Are you a cryptocurrency enthusiast who has made gains, losses, or income from crypto transactions? If so, the IRS requires that you report these transactions and pay taxes accordingly.

With the recent increase in enforcement of crypto tax reporting, it’s important to understand the requirements and to utilize tools that can simplify the process. That’s where Form 8949 and Schedule D come in – mastering the art of crypto tax reporting with these forms will help you stay compliant and avoid any potential penalties.

In this article, we will provide a comprehensive guide to navigating the IRS crypto reporting requirements and utilizing tax software such as Koinly and CoinLedger to simplify the tax reporting process. We’ll cover everything from the basics of crypto taxes to the specific requirements for short-term and long-term disposals.

By the end of this article, you’ll have a firm understanding of how to report your crypto transactions using Form 8949 and Schedule D, as well as the tools available to make the process easier.

So let’s dive in and master the art of crypto tax reporting!

| Topic | Summary |

|---|---|

| 📝 Crypto Tax Basics | Cryptocurrency is considered property by the IRS and is subject to capital gains and income tax. Form 8949 and Schedule D are used to report these taxes. |

| 📊 Reporting Requirements | All gains, losses, and income from cryptocurrency transactions must be reported by April 18th, 2023. Forms 8949, Schedule D, Schedule 1, Schedule C, and Form 1040 are used for reporting. |

| ⏳ Short-Term vs Long-Term Disposals | Short-term disposals (assets held for less than a year) are taxed at your normal Income Tax rate, while long-term disposals (assets held for more than a year) are taxed at a lower rate. |

| 📑 Schedule D and Form 8949 | These forms are used to report capital gains and losses from the sale or trade of property, including cryptocurrencies. |

| 💰 Crypto Income Reporting | All cryptocurrency earnings are taxable and need to be reported on your tax return. Some earnings are considered ordinary income and not capital gains. |

| 🛠️ Tax Software and Tools | Tools like Koinly, CoinLedger, TurboTax, and Crypto Tax Calculator can help simplify the tax reporting process and ensure compliance with IRS regulations. |

| 🎉 Conclusion | Mastering the art of crypto tax reporting can be a daunting task, but with the right tools and knowledge, it can be made significantly easier. |

What you'll learn 👉

Crypto Tax Basics

You might be wondering how to navigate the basics of reporting your cryptocurrency transactions and income to the IRS. It’s important to remember that crypto is considered property by the IRS and subject to capital gains and income tax. This means that any trading or earning income from crypto activities likely results in owing crypto taxes.

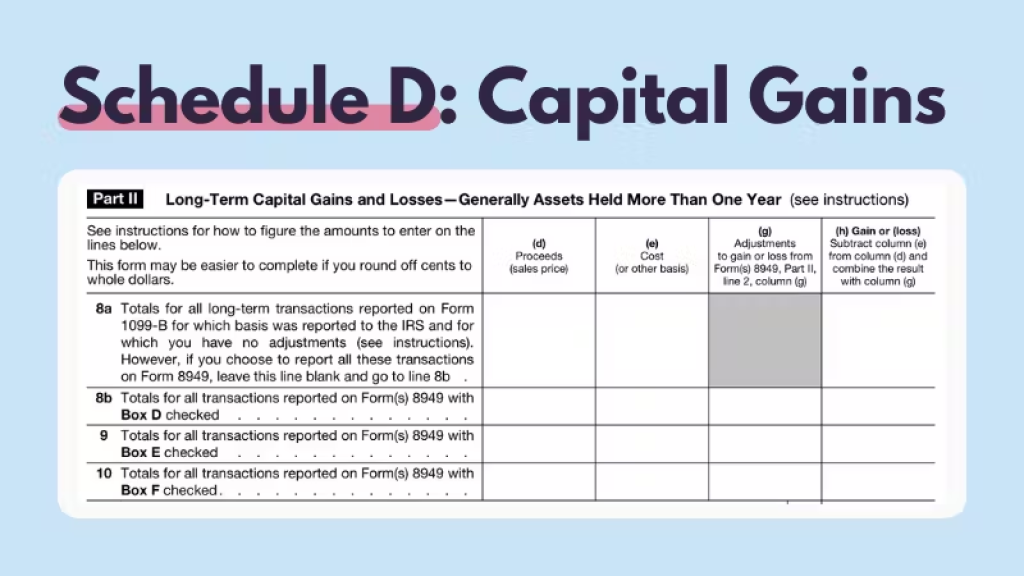

To report these taxes, you’ll need to use Form 8949 and Schedule D. Form 8949 is used to report the details of each cryptocurrency disposal, including the cost basis, gross proceeds, and date of receipt and disposal. Short-term and long-term disposals need to be reported separately, and the correct option must be selected in both sections.

Schedule D is used to report the net short-term and long-term capital gains/losses from the disposals. It’s important to track all crypto transactions for accurate tax liability determination, and crypto tax software can generate comprehensive tax reports to simplify the process.

Reporting Requirements

As a cryptocurrency investor, it’s important to understand the reporting requirements for your gains, losses, and income to avoid potential penalties from the IRS. Here are some key requirements to keep in mind:

- The IRS requires you to report all gains, losses, and income from cryptocurrency transactions by April 18th, 2023.

- You’ll need to use Forms 8949, Schedule D, Schedule 1, Schedule C, and Form 1040 to report your crypto transactions.

- Short-term disposals are taxed at your normal Income Tax rate, while long-term disposals are taxed at a lower rate. You’ll need to report both separately on Form 8949.

In addition to these requirements, it’s important to note that the IRS is proactively chasing non-compliant taxpayers. This means that it’s crucial to accurately report all of your cryptocurrency transactions to avoid any potential penalties.

Using crypto tax software like Koinly or CoinLedger can help simplify the reporting process and ensure that you’re in compliance with IRS regulations.

Read also:

- How are Crypto IRAs Taxed?

- How Are Crypto Airdrops Taxed?

- Koinly Alternatives & Competitors

- Is transferring crypto between wallets taxable?

- ZenLedger Review

Short-Term vs Long-Term Disposals

If you’re not sure whether to hold onto your cryptocurrency for the long haul or sell it in the short term, keep in mind that the IRS distinguishes between short-term and long-term disposals when it comes to tax rates.

Short-term disposals refer to assets held for less than a year, while long-term disposals refer to assets held for more than a year. The tax rates for short-term disposals are based on your ordinary income tax rate, which can range from 10% to 37%.

On the other hand, the tax rates for long-term disposals are more favorable and can range from 0% to 20%.

When reporting your crypto taxes, it’s important to differentiate between short-term and long-term disposals and report them separately on Form 8949.

You will need to provide the cost basis, gross proceeds, and date of receipt and disposal for each transaction. Correctly selecting the option for short-term or long-term in both sections of Form 8949 is crucial to ensure accurate reporting.

Remember, short-term and long-term disposals are subject to different tax rates, so it’s important to accurately report them to avoid any potential penalties or audits from the IRS.

Schedule D and Form 8949

Get ready to accurately report your crypto transactions and avoid potential penalties or audits from the IRS by learning about the crucial information found in the current section on Schedule D and Form 8949.

Schedule D is used to report capital gains and losses from the sale or trade of property, including cryptocurrencies. It’s important to note that all reportable crypto transactions and income should be reported on tax returns, even if no Form 1099-B is received from a crypto exchange.

Form 8949 provides additional information for the sale or exchange of capital assets, specifically for crypto disposals. Each cryptocurrency disposal requires cost basis, gross proceeds, and date of receipt and disposal.

It’s important to select the correct option in both the short-term and long-term sections of Form 8949, as short-term and long-term disposals need to be reported separately. Even if you receive a Form 1099-B, it’s still necessary to fill out Form 8949.

The net short-term and long-term capital gains/losses must be reported on Schedule D, with long-term disposals subject to more favorable tax rates. To make the tax reporting process simpler, consider using crypto tax software such as Koinly or CoinLedger, which can generate comprehensive tax reports automatically.

Crypto Income Reporting

You’re in luck because it’s time to dive into the nitty-gritty of reporting your cryptocurrency income, painting a clear and accurate picture of your financial gains and ensuring compliance with the IRS.

First, it’s important to note that all cryptocurrency earnings are taxable and need to be reported on your tax return. Some cryptocurrency earnings are considered ordinary income and not capital gains, so it’s important to accurately categorize your earnings.

For instance, if you earn cryptocurrency through staking, rewards, or promotional incentives, you’ll likely receive a Form 1099-MISC. Even without a 1099-MISC, all income needs to be reported on Schedule 1 of your tax return.

If you earn cryptocurrency through mining, you’ll receive a Form 1099-NEC. Short-term capital gains, which are gains from assets held for less than a year, are taxed as ordinary income up to 37%. Long-term capital gains, which are gains from assets held for more than a year, are taxed at preferential rates of 0%, 15%, or 20%.

To calculate your gain or loss, subtract your adjusted cost basis from your adjusted sale amount. You can use a Crypto Tax Calculator to estimate your tax owed from capital gains or losses. If you receive a Form 1099-B from a trading platform for capital asset transactions, enter the information on Schedule D of your tax return. Use Form 8949 to provide additional transaction information or adjustments.

Schedule D reconciles your gains and losses and determines your taxable gains and deductible losses. If you earn cryptocurrency from non-trading or exchange activities, report it on Schedule C of your tax return. Self-employment income over $400 is subject to self-employment taxes, which you can calculate using Schedule SE.

Remember to accurately calculate and report all taxable crypto activities, as the IRS has increased enforcement of crypto tax reporting.

Tax Software and Tools

Now that you know how to report your crypto income, it’s time to explore the tax software and tools that can make the process easier and more accurate. These tools can help you track your transactions, calculate your gains and losses, and generate the necessary tax forms for the IRS.

Here are some of the most popular tax software and tools for crypto tax reporting:

Koinly

This software can calculate your crypto taxes and generate reports specific to your location and tax authority. It can also generate IRS reports (Form 8949 and Schedule D) for US investors and income totals for Schedule 1 via its Complete Tax Report feature. Koinly can also generate reports for TurboTax and TaxAct.

CoinLedger

This tool can help you generate Form 8949 and import transactions from exchanges and blockchains. It can also generate a consolidated capital gains report that can be mailed to the IRS if you have too many transactions to report on Form 8949.

CoinLedger has integrations with major exchanges and can simplify the tax reporting process for you.

TurboTax

This tax software offers a Cryptocurrency Info Center to answer common questions about crypto taxes. TurboTax Premier covers stocks, crypto, ESPPs, rental property income, and more for investment taxes.

It also offers related articles on tax tips for bitcoin and virtual currency, your cryptocurrency tax guide, and capital gains tax. TurboTax provides security guarantees such as 100% accurate calculations, maximum refund guarantee, and audit support guarantee.

Crypto Tax Calculator

This tool can help you estimate the tax owed from your capital gains or losses. It can also provide you with a detailed breakdown of your transactions and help you calculate your adjusted cost basis.

The Crypto Tax Calculator is a platform that helps its users to calculate crypto taxes on virtual trading activity. The platform was founded by Shane Brunette back in 2018. Shane decided to create a Crypto Tax Calculator after he had many issues calculating crypto taxes in 2017 (ICO boom).

Resources

If you’re feeling overwhelmed by the cryptocurrency tax reporting process, don’t worry – there are plenty of resources available to help make it easier.

One such resource is CoinLedger, which can help generate Form 8949 and import transactions from exchanges/blockchains. This software can generate a comprehensive tax report automatically, and a consolidated capital gains report can be generated and mailed to the IRS if there are too many transactions to report on Form 8949. CoinLedger has integrations with major exchanges and can simplify the tax reporting process. Additionally, the software can help generate a consolidated capital gains report that can be mailed to the IRS.

With more than 400,000 investors around the world using CoinLedger to simplify the tax reporting process, it’s a trusted resource for individuals looking to accurately and efficiently report their cryptocurrency taxes.

Another helpful resource for cryptocurrency tax reporting is TurboTax. The platform offers a Cryptocurrency Info Center to answer common questions about crypto taxes, and TurboTax Live Full Service Premier provides specialized tax experts to help with investment taxes.

TurboTax Premier covers stocks, crypto, ESPPs, rental property income, and more for investment taxes. The platform offers related articles on tax tips for bitcoin and virtual currency, your cryptocurrency tax guide, and capital gains tax. TurboTax provides security guarantees such as 100% accurate calculations, maximum refund guarantee, and audit support guarantee.

With a variety of options and resources available, TurboTax can help individuals accurately and confidently report their cryptocurrency taxes.

Conclusion

Congratulations! You’ve successfully navigated the world of crypto tax reporting. By using the IRS reporting requirements, you’ve gained a greater understanding of how to report your gains, losses, and income from crypto transactions.

Did you know that in 2020, the IRS sent out letters to more than 10,000 individuals who may have failed to report their crypto transactions correctly? This shows just how important it is to stay on top of your tax reporting obligations.

In conclusion, mastering the art of crypto tax reporting can be a daunting task, but with the right tools and knowledge, it can be made significantly easier. By utilizing tax software such as Koinly and CoinLedger, you can simplify the process and ensure that your reporting is accurate.

Remember to keep track of your transactions, report your income correctly, and file your taxes on time to avoid any penalties or fines. With these tips and resources, you can confidently navigate the world of crypto taxes and stay on top of your reporting obligations.