ArbitrageScanner Review: Pricing, Supported Exchanges, Safety, Pros, Cons

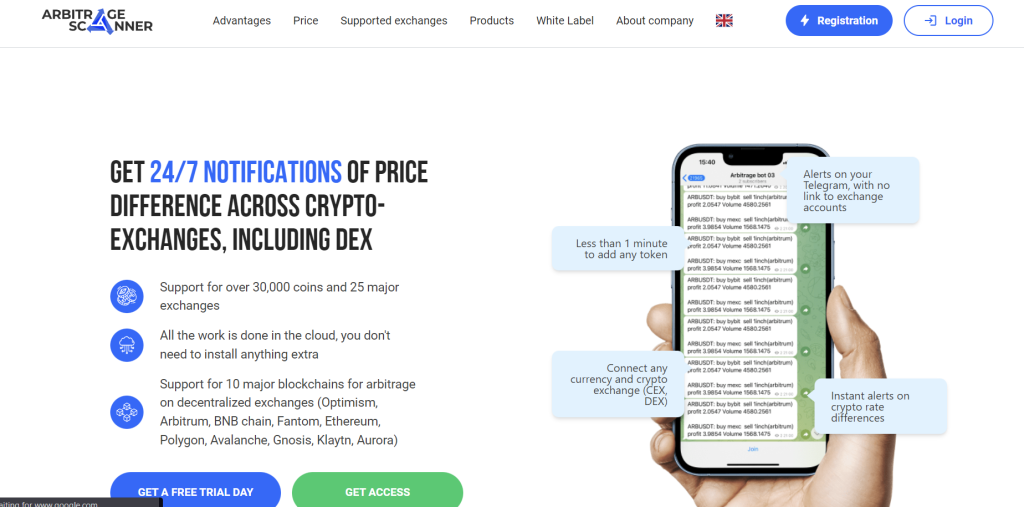

ArbitrageScanner allows traders to capitalize on price differences across exchanges. Here’s what you need to know.

ArbitrageScanner is a well-regarded bot, with support from numerous users. It accommodates over 70 CEX exchanges and more than 20 DEX exchanges, standing out for its unique support of DEX exchanges across 20 blockchains. Additionally, ArbitrageScanner offers a cryptocurrency arbitrage screener, a tool that provides information about a variety of coins across different exchanges, useful for both classic and output arbitrage.

| Topic | Key Points |

|---|---|

| What is Arbitrage Scanner? | A cloud-based tool for tracking arbitrage opportunities across centralized and decentralized crypto exchanges |

| How It Works | Monitors price differences, sends customizable Telegram alerts, no API connection needed |

| Pricing | 4 pricing tiers from $69 to $1999 for tracking more assets and exchanges |

| Supported Exchanges | 25+ major exchanges including Binance, Coinbase; works across 10 blockchains |

| Is It Safe? | Manual bot, no API access so no funds at risk from the service |

What you'll learn 👉

What is Arbitrage Scanner?

Arbitrage Scanner is a cloud-based arbitrage tracking service created by Anthropic. It monitors price differences for crypto assets across both centralized (CEX) and decentralized (DEX) exchanges.

The bot works by tracking bid-ask spreads across multiple exchanges in real-time. When spreads widen past user-defined thresholds, the service sends customizable Telegram alerts so traders can capitalize on arbitrage opportunities.

How Arbitrage Scanner Works

ArbitrageScanner does not directly connect to user exchange accounts via API. This keeps funds secure, as the service has no ability to execute orders or access balances.

Instead, the bot runs price scans every 4 seconds across supported exchanges. You add the exchanges and assets you want to monitor.

When arbitrage opportunities meeting your criteria appear, Arbitrage Scanner sends Telegram alerts with actionable details:

- Which exchanges have the price difference

- Ideal buy/sell amounts for profit

- Estimated profit in USD or %

You then manually execute trades based on the alerts. This gives full control without putting funds at risk.

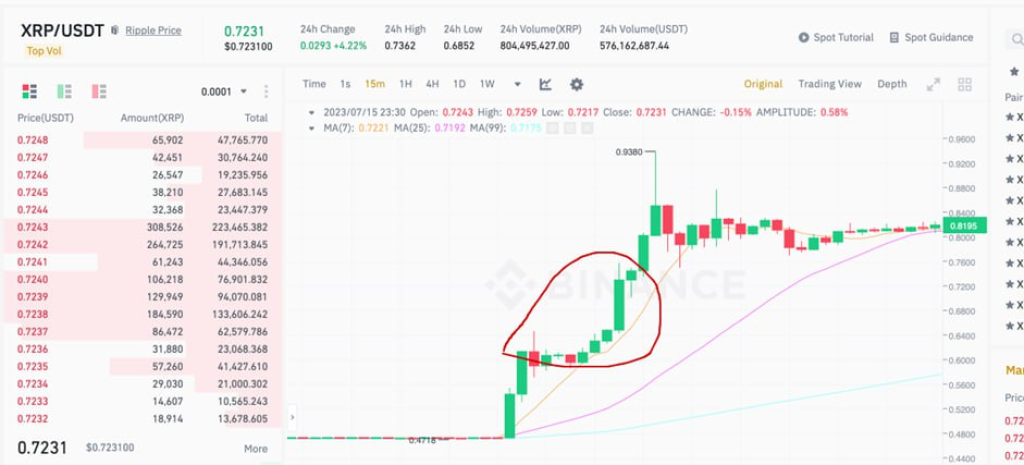

For instance, one of the project users and also our reader purchased XRP at $0.55 on the Bybit exchange when the price on Binance was already $0.63. They transferred the coin to Binance, and when it arrived, the price on Bybit was $0.62, while on Binance, it reached $0.7. By selling XRP on Binance, they made a profit of 27% within a couple of minutes.

Pricing Plans and Features

Arbitrage Scanner offers 4 pricing tiers with different combinations of supported assets, exchanges, and Telegram alerts.

At the low end, the $69 “Test” plan tracks 5 assets across 10 top CEXs. The high-end $1999 “Expert” plan covers 15 assets across 20 CEXs and 50 DEXs.

DEX tracking and arbitrage opportunities across blockchains are key features only available in higher tiers. This allows arbitraging between chains like Arbitrum, Optimism, Avalanche, and more.

Major Supported Exchanges

Supported centralized exchanges include:

Supported DEXes span major blockchains:

- Ethereum

- BNB Chain

- Polygon

- Optimism

- Arbitrum

- Avalanche

- Fantom

- Gnosis

- Klaytn

- Aurora

Is Arbitrage Scanner Safe to Use?

Yes, Arbitrage Scanner is safe because it does not connect to exchange accounts via API. Without API access, the service has no ability to execute orders or withdraw user funds.

You remain in full control of your capital when acting on alerts. The bot merely surfaces opportunities – you decide if and how to trade them.

This manual approach avoids the risks seen with services that auto-trade via API. For crypto arbitrage, Arbitrage Scanner strikes the right balance of automation and security.

Conclusion

With its real-time tracking across CEX and DEX markets, Arbitrage Scanner simplifies discovering and capitalizing on arbitrage opportunities. Its modular plans and focus on security make it a compelling tool for crypto traders. All in all, one of the best arbitrage scanners on the market.