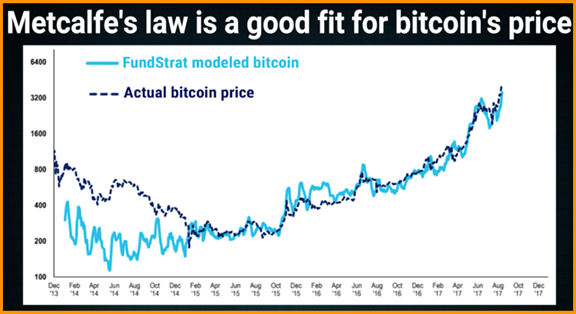

- Robert Metcalfe’s Law

Metcalfe’s law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system. It is another name for Network Value that we talked about in section 3.

Additionally, American TV broadcaster Max Keiser says that one of the reasons behind Bitcoin’s price surge is because it is the perfect alternative to traditional financial systems that are used by banks and other financial institutions. Additionally, Keiser says that the value of Bitcoin is derived from „Theirs law“ which argues that bad money would drive good money to a premium rather than driving it out of circulation. This is the reason why, in many countries, value of Bitcoin is priced much higher on premiums it is superior to that country’s bad money.

- Smart Contracts Support

In its early days, value of Bitcoin was in cents. As the time goes by, more and more people are looking into Bitcoin’s protocol on daily basis and they are coming up with new inventions and different solutions.

The Bitcoin blockchain is not known for its ability to enable smart contracts. In fact, most developers creating smart contracts use a different blockchain, like Ethereum. But the truth is that the Bitcoin protocol can be used to create smart contracts.

A smart contract is an agreement that can be enforced through a blockchain. Rather than relying on trust or a legal framework to ensure that each party that enters into a contract will adhere to its terms, you can use the blockchain to create a contract that is automatically enforced, between two people, in a decentralized fashion.

Bitcoin supports some of the basic smart contracts such as:

- Hashed Timelock Contracts (HTLCs)

- Chanelling Contracts

- Multi-sig Contracts

Final Thoughts

Estimating the value of Bitcoin in fiat currencies such as USD, EUR or GBP is not the good way to go as there is no current model of measuring it.

But, due to the numerous developments going around Bitcoin, the price of Bitcoin is going to be much higher. You can expect developments such as:

– Lightning Networks for lowering fees and making transactions;

– ETFs to be launched for Bitcoin;

– Futures market trading;

– RSK, a smart contract enabling project on Bitcoin;

– Crypto hedger funds of 2018.

Bitcoin’s value cannot be reduced to one single element or feature. Many aspects of the cryptocurrency contribute to its usefulness and offer benefits that outweigh traditional paper money and its encumbent systems. As a decentralized network with a consensus-based ledger, the Bitcoin blockchain has features that are innovative and encourage further innovation. Bitcoin’s Open Source Software model facilitates additions and improvements.

If something is both useful and scarce, it will demand value and a price. Bitcoin is both useful and scarce, so it has a value and a price, determined by supply and demand.