Almost any activity you do in crypto involves some kind of transaction to be recorded on the blockchain. And any kind of transaction is an alert for tax authorities to come and get their piece of your pie. Staking is no exception to this so here is a guide on how to pay taxes on your staking activities.

In 2025, tax agencies actively track staking activity using blockchain analytics tools, so reporting has become stricter worldwide.

Crypto staking rewards are considered taxable income when you gain “dominion and control” over them, meaning you can transfer, sell, or use them without restrictions.

What you'll learn 👉

What is staking?

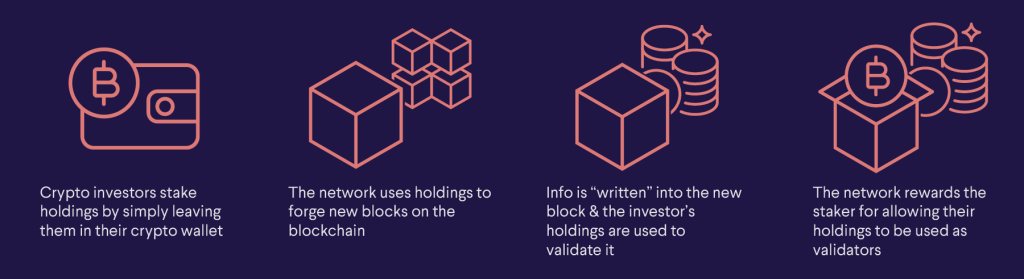

In Proof of Stake blockchains protocols like Solana and Cardano (and since September 2022 Ethereum as well), transactions are validated by stakeholders.

The whole process is called staking and plays the same role as mining does in the bitcoin ecosystem.

Today, liquid staking platforms such as Lido and Rocket Pool dominate the market, and rewards from these services are also taxable.”

How is staking taxed?

In 2025, the IRS confirmed that staking rewards are taxable as income when received, even if the tokens remain locked or cannot be withdrawn immediately.

In addition, the IRS considers crypto to be treated as capital gains when you trade or spend crypto to buy something, which is subject to taxation at ordinary rates.

How to Stake Crypto Coins?

There are two main ways to stake crypto, depending on where you store it. They are:

- Non-custodial wallet

- via Third-Party

Non-custodial wallet

This is a non-custodial wallet (you control the seed words and thus the coins) that makes it possible for you to trade cryptos via decentralized exchanges and protocols without having to rely on centralized exchanges or custodians.

These wallets are known as “non-custodial“, meaning that they do not hold your funds on their servers. Instead, they are just a tool which allows you to interact with the blockchain and all your data is kept locally on your device.

Via Third-party

When you use a third-party wallet, you are giving that third party permission to the custody of your funds. This indicates that they will handle all of your financial dealings in the same manner as a traditional bank would. Kraken and Coinbase are just two examples of some of the most well-known third parties. In several jurisdictions, crypto staking taxes depend on whether you utilize a PoS or a third party.

Learn more about staking on Kraken, staking on Coinbase, staking on Kucoin. Also, check this guide to see what is the best platform to stake crypto.

From a tax perspective, it doesn’t matter whether you stake through a custodial exchange like Coinbase or a non-custodial wallet. The rewards are taxable as soon as you gain control over them.

Do I have to pay taxes if I sell my staking rewards?

The sale of stake rewards is a taxable event in the same way that the sale of any other crypto would be.

You will have a capital gain or loss on your capital account depending on how much your stake awards have increased or decreased in value since you first received them. The cost basis here can be calculated as the fair market value of your rewards as of the date of receipt.

This means staking rewards create two taxable events: first as income when received, and second as a capital gain or loss when sold later.

How is Staking Taxed in the US?

In 2024, the IRS updated Form 1040 to explicitly include staking rewards as taxable income, making the reporting requirement unambiguous.

How is Crypto Staking Taxed in Canada?

By 2025, the CRA clarified that staking rewards should be treated as income at the time they are received, similar to mining rewards.”

Read more about the best tools to report crypto taxes in Canada.

How is Crypto Staking Taxed in the UK?

According to HM Revenue & Customs (HMRC) crypto guidance, everyone participating in the process of staking tokens – including those who hold them, are rewarded for holding them, or are paid to stake them – may face taxation.

HMRC guidance now makes clear that most individuals must report staking rewards as miscellaneous income, with capital gains due upon sale.

If staking is not considered to be a taxable transaction, the pound sterling value is taxed as miscellaneous income. When the property is sold, capital gains tax will be levied.

How is Crypto Staking Taxed in Australia?

The Australian Taxation Office (ATO) has suggested that the Australian dollar worth of awards received by taxpayers participating in crypto-staking activities will be taxed as ordinary income rather than capital gains at the time of receipt.

According to the ATO, this applies to both prizes paid to participants and those paid to third parties operating on their behalf. Individuals who operate as ‘validators,’ or persons who participate in consensus methods, are among those who receive incentives.

This is consistent with long-standing tax law concepts about the derivation of ordinary income, i.e., the receipt of a reward for delivering services. When the property is sold, Capital Gains Tax will be levied.

In 2025, the ATO reiterated that both individual validators and those using third-party platforms must report staking rewards as ordinary income.

Read more about the best tools to report crypto taxes in Australia.

When should I recognize income from my staking rewards?

Staking income should be recognized when it is received. This includes both the amount you receive and the timing of receiving those funds. However, there are exceptions to this rule. Some investors who earn staking revenues through a third party do not know whether they should report income when the rewards are generated or when they withdraw their earnings into a personal wallet.

To help clarify when income is considered taxable, it’s helpful to think about the concept of “dominion and control.”

Experts believe that staked rewards will be considered received for tax purposes when investors have dominion and full authority over their coins. They earn money when they may freely trade and swap them.

Once investors withdraw staking earnings, the IRS may allege they have “dominion and control.” Whether the coins are in your wallet or a third party’s, you may realize income. Most tax authorities now agree that income is recognized the moment rewards are credited to your account or wallet, regardless of when you withdraw them.

Read also: Best Ways to Cash Out Crypto Anonymously in 2025

Do I pay taxes if I run a staking business?

If you run a staking business in the United States, you are required to file and pay income tax on the whole amount of profit you made from staking.

Are there any situations where staking rewards are non-taxable?

It’s prudent to treat staking rewards as taxable income and report them as such.

In the event that the staked reward cannot be withdrawn, a more aggressive strategy would be to argue that it is not taxable.

The only possible non-taxable cases are when rewards are locked and inaccessible, but even then, most regulators still treat them as income at receipt.

Learn more about how to report taxes on other crypto activities:

How are staking pools taxed?

Even if you choose not to cash out your bonuses immediately upon receipt, you should still consider the staking rewards you earn from your mining pool to be revenue.

In contrast, the act of adding or removing crypto from a staking pool is probably not regarded as a taxable event.

Liquid staking pools such as Lido and Rocket Pool are treated the same as direct staking, with rewards taxable when credited to your account.

What if I can’t determine the fair market value of my staking rewards?

Fair value for staking rewards obtained at the time of receipt can be hard to assess in some circumstances, such as when you receive your reward from a mining pool.

In these cases, using crypto tax software like CoinLedger, Koinly, or TokenTax is recommended, as they track historical token prices automatically.

Can I deduct staking equipment?

Large initial investments in equipment like staking hardware are fully deductible in the United States if you run a staking business in the same vein as a Bitcoin mining operation. Moreover, your operational expenses, such as electricity, may be tax deductible, reducing your final tax liability. Individuals cannot deduct investment costs under current tax legislation.

How to report staking rewards on your tax return?

Individuals who invest in crypto can declare them on Schedule 1 of Form 1040 as “Other Income.” Businesses that earn staked crypto as part of their business can deduct staking expenses under Schedule C. Staking costs may also be deducted (provided they can be proved and they are a necessary expense of business operations).

Best tools to report crypto staking tax?

Aside of the already mentioned Coinledger, other good options that account for staking when creating your crypto tax reports include:

- Koinly – most popular crypto tax calculator

- Zenledger

- Cointracking