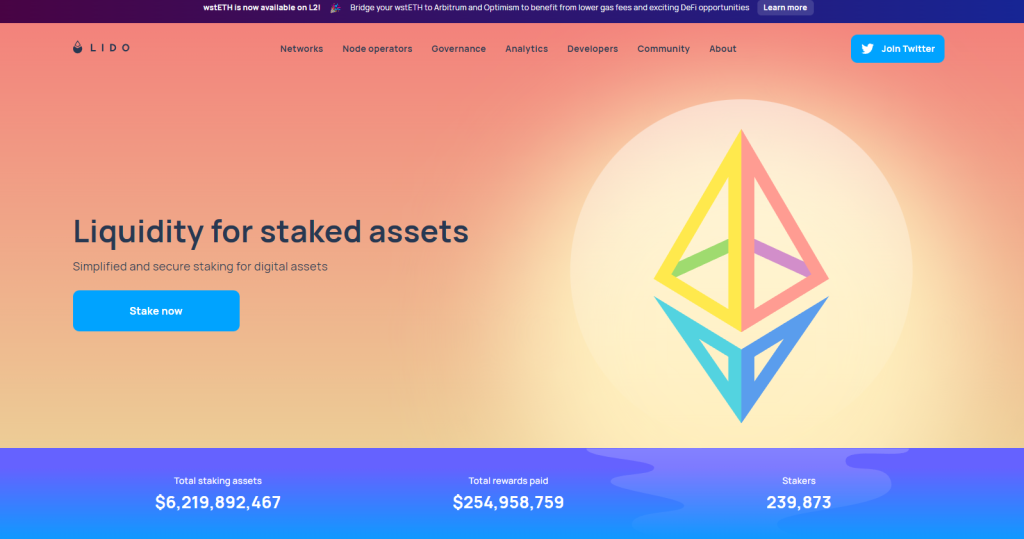

Lido Finance Staking Review – Is Lido Staking Legit & Trustworthy?

In the realm of cryptocurrency, safety and profitability often walk hand in hand. This is especially true when it comes to staking, a popular method for earning passive income in the crypto space. One platform that has been gaining attention in this regard is Lido Finance. But the question on everyone’s mind is: Is Lido staking safe?

In this comprehensive Lido staking review, we aim to answer these pressing questions. We’ll delve into the inner workings of Lido, exploring its unique features, the pros and cons of staking with Lido, and most importantly, its safety measures.

By the end of this article, you’ll have a clear understanding of Lido staking and the security it offers to its users. So, if you’re considering dipping your toes into the world of crypto staking, this review could be the guide you’ve been waiting for. Let’s dive in!

| Topic | Summary |

|---|---|

| 🔑 Key Features | Lido Finance provides a user-friendly interface, maximized earning potential through daily staking rewards and DeFi activities, a native token (LDO), quality audits by reputable firms, and supports popular DeFi wallets like TrustWallet and MetaMask. |

| 👍 Pros | Lido Finance offers liquid staking, allowing users to unstake their funds at any time. Users maintain custody of their assets, reducing the risk of losing funds due to security breaches. Lido also aims to provide competitive staking rewards for potential passive income. |

| 👎 Cons | Lido charges a 10% fee on staking rewards, which is split between the node operators and the protocol’s treasury. The rewards earned from staking with Lido may be taxable depending on your location and personal tax situation. |

| 💰 Fees | Lido charges a 10% fee on staking rewards earned by users. This fee is divided between the node operators and the protocol’s treasury. Users may also incur Ethereum gas fees when interacting with the Lido protocol. |

| 🔄 Alternatives | Alternatives to Lido Finance for staking crypto assets include centralized exchanges like Coinbase, Kraken, and Binance, and other decentralized staking services like Rocketpool. |

What you'll learn 👉

What is Lido Finance?

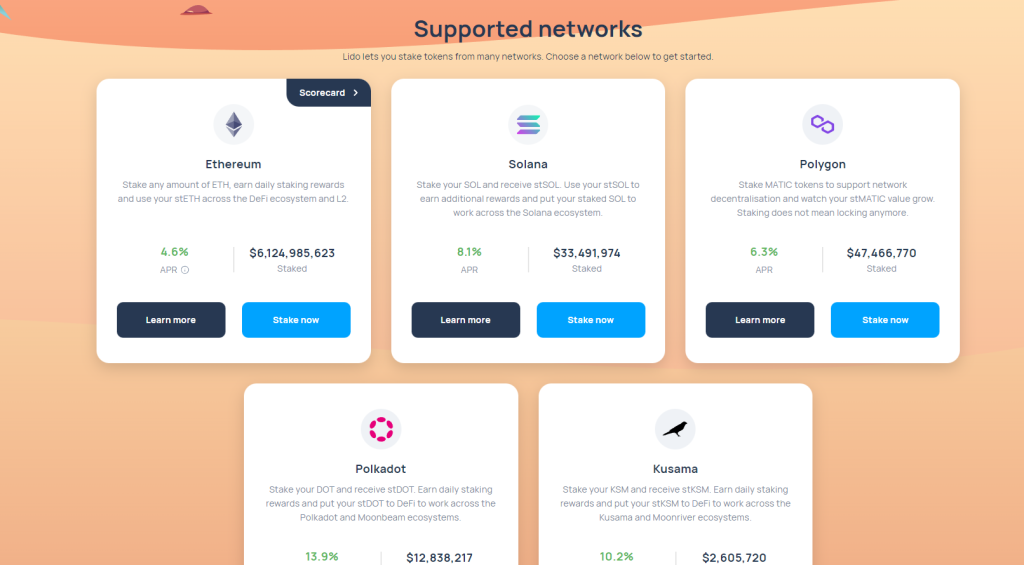

Lido Finance is a decentralized liquid staking protocol that lets users stake Ethereum, Solana, Polygon, Polkadot, and Kusama. When staking ETH and other similar assets, the staked tokens are locked for a period, which means you can’t use them as collateral on lending platforms to earn additional yield rewards.

Lido aims to solve the problem above by using liquid staking, which allows you to use your staked assets as collateral and earn interest from lending on top of the rewards generated by staking. Lido also has its native token available on many exchanges, called LDO.

Lido’s liquid staking process involves depositing and staking native ETH and receiving a new token called stETH, which is equivalent on a 1:1 basis with the staked tokens. Lido’s stETH token is pegged to the value of your staked Ethereum and can be used for on-chain lending and other DeFi activities without the restrictions encountered with normal staking, which lacks a liquid alternative to the token.

How does Lido work?

When you deposit ETH (or other tokens) to the Lido platform, you will receive st-tokens that are pegged to ETH, just like stablecoins are pegged to the US dollar. Users can use st-tokens as collateral or for other DeFi activities. This lets them get the most out of their staked assets and earn the most rewards. Users can turn their liquidity tokens back into their native tokens at any time on the Lido platform.

Who is doing the staking on Lido?

Lido Finance is one of the world’s largest staking providers. It is made up of a DAO (decentralized autonomous organization) with members like Libertus Capital, Semantic VC, StakeFish, Bitscale Capital, and various angel investors like Kain Warwick from Synthetix or Stani Kulechov (Aave).

Is Lido decentralized?

Yes. Lido Finance is a decentralized platform that is owned by a DAO made up of well-known members.

What makes up Lido Finance?

1. Lido DAO

The Lido DAO is owned by members that include leading venture capital firms and angel investors.

2. Staking Service

Lido allows users to stack assets such as Ethereum or Solana and receive daily staking rewards while also using the staked tokens as collateral through liquid staking. When compared to other similar staking solutions on the market, Lido’s APR rates are fair. For Ethereum and Polygon, the APR is 6.4%, and for Polkadot, it goes up to 12.9%.

3. Lido’s Derivative Tokens

When you deposit ETH or SOL tokens to Lido, you will get the same amount (1:1) of stETH or stSOL tokens, which are pegged to the native tokens and can be used as collateral for loans.

Bonded Luna (bLUNA) is another example of a derivative token. It is pegged to Luna and can be used on the Anchor protocol as collateral to borrow stablecoins.

4. Governance Token (LDO)

LDO is the native utility token that Lido DAO uses to give out voting rights, add or remove node operators, and manage how fees are split.

5. Security and Insurance

The Lido Insurance Fund is a vault contract that stores funds for insurance purposes. This is how Lido protects its users.

What fees does Lido charge?

Lido charges a 10% fee on your staking rewards, which goes to the node operators and the DAO Treasury. The Lido fee can be changed in the future if the DAO decides to do so via voting.

Is Lido safe and trustworthy?

Yes. With billions of dollars in staked assets, Lido is one of the biggest companies in the cryptocurrency staking industry.

How to stake Ethereum on Lido?

To start staking Ethereum on Lido, visit here, connect your wallet, select the amount of ETH you wish to stake, and click the submit button.

What are the risks of staking using Lido Finance?

Some of the risks involved with staking cryptocurrencies on Lido include potential smart contract vulnerabilities, derivative token stETH losing its peg to the native token, and DAO key management risks,

Who is Lido Finance best suited for?

Lido Finance is best for users who are looking to stake assets and use them as collateral at the same time, with the purpose of increasing earnings.

Read also:

FAQs

At the time of writing, your staked ETH tokens on Lido will earn daily staking rewards that average 6.4% APR. Additionally, you can use your stETH to earn extra interest from lending and other DeFi activities.

Yes. Lido is a decentralized liquidity staking application.

No. You can only stake ETH, SOL, MATIC, DOT, and KSM on the Lido platform. LDO is its governance token.

Yes. Many users are staking ETH on Lido to earn passive income.

Your ETH staking rewards are applied to your stETH token balance once every day, at midnight (12 PM UTC).

Yes. You can potentially lose money through staking if the value of the assets drops too low.

Although staking has a good potential for earning passive income, it is still a business that is considered risky due to market volatility and other unpredictable factors.

Yes. You can lose your staked ETH for a number of reasons, including network failure, slashing, possible exploits, and so on.

Some of the best platforms for staking assets are Binance, Kraken, Crypto.com, Lido, and KuCoin.

There are many good wallets for staking cryptocurrencies, such as Ledger Nano X and Nano S, Trezor, ZenGo crypto wallet, and others.

Yes. You can use a wallet like Ledger or Trezor to stake assets safely.

Yes. It is possible to earn enough passive income to make a living. But that depends on how good you are at choosing the right asset to bet on and other things.

There are various safe platforms where you can stake Ethereum, such as Binance, Coinbase Pro, Kraken, Crypto.com, KuCoin, or Lido Finance. However, using both centralized and decentralized platforms involves the risk of losing your funds, temporarily or permanently.

Good article but it would be better if you guys included the date that it was published.thanks

agreed