What you'll learn 👉

Introduction – Cryptos With the Most Potential

The cryptocurrency market is constantly evolving with new and innovative projects emerging regularly. With over 18,000 cryptocurrencies in existence today, it can be challenging for investors to identify projects that have long-term viability and growth potential.

This guide will explore the top 15 cryptocurrencies that analysts and industry experts believe have the highest potential going into 2023. For each cryptocurrency, we will examine its use case, tokenomics model, community support, and other factors that contribute to its investment appeal.

Understanding the fundamentals of a project is key to making informed investment decisions in the crypto space. The cryptocurrencies listed here have solid foundations and utility that make them promising investments for the future.

Best Crypto Coins With Highest Potential

Tectum (TET)

Tectum is a groundbreaking blockchain platform developed by the cybersecurity company CrispMind. It’s designed as a Layer 2 solution for Bitcoin and other cryptocurrencies, aiming to resolve the limitations of existing networks like the Lightning Network. With a remarkable speed of 1.3 million transactions per second (TPS), it claims the title of the world’s fastest blockchain without sharding.

👉 Use Case

- SoftNote Feature: Tectum introduces SoftNote, enabling instant, trustless, and decentralized crypto payments at zero cost. It not only facilitates quick transactions but also creates digital cash, providing unlimited scalability for any blockchain.

- Digital Cash Creation: SoftNote also plays a role in creating digital cash, which can be a pivotal feature for the blockchain in terms of providing scalable financial solutions.

- Decentralized Payments: The platform aims to offer a decentralized payment system, ensuring that transactions are not only fast but also secure and trustless.

👉 Good Investment

- High-Speed Transactions: Tectum boasts an astonishing speed, which is a crucial factor for a blockchain platform’s success.

- SoftNote Marketplace and NFT Marketplace: The roadmap includes launching a SoftNote marketplace and an NFT marketplace, which could potentially be lucrative given the current trends in the crypto space.

- User Base: Having already minted over 1.4 million SoftNotes and garnered a user base of 45,000+ wallet holders, it shows a level of existing user interest and investment.

- Integration with Metamask: The integration of the T12 protocol into the Metamask wallet, a widely-used noncustodial wallet, could potentially boost its usability and adoption.

👉 Tokenomics

- Various Tokens: Tectum offers various tokens, including the Tectum Emission Token (TET), an ERC-20 Wrapped TET, and a BEP-20 Wrapped TET, each with its unique functionalities and utilities.

- Revenue Streams: The platform has multiple revenue streams, including merchant terminal fees and SoftNote minting, which could potentially provide financial stability to the platform.

- Token Utilities: Tokens can be used for various utilities such as minting SoftNotes and reduced merchant fees, providing users with varied use-cases.

👉 Team & Community

- CrispMind: With over eight years of experience in cybersecurity, the CrispMind team brings a high level of security to the platform, which is pivotal for any blockchain platform.

- Strategic Partnerships: Tectum has formed strategic partnerships and has a strong advisory board, positioning it for significant growth in the blockchain space.

- Community: The existing user base and wallet holders indicate a community that might be growing and could potentially support the platform’s future developments.

Synthetix (SNX)

Synthetix is a derivatives liquidity protocol that enables the creation of on-chain synthetic assets. These synthetic assets, known as Synths, provide exposure to real-world assets like gold, stocks, fiat currencies without needing to hold the underlying asset.

👉 Use Case

Synthetix creates synthetic derivatives to give decentralized finance (DeFi) applications exposure to real-world assets. The protocol has created over 40 Synths pegged to assets like Tesla stock, gold, and cryptocurrencies. The Synths tap into unlimited on-chain liquidity and are available on Ethereum and Optimistic Ethereum.

👉 Good Investment

As one of the top DeFi protocols, Synthetix has a proven track record and strong reputation. The protocol has over $1 billion in total value locked. Synthetix is also working to offer synthetic stock exposure for the traditional equities market, which creates new opportunities.

👉 Tokenomics

SNX is the native token of Synthetix used for staking and minting Synths. SNX uses a deflationary tokenomics model with staking rewards, fees, and token burns.

There is a maximum supply of 250 million SNX. The token allows holders to stake SNX as collateral to mint Synths. A portion of exchange fees is distributed to SNX stakers as rewards.

👉 Team & Community

Synthetix was founded in 2017 by Kain Warwick. The project is supported by the Synthetix Foundation and has backing from major investors like Coinbase Ventures. The community is active with proposals and discussions happening on Discourse and Twitter.

Rollbit Coin (RLB)

Rollbit Coin is the utility token that powers Rollbit, a popular online cryptocurrency gaming and gambling platform. The RLB token offers users benefits within the Rollbit ecosystem.

👉 Use Case

The RLB token is used for reduced rake fees, daily rewards, and other incentives within the Rollbit gaming platform. RLB also allows users to access exclusive games, prizes, and features.

As Rollbit grows in popularity, the utility of the RLB token increases. The fixed token supply also makes RLB deflationary as demand for it rises over time.

👉 Good Investment

Rollbit already has an established user base as a top online crypto gambling site. With over $1 billion wagered, Rollbit sees strong activity and demand.

The utilities of RLB also give it intrinsic value within the Rollbit ecosystem. As a specialized utility token for a thriving platform, RLB has long-term growth potential.

👉 Tokenomics

RLB has a fixed total supply of 97,967,933 tokens. The circulating supply is over 95 million RLB currently. Rollbit uses a buyback and burn mechanism to continuously decrease the circulating supply and increase the value of RLB.

RLB holders receive a share of the daily betting rake based on their proportional holdings. The token also offers reduced Rollbit rake fees, exclusive games and prizes.

👉 Team & Community

Rollbit was launched in 2019 by two anonymous founders known as House and Prophet. Despite its anonymous team, Rollbit has built a significant community presence across social media and Discord.

Rollbit emphasizes transparency by making its house edge and odds public. The platform regularly engages with its community to get feedback and input on improving the Rollbit ecosystem.

Rocket Pool (RPL)

Rocket Pool is a decentralized Ethereum 2.0 staking protocol, allowing users to earn staking rewards on Ethereum without needing 32 ETH to run a validator node.

👉 Use Case

Rocket Pool allows any user to earn yields on Ethereum by staking their ETH. Rocket Pool handles the validator node operations in a decentralized network of node operators.

Users with less than 32 ETH can earn staking rewards by depositing their ETH into Rocket Pool and receiving rETH in return. rETH represents staked ETH and accrues network rewards over time.

👉 Good Investment

As Ethereum transitions to proof-of-stake, Rocket Pool provides an accessible way for anyone to earn yields on their ETH. Rocket Pool is trusted and decentralized, removing barriers to staking.

Rocket Pool is currently the second largest Ethereum staking protocol with over $1 billion value locked. The protocol and token economics have proven to be secure and effective.

👉 Tokenomics

The RPL token has a maximum supply of 18 million tokens. RPL is required to run validator nodes on Rocket Pool, creating inherent utility and demand for RPL.

Node operators must stake RPL along with ETH as collateral. A percentage of network rewards also goes to RPL holders, incentivizing holding RPL long-term.

👉 Team & Community

Rocket Pool was founded in 2018 by David Rugendyke. The protocol is supported by ConsenSys and other major backers.

Rocket Pool has fostered an active community across Discord and social media. The team regularly implements community suggestions and proposals.

Conflux Network (CFX)

Conflux Network is a permissionless Layer 1 blockchain that aims to solve major issues like scalability and transaction speeds using a unique Tree-Graph consensus model.

👉 Use Case

Conflux offers fast transaction confirmation times and throughput over other blockchains. By improving speed, scalability and security, Conflux creates a better infrastructure for DeFi, NFTs, games, payments and other use cases.

👉 Good Investment

Conflux has an innovative tech stack that provides demonstrable improvements over older blockchains. With transaction fees under $0.01, Conflux is usable for micropayments and everyday transactions.

Major ecosystem partners include Gate.io, Huobi, and the Ministry of Industry and Information Technology of China. Significant backing and development activity make Conflux a promising project.

👉 Tokenomics

CFX tokens have a maximum supply of 1 billion. The Conflux team receives 10% of the total supply, while 35% goes towards staking rewards and the rest is mined.

CFX is used to pay fees, secure the network through staking, and provide governance over Conflux’s protocol upgrades.

👉 Team & Community

Conflux was founded in 2018 by a highly experienced team including Andrew Yin, the former CTO of Qihoo 360. Conflux has over 100 core team members and is backed by prominent Chinese VCs and tech companies.

Conflux has an active global community across Telegram, Discord, Twitter and Forum channels. The team regularly interacts with the community to discuss developments.

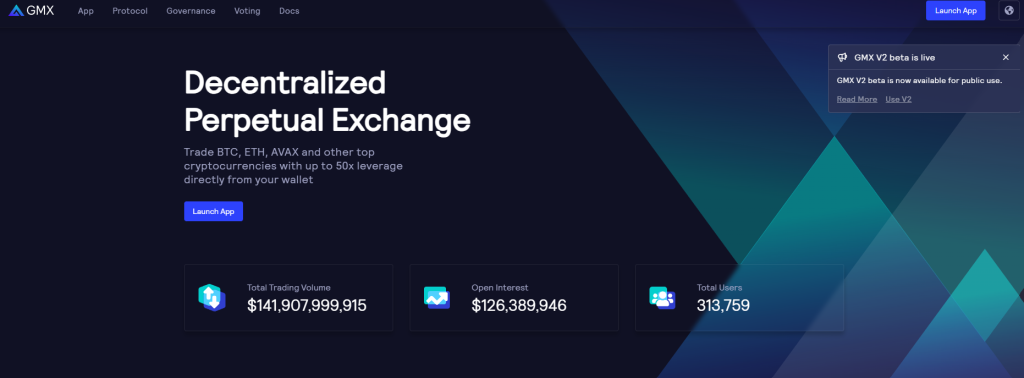

GMX (GMX)

GMX is a decentralized perpetual exchange allowing up to 30x leverage trades on major cryptocurrencies. GMX provides access to derivative trading for DeFi.

👉 Use Case

GMX allows traders to long or short cryptocurrency assets using leveraged positions. Traders can also earn yield by providing liquidity for trading pairs and staking GMX tokens.

GMX creates an on-chain alternative to trading on centralized exchanges like Binance for perpetual swaps. Decentralized trading improves security and transparency.

👉 Good Investment

GMX is the leading decentralized perpetual exchange with the highest trading volumes. GMX has quickly gained adoption with over $1 billion in positions closed already.

Arbitrum Nova, GMX’s underlying blockchain infrastructure, makes trading cheap and efficient. GMX has become integral to the Arbitrum and overall DeFi ecosystem.

👉 Tokenomics

GMX has a total token supply of 101 million. The token accrues value from fees, staking rewards, and governance rights over the DAO and treasury.

30% of all platform fees are used to buy back and burn GMX tokens. GMX stakers also receive 85% of remaining platform fees as rewards. This incentivizes holding GMX long-term.

👉 Team & Community

GMX was launched in 2021 by a team of experienced DeFi builders including Daniele Sestagalli and Will Papper. GMX is governed by a DAO which allows the community to guide development.

Despite being a relatively new project, GMX has a thriving community across Discord, Twitter and Telegram. The team actively engages the community through the DAO.

Oasis Network (ROSE)

The Oasis Network is a privacy-focused Layer 1 blockchain for open finance and a responsible data economy. Oasis Network allows private and scalable apps.

👉 Use Case

Oasis Network provides a secure environment for financial transactions, healthcare data, identity management and other sensitive use cases. The network uses advanced cryptography and privacy-preserving computation.

Decentralized apps can ensure data confidentiality while leveraging the transparency of a blockchain. Oasis brings privacy to DeFi, gaming, identity, and more.

👉 Good Investment

Data privacy is increasingly important. Oasis Network is one of the most advanced and usable blockchain projects focused on privacy. Partners like NEAR, Magic and Celo also attest to Oasis Network’s value.

Oasis already supports ecosystem development through its Oasis Emergents Program. With strong foundations, Oasis Network is poised to become a core privacy infrastructure.

👉 Tokenomics

The ROSE token has a maximum supply of 10 billion tokens. ROSE is used to pay fees, secure the network through staking, and provide governance over Oasis’ evolution.

65% of the token supply goes towards staking rewards. 20% goes to the Oasis Foundation to support growth. The remaining 15% rewards early backers and the team.

👉 Team & Community

Oasis Network was founded in 2018 by Dawn Song, a computer science professor at UC Berkeley recognized for her work in security and privacy.

Oasis has strong ties to academia with subject matter experts on its team. The Oasis community discusses development and proposals through the official forum.

Unibot (Unibot)

Unibot provides an automated DeFi trading platform with three primary products: Uniswap trading bots, portfolio management, and educational courses.

👉 Use Case

Unibot allows users to automate trading across various DeFi protocols. Users can create limit orders, set stop losses, and customize bots for automated yield farming. Unibot also offers tools to track and analyze a portfolio.

By automating DeFi trading, Unibot makes complex liquidity provisioning, yield farming and arbitrage accessible to any user. The platform provides a suite of customizable trading tools.

👉 Good Investment

Unibot is the leading platform for automated DeFi trading with over $350 million in total value locked in its smart contracts. Unibot has a proven product-market fit and has paid its users over $10 million in rewards so far.

As DeFi grows, the need for sophisticated and automated trading tools also increases. Unibot provides infrastructure that is critical to DeFi going mainstream.

👉 Tokenomics

While Unibot does not have a native token currently, its tokenomics are worth considering. A native token can better align incentives between Unibot and its users. Properly designed tokenomics can increase the long-term viability of the ecosystem.

If introduced, a UNIB token could offer benefits like protocol governance, fee discounts, and staking rewards. The token could make contributing to Unibot more attractive.

👉 Team & Community

Unibot was founded by an anonymous team of experienced DeFi builders. Despite its secretive team, Unibot upholds strong principles of transparency and accountability with its users.

Unibot has cultivated an avid community of DeFi enthusiasts who share trading strategies and provide feedback on Discord and Twitter. The team frequently interacts with the community.

Ocean Protocol (OCEAN)

Ocean Protocol is a blockchain-based ecosystem for data sharing and monetization. Ocean Protocol lets users publish data, then set prices and licensing terms for its consumption.

👉 Use Case

Ocean Protocol creates a marketplace for datasets that brings buyers and sellers together. Data owners can sell data directly to consumers peer-to-peer. This gives data owners greater control and monetization.

For enterprises, Ocean Protocol unlocks complex data dynamics by using blockchain-based data asset control, provenance tracking, and privacy-preserving compute.

👉 Good Investment

Data is an immensely valuable asset class. Ocean Protocol unlocks the value of data assets using blockchain technology. The project has strong partnerships with enterprise and government partners.

Ocean Protocol is uniquely positioned to become a fundamental data infrastructure for organizations and critical for analytics or machine learning.

👉 Tokenomics

Ocean Protocol has a fixed maximum supply of 1.4 billion OCEAN tokens. OCEAN is utilized in the network for staking, governance, and transactions like dataset purchases.

Data publishers must stake OCEAN to mint dataset tokens. Consumers use OCEAN to purchase access to datasets. Service providers also earn OCEAN for providing infrastructure support.

👉 Team & Community

Ocean Protocol was founded in 2017 by data science PhDs Trent McConaghy and Bruce Pon. Ocean has partnered with several multinational corporations like Roche and Unilever.

The Ocean Protocol community is focused on technical discussions around ecosystem development. Much coordination and brainstorming happens through GitHub issues.

Radiant Capital (RDNT)

Radiant Capital is a decentralized money market built for the Arbitrum ecosystem. Users can lend, borrow, and leverage assets using Radiant Capital.

👉 Use Case

Radiant Capital creates an interconnected market for volatile crypto assets like WBTC, WETH, UNI. Users can earn yield by lending assets or get quick access to liquidity by borrowing.

The protocol also facilitates leveraged trading. Radiant Capital brings money market infrastructure natively to Arbitrum for the first time.

👉 Good Investment

As part of Arbitrum Odyssey, Radiant is backed by Offchain Labs and receives strong ecosystem support. Arbitrum is one of the leading Layer 2 scaling solutions for Ethereum.

Radiant fills a key gap in the Arbitrum ecosystem by providing DeFi borrowing and lending. The protocol shows product-market fit with over $1.4 billion total value locked already.

👉 Tokenomics

RDNT will have community and liquidity mining token distributions. RDNT provides governance rights to shape Radiant and claim protocol fees. Users can also stake RDNT to boost rewards.

Radiant uses veRDNT, a locked staking derivative, to heavily incentivize long-term protocol ownership and alignment. This benefits committed community members.

👉 Team & Community

Radiant Capital was founded by the team of linear.finance, led by 0xMaki. As DeFi natives, they built Radiant specifically for the needs of Arbitrum users.

Radiant has an engaged community of Arbitrum supporters and DeFi builders. The team and community coordinate and improve Radiant together through Discord and Twitter.

Verasity (VRA)

Verasity is a video delivery and loyalty platform creating new engagement and monetization channels between viewers, publishers, and advertisers.

👉 Use Case

Verasity improves monetization for publishers with its Proof-of-View technology and VeraPlayer video player. Viewers can earn rewards redeemable for products, services, or VRA tokens by watching videos.

Advertisers get guaranteed views from real users. Verasity’s ad stack enables influencer marketing, video ads, and innovative rewarded ad formats.

👉 Good Investment

Online video is a multi-billion dollar industry. Verasity makes video infrastructure more effective for every stakeholder and provides critical analytics. Partners include Amazon, Reuters, and Yahoo.

VRA powers the whole ecosystem. With strong utility and a deflationary economic model, VRA is poised to capture value as Verasity grows.

👉 Tokenomics

VRA’s circulating supply started at 12.5 billion tokens and declines over time due to token burns. VRA is used for staking, governance, transaction fees, and more.

Many VRA tokens are locked away by the team and ecosystem partners. This restricted supply along with ongoing burns makes VRA deflationary long-term.

👉 Team & Community

Verasity was founded by RJ Markowski, the former CEO of vRun. The team brings years of video infrastructure experience across media, advertising, and blockchain.

Verasity fosters an active community with over 440,000 members across social platforms. The company regularly interacts with its community through Telegram, Twitter, and email newsletters.

AirTor Protocol (ATOR)

AirTor Protocol is a blockchain-based platform for distributed, anonymous, and secure communications and services on Web3.

👉 Use Case

AirTor Protocol enables private communication, asset transfers, document storage, identity management and more on its decentralized network. AirTor Protocol uses zero-knowledge proofs and other cryptography advances to preserve privacy.

AirTor brings provable anonymity to messaging, finance, healthcare, voting, IoT networks, and other applications.

👉 Good Investment

Private communication and transactions are increasingly demanded by consumers concerned about data privacy. AirTor uniquely combines anonymity and auditability using blockchain technology.

Partnerships with leading cryptography researchers lend credence to AirTor’s technical capabilities. The anonymous nature of the protocol itself also garners strong community support.

👉 Tokenomics

The ATOR utility token enables anonymous transactions, governance participation, network operation, and staking incentives. ATOR follows a deflationary model using token burns and limited issuance rates.

Staking ATOR allows users to anonymously run nodes, verify transactions, and enable scaling. Stakers earn transaction fees and voting rights in return.

👉 Team & Community

AirTor Protocol was launched in 2021 by a team of anonymous cryptography and security researchers. Despite its anonymous team, AirTor has built an engaged community of privacy advocates on Twitter and Telegram.

The protocol promotes grassroots adoption and voluntary “Privacy Ambassadors” help grow AirTor’s userbase. The community assists with testing and providing feedback as AirTor develops.

Chainge Finance (CHNG)

Chainge Finance offers automated DeFi services like trading, lending, borrowing, payments, and portfolio management on the Fusion blockchain.

👉 Use Case

Chainge Finance provides a decentralized financial toolkit accessible 24/7. Users can efficiently manage assets, invest automatically using bots, send cross-chain payments, and more.

Chainge Finance makes interacting with Web3 and managing crypto easy for newcomers while still supporting advanced features for power users.

👉 Good Investment

As a protocol enabling simplified DeFi, Chainge Finance taps into a huge market opportunity as cryptocurrency goes mainstream. Chainge aims to be the gateway to DeFi for the next billion users.

Built on Fusion, Chainge Finance also uniquely supports both centralized and decentralized assets from any chain. This flexibility drives adoption and TVL growth.

👉 Tokenomics

The CHNG token enables community governance of Chainge Finance while rewarding ecosystem participation. CHNG is given to users for staking assets, running nodes, and providing liquidity.

CHNG also captures a portion of network fees and interest from Chainge’s lending platform. Token holders receive airdrops from new Chainge ecosystem projects.

👉 Team & Community

Chainge Finance was founded by a team of DeFi builders whose previous project FinNexus pioneered DeFi options trading. The Chainge team has demonstrated its ability to create cutting-edge DeFi products.

Chainge Finance fosters its community through Telegram and Discord channels. Chainge emphasizes multilingual support and has core community members from across the globe.

Nexa (NEXA)

Nexa is an open-source distributed ledger technology (DLT) designed to connect economies, communities, and networks across multiple blockchains. It aims to enable the decentralized web.

👉 Use Case

Nexa makes sending data and value between any two blockchains easy. Via Nexa smart contracts and APIs, apps built on different chains can interoperate. Users can seamlessly move assets between isolated networks.

Nexa offers the benefits of interoperability, asset composability, and cross-chain infrastructure needed for an interconnected blockchain ecosystem.

👉 Good Investment

As blockchain networks grow, the need for interoperability solutions like Nexa increases. Nexa helps unlock network effects across chains to drive mainstream adoption.

Partnerships with chains like Harmony, TrustSwap, and TomoChain validate the real-world demand for inexpensive cross-chain transactions that Nexa provides.

👉 Tokenomics

NEXA tokens enable fee-less cross-chain transactions. Tokens are minted and burned to facilitate transfers across chains. NEXA also provides governance rights proportional to the amount held and staked.

The token aligns incentives by rewarding nodes for services like transaction validation. Validators that hold higher NEXA stakes have greater influence on governance decisions.

👉 Team & Community

Nexa was created in 2020 by a distributed team of blockchain engineers and community members. As a DAO, Nexa relies on its community to help review proposals and build out the ecosystem.

Developers coordinate efforts and implement improvements together through GitHub. Nexa’s tech-focused community values transparency and pushes for continuous enhancements.

Router Protocol (ROUTE)

Router Protocol is a decentralized cross-chain asset routing network designed to aggregate liquidity and enable seamless swaps between chains.

👉 Use Case

Router Protocol makes moving assets between blockchains simple. Users can swap tokens instantly from networks like Ethereum, BNB Chain, and Polygon using Router’s liquidity and routing infrastructure.

Apps built atop Router inherit interoperability features to share data or move assets cross-chain. Router Protocol connects isolated DeFi ecosystems into one.

👉 Good Investment

Making cross-chain DeFi trades seamless and inexpensive is key to achieving a truly open financial system. Router Protocol is positioning itself as core multi-chain infrastructure with partnerships with major DeFi players.

Router v2 upgrades enhance capital efficiency, security, and router incentives. The project shows strong technical fundamentals and ecosystem support for its roadmap.

👉 Tokenomics

ROUTE is Router Protocol’s utility and governance token. ROUTE holders can participate in fee generation, staking, and voting on governance proposals.

The token has a max supply of 100 million. Protocol fees are used to market buy and burn ROUTE tokens, which makes the remaining supply more valuable.

👉 Team & Community

Router Protocol was founded in 2020 by former Uber and EY engineers. Router Protocol collaborated with leading chains like Avalanche, Fantom, and Harmony to develop its cross-chain architecture.

Router Protocol has an engaged developer community. Contributors actively develop Router’s open source codebase on GitHub to enhance functionality. The team hosts regular calls to discuss improvements.

RocketX Exchange (RVF)

RocketX Exchange is a decentralized cryptocurrency exchange that combines DEX, CEX, and cross-chain infrastructure to make trading simple and accessible for everyone.

👉 Use Case

RocketX Exchange makes buying, selling, and managing crypto assets intuitive through one unified interface. Users can trade across multiple centralized and decentralized exchanges with optimized order routing and pricing.

RocketX also enables in-app cross-chain swaps powered by its AMM engine. This provides easy access to multi-chain liquidity from a user’s wallet.

👉 Good Investment

RocketX unlocks the liquidity fragmented across isolated trading platforms and blockchains. Aggregating liquidity using optimized routing algorithms gives traders better prices.

Partnerships with major chains and backing from top Asian and US crypto funds provide RocketX the runway to become a leading retail and institutional exchange worldwide.

👉 Tokenomics

While RocketX Exchange does not currently have a native token, exchange tokens offer deep utility and value capture potential.

A planned RVF token could provide governance rights, trading incentives for liquidity providers, and the ability to capture a portion of exchange fees.

👉 Team & Community

RocketX Exchange was founded by a team of engineers and quants with extensive trading infrastructure experience at companies like Kraken and Jump Trading.

RocketX has built a community of crypto enthusiasts who engage with the team to receive trading tips, discuss market trends, and provide product feedback through Telegram and Discord channels.

Read also:

- Best Future Crypto Projects to Buy: Which Crypto Will Grow Fastest?

- Best Crypto to Buy Now on Reddit

- Best DeFi 2.0 Coins to Buy: The Future of Decentralized Finance

How to Find Good Crypto Projects to Invest In

- Research the project’s technology and read its technical documentation to assess the quality of its engineering. Analyze the codebase to evaluate technical merits.

- Examine the utility and real-world use cases for the project’s token. Coins with strong utility and demand drives value.

- Evaluate the tokenomics model including the token distribution schedule, emission rate, and incentives. Sustainable models align long-term incentives.

- Assess the team’s background and track record of delivering successful products. Experienced leadership improves execution.

- Join online communities to gauge genuine community engagement and developer participation. Active communities demonstrate strong support.

- Check whether reputable investors and partners are backing the project for the long-term. Big investor names validate quality.

- Monitor social media channels to assess community hype and stay updated on significant development announcements. High social traction can signal growth potential.

- Follow cryptocurrency analysts, influencers and media outlets to get balanced opinions on new and trending projects in the space.

What to Look for in a Good Crypto Project

- Compelling and long-term relevant use case that provides real utility and value

- Technical innovation that improves upon existing blockchain solutions

- Effective token economic model that incentivizes participation and aligns stakeholder interests

- Sufficient liquidity and healthy trading activity to enable entry and exit

- Fully decentralized network controlled by community governance

- Strong core development team with proven capabilities

- Vibrant community providing promotion, feedback, and contributions

- Robust security infrastructure that has been externally audited

- Extensive documentation providing project transparency

Conclusion

Identifying cryptocurrencies with good fundamentals and long-term growth potential can be challenging amidst thousands of projects. This guide covered 15 top crypto contenders to watch heading into 2023 based on their solid foundations and real-world utility.

The cryptocurrencies profiled here span various use cases from DeFi to privacy to data sharing. When analyzing new crypto investments, be sure to look at critical factors like the tokenomics, technology merits, team caliber, ecosystem adoption and community support.

Projects with strong fundamentals tend to weather market volatility and appreciate over the long run as their network usage and utility increases. Risks remain investing in any young project, so appropriate due diligence is always advised before investing in any cryptocurrency.