Are you looking to invest in cryptocurrency but unsure which one will yield the highest profits in 2024? With the volatile nature of the crypto market, it’s essential to make informed decisions to maximize your returns. Luckily, I’ve done the research for you and identified the most profitable cryptocurrency to invest in for the upcoming year.

Cryptocurrencies have taken the financial world by storm, and their potential for high returns has attracted investors from all walks of life. However, with thousands of options available, it can be overwhelming to determine which cryptocurrency will provide the greatest gains. That’s why I’ve analyzed market trends, technological advancements, and expert opinions to identify the top cryptocurrency that promises substantial profitability in 2023 and 2024.

In this article, I will unveil the most profitable cryptocurrency to invest in for 2024, providing you with valuable insights and reasons why this particular digital asset stands out among the rest. Whether you’re a seasoned investor or a newcomer to the crypto space, this information will help guide your investment decisions and potentially lead to significant financial gains.

What you'll learn 👉

Most Profitable Cryptocurrency to Invest in 2024

Tectum (TET)

Tectum is a groundbreaking Layer 2 blockchain solution that boasts the fastest transaction speeds in the industry without the need for sharding.

The TET token has several utilities:

- Facilitates the creation of SoftNotes, Tectum’s digital cash solution.

- Offers zero-cost, trustless transactions across its network.

- Provides discounts on merchant fees within the Tectum ecosystem.

- Serves as a stake in the Tectum network, enabling participation in governance and decision-making processes.

TET may appreciate in value due to:

- The increasing adoption of Tectum’s high-speed transaction capabilities by businesses and individuals.

- The potential integration of T12 protocol into popular cryptocurrency wallets like Metamask, which could significantly boost TET’s usability and demand.

- The ongoing development and expansion of Tectum’s ecosystem, including new product launches and cross-chain integrations.

- The growing recognition of Tectum’s advanced cybersecurity measures, which can enhance investor confidence in the platform’s long-term viability.

Immutable X

Immutable X uses ZK-Rollups to bundle NFT transactions off-chain and submit proof to Ethereum, improving scalability.

The IMX token has several utilities:

- Trading – IMX is traded by investors/traders, reflecting platform adoption

- Liquidity Provision – IMX incentivizes adding token pairs to DEX liquidity pools

- dApp Building – Developers need IMX to pay gas fees for dApps on Immutable X

IMX aligns incentives between traders, creators, and NFT marketplaces. Increased ecosystem activity requires using IMX, benefiting all participants.

IMX may appreciate in value due to:

- Solving Ethereum congestion issues for NFT/gaming adoption

- Capitalizing on surging mainstream NFT demand

- Aligned incentives creating feedback loop of usage driving IMX utility

But crypto investments carry risks like volatility. Thorough research is required before investing.

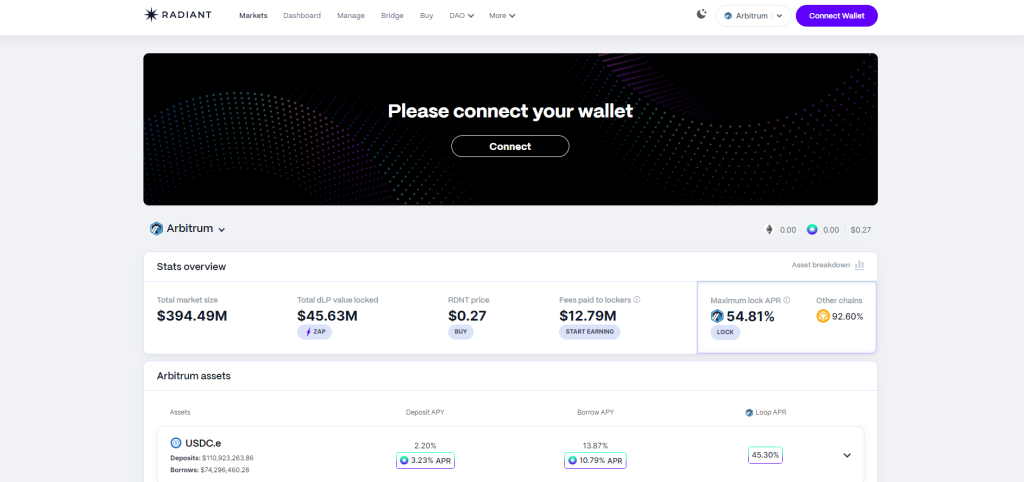

Radiant Capital

Radiant Capital is a DeFi protocol for cross-chain lending and borrowing. The RDNT token incentivizes providing platform utility as a dynamic liquidity provider.

RDNT functions:

- Trading – Can be freely traded by investors and speculators

- Liquidity Provision – RDNT rewards supplying assets for lending pools

- dApp Building – Developers need RDNT to build apps on Radiant Capital

RDNT aligns incentives between traders, lenders, and borrowers. Platform usage requires RDNT, benefiting the ecosystem.

Radiant Capital made tokenomics more sustainable by extending rewards over 5 years instead of 2, allowing more development.

RDNT may increase in value due to:

- First mover advantage in fragmented cross-chain lending market

- Surging popularity and demand for DeFi lending

- Aligned incentives driving usage and RDNT utility

But crypto investments are risky. Careful analysis of tokenomics and market conditions is required.

Injective Protocol

Injective Protocol is a decentralized exchange for derivatives and futures trading. The INJ token drives platform utility.

INJ functions:

- Trading – INJ is traded by investors speculating on growth

- Liquidity Provision – INJ incentivizes supplying assets to DEX liquidity

- dApp Building – Developers require INJ to build on Injective Protocol

INJ aligns incentives of traders, creators, and market makers, benefiting the ecosystem.

INJ may appreciate due to:

- Advanced trading features attracting users and volume

- Focus on fast-growing DeFi derivatives sector

- Aligned incentives increasing activity and INJ utility

But crypto investments involve volatility risks. In-depth research into tokenomics and market dynamics is recommended before investing.

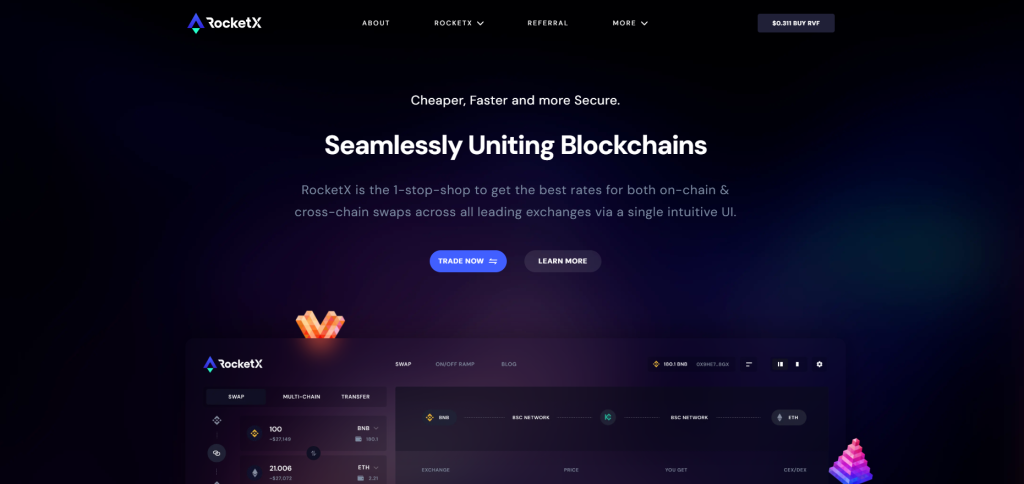

RocketX Exchange

RocketX Exchange is a non-custodial cryptocurrency exchange aggregator that aims to provide users simplified access to global liquidity. It integrates with over 270 centralized and decentralized exchanges.

Some key features of RocketX Exchange include:

- Liquidity Aggregation – RocketX aggregates liquidity across centralized and decentralized exchanges, allowing users access to a wide range of trading pairs and competitive prices.

- Cross-Chain Swaps – Users can seamlessly swap crypto assets across different blockchains, including BTC to ETH, ETH to BNB, ETH to AVAX, and more.

- Simplified Trading Interface – RocketX provides an easy-to-use trading interface for smooth order execution. Users can navigate the platform and make trades easily.

While the tokenomics details of the RocketX native token (RVF) are unclear, it can be inferred that RVF plays an integral role in the ecosystem. As the native token, RVF likely provides utility such as discounted trading fees, staking rewards, governance rights over the protocol, and more. However, further research directly from RocketX official sources is required to fully understand the RVF tokenomics model.

The utility, supply and demand dynamics, and incentive structures around RVF will determine its potential value. As a key component of the RocketX Exchange ecosystem, comprehensive documentation around RVF’s tokenomics from the RocketX team would shed light on its investment merits and risks for interested users.

Sui

Sui is a layer-1 blockchain developed by former Meta developers to solve common issues like gas fee spikes. Here are the key details of Sui’s tokenomics:

- Total Token Supply – The max supply of Sui tokens is 1 billion

- Token Distribution – The distribution is 30% to community, 20% to team, 15% to foundation, 10% to advisors, partnerships, and liquidity each, and 5% to marketing.

- Token Utility – The SUI token incentivizes participation across the Sui network. Key utilities include trading, liquidity provision, dApp development, transaction fees, and staking.

- Staking – SUI holders can stake tokens to earn yields and participate in governance. Staking contributes to security.

- Governance – SUI enables voting on network changes as part of a DAO governance structure.

- Inflation – New SUI is minted yearly as staking rewards at an inflationary rate that encourages participation while maintaining scarcity.

The experienced team, solutions to network gas issues, and aligned incentives between SUI holders and the Sui platform may increase its value. But risks around volatility and speculative investment remain.

Illuvium

Illuvium is a decentralized blockchain-based gaming studio creating high production quality NFTs playable across an interconnected universe of games. Its flagship game enables players to earn rewards through open world exploration, creature collection, and autobattler gameplay.

The ILV tokenomics include:

- Total Supply – 9.63 million ILV supply cap

- Utility – ILV enables staking, governance, yield farming and access to in-game assets and rewards.

- Distribution – 30% to community, 20% team, 15% foundation, 10% advisors, partnerships, and liquidity each, and 5% marketing.

- Play-to-Earn Model – ILV is integral to the play-to-earn mechanics of Illuvium, allowing players to monetize through gameplay.

The unique merging of gaming and crypto, popularity of play-to-earn models, desirability of scarce in-game NFT assets, and protocol owned liquidity may potentially drive demand for ILV. However, speculative investment and volatility risks remain.

Dynex

Dynex is a high-performance blockchain network that utilizes artificial intelligence and machine learning to enable fast and efficient processing of transactions.

Key aspects of Dynex tokenomics:

- Consensus Algorithm – Dynex uses a Proof of Useful Work consensus that requires miners to perform useful computational tasks to validate transactions. This enhances efficiency.

- Total Supply – There is a fixed maximum supply of 110 million DNX tokens.

- Distribution – 50% of DNX is allocated for community incentives, 20% for team and advisors, 15% for ecosystem development, and 15% for private sale.

- Utility – DNX has multiple utilities including staking for rewards and governance rights, payment of fees on the network, and incentivizing validators and developers.

- Governance – Dynex uses a Decentralized Autonomous Organization structure that lets DNX holders participate in governance through voting on proposals.

- Staking – DNX holders can stake their tokens to earn yield and help secure the network while retaining governance rights.

Dynex’s innovative technology and incentivization of participants through DNX contributes to its investment potential. However, as with any crypto asset, risks are inherent.

Merit Circle

Merit Circle is a decentralized autonomous organization focused on maximizing yields across play-to-earn gaming and the expanding metaverse.

Key details:

- Governance Token – The MC token is the governance token of the Merit Circle DAO, giving holders voting rights on platform decisions.

- Staking – MC tokens can be staked to increase voting power in the DAO. Higher stakes confer more governance influence.

- Utility – MC provides access to play-to-earn gaming opportunities and in-game asset ownership and trading.

- Distribution – MC has a maximum supply of 1 billion. Distribution specifics are set by the DAO.

- Revenue Share – Merit Circle DAO treasury revenue is used to reward MC stakers and fund growth.

MC benefits from growth of metaverse and play-to-earn gaming. And a decentralized governance structure can incentivize community ownership.

Cartesi

Cartesi provides an off-chain layer-2 infrastructure to enhance blockchain scalability and allow mainstream software development of complex dApps.

Key tokenomics details:

- Total Supply – Fixed maximum supply of 1 billion CTSI

- Utility – CTSI is used for staking, transaction fees, governance, and incentivizing developers

- Distribution – 30% for team, 19% for seed investors, 18.5% for private sale, 12.5% for ecosystem and platform development, 10% for community & awareness, 10% for platform partners

- Staking – CTSI holders can stake tokens to earn yield and participate in governance

- Transaction Fees – Fees for using Cartesi are paid in CTSI, increasing token demand

Cartesi’s solutions to blockchain limitations and ability to attract developers with familiar tools improve CTSI’s investment appeal. But inherent cryptocurrency risks remain.

Should You Invest In The Most Profitable Cryptocurrency?

Investing in the most profitable cryptocurrencies can be an appealing prospect due to the potential for significant returns. However, it also carries higher risk. Here are some key considerations when deciding whether to invest in top performing cryptocurrencies:

- Past performance is no guarantee of future results – A cryptocurrency may have yielded huge returns historically but could underperform moving forward. Market conditions change.

- High volatility – The most profitable cryptos tend to be extremely volatile due to potential “pump and dump” schemes and speculative trading. This volatility can result in large drawdowns.

- Lack of fundamentals – Cryptos chasing quick profits often lack fundamentals like utility, adoption, or differentiated technology. Their valuations are purely speculative.

- Getting the timing right – Maximizing gains often requires buying a crypto right before it explodes in price and selling shortly after. This kind of timing is difficult to execute consistently.

- Diversification is key – Concentrating in one or two high-risk, high-reward cryptos can be dangerous. Diversifying across a basket of assets reduces risk.

The massive profit potential makes hot cryptos enticing. But the elevated risks and challenges around timing and selection makes a diversified, balanced crypto portfolio more suitable for many investors. Do thorough research before chasing quick profits in any asset.

How To Find The Next Most Profitable Cryptocurrency

Finding the next crypto to generate huge returns is challenging, but these strategies can help identify promising contenders:

- Analyze price charts to spot upward trends and bullish patterns signaling momentum. Use indicators like moving averages.

- Research project teams, whitepapers, and fundamentals to gauge real-world utility and adoption potential. Assess community support.

- Identify undervalued cryptos with solid technology and use cases. Look for signs of increased developer activity.

- Evaluate the macro environment and news flow for indications of market cycles and emerging trends that could benefit certain crypto sectors.

- Monitor social media hype and “vibe shifts” to detect rising popularity and buzz around specific coins. But don’t base decisions solely on hype.

- Find cryptos recently listed on major exchanges or added to leading indexes which could benefit from increased visibility and accessibility.

- Consider small market cap gems with low liquidity that could gain tremendous upside from increased investor demand. But beware minimal fundamentals.

Profitable crypto investing requires a pulse on market psychology and momentum. But also assess project viability to avoid speculation-fueled pumps.

Read also:

- Next Cryptocurrency to Explode – Which Tokens Are Set to Skyrocket?

- Top 15 Cryptos With the Highest Potential: Comprehensive Analysis & Investment Guide

- Cheapest Crypto to Buy – With Significant ROI Possibilities

How To Buy The Next Most Profitable Cryptocurrency

Once you’ve identified a promising investment opportunity, here’s how to buy:

- Sign up with a reputable exchange listing the crypto, like Coinbase, Binance or Kraken. Complete identity verification.

- Deposit fiat currency or purchase a stablecoin to fund your account and have capital ready to trade.

- Search for the desired cryptocurrency and enter your order details including order type, size, and price if appropriate.

- Double check order specifics like exchange rate, fees, and total cost. Submit the order.

- Allow time for the exchange to process and fulfill your buy order. The crypto will show in your wallet.

- Move cryptos to a secure external wallet rather than leaving long term on an exchange account.

Execute trades according to exchange guidelines and legal requirements. Consider tax implications as well. Timely buy and sell decisions are key for profitability.

Conclusion on Most Profitable Cryptocurrency to Buy

Identifying and investing in the most profitable cryptocurrencies has massive upside potential but also elevated risk. Past performance does not guarantee future gains. By diversifying and avoiding speculation-driven assets, investors can balance returns with risk management.

Do extensive research to assess project viability beyond just price trends and hype. Cryptocurrency profits require getting the timing right on both entry and exit. Consider working with an experienced financial advisor when navigating these risky markets.

The crypto space still offers tremendous opportunities for savvy investors. But reckless speculation on unsustainable rallies rarely ends well long term. With prudent strategies, the right crypto purchases can yield outstanding returns without undue risk.