What you'll learn 👉

Table Of Contents

Anyone who has been around the ever-booming crypto world realizes that it is becoming increasingly hard to “thread the crypto-wheat” and identify the best up and coming cryptocurrencies in a sea of pump-and-dump scams and Ponzi schemes. Usually, a good strategy to lift your coin out of that sea is to hire quality developers who have good track records in the Blockchain industry.

Another smart, often used move is to get big business interested in your project. Signing long term partnerships with major companies gives your project brand recognition and signals that real people (with real, big money) believe in what you are trying to accomplish. Combining the abovementioned strategies has worked well for numerous crypto projects so it’s no surprise that the founder of Stellar Lumens, Jed McCaleb, decided to follow suit.

Jed McCaleb is an American programmer who gained fame by creating peer-to-peer technologies eDonkey and Overnet, as well as the bitcoin exchange Mt. Gox. The last one is probably the one that he doesn’t like being connected to, as it was hacked and went bankrupt in a very dubious fashion in 2014. Still, by then he was long gone as the majority owner of the exchange, having sold his shares to Mark Karpelès in 2009. He founded the company Ripple in 2011 which he promptly left in 2013 and went on to work on Stellar in 2014.

He didn’t abandon the project entirely as he kept a bag of Ripple tokens which, as of January 2018 were worth $20 billion, equaling his worth to the 40th place in Forbes’ list of world’s richest people. Therefore Jed easily passes the “quality developer” test mentioned before.

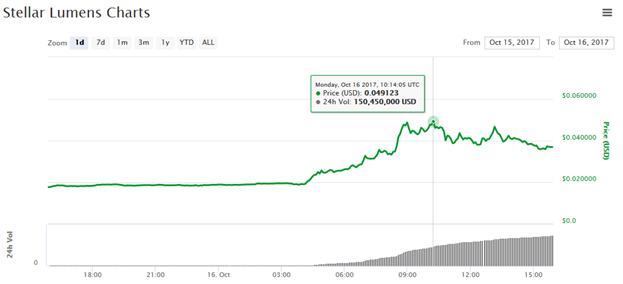

The big business part of the test was passed back in October 2017, when the Stellar network announced its plans to partner up with IBM Corp. and KlickEx. This announcement immediately led to Lumens token price rising by 100%.

The main goal of this partnership is to “eliminate inefficiencies and frustrations in current cross-border payment systems”, specifically centered to create faster and cheaper transactions in the South Pacific. Under this blockchain based arrangement, banks will conduct the transactions using Lumens, and then rely on local market makers to convert the Lumens into local fiat currency. IBM themselves mention a hypothetical Samoan farmer who will be able to use this network to conduct a trade (via an internet contract) with a buyer based out of Indonesia. The blockchain will record data from every step of this transaction, from stipulating the terms of the contract, over managing collateral to obtaining letters of credit and finalizing the payment. This newly established network includes “12 currency corridors” that encompass Australia and New Zealand, as well as smaller countries like Fiji and Tonga. After the deal was officially announced, McCaleb said:

“This new innovation and collaboration represents a significant milestone for Stellar as well as the financial technology industry as a whole. For the first time, public blockchain technology is being used in production to facilitate cross-border payments in multiple integrated currency corridors. Currently, cross-border payments tend to take up several days to clear. This new implementation is poised to start a profound change in the South Pacific nations, and once fully scaled by IBM and its banking partners, It could potentially change the way money is moved around the world, helping to improve existing international transactions and advancing financial inclusion in developing nations.”

IBM has hinted that Stellar services could be used to eventually process up to 60 percent of the “cross-border payments in the South Pacific’s retail foreign exchange corridors”, giving the network a sizeable, $1 billion per month, share of the market. The move sees a significant implementation for Stellar within the global financial framework of legacy institutions, putting it alongside Ripple as one of the principal entities in Blockchain-based institutional settlements.

What is Stellar Lumens

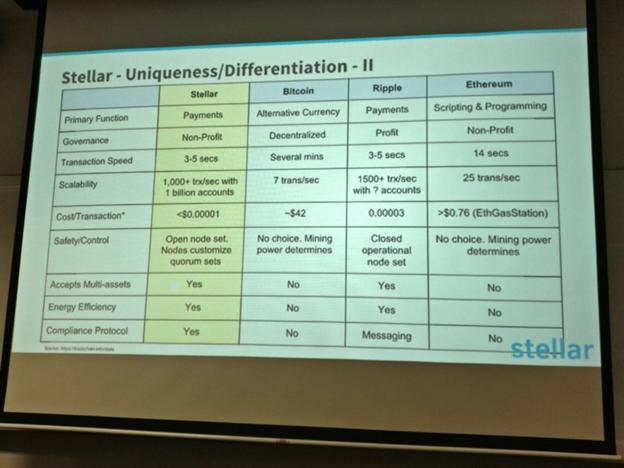

Stellar dates back to 2011, when programmer Jed McCaleb and several other men decided to split from the Ripple project and start developing a separate currency. Main goals for Ripple at the time were to address the transaction speed issues which plagued Bitcoin and to develop a working relationship with banks in order to gain access to new ideas and implementations for the blockchain technology. McCaleb saw that second part as fundamentally against the philosophy of blockchain, as he felt that Ripple is abandoning the principle of decentralization by co-operating with the banking establishment. If we consider the fact that Ripple kept 60% of its ICO to themselves, it’s clear that a centralized entity (like a bank) could potentially manipulate the Ripple market. This made McCaleb leave Ripple and use its protocol to create Stellar, a decentralized “coin for the people”. Similarities and connections with Ripple don’t end there. Like Ripple, Stellar dominates Bitcoin when it comes to blockchain transaction settling speeds as it completes transactions in a matter of seconds, two to five to be exact. But where Ripple is considered more centralized, thanks to partnerships with established banking institutions and its for-profit status, Stellar operates as a decentralized non-profit. Finally, unlike Ripple, Stellar users’ cannot be frozen out of their accounts and funds. Stellar founder McCaleb made a point to make this a feature after $1 million of his own Ripple funds were frozen as he departed the company.

Comparison of Stellar to the biggest cryptocurrencies out there

Stellar Lumens advertises itself as an open-source, distributed payments infrastructure, based on a growing need of the international community for “a worldwide financial network open to anyone.” While quality financial services are basically part and parcel of living in the average developed 1st world country, same cannot be said about the rest of the world. Due to high costs, bad government regulation, lack of expertise as well as many other challenges it is almost impossible for developing countries to efficiently offer banking services. Not everything is peachy in the developed world either, as even the most lauded financial systems out there suffer from issues related to liquidity, transaction speeds and high middleman fees. The company aims to fulfill this obvious need for a worldwide financial infrastructure by connecting individuals, institutions, and payment systems through their Stellar platform and its related coin Lumens (XLM). With their platform the Stellar Lumens team, in line with their “The future of banking” moniker, wants to push aside the currently utilized centralized systems in order to make monetary transactions cheaper, quicker, and more reliable. In addition, their decentralized protocol would allow people from all over the world to conduct their cross-border payments in an efficient and safe way.

Types of transactions

Stellar boldly presents its platform with the words “the future of banking is here”. Looking at the types of services they offer, it seems like those words aren’t exactly in vain:

- Remittances

A remittance is a transfer of money by a foreign worker to an individual or an account in his/hers home country. These transactions are one of the greatest sources of foreign currency for the developing world. Just in 2017, the total amount of remittance value sent around the world shot over 500 billion dollars. Unfortunately, remittances are not efficient. When done through the banking system they can be very costly due to high forex charges and various other commissions. That’s where Stellar Lumens comes in, as it offers a decentralized network which allows for almost zero fee transactions and payments to be conducted across different currencies.

- Micropayments

A micropayment is a financial transaction involving a very small sum of money and usually one that occurs online. The main issue with micropayments is the fact that related fees often times become impractical and unscalable, as there are fixed costs that come with each transaction. Due to microtransactions coming with lower fees, it can sometimes take longer for them to be verified and processed as the middlemen prefer to earn more by working on larger transfers. Stellar Lumens aims to offer its customers increased efficiency and scaled down costs for smaller transfers. In fact, a fee of just $0.01 will handle about 600,000 transactions.

- Mobile Branches

A vital banking service for rural and semi-rural communities. Most banks don’t operate full time in smaller communities but rather organize mobile ATMs and in some cases even fully staffed mobile branches which seek out customers in areas that don’t have easy access to financial services. Often times these operations come with heavy overhead costs, like rent and electricity. The potential to run similar branches with the Stellar network while keeping the costs at a minimum is there.

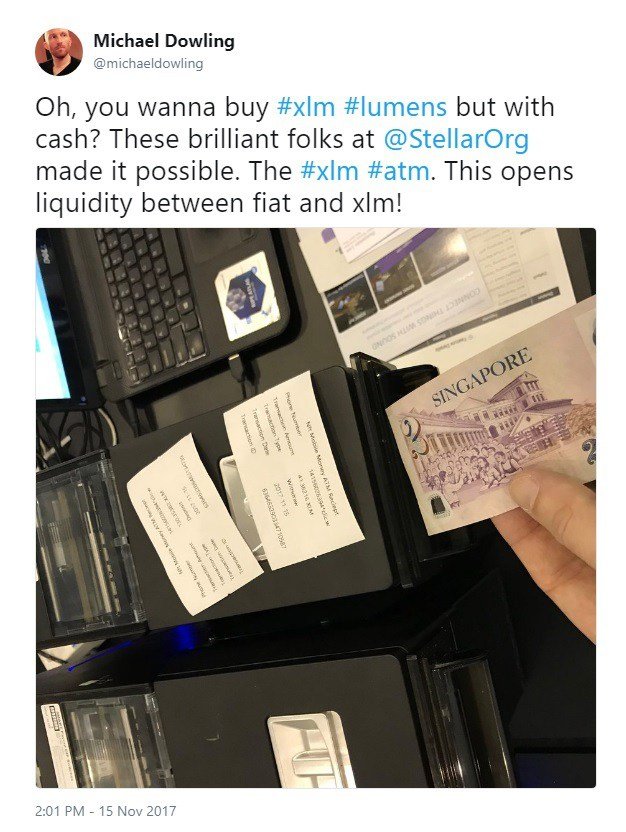

IBM CTO Michael Dowling showcasing the first XLM ATMs

- Mobile Money

Mobile Money is an electronic wallet service, available in many countries, that lets users store, send and receive money using their mobile phone. This service makes various platforms interoperable and brings increased liquidity to rural areas. Stellar plans to brings this service to another level with its Lumens coin and a fitting crypto wallet.

- Service for the underbanked

Underbanked are people or organizations that do not have sufficient access to mainstream financial services and products typically offered by retail banks. Thus these people are often deprived of banking services such as credit cards or loans. The underbanked rely on non-traditional forms of finance and micro-finance associated with disadvantaged and the poor, such as cheque cashers, loan sharks and pawnbrokers. Through their network Stellar plans to provide cheap accounts, loans and micro-savings to anyone who has access to the World Wide Web.

In addition to these, the Stellar network also features an automatic currency exchange which swaps fiat, government-backed currencies like dollar or euro. It is regulatory compliant, and its payments move similarly to an email service. Clicking on “Build with Stellar” will lead you to an impressive list of resources which can teach you everything from the very basics of the network to more detailed topics like submitting transactions at a high rate with channels. Ultimately, this page is here to provide tools for developers which will allow them to add to the Stellar network by building their own affordable financial services like mobile wallets, banking tools, smart devices or anything that involves payments.

Stellar is a non-profit organization, stating that they understand how important financial services are for maximizing human potential and escaping the poverty. Therefore they point out that their main goal is to aid the “unbanked” across the world by giving them access to low-cost financial services like loans and credits which should help them increase their standard of living. The company accepts donations which are tax-deductible (as with most non-profits) and you can donate yourself if you think their project is worth it.

Stellar Network Overview

Stellar network can be divided into two important parts:

- Horizon API

Horizon is an HTTP API server for the Stellar ecosystem. It acts as the interface between the Stellar Core and applications that want to access the Stellar network like online wallets, payment services, online banking apps and custom made payment apps. It allows you to submit transactions to the network, check the status of accounts, subscribe to event streams etc. Because it’s just HTTP, you can communicate with Horizon using your web browser, simple command line tools like cURL, or the Stellar SDK for your favorite programming language.

- Stellar Core

Behind the scenes, every Horizon server connects to Stellar Core, the backbone of the Stellar network. The Stellar Core software does the hard work of validating and agreeing with other instances of Core on the status of every transaction through the Stellar Consensus Protocol (SCP). The Stellar network itself is a collection of connected Stellar Cores run by various individuals and entities around the world (similar to Bitcoin nodes). Some instances have a Horizon server you can communicate with, while others exist only to add reliability to the overall network. You can even host your own instance of Stellar Core in order to submit transactions without depending on a third party, have more control over who to trust, or simply to help make the Stellar network more reliable and robust for others.

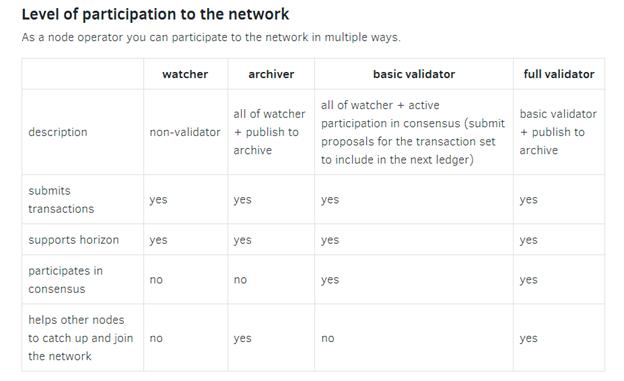

There are 4 types of participation in the Stellar Network

Ultimately the worldwide collection of Stellar Nodes, each maintained by different people and organizations, creates the Stellar network. This distributed nature of the network makes it reliable and safe. This network of nodes eventually reaches a consensus on sets of transactions. Each transaction on the network costs a small fee of 100 stroops (0.00001 XLM). This fee helps prevent bad actors from spamming the network and launching DDoS attacks against it.

SCP (Stellar Consensus Protocol)

Financial infrastructure is currently a mess of closed, non-interoperable systems. The lack of communication between these systems mean that transaction costs are high and money moves slowly across political and geographic boundaries. This friction has slowed the growth of financial services as well as worldwide human development, leaving billions of people underserved. To get rid of this friction, a decentralized worldwide financial network needs to be implemented. It would remove barriers to entry and allow new, innovative participants with modest financial and computing resources to gain access to modern financial services. This network with low barrier to entry will spur organic growth while relying on all network participants to ensure accuracy of data by agreeing on the validity of one another’s transactions. This decentralized agreement process is one of the main building blocks of the Stellar network and is called Stellar Consensus Protocol.

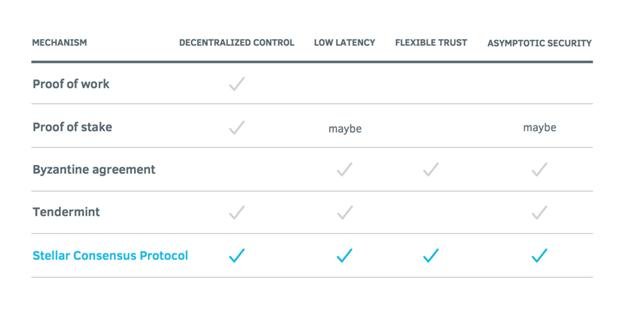

The protocol is considered as the next step in the evolution of blockchain. Stellar Consensus Protocol is the first provably safe consensus mechanism that simultaneously introduces for important elements: decentralized control, low latency, flexible trust, and asymptotic security. For comparison, proof of work blockchains are only capable of decentralized control and even that can be compromised.

Stellar Consensus Protocol is an evolution of the federated Byzantine agreement, a new approach to distributed consensus. In a distributed system, all nodes must periodically update the state that they’re replicating — for example, a transaction ledger. We identify each update by a unique slot; a consensus protocol requires that all nodes agree upon slot content. When nodes decide that an update is true and safe to apply, they externalize the agreed-upon data to their copy of the ledger. Consensus is reached when all nodes update their ledgers and externalize the same value.

While being a good, democratically sound system, consensus protocol can falter if individual nodes start acting arbitrarily. This behavior and this flaw are known as the Byzantine failure. To tolerate Byzantine failure, Stellar Consensus Protocol is designed not to require unanimous consent from the full set of nodes for the system to reach agreement. It introduces the concept of a quorum which allows the network to tolerate and ignore the nodes that lie or send incorrect messages.

In a distributed system, a quorum is a set of nodes sufficient to reach agreement. Federated Byzantine agreement initially introduced the concept of a quorum slice, a sub- quorum of sorts that is comprised of various particular nodes which trust each other.

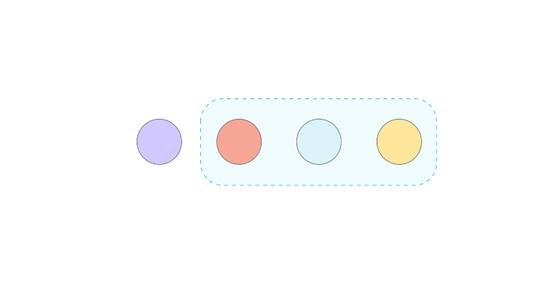

FBA introduces quorum slice, smaller parts of the quorum

The traditional Byzantine agreement guarantees distributed consensus despite the Byzantine failure of participants. However, it requires unanimous agreement on system membership by all participants. Each node in the network must be known and verified ahead of time.

Federated Byzantine Agreement is the opposite of that, as it brings open membership and decentralized control to Byzantine agreement. The key difference between a Byzantine agreement system and a federated Byzantine agreement system is that in FBA each node can choose its own quorum slices. As there are no centralized gatekeepers, a node can decide who it trusts and who it doesn’t and become a part of a quorum slice based on its choice. Nodes can be a part of multiple slices and a system-wide decentralized quorum will ultimately be the result of individual nodes making decisions. Quorum slices need to be large enough and nodes they contain need to be important enough not to risk their reputations by lying and feeding different information to different people.

Good quorums share nodes and create overlaps. We call these overlaps quorum intersections. When quorums don’t intersect, we end up with disjointed quorums. If quorums are disjointed, quorum A can, for example, agree on a statement to buy a pizza, while quorum B can agree on a statement to buy a hamburger. Because they can independently agree on contradictory statements, disjoint quorums can undermine consensus.

Disjoint quorums vs. quorum intersection

As a node selects the slices it wishes to be a part of it must maintain a balance between safety and liveness. We want the system to be responsive, but not at the expense of correctness.

- Nodes lack liveness when they get blocked on the way to agreement, slowing down and blocking the system.

- Nodes lack safety when they externalize values inconsistent with those externalized at other nodes, undermining system-wide agreement and creating divergent systems.

A divergent state occurs when ledgers held by different nodes store contradictory states. A blocked system is less dangerous than a divergent one.

FBA nodes use a federated voting technique to circumvent the issues of blocked/divergent systems.

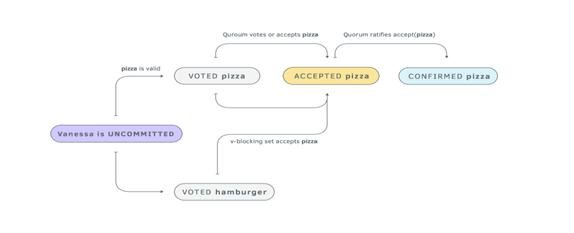

The federated voting technique showing how a bunch of people in a coworking space can be led to an agreement

To describe in more detail the federated voting process through which a node votes for and eventually accepts a statement, allowing a system to reach agreement, we can use an example of a group of coworkers voting on what to order for lunch. In this example, all coworkers are nodes while all food options are statements that the nodes need to gain consensus on. Let’s say that a worker named Vanessa wants pizza for lunch; she will need to remain open in case a large part of the group votes for one of the other options. After all Vanessa works in a public coworking space where lunch is ordered when enough members of the group come to agreement on a single decision. The process itself has three steps:

- Initial voting

In the first step of the federated voting process, Vanessa votes to remain open to the possibility of accepting pizza by asserting that pizza is valid and promising she has never and will never individually vote for any option contradicting pizza. She may, however, end up accepting something other than pizza if enough of her coworkers vote otherwise (peer pressure!).

- Acceptance

Thanks to quorum intersection, slices influence one another. If Winnie, Andrew, and Eva are Vanessa’s coworkers who want lunch as well (meaning they are in quorum slices with Vanessa), they can block the progress of accepting pizza. A v-blocking set of nodes contains at least one node from each of Vanessa’s slices and can block action in all quorums that contain Vanessa, causing Vanessa to accept something other than pizza for lunch.

Vanessa actually accepts pizza if: 1) she has never accepted a statement contradicting pizza (for example, burritos), and 2) if each member of a v-blocking set claims to accept pizza, or each member of a quorum including Vanessa either votes for or claims to accept pizza

- Ratification

When every member of a quorum votes for pizza, we say that the quorum ratifies pizza. A node doesn’t need to ratify a statement firsthand. For example, Scott often relies on Andrew and Iris to decide what to eat. They are his quorum. If they all three vote for pizza, the quorum has ratified pizza. A coworker can vote for one lunch option and later accept a contradictory one. Voting for pizza doesn’t assert pizza as lunch — pizza will be accepted as lunch only if it’s ratified.

- Confirmation

Confirmation is the final step of the voting process and implies system-wide agreement. To ensure agreement, coworkers (nodes) exchange confirmation messages. The office (system) agrees on a lunch (statement) if, once sufficient messages are delivered and processed, and no matter what events subsequently transpire, every responsive, accurate coworker (node) accepts the lunch (statement).

These messages, on the principle of peer pressure, may convince additional people to accept pizza. These additional people convince as many others as possible, broadcasting the pizza confirmation message until a point when everyone who can accept pizza has accepted it. A subsequent quorum of confirmation messages allows Vanessa to confirm pizza, which implies the system agrees on a statement and the office is eating pizza for lunch.

Stellar Consensus Protocol takes on the main challenge of distributed consensus: the system not being able to agree on a statement without the risk of getting blocked and losing liveness.

It’s possible for a statement to get stuck in a permanently indeterminate state before the system reaches agreement on it. Stellar Consensus Protocol solves this issue by crafting statements which will neutralize blocked statements if they get stuck in the voting process. It also implements a ballot-based approach to the problem. A ballot is a referendum on the value associated with the ballot, i.e., “What is the value that we’re voting on?” The ballot-based approach means that, to eventually externalize a value, a node must commit the ballot tied to that value. Each node may either commit or abort any ballot. To return to the lunch order analogy, the group of coworkers could get stuck, with the group unable to come to agreement. We need a way to neutralize an option — say, hamburgers — if the team gets stuck on it so they can make progress and eventually place an order. To neutralize hamburgers as an option, coworkers accept “abort hamburgers,” hamburgers become irrelevant, and the group moves on to vote on another lunch option. If, on the other hand, coworkers ratify the statement “commit pizza,” then the group will agree on the value, pizza, tied to that ballot. A statement “commit pizza” is valid, and therefore can legitimately appear in votes, only if all incompatible ballots have been aborted.

In an SCP system with quorum intersection, there are no blocked states for intact nodes. There’s always a sequence of events through which intact nodes can reach agreement on and commit a value. However, a node can become befouled, meaning that it can start working in a way which can undermine the agreement between the nodes. In an FBA system, befouled nodes form a dispensable set, which means intact nodes can ratify statements without the cooperation of befouled nodes, which directly implies that befouled nodes cannot undermine agreement among intact nodes. If no intact node has voted to commit any ballot, they can then move on to any ballot higher than any they’ve pledged to abort. Lack of response from befouled nodes won’t block intact nodes from assembling quorums and making progress. The ballot process, including how to deal with scenarios like split votes, is intricate and much more technical than it is described here. For a fuller description, as well as theorems and proofs, head over to the projects technical summary, read the projects white paper or check out this neat comic book novel.

How do Stellar transactions work?

To help increase its networks worldwide reach, the Stellar team offers a very straightforward explanation of the network and how it allows users to send money in one currency to a friend in another country who will receive said money in another currency.

Stellar is a decentralized network of servers that store a public distributed ledger. The ledger contains every transaction ever made and its copy is stored on each server. The servers on the Stellar network communicate between themselves to sync the ledger and verify transactions (the process also known as consensus).

Stellar consensus at work

Let’s take a look at what happens if you want to make a transaction (for example send money to someone in another country). You will first need to make a deposit with your anchor. An anchor is basically a payment processor or a bank which serves as the bridge between the fiat currency and the Stellar network. You trust the anchor to hold money and honor withdrawals like you would a physical bank. Upon making a deposit you will be given credit on your online stellar account which will essentially serve as a virtual wallet.

Next step will be to instruct your Stellar account to create a transaction (entering the amount and confirming the transaction will do it). Your Stellar account then communicates with your anchor and passes on a request for funds. Upon receiving this request, your anchor contacts the anchor which is connected to your friends account (the foreign bank which holds your friends deposits/takes care of his withdrawals). Your anchor will ask the foreign one if your friends account is compliant and, upon receiving a positive response, it will charge your wallet with the sum you instructed to be sent. This sum will be deducted from your wallet and moved into your anchors pool account, and then moved onto the Stellar network by issuing credits for the sum you wish to send. Once your anchor’s credits are inside the network, the network will search for an exchange which offers the best exchange rate amongst all the market makers that are available. The network picks this market maker, completes the exchange, and sends the now-exchanged sum into your friends anchor account. This bank registers the payment and credits your friend’s Stellar account, which completes the transfer of funds. Currently Stellar allows you to transfer/exchange 180 fiat currencies via their platform.

Create a Stellar account

The first thing you’ll need in order to interact with the Stellar network is an account. Accounts are the central data structure in Stellar, identified by a public key and saved on the ledger. Everything else in the ledger, such as offers or trustlines, is owned by a particular account. Accounts are created with the Create Account operation.

Account access is controlled by public/private key cryptography. For an account to perform a transaction–e.g., make a payment–the transaction must be signed by the private key that corresponds to that account’s public key. A unique seed is used to generate both of those keys and your account. You shouldn’t under any circumstances share this seed with anyone. You can also set up more complicated multi-signature schemes for authorizing transactions on an account.

Account fields

Accounts have the following fields:

- Account ID

The public key that was first used to create the account. You can replace the key used for signing the account’s transactions with a different public key, but the original account ID will always be used to identify the account.

- Balance

The number of lumens held by the account denominated in 1/10000000th of a lumen, the smallest divisible unit of a lumen.

- Sequence number

The current transaction sequence number of the account. This number starts equal to the ledger number at which the account was created.

- Number of subentries

Number of other entries the account owns. This number is used to calculate the account’s minimum balance.

- Inflation destination

(optional) Account designated to receive inflation. Every account can vote to send inflation to a destination account.

- Flags

Currently there are three flags, used by issuers of assets.

- Authorization required (0x1): Requires the issuing account to give other accounts permission before they can hold the issuing account’s credit.

- Authorization revocable (0x2): Allows the issuing account to revoke its credit held by other accounts.

- Authorization immutable (0x4): If this is set then none of the authorization flags can be set and the account can never be deleted.

- Home domain

A domain name that can optionally be added to the account. Clients can look up a stellar.toml from this domain. This should be in the format of a fully qualified domain name such as example.com.

The federation protocol can use the home domain to look up more details about a transaction’s memo or address details about an account. For more on federation, see the federation guide.

- Thresholds

Operations have varying levels of access. This field specifies thresholds for low-, medium-, and high-access levels, as well as the weight of the master key. For more info, see multi-sig.

- Signers

Used for multi-sig. This field lists other public keys and their weights, which can be used to authorize transactions for this account.

Check out this link to fully understand the account creation process.

Lumens tokens

A lumen, or XLM, is the digital currency unit built into the Stellar network. At the launch in 2014 the currency was named stellar and its total cap was 100 billion. When the upgraded network launched in 2015 stellars were renamed to lumen; this was done to help separate the currency from the name of the network and the nonprofit. Lumens are used for various purposes, including bridging the transactions system on the network, preventing spammers from flooding the network and making sure that accounts are authentic. Lumens holders can also use the Stellar network and its built-in ERC-20 token capabilities to launch their own ICO’s and some companies like Mobius have already done so.

Reasons to pick Stellar for your ICO over Ethereum

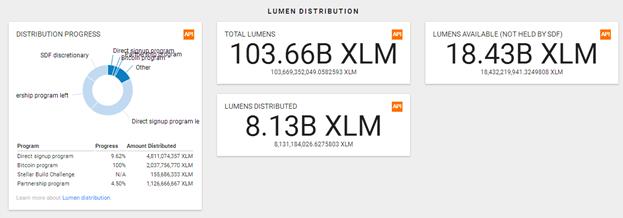

What’s interesting about the coin is that 95% of the lumens created when the Stellar network began will be given away to the world. They are giving these coins away because it goes along with their two main goals: achieving a more inclusive global economy and expanding the reach of the Stellar network. 5% remains with Stellar.org for operational costs. Stellar.org designed the giveaway program to ensure that lumens are given away to diverse groups:

- 50% to individuals who want lumens

- 25% for nonprofits to reach underserved populations

- 20% to bitcoin holders

Currently, only a small percentage of Stellar network users will receive invites to become a part of the free distribution at any given time. The first attempt to give lumens away to individuals – a different amount per user – resulted in some abuse, but still resulted in company giving away 1,694,618,200 lumens. Stellar are currently working on a new prototype for the lumens giveaway. Check here for the latest update on the giveaway process.

The Stellar.org mandate reserves 5% of the original lumens to support the operations of Stellar.org. Stellar.org will cover its operational costs via its own lumens in the following ways:

- Auction: They are periodically offering portions of the reserved lumens at auction.

- Batches. They are periodically auctioning larger batches of the reserved lumens to parties interested in supporting the Stellar.org mission.

Where and how to buy Lumens

Even though the token is in a free distribution phase, you can still find it on exchanges if you are unwilling to wait. By buying the coin you both support the project and make sure that you will have Lumens to conduct transfers on the Stellar network. Lumen tokens are available for purchase on various exchanges. Obviously Upbit has the most volume by a large margin but many non-Korean people have regretted using it, with reports surfacing how it apparently holds somewhat of a bias towards its native customers while throttling the traffic of everyone else. You can store them in any of the wallets that are listed on their official wallets page.

The easiest way to buy Lumens is through a two-step process that requires an exchange with another cryptocurrency. Before purchasing lumens, consult the Consumer Advisory brief by the Consumer Protection Finance Board (CPFB) on the potential risks associated with digital currencies. When buying/selling lumens you pay a nominal fee, referred to as a base fee, associated with each operation in a transaction. The sender of the transaction incurs the fee. The fee functions as a deterrent: Though nominal, it discourages users with malicious intentions from flooding the network (otherwise known as a DoS attack). The base fee is currently set to .00001 XLM, which will increase if the system suspects an account is submitting transactions with the malicious intent of overloading the servers. No one profits from the base fee as the ledger collects the funds and redistributes them in the process of inflation.

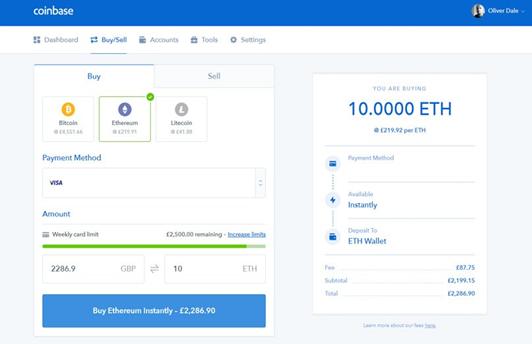

- Buy BTC/ETH on Coinbase

First time buyers of crypto currency can use Coinbase to make their first purchase – its easy to use, fully regulated by the US government so you know it is one of the safest and most reputable places to purchase cryptocurrency from. On Coinbase you can purchase Bitcoin, Litecoin and Ethereum with a credit or debit card or by sending a bank transfer.

You will have to carry out some identity verification when signing up as they have to adhere to strict legal guidelines. Make sure you use our link to signup (ovde referral link moze) as you will be credited with $10 in free bitcoin when you make your first purchase of $100.

To get started, click the “Sign up” button where you will be taken to a registration form where you will need to enter your name, email and choose a password. Fill out the required data, check your e-mail for the verification link and your account will be ready for your first purchase.

Purchase Ethereum

The reason for purchasing Ethereum and not Bitcoin is that it has far cheaper fees than Bitcoin for sending and the transaction also happens a lot faster. So in Coinbase, visit the “Buy / Sell” tab at the top, select “Ethereum”, choose your payment method and enter the amount you wish to purchase – you can either enter a US Dollar amount or a number of Ether.

You will then be asked to confirm your transaction (if paying with a card you might have to complete verification with your card provider). Once that’s complete, your Ethereum will be added to your account.

2. Exchange your Bitcoin or Ether for Lumens.

After your bitcoin or Ether hits your digital wallet, transfer them to an exchange which offers Stellar. Some of the exchanges which do exactly that are: Binance, a super-low fee-trading exchange with an abundance of features and functionality; Bittrex, a US-based exchange, regularly sitting in the Top 5 trading volumes; Poloniex, known for its incredible, extensive range of altcoins, so you can trade lumens in various pairs; Kraken, a Bitcoin exchange that has expanded its currency selection, and is a popular option, although the user interface and their website can be a nightmare at times.

Finally, once you have purchased your Lumens, you should transfer them into cold storage as it’s not recommended to keep your funds on an exchange.

Alternatively, you can trade on the Stellar Decentralized Exchange. StellarTerm is just a client that can be used to access the Stellar Decentralized Exchange, allowing buyers to trade with various sellers. Purchasing options vary depending on what listings are available at the time.

Future of Stellar Lumens

On January 25, 2018, a person named Christian published what is titled the 2018 Stellar Roadmap. This roadmap discusses Stellar’s recent rise to fame among “randos”, its growing mainstream appeal and its plans for the future year.

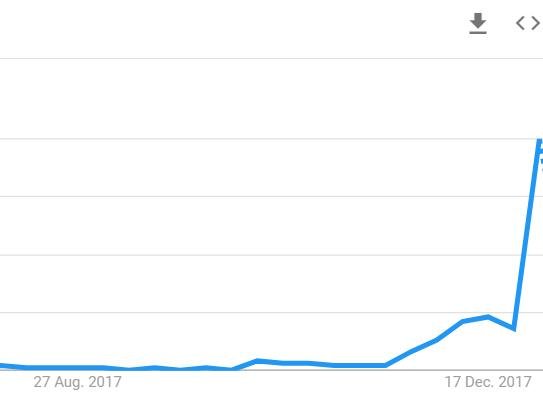

Rise in search term “buy stellar”

These plans include two main goals:

- SDEX – the Stellar Decentralized Exchange

SDEX is the working name for the project of building a front-end for Stellar’s inherent decentralized exchange. It will enable on-chain, protocol-level trades for any Stellar token, and will be supported by liquidity to minimize spreads and maximize choice of assets. SDEX will also offer:

– Day One trading for any Stellar ICO token

– atomic pathfinding to discover the cheapest rates between any two assets

– very low trading fees

– end-user control of secret keys

- Implementing Lightning Network on Stellar

There is apparently a significant market demand for more private channel transactions on Stellar, and Stellar plans to satisfy this demand by integrating Lightning in 2018. Lightning should have a huge positive effect on Stellar’s long-term scalability and security.

They also have some side objectives which include better overall brand communication, quality walk-throughs to help new developers get going, better technical documentation and continued improvement to the Horizon API and the surrounding SDKs. They will also continue to award lumens, via the Stellar Build Challenge, to people and businesses who contribute to Stellar ecosystem.

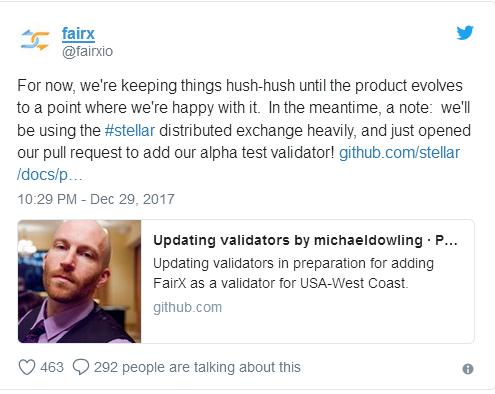

Besides the roadmap, there is a lot of positive news surrounding the project. For starters there is talk of Stellar being involved in building FairX, a new crypto-to-fiat exchange backed by IBM. As more people start using FairX, the Stellar network will see a huge increase in traffic and liquidity. This is great news for Stellar investors, as the increased demand will see the value of XLM rise. An update on FairX’s development is slated sometime at the end of January or the beginning of February, and if Stellar is as “heavily” involved as FairX has implied, the news could be beneficial to the cryptocurrency.

The coin is also mentioned all the time in the same breath as Ripple, currently the 3rd coin in the world according to its market cap. The market for cross-border payments, microtransactions, and intermediary currency functionality is huge and both Stellar and Ripple are tackling it with superior technology, but each in their own way.

Alexis Ohanian Sr., CEO and co-founder of Reddit, recently indirectly pledged his allegiance to Stellar as he tweeted that r/Stellar, the cryptocurrency’s subreddit, is “[definitely] worth subscribing to in 2018.”

John McAfee echoed Time Magazine’s sentiments as he “promoted” XLM as his coin of the week recently, adding to the list of prominent figures noting Stellar Lumens as a strong investment in 2018.

Stellar price soared up 20 percent back in January after online payments company Stripe said it may add support for the cryptocurrency. An all time high need for third-world banking services should also help in rising this price even further.

A total of 37 partners were signed on to the Stellar project last year. Their partnerships with IBM and KlickEx for cross-border payments as well as ones with Remitr, MSewa Software Solutions, PesaChoice, Chaneum ICO Advisory Services, Deloitte, Parkway Projects and Tempo suggest that Stellar networks real world usage is going to increase a lot in the future.

Stellar plans on adding its own Stack Exchange feature which at might seem like it won’t have a big impact. Still this Stack Exchange is being created just for Stellar and developers can easily get any questions answered that they have about it, which will help adoption.

It’s important to see Stellar for what it is: an extremely new cryptocurrency with ambitious goals. However those goals might just be met as it’s pretty easy to see that 2018 is going to be very big for Stellar. Lumens will be adopted for more real-world applications, become way more accessible to users and new investors, and the demand for XLM is about to skyrocket. All of this will definitely further establish the position of Stellar Lumens as a valuable cryptocurrency that is here to stay.

You can’t buy it directly for fiat on any exchange. You can choose the best cryptocurrency exchange for your region and but BTC there, then trade it for XLM on Bittrex or Binance(review of Binance here). Learn here how you can instantly convert altcoins to bitcoin and vice versa.

Our recommendation is always check if Coinbase is available for your country and buy there – as it is by far the safest and best regulated bitcoin exchange. Coinbase is legit and trustworthy crypto exchange.

If your country is not available on Coinbase – check for Coinbase alternatives and buy BTC on one of those exchanges.

Best and safest option to store your coins is to download an official coin wallet and store it on a hardware wallet – our recommendation is just go and buy Ledger Nano S, it is the safest option.